Report Overview

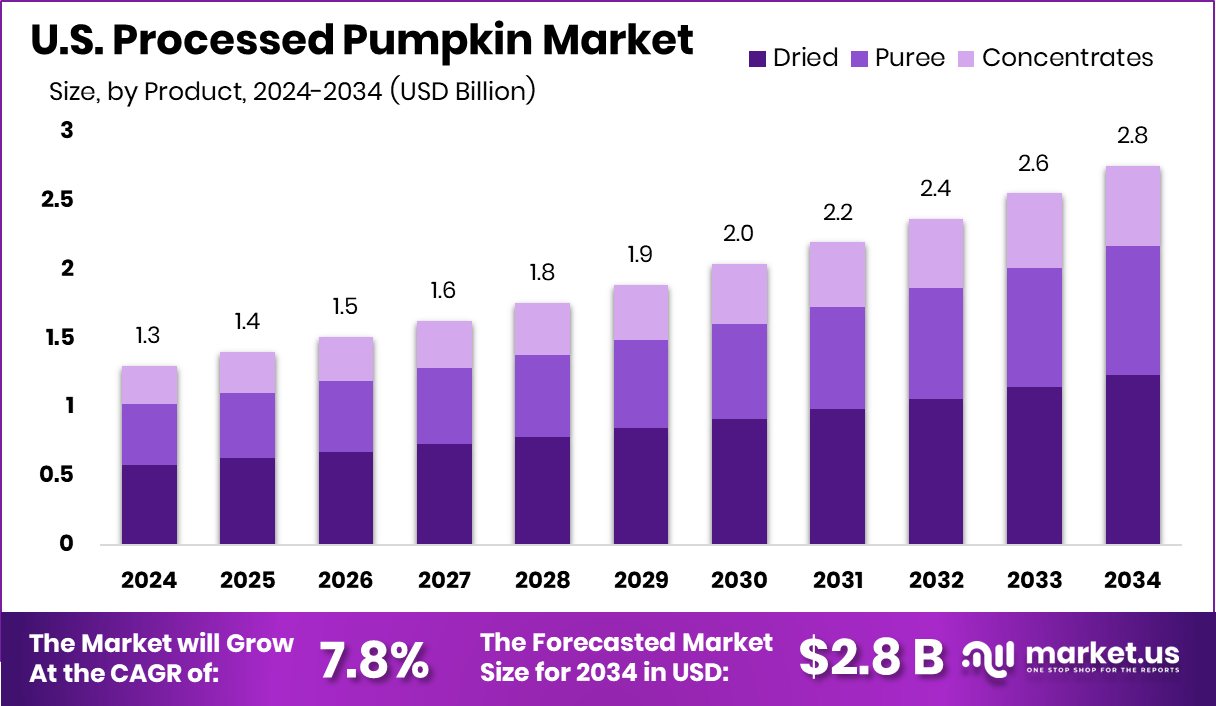

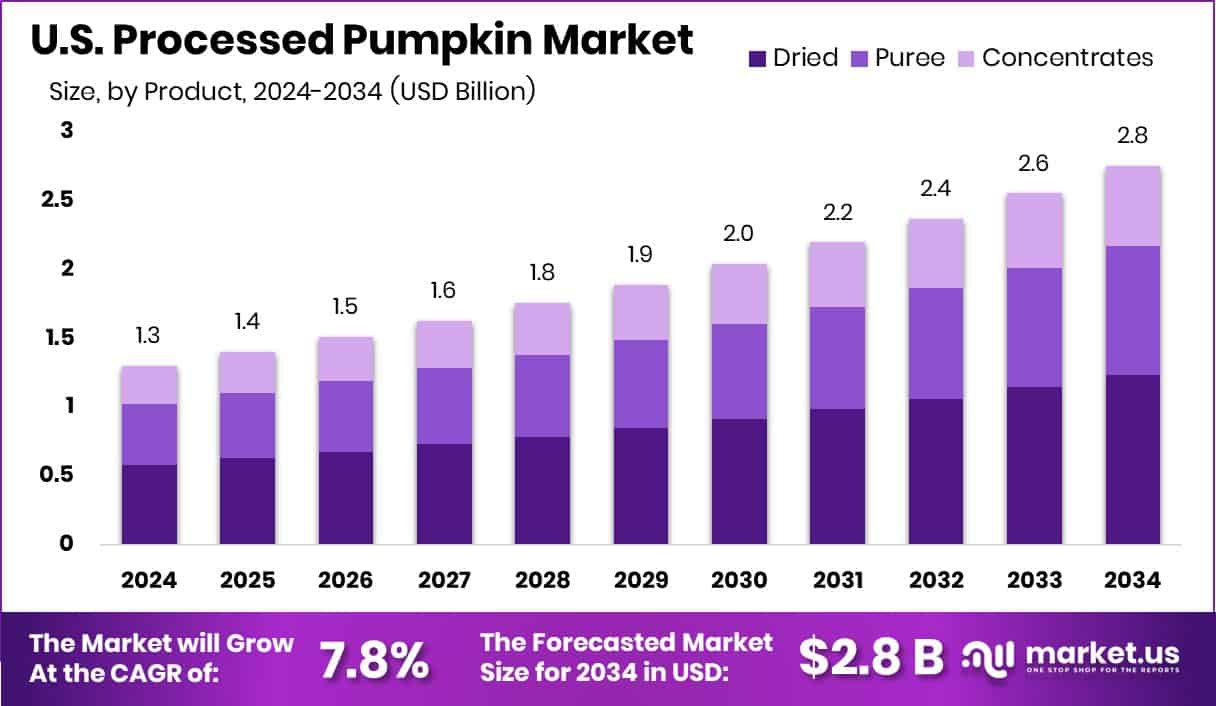

The Global U.S. Processed Pumpkin Market is expected to be worth around USD 2.8 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 7.8% from 2025 to 2034.

U.S. processed pumpkin refers to pumpkin that’s been transformed into value-added forms—typically canned pumpkin, puree, concentrates, powder, or dried pieces—rather than sold fresh. These products are prepared for various culinary and food processing uses, such as baking, soups, baby food, snacks, and beverages. By removing seeds, cooking the flesh, and then preserving it (often through canning, freezing, or drying), processed pumpkin provides convenience, longer shelf life, and consistent quality for both consumers and food manufacturers.

The U.S. processed pumpkin market represents the industry that produces, distributes, and sells pumpkin in various processed forms for domestic consumption and export. It is closely tied to consumer demand for healthy, natural, and seasonal foods, as pumpkin is rich in fiber, vitamins, and antioxidants. The market is supported by advancements in processing technology, increased interest in plant-based ingredients, and government programs that encourage fruit and vegetable consumption as part of national dietary guidelines.

Opportunities include expansion into organic, specialty, and value-added pumpkin products (e.g., powders, artisan purees, seed-based snacks) and breeding of varieties with better flavor, color, or processing traits. Government funding bolsters these opportunities. For example, the USDA awards over US$82.3 million through its Specialty Crops Block Grant Program and Multi-State Grant Program to support specialty crop competitiveness, including research on new varieties and market development.

There’s an opportunity to expand value-added pumpkin product lines—such as organic puree, pumpkin powders, functional snack ingredients, and baby foods—as well as to develop niche regional or artisanal offerings. Government programs support such innovation: for example, the USDA’s Value-Added Producer Grant (VAPG) provides funding (up to $250,000 working capital grants) to farmers and producer groups for processing and marketing value-added products.

A key driver for growth in processed pumpkin is its versatility: creamy texture and nutritional richness make it attractive for use in sweet and savory applications such as desserts, soups, bakery items, snacks, and beverages. Rising consumer interest in convenient, shelf-stable, wholesome ingredients further accelerates adoption. Additionally, higher yields in prominent pumpkin-producing states (e.g., Illinois dedicating 70% of its acreage to processing varieties) and improvements in growing practices support a stable supply and economies of scale.

Key Takeaways

The Global U.S. Processed Pumpkin Market is expected to be worth around USD 2.8 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 7.8% from 2025 to 2034.

By Product, dried pumpkin holds 44.8% in the U.S. Processed Pumpkin Market, showing rising shelf-stable demand.

