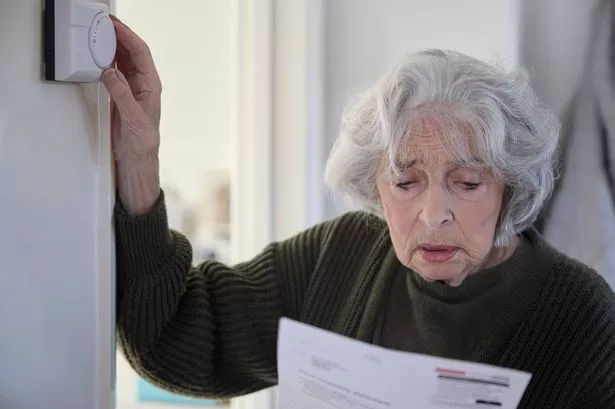

New rules mean that everyone over State Pension age will get between £200 and £300 this winter to help with heating bills For the first time since the payment was introduced in 1997, the allowance is no longer guaranteed for all(Image: Daisy-Daisy via Getty Images)

For the first time since the payment was introduced in 1997, the allowance is no longer guaranteed for all(Image: Daisy-Daisy via Getty Images)

Pensioners may have to return some of their Winter Fuel Payment to the Government through taxes. Under new regulations, everyone over state pension age will receive between £200 and £300 this winter to assist with heating bills.

However, pensioners with an annual income exceeding £35,000 will be required to return it through the tax system. This means that many will see the money appear in their bank account in November or December, only for it to vanish when their tax bill is calculated.

For the first time since the payment was introduced in 1997, the allowance is no longer guaranteed for all. The Treasury states that the changes will save £450million a year by excluding approximately two million wealthier pensioners.

READ MORE: DWP errors could mean carers get huge payouts Pensioners have until midnight tonight to decide whether to keep their winter fuel payment(Image: Nes via Getty Images)

Pensioners have until midnight tonight to decide whether to keep their winter fuel payment(Image: Nes via Getty Images)

Chancellor Rachel Reeves unveiled the new system in June following outrage over plans to scrap the benefit for millions. Campaigners argue that the tax clawback will confuse many people, particularly those just above the threshold.

Alice Haine, from Bestinvest, said: “For pensioners earning just above the £35,000 threshold, the latest news will be disappointing. Some may even choose to reduce their income from private pensions if it means they can just skim under the threshold to receive the payment.”

Sarah Coles, of Hargreaves Lansdown, added: “The balance of property assets and pension income for older people can leave them wealthy on paper and yet seriously strapped for cash on a daily basis. In the short term, things like the Winter Fuel Payment can help.”

READ MORE: DWP PIP and legacy benefits update before April changes start

Those who didn’t want the cash clawed back were able to opt out by filling in a Government form online by midnight yesterday, or by calling 0800 731 0160 before 6pm yesterday. The allowance will be paid automatically to those who qualify.

Under-80s get £200; over-80s get £300. Where couples live together, the money is split – but the tax clawback is applied individually. That means if one pensioner in a household earns over £35,000 but their partner doesn’t, only their share will be taken back. If both are above the threshold, the entire payment will be lost.

Campaigners warn the change risks creating another “child benefit-style trap”, with older people caught out by complicated rules and unfair tax grabs.