Strava, the popular American fitness-tracking app, is making serious moves to become a publicly traded company. The news, first reported by Reuters, says the company is inviting major investment banks to guide them through its initial public offering (IPO).

That process would enable company shares to be sold to investors, with the shares sold giving the company additional funds to reinvest in the business, but with the expectation of paying out profits to those shareholders in the form of dividends.

This is not the first time that the company has taken steps towards going public, but its latest recruitments suggest this is the most serious effort yet. Strava’s co-founder and CEO, Michael Horvath, stepped down in 2023 and was replaced by former YouTube executive Michael Martin. Last month, Strava hired a new Chief Financial Officer who had previously led the IPO process for the financial services company Square. They are also hiring roles with responsibilities for “IPO-readiness”.

The user experience on the app has also changed in recent years. In 2020, as home exercise surged during the coronavirus pandemic, Strava moved several of its mapping and segment features behind a subscription paywall. At the same time, the company announced it was “betting on [its] athletes” by reserving its future app developments for subscribers. Today, a subscription costs £8.99 a month or £54.99 a year.

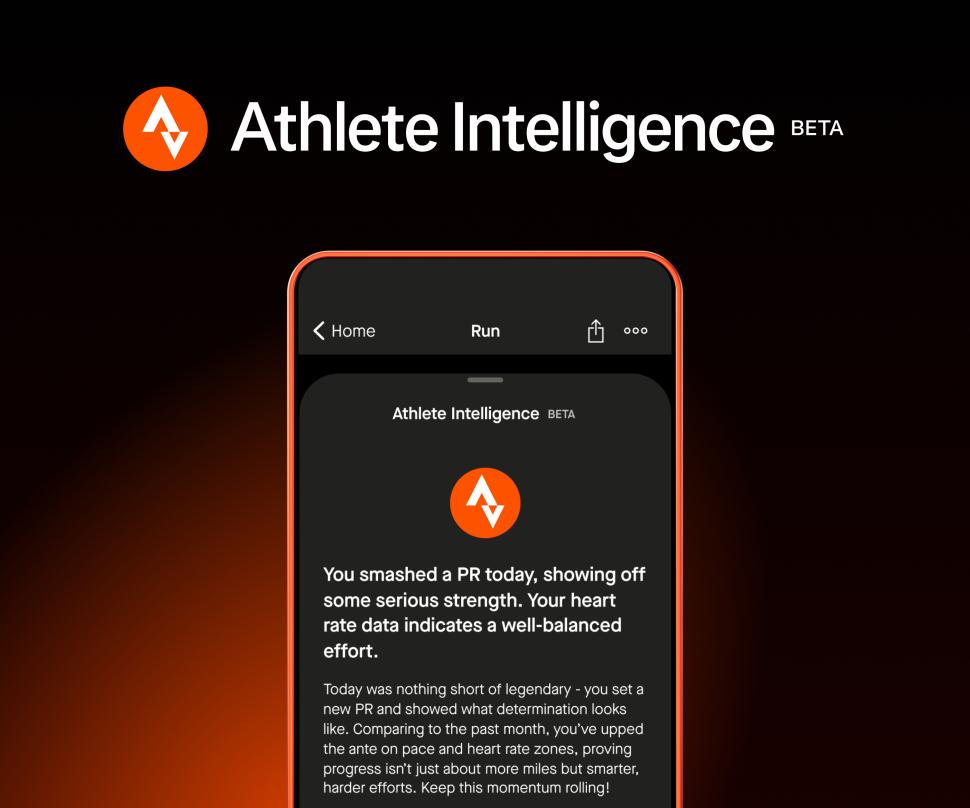

2024 Strava Athlete Intelligence (credit: road.cc)

2024 Strava Athlete Intelligence (credit: road.cc)

Last year Strava rolled out the introduction of Athlete Intelligence, an AI training model designed to offer feedback to users on their exercise performance. It has also retained its position in the market by acquiring several rival companies, including 3-D mapping company Fatmap, and the AI training apps Runna and The Breakaway. At the same time, users are now no longer able to sync Strava’s data across other platforms (this doesn’t prevent other platforms’ data being shared and uploaded to Strava).

Whilst Strava claims to have more than 150 million users (though maybe that should read 150 million accounts), it is understood that approximately 5 percent of that total are premium subscribers and that the business has yet to become profitable. In 2022, the company shrunk its workforce by 15 percent following a round of redundancies.

But despite that, the company was valued at £2.2 billion earlier this year, and is likely to attract the attention of several venture capitalists and larger tech firms. A similar example might be the case of wearable activity trackers Fitbit, which went public in 2015 until being bought and folded into Google in 2021.

The move will lead to greater scrutiny of Strava’s handling of its user data, which has in the past faced privacy concerns.The move may also spark fear among users that interested investors may be motivated in purchasing the company to gain access to user data rather than growing and improving the business.