![]()

Journalist

Posted: September 8, 2025

Key Takeaways

Bitcoin’s whale reserve saw its largest drop since 2022. Is this setting the stage for major price moves, or just a routine rotation?

Bitcoin [BTC] closed August 6.5% lower off its $115,778 open, snapping a four-month green streak and logging its worst monthly close since the “Liberation Day” FUD.

In other words, after a 50% leg up from April’s $82k base, August was the first real stress test for Bitcoin. And it wasn’t random. Smart money rotated capital out via exit liquidity.

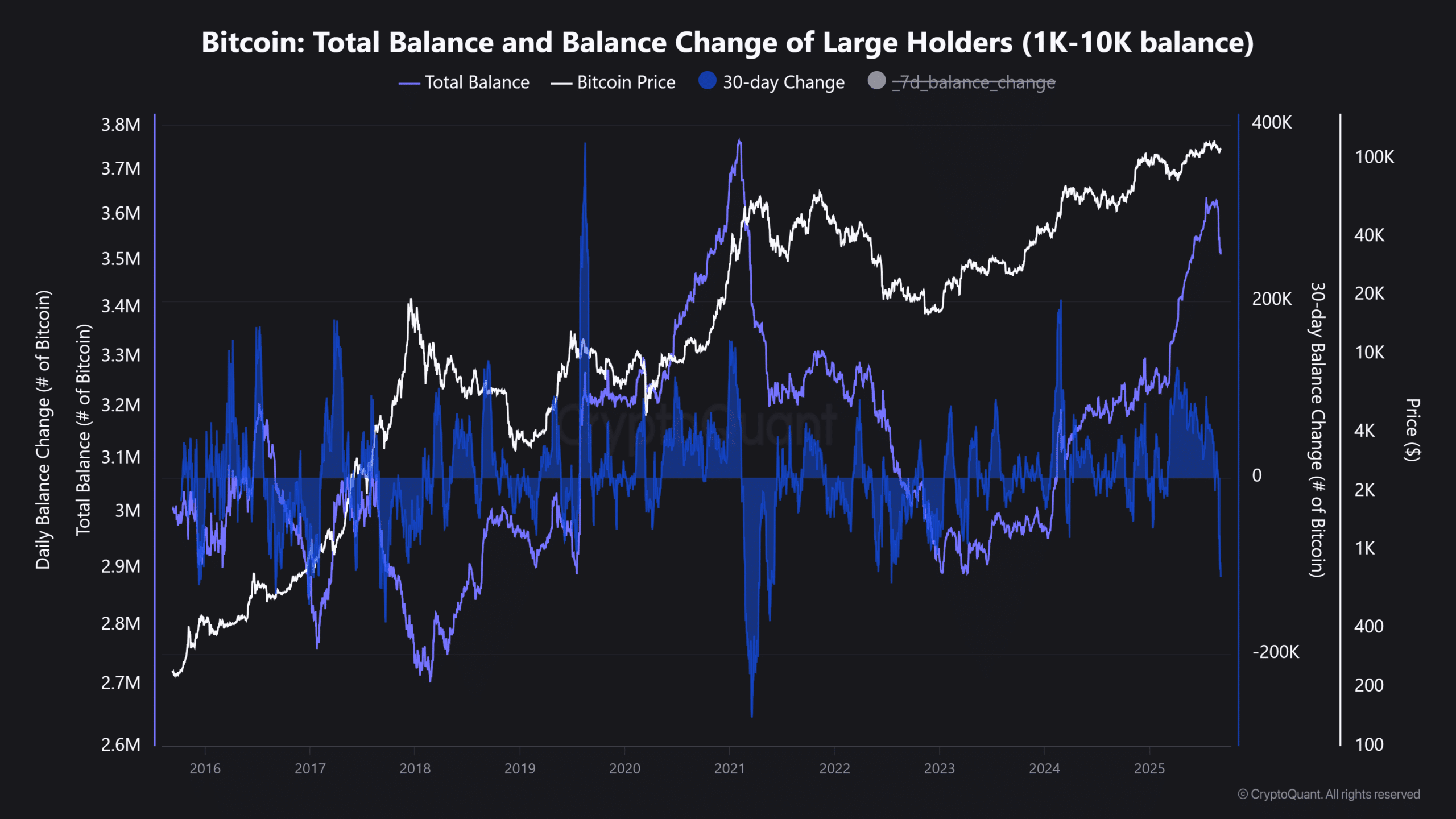

Whales in the 1k–10k BTC cohort absorbed roughly 270k BTC through April–August, lifting their stack to 3.62 million by mid-August, right as BTC tagged its $124k local ATH.

What followed? A record supply shift.

Source: CryptoQuant

The blue lower wick (30-day change) printed its lowest read since 2022.

