Indian markets bucked last week’s downward trend, with the NIFTY50 climbing by over 300 points as positive macroeconomic data and GST rate cuts boosted investor confidence. However, the rupee continued to decline to new all-time lows of around 88.36 amid ongoing foreign outflows and tariff concerns.

Key tailwinds included better-than-expected manufacturing and services PMI figures and GST rate cuts that revived demand outlooks, offsetting concerns about continued foreign institutional investor (FII) selling and uncertainty surrounding U.S. trade policy.

In the broader market, the NIFTY Midcap 150 index increased by 2.1%, closing at 21,187, and the NIFTY Smallcap 250 index rose by 2.5%, closing at 16,922. These results suggest an improvement in investor appetite.

Sectorally, Metals soared by 5.7% amid optimism about the global steel market and GST relief. Meanwhile, the Auto sector advanced by 5.2%, and the Consumer Durables sector gained 3.6%. IT stocks fell by 1% due to ongoing concerns about U.S. tariffs.

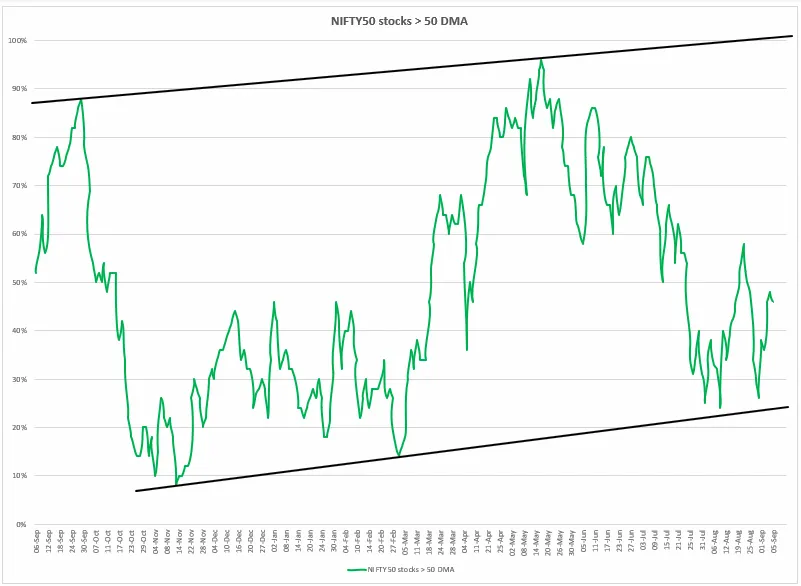

Index breadth

NIFTY50 breadth showed a modest recovery this week, with the percentage of stocks trading above their 50-day moving average rising to almost 46%. While this represents an improvement on last week’s extreme lows of around 26%, it still indicates that short-term momentum is not yet widely distributed across the index.

Despite the rebound, breadth remains well below the peaks seen in April and June. In order to create a healthier backdrop, it is important that this metric pushes decisively above the 50% zone and maintains gains there for multiple weeks.

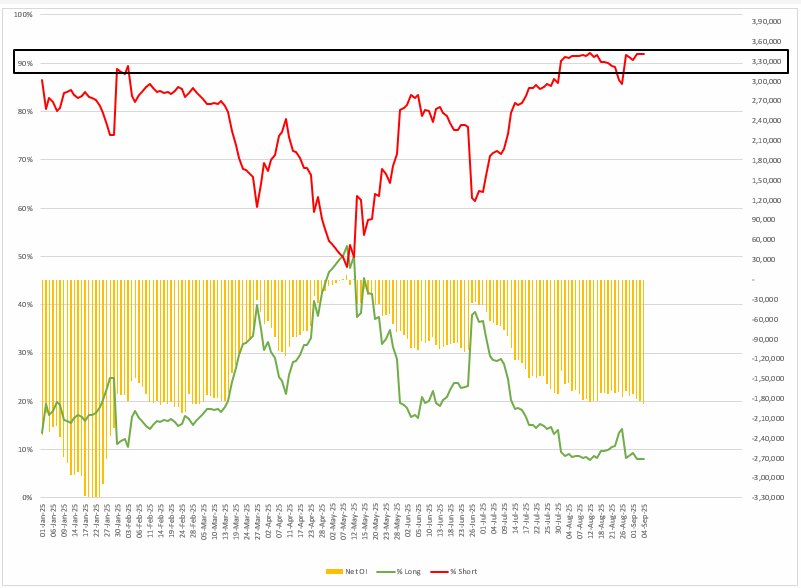

FIIs positioning in the index

As the September series gets underway, Foreign Institutional Investors (FIIs) have maintained their aggressive bearish positioning in index futures, with short positions staying above 90% and long positions holding just above 10%. The long-to-short ratio remains deeply negative, indicating that FIIs have not unwound their bearish bets.