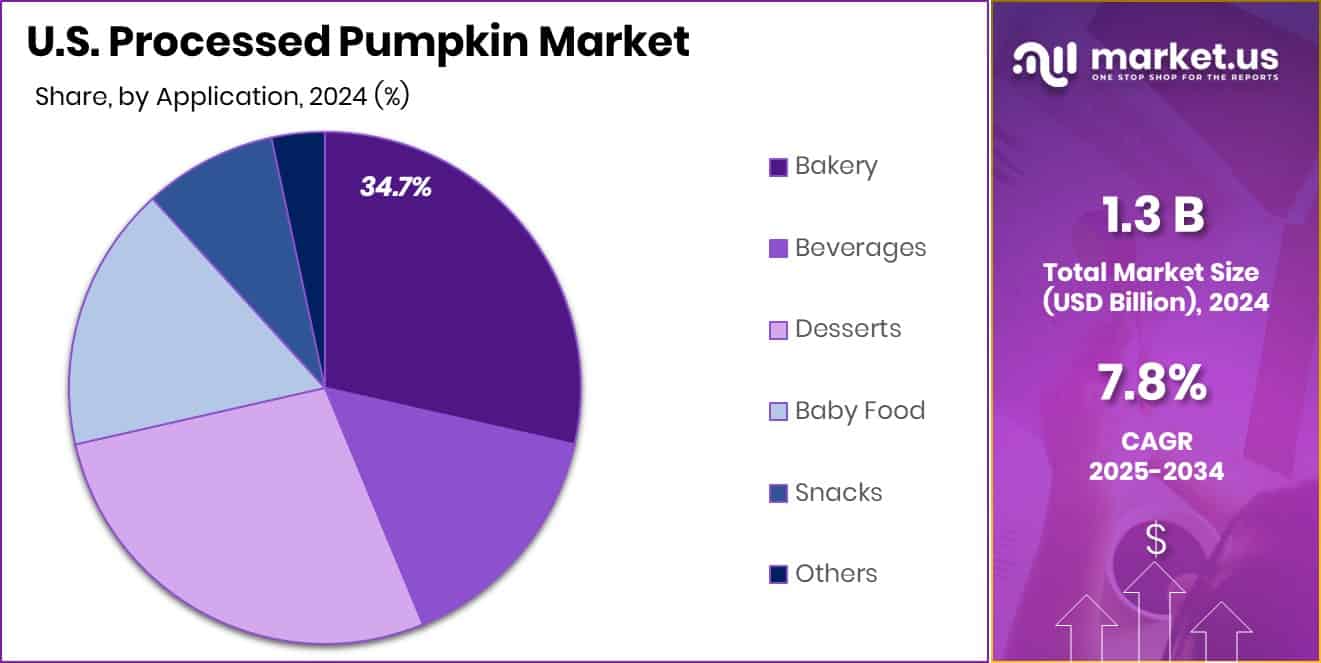

By Application, bakery dominates with a 34.7% share in the U.S. Processed Pumpkin Market, driven by seasonal use.

By Product Analysis

In the U.S. Processed Pumpkin Market, dried forms captured 44.8%.

In 2024, Dried held a dominant market position in the By Product segment of the U.S. Processed Pumpkin Market, with a 44.8% share. This strong lead is supported by its long shelf life, lightweight nature, and convenience in transportation compared to fresh or canned alternatives. Dried pumpkin is widely used in soups, bakery mixes, snacks, and powdered nutritional supplements.

The segment benefits from increasing consumer demand for functional and natural ingredients in packaged food products. Its versatility in powder and flake formats has made it attractive for food manufacturers seeking cost-effective formulations with nutritional value. With health-driven trends and the rising adoption of dried fruits and vegetables in daily diets, dried pumpkin continues to secure growth momentum in the market.

By Application Analysis

In the U.S. Processed Pumpkin Market, bakery applications held 34.7%.

In 2024, Bakery held a dominant market position in the By Application segment of the U.S. Processed Pumpkin Market, with a 34.7% share. The dominance is driven by the widespread use of pumpkin puree and dried forms in pies, muffins, breads, and seasonal desserts. Strong consumer preference for pumpkin-flavored bakery items during festive seasons further supports the segment’s leadership.

The segment also benefits from rising health awareness, as pumpkin’s fiber, vitamins, and low-calorie profile align with the demand for nutritious baked goods. Innovation in bakery recipes, including gluten-free and organic pumpkin-based products, continues to expand its reach. With consumers embracing convenient, ready-to-eat pumpkin bakery products, this application is positioned to maintain robust demand throughout the year.

Key Market Segments

By Product

By Application

Driving Factors

Federal Specialty Crop Grants Boost Pumpkin Processing Capacity

One of the key drivers in the U.S. processed pumpkin market is the role of the Specialty Crop Block Grant Program (SCBGP), administered by the USDA. These federal grants provide crucial funding to help growers, processors, and state agencies enhance production, improve processing infrastructure, develop new pumpkin products, and expand market reach.

For example, Pennsylvania recently received over $1 million through SCBGP—part of $72.9 million in nationwide funding—to support projects that improve quality, promote value-added products, and strengthen the competitiveness of specialty crops, including pumpkins.