As of press time, Bitcoin’s 30-day change of this cohort stood at -112.8k BTC, meaning whales have unloaded over 112k coins in just a month, marking their steepest net distribution since 2022.

That makes BTC’s 6.5% August drawdown more than just repositioning. It shows smart money realizing gains off the post-Liberation FUD rally, where Bitcoin rallied 50% in under five months.

Is a Bitcoin bottom still far off?

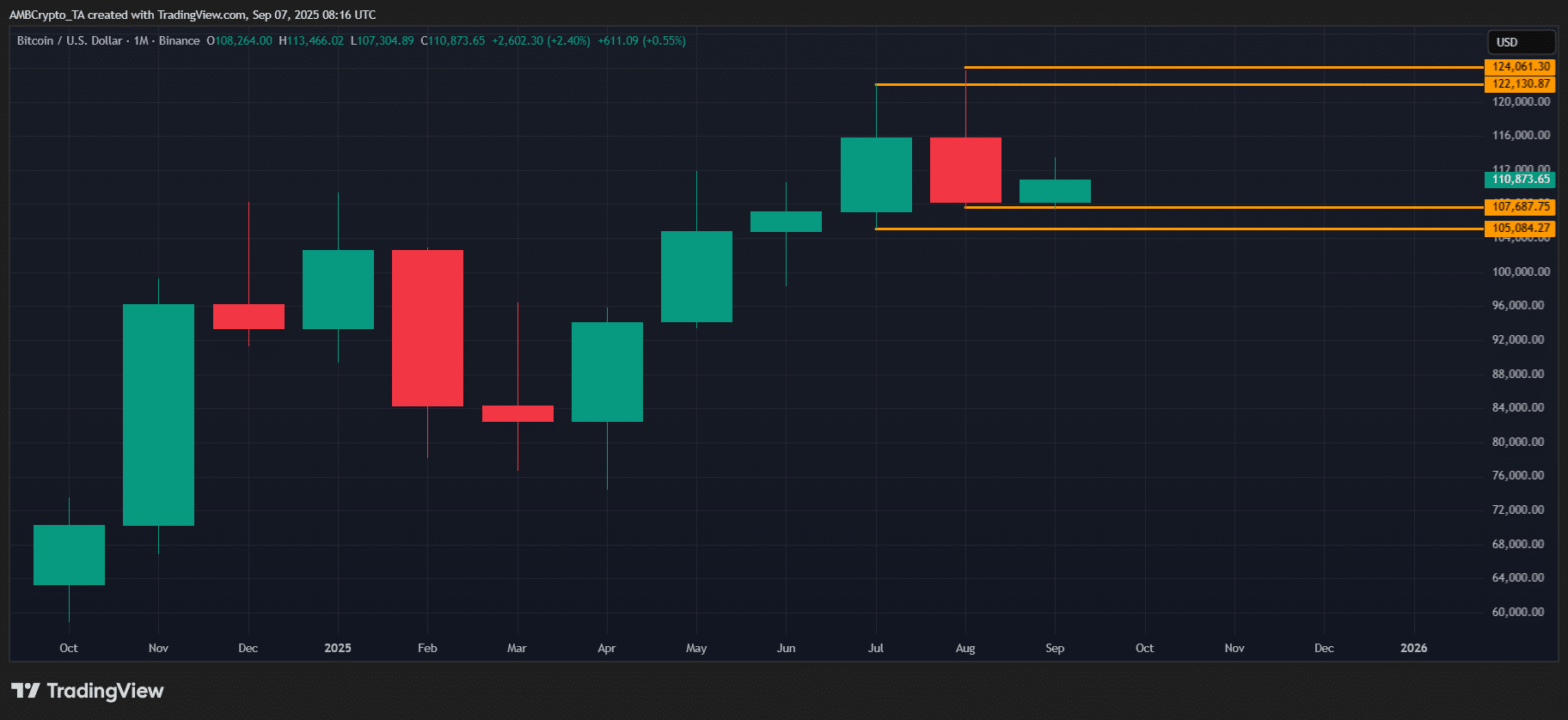

Technically, Bitcoin’s support remains fragile.

Since July, BTC has settled each monthly close below $110k, failing to hold against breakdown pressure. Even with fresh ATHs — $123k in July, challenged again in August, there was no sustained follow-through.

That tells us smart money isn’t chasing tops here, which ups the odds BTC skips a clean price discovery move in September, unless the Federal Reserve rolls out easing, with the next FOMC only 10 days away.

Source: TradingView (BTC/USDT)

For now, Bitcoin’s $110k floor remains far from a true bottom.

As a result, September looks set to close on a bearish note. With smart money sidelined, BTC could face extended consolidation, or even a potential breakdown, before attempting another run at price discovery.

Next: Solana traders stay bullish despite 98% token failure rate: What gives?