The finance expert said it could be switched to being means tested

09:33, 17 Sep 2025Updated 09:58, 18 Sep 2025

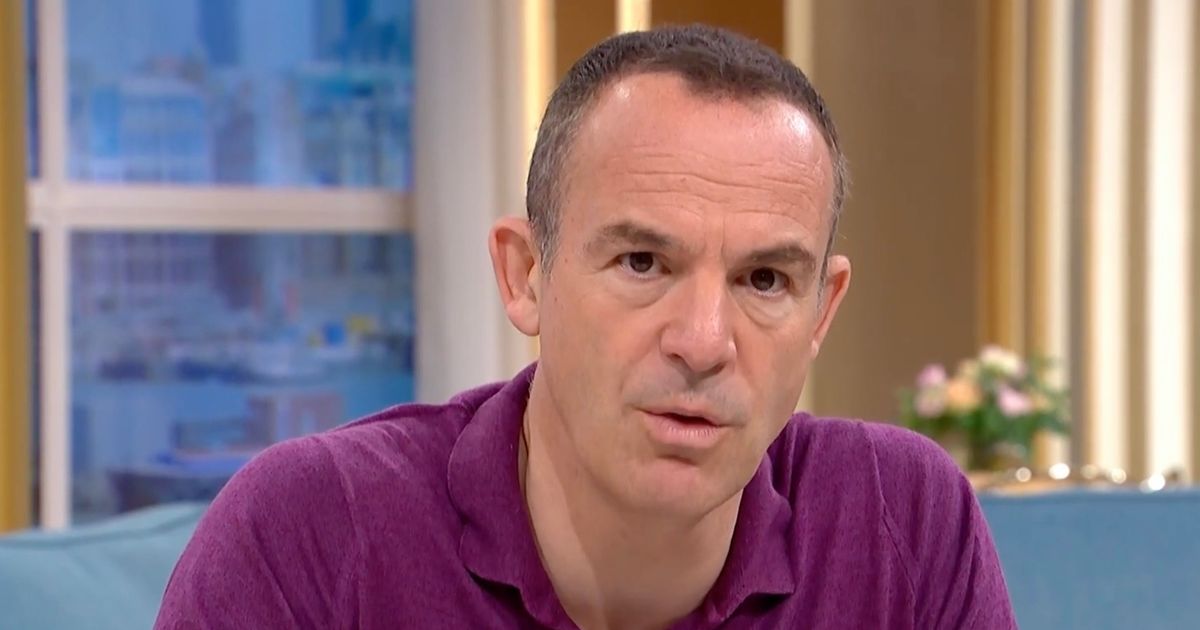

Martin Lewis has warned that it is “possible” that the State Pension could be scrapped in favour of it being means tested(Image: ITV)

Martin Lewis has warned that it is “possible” that the State Pension could be scrapped in favour of it being means tested(Image: ITV)

Martin Lewis has warned that it is “possible” that the State Pension could be scrapped in favour of it being means tested.

This is if the triple lock is under threat, as the Money Saving Expert (MSE) founder recently addressed the State Pension rise of 4.7 per cent next year.

On his eponymously titled podcast, when asked by caller John, 53, if the state pension could be scrapped, he answered: “Yes, it is possible.”

Read more: British Gas customers warned to act before midnight on Wednesday

Martin added: “Parliament is what is called omnicompetent – a technical term meaning parliament can legislate anything it chooses to do. Do I think it’s likely? No.

“I think the most likely eventuality with the state pension is that the age at which you get it is increased. And I certainly think by the time someone who is 18 now retires, it’s probably going to be in their 70s when they get their state pension, not in their late 60s.

“I would say what you’re asking is, ‘What are the risks to the state pensions?’ and I’m going to give you in order of likelihood. So I would say that is the most likely risk.

“The next most likely risk, and I think we’ve moved from the first one, which is probable, so I think that is likely to happen. This next one I think is unlikely to happen but not improbable.

“Limited odds, but I wouldn’t be bowled off my chair if it were to happen sometime in the next 20-30 years.”

He said this shortly after addressing the upcoming 4.7 per cent rise for State Pension next April, warning that next year some pensioners will have to pay tax.

The Office for National Statistics (ONS) reported yesterday (16 September) that the state pension is on track to rise by 4.7% next April after new labour market figures confirmed average earnings growth.

This has called into question the long-term sustainability of the triple-lock guarantee and its clash with frozen tax thresholds.

On social media, the Money Saving Expert founder warned that, “unless something changes,” anyone “on the full new state pension with no other income will for the first time pay tax on it.”

The new state pension will rise to £12,535 a year, only £35 below the frozen personal allowance.

Taking to X, Martin wrote: “NEWS. The State Pension is set to rise 4.7% next April. We know this as it is ‘triple locked’, ie rises by the higher of 2.5% or inflation or average earnings rise.

“The final figure has just come in, for earnings up to July and it’s the highest of the three, at 4.7%. So based on that the FULL state pension (ie for someone with all the qualifying national insurance years) is set to rise from…

“NEW state pension £230.24 to £241.05/wk

OLD state pension (retirees pre Apr 2016) £176.45 to £184.75/wk

“This will take someone on the full new state pension to £12,535 a year, only £35 below the frozen personal allowance (amount you can earn tax free each year).

“So as state pension income is taxable, that means without any question the following year (unless something changes), those on the full new state pension with no other income will for the first time pay tax on it (as it will rise a minimum 2.5% and personal allowances are frozen).”