Such government investments help growers invest in equipment, adopt better processing practices, and diversify into processed forms like canned pumpkin, puree, and specialty pumpkin products, thus driving growth in processed pumpkin supply and capacities.

Restraining Factors

USDA Grant Freezes Cause Investment Uncertainty for Pumpkin

A major restraint on the U.S. processed pumpkin market is the recent USDA freeze of agricultural grants and assistance programs, which has sown investment uncertainty among growers and processors. Many producers depend on predictable federal support for farm improvements, processing equipment, safety certifications, and marketing initiatives. When funding streams such as specialty crop grants or local purchasing assistance are delayed or halted, businesses postpone expansions or upgrades, curbing growth in processing volume and efficiency.

For example, numerous USDA grant programs have been frozen or cut, disrupting funding for local food systems and investment planning. This unpredictability in government support makes financial decisions riskier for pumpkin processors, reducing their willingness to invest in capacity or innovation.

Growth Opportunity

Crop-Insurance Improvements Secure Pumpkin Processors’ Tomorrow

A promising growth opportunity for the U.S. processed-pumpkin market stems from new enhancements in federal crop insurance policies for processing pumpkins. The USDA’s Risk Management Agency (RMA) has turned this program from a pilot into a permanent policy, raising the maximum coverage level from 80% to 85% for insured yields. It also now allows organic growers, enterprise units, and written agreements, providing more flexibility and protection.

As a result, more pumpkin growers and processors feel confident investing in expanded capacity, newer processing lines, and quality-focused improvements—knowing they are better shielded from crop losses and price drops. This added stability lowers financial risk, encouraging scale-ups and modernization in the supply chain. It also strengthens the business case for adopting innovative processing technologies and branching into new markets like niche pumpkin ingredients or specialty purees.

Latest Trends

Urban Agriculture Grants Spur Local Pumpkin Processing Growth

A notable recent trend in the U.S. processed pumpkin market is the rising role of urban agriculture and innovative production in expanding processing capacity and local pumpkin product development. The USDA’s Office of Urban Agriculture and Innovative Production (OUAIP) has awarded more than $14.4 million in grants and technical assistance for urban and controlled-environment farming, including indoor, vertical, and hydroponic systems.

These programs help urban growers increase production and connect with processors, potentially supplying fresh-cut, puree, or specialty pumpkin products directly to local food systems. This supports shorter supply chains, fresher products, and taps into consumer demand for locally sourced and sustainable foods. As more urban farms join processing networks, we may see new product formats and value-added offerings emerging from cities and suburbs.

Key Players Analysis

Libby’s Brand Holding (trademark owner of the Libby’s pumpkin brand): In the 2024 Nestlé Non-Financial Statement, Libby’s continues its dominant position in processed pumpkin branding, with high name recognition (about 78% brand awareness in North America). The report also highlights Libby’s commitment to regenerative agriculture, where central Illinois pumpkin farmers are adopting sustainable practices under Nestlé’s guidance. These efforts enhance long-term quality, supply resilience, and alignment with consumer demand for sustainability. Although financial data specific to pumpkin operations isn’t broken out, Libby’s remains the legacy leader—especially given its processing infrastructure in Morton, Illinois (often called “Pumpkin Capital of the World”).

Del Monte Foods: Direct company materials from 2024 do not provide specific updates on processed pumpkin; however, the broader business segment shows that Del Monte Foods filed for Chapter 11 bankruptcy protection in July 2025, signaling distress potentially affecting all product lines—including canned pumpkin. While this occurs outside the 2024 window, the build-up of cost pressure and financial restructuring may have already been underway, potentially limiting investments in pumpkin production or innovation during 2024.

Seneca Foods: According to its 2024 Annual 10-K, food operations accounted for 98% of total net sales, with canned vegetables comprising 83%. Seneca explicitly markets premium pumpkin purée, made from vine-ripened pumpkins, available in both conventional and organic formats.

Top Key Players in the Market

Libby’s Brand Holding

Del Monte Foods

Seneca Foods

Kraft Heinz, Inc.

Pinnacle Foods Co

Woodland Gourmet

Döhler Group

Seawind Foods

Great American Spice Company

Kerr by Ingredion

Recent Developments

In September 2025, Kraft Heinz approved a plan to split into two independent companies, aiming to sharpen its focus on their brand portfolios and operate more efficiently. One company will focus on sauces and condiments, while the other will focus on grocery products.

In May 2024, Woodland (then still Woodland Foods) acquired Idan Foods, a company that focuses on batter, breading, coating systems, and baking mixes and seasonings.

Report Scope