Initially reported by Reuters on Wednesday evening, it appears the popular fitness and social app, Strava, is set for an initial public offering (IPO) ‘as early as 2026’. Large banks, including JPMorgan, Morgan Stanley, and Goldman Sachs, have been approached.

The valuation of the company is currently estimated at $2.2bn, thanks to an active user base of 150 million, based on a funding round completed in May of this year. It is unclear at this time how much the San Francisco-based company hopes to raise from this IPO and the valuation it will seek.

What is an IPO?

Strava is currently a private company, meaning ownership of the brand and the profits from it are kept to a small group of individuals, usually the founders and private investors who come aboard as shareholders during rounds of funding, as occurred in May.

You may like

An initial public offering is the official launch of the company to the general public on the stock exchange, meaning that if this reporting is true, then members of the public will be able to buy or sell shares in Strava on the stock exchange (which particular exchange is unclear), and the value of the company is more greatly affected by market sentiment.

Signs this was coming?

In 2023, co-founder and outgoing CEO Michael Horvath suggested that an IPO is something the business would consider at the right time. Hovarth subsequently suggested the business needed a CEO with experience to “make the most of this next chapter”, before Strava went on to appoint Michael Martin, an ex-Google executive, as its new CEO.

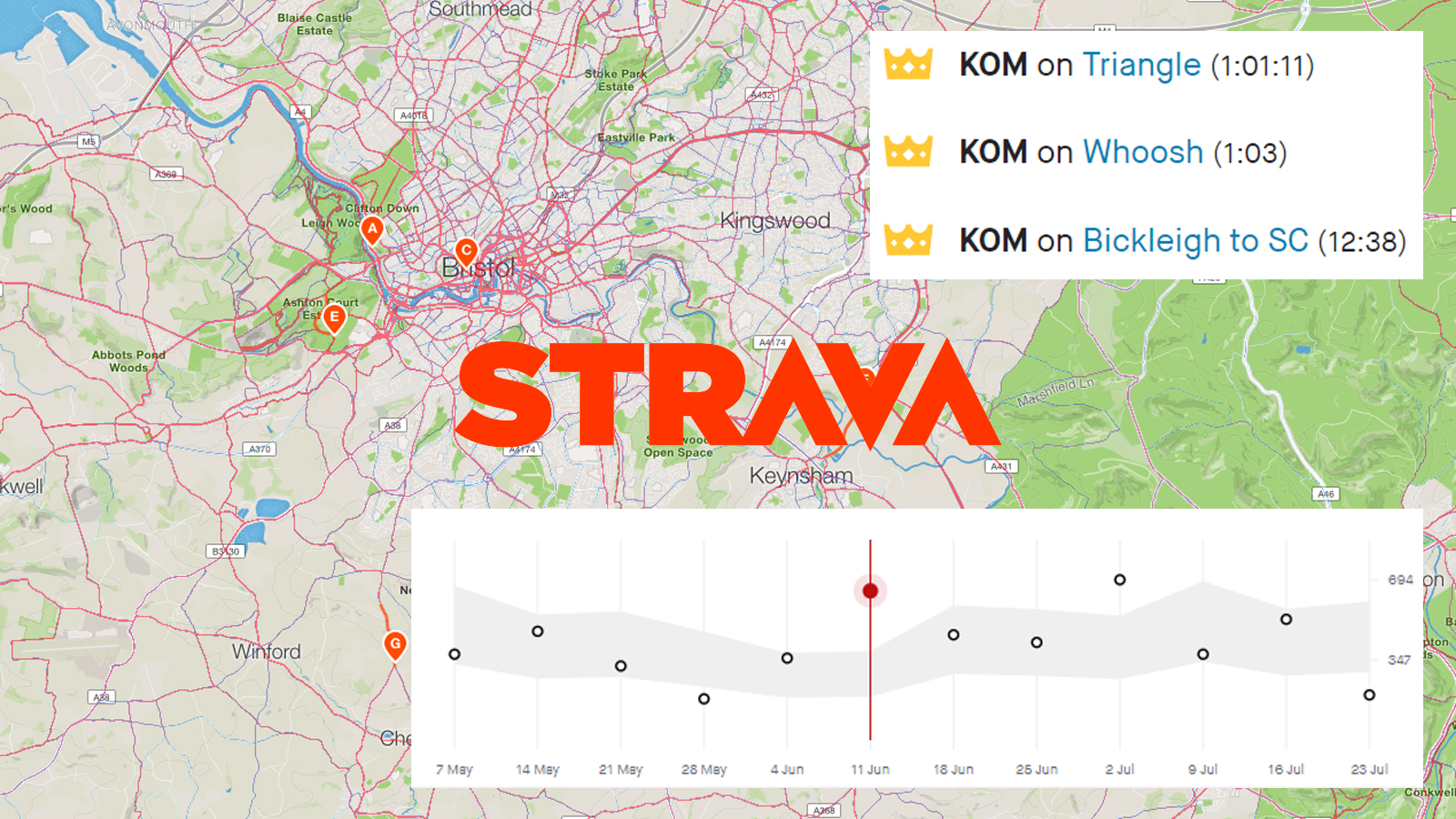

Before this, in 2020, Strava made its leaderboards for KOM/QOM segments available only to paid subscribers, which could be taken as a slow move towards making the app more financially viable, too.

Last year, however, the platform brought out a slew of new updates, from night mode to aid its users in running or cycling on safe routes after dark to AI integration in the flagging of dodgy segment times. AI has become something of a buzzword with all tech platforms, but combined with the integration of Oakley’s Meta-enabled AI sunglasses, Strava’s deployment of it certainly paints a picture of a forward-looking brand with an eye on creating a diverse value package for investors to see.

What will this mean for users?

It’s hard to say at this stage what Strava’s going public will mean, but once brands (and especially apps) go public, there is often a concurrent push to create more shareholder value (i.e. extract more value from the customers).

Whether Strava’s shareholder accountability would see more monetisation creep in is impossible to tell, but it wouldn’t be out of the question to suggest it will likely have a bigger push to vie for your time in the attention economy for both paid and free users, one way or another. It is for many users already as much a social media app as it is an activity tracker.

Given that the platform is such an ingrained part of not just cycling but more or less any endurance sport at this point, we hope that it doesn’t succumb to platform decay, whereby initially engaging, free platforms (free, such that they draw a critical mass of users) slowly degrade in quality as they seek to claw back money for their investors.

While it didn’t follow an IPO, Komoot drew the ire of many when its founders sold the brand to private equity firm, Bending Spoons, with users lamenting not only the axing of most of the staff but also the continued ‘enshitification’ of the platform with key features like Garmin and Wahoo integration and being paywalled for new users. A cautionary tale, perhaps.