Net open interest has remained firmly in the negative territory at -1.9 lakh, higher than 9% from last week. The extension of this extreme bearishness from August into September highlights the persistent downside pressure on NIFTY50 at higher levels, which has stalled any meaningful rally attempts so far.

In the cash market, the Foreign Investors have remained net sellers and offloaded shares ₹5,666 crore in the September so far. In contrast, the Domestic Institutional Investors emerged as strong supporters and have bought shares worth ₹13,444 crore during the same period.

.webp)

NIFTY50 index

The NIFTY 50 index oscillated in the range of the previous week and formed a bullish piercing pattern on the weekly chart. The index failed to breach previous week’s low, indicating support based buying from lower levels. Meanwhile, on the daily chart the index is trading around its 21-day and 50-day exponential moving averages (EMAs), indicating consolidation in a narrow range.

For the upcoming sessions, the index has immediate resistance around 25,150 and support is around 24,300 zone. Unless the index breaks this range on a closing basis, the trend may remain range-bound.

.webp)

📌Spotlight: The NIFTY Auto index outperformed the benchmark indices, rallying over 5%. The positive momentum was fuelled by reduced GST rates, strong expectations for festive demand, and attractive pricing moves announced by leading car manufacturers. These factors have boosted investor confidence in the sector’s short-term growth as the festive season approaches. Key contributors to this rally were Mahindra & Mahindra (+11.3%), Eicher Motors (+7.8%), TVS Motor (+6.1%) and Hero MotoCorp (+5.4%).

.webp)

🗓️Key events in focus: In the coming week, investors will be closely monitoring several key economic data releases in the U.S. and India that could impact market trends. In the United States,

The Bureau of Labor Statistics (BLS) will release its preliminary revision of jobs growth data for the period April 2024 through March 2025 on September 9. Last week, the Labour department said that the U.S. economy added 22,000 jobs in August, well below expectation of 76,600. Experts believe any downward revision will signal a weaker labour market than initially reported, pushing the U.S. Federal Reserve to consider lowering interest rates.

The latest data from the CME FedWatch tool shows over 91% chance of a 25 basis point rate cut. There is also a roughly 12% probability of a larger 50 basis point (0.5%) cut, reflecting market participants’ anticipation of significant monetary easing due to weakening labour market conditions and inflation dynamics.

Additionally, the Inflation data will also remain in focus, with the Producer Price Index (PPI) due to be released on 10 September, followed by the Consumer Price Index (CPI) the next day. Although inflation readings have taken a back seat to labour market weakness since Fed Chair Jerome Powell’s recent Jackson Hole speech.

On the domestic front, August CPI and WPI inflation, industrial production, and bank loan growth data will be closely watched, as they will shape the RBI’s monetary policy decisions at its meeting later in September.

🛢️Oil: Last week, crude oil prices experienced notable weakness, with WTI crude oil falling to around $62.38 per barrel, marking a decline of 3.4%. The price fall was influenced by a surprising 2.4 million-barrel increase in U.S. crude inventories, contrary to expectations of a drawdown, alongside concerns about an impending rise in OPEC+ production as Saudi Arabia reportedly pushes for higher output to regain market share.

Gold prices in the domestic and futures markets will also be in spotlight this week. Last week, MCX Gold futures saw strong traction as the gold rate in the futures market rose 3.76% to close at a new lifetime high at ₹1,07,728 per 10 gram. Futher fall in US dollar index could trigger fresh buying in the yellow metal.

📓✏️Takeaway: The NIFTY 50 index remained within the previous week’s range and formed a bullish piercing pattern on the weekly chart. Notably, the index did not fall below the previous week’s low, suggesting support based buying. In the near term, immediate resistance is expected around the 25,150 level, with support located in the 24,300 zone.

The trend is likely to remain range-bound unless the index breaks out above resistance or below support on a closing basis. Traders may wish to adopt a cautious approach and wait for a confirmed breakout, which would indicate a move beyond the current consolidation phase in a new direction.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.