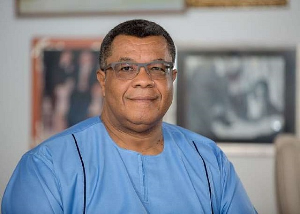

Goosie Tanoh is the Presidential Advisor on the 24-Hour Economy

Goosie Tanoh is the Presidential Advisor on the 24-Hour Economy

Government’s plan of shifting to a 24-hour economy will depend heavily on how far banks are willing to expand credit while managing risk, according to policymakers and advisers who spoke at a banking sector roundtable in Accra.

The initiative, described as a private sector-led programme aimed at boosting productivity and job creation through round-the-clock operations, is being championed by government as a strategy to revive growth and attract investment.

Under this policy, the Bank of Ghana (BoG) is tasked with maintaining price stability, safeguarding the financial system and creating conditions that enable banks to support the initiative.

Delivering remarks on behalf of BoG Governor Johnson Pandit Asiama, Ismail Adam – Director of Banking Supervision – said the central bank views the 24-hour economy as capable of boosting capital formation, improving asset use and creating jobs.

Cedi continues to sell at GH¢12.25 to $1 on interbank market

“No nation has developed without an appreciable growth in the financial sector. The programme’s success therefore rests on the soundness of banks and availability of affordable credit,” he said.

The Bank of Ghana indicated it will use monetary policy to create a stable environment in which borrowing costs can ease, enabling firms to expand.Job creation opportunities

Adam stressed that reduced inflation and stable prices could give the central bank space to cut interest rates, widening access to loans.

At the same time, he noted banks must uphold strong governance and risk management to prevent failures that could undermine the system.

Payment infrastructure is also expected to play a role. The central bank said expanding the use of ATMs, online platforms and digital payments will reduce transaction costs and ensure liquidity around the clock, which is vital for a continuous economy.

The banking regulator also pointed to development finance institutions like Development Bank Ghana as key providers of long-term capital for industries aligned with the policy.

Nonetheless, structural barriers remain. The 24-Hour Economy Secretariat acknowledged that while finance is central to the plan, many businesses face high borrowing costs, strict collateral requirements and short-term lending structures that constrain growth.

The Secretariat’s Presidential Adviser, Goosie Tanoh, said these obstacles are among the biggest complaints of entrepreneurs.

According to the presidential adviser, the policy is centred on micro, small and medium enterprises, cooperatives and both local and foreign firms. But without more flexible credit, the ability of these groups to scale up remains limited.

He also pointed to long-standing regulatory inefficiencies and the diversion of banking sector resources toward government financing as constraints on enterprise development.

Meanwhile, to overcome the aforementioned challenges, the Secretariat said it has engaged stakeholders – including banks – to design a package of financing solutions it hopes will align with central bank standards while remaining profitable for lenders.

“We believe we have a package of workable solutions that you can help us improve and use to drive growth and profitability for entrepreneurs and the banks,” he said.

Watch the latest edition of BizTech below: