A recovery in the European market is expected closer to October-November

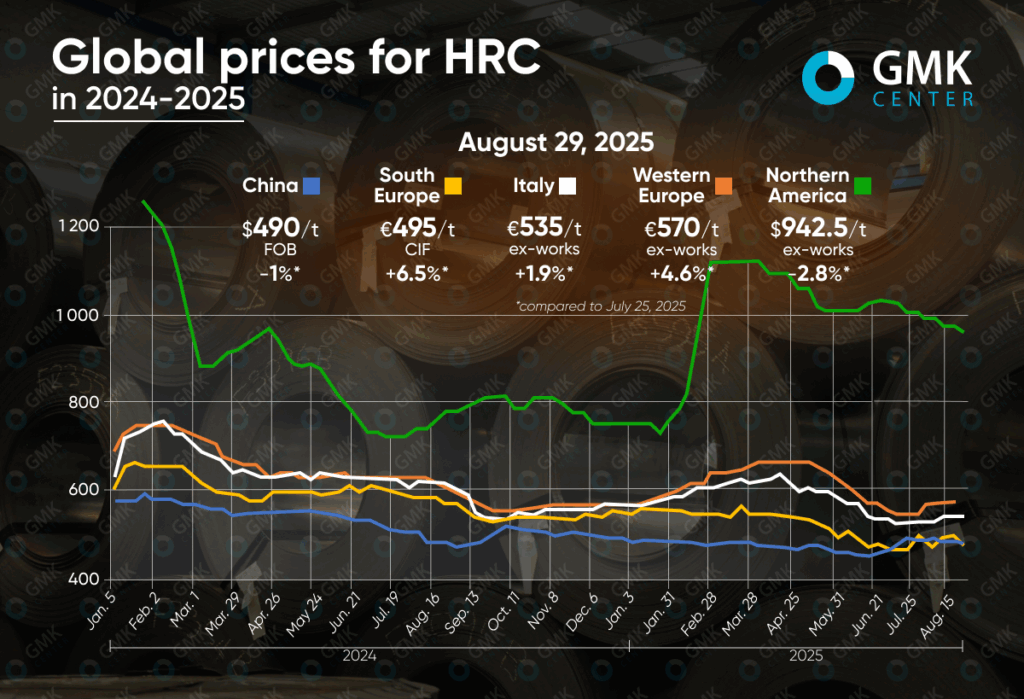

The global hot-rolled coil market developed unevenly in August 2025. European prices rose due to expectations of regulatory changes, while the US saw a decline due to weak demand and excess supply. The Chinese market remained relatively stable, with minimal price declines amid high inventories and sluggish exports.

EU

In August 2025, the hot-rolled coil market in Europe showed moderate price growth amid weak demand and high importer activity. The cost of rolled steel increased by 2-7% depending on the region: in Western Europe, offers reached €570/t ex-works (+4.6% compared to July), in Italy – €535/t ex-works (+1.9%), while imports to Southern Europe rose the most – to €495/t CIF (+6.5%).

The key factor behind the rise was not so many fundamental changes in demand as expectations of new trade restrictions from the EU. ArcelorMittal raised its prices twice in August, bringing the base price to €610/t delivered. European producers tried to consolidate the growth, relying on the prospect of the introduction of the CBAM mechanism from 2026 and new protective measures from the European Commission, which should reduce the share of imports.

However, the real situation on the market remained controversial. Most large buyers had already contracted significant volumes in Asia and Turkey in June-July at €450-515/t CFR, so the market was passive in August. Demand in the end segments – automotive and construction – remained weak, and business activity traditionally declined during summer. Service centers noted that prices were being held up more by expectations of regulatory changes than by a real recovery in consumption.

In early September, import quotations were already showing a downward trend to €477/t CIF, while domestic producers are seeking to bring the transaction level to €600/t. In the short term, prices in the EU are expected to rise slowly and unevenly: protective measures and CBAM will limit import pressure, but large stocks brought in during the summer will hold back a rapid recovery. The main revival of buyers is expected closer to October-November, when the market will begin to form orders for 2026.

USA

The US hot-rolled coil market continued to show a downward trend last month. The average price fell by 2.8% to $931.45/t. Leading producers, including Nucor and California Steel Industries, adjusted their base prices downwards several times, reducing them by $10 in the middle of the month. This reflected weak demand and buyers’ reluctance to contract large volumes at higher prices.

The main factors behind the decline were sluggish business activity during the summer, oversupply, and short order fulfillment times, averaging 3-5 weeks. Distributors noted that actual deals were concluded closer to the lower end of the price range, while the levels announced by manufacturers remained more of a benchmark. Demand in key segments remained weak, although some market participants expected a revival after the end of the summer holidays and seasonal downtime.

Despite the overall stagnation, there is some optimism for September due to the traditional increase in purchasing activity at the end of summer and the desire of factories to raise base levels before negotiations on contracts for the end of the year. However, at the beginning of autumn, the market will continue to be under pressure from weak demand and high competition among producers. In the short term, prices are likely to remain around $930/t, and their growth will depend on the intensity of purchases in September-October.

China

Prices on the Chinese market showed a slight decline of 1% to $490/t FOB. Overall, the month was stable: quotations fluctuated within a few dollars but returned to their starting levels at the end of August. At the beginning of the month, prices were supported by rumors of a reduction in coal production, but the effect was short-lived. By the second decade, it became clear that fundamental factors – growing stocks, low apparent consumption, and buyer caution – were putting pressure on the market.

The domestic market was supported by the dynamics of futures and a certain increase in prices for thick-gauge rolled products. At the same time, exports remained weak: most deals were small in volume, and buyers often postponed purchases due to volatility and expectations of more favorable conditions.

In the short term, limited support is expected from domestic demand and seasonal restocking. At the same time, weak exports and high inventories will hold back growth, so prices are likely to fluctuate around current levels in September.