LiDAR in Mapping Market Size and Share Forecast Outlook 2025 to 2035

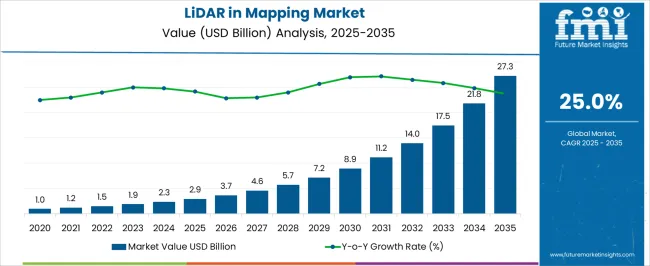

The LiDAR in mapping market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 27.3 billion by 2035, registering a compound annual growth rate (CAGR) of 25.0% over the forecast period.

The LiDAR in mapping market is valued at USD 2.9 billion in 2025 and is set to reach USD 27.3 billion by 2035, with a CAGR of 25.0%. Between 2021 and 2025, the market shows steady growth from USD 1.0 billion to USD 2.9 billion, moving incrementally from USD 1.2 billion, 1.5 billion, 1.9 billion, and 2.3 billion. This phase marks the early adoption of LiDAR technology in mapping applications, driven by demand in sectors like surveying, environmental monitoring, and urban planning. The initial breakpoint occurs in 2025, where growth accelerates significantly from USD 2.9 billion to USD 7.2 billion by 2030.

During this period, the values progress through USD 3.7 billion, 4.6 billion, 5.7 billion, and 7.2 billion, as the market experiences a shift in dynamics, driven by technological advancements and a wider range of applications. This includes increased use of LiDAR for autonomous vehicles, agriculture, and infrastructure development.

From 2031 to 2035, the market continues its upward trajectory, reaching USD 27.3 billion by 2035, with values passing through USD 8.9 billion, 11.2 billion, 14.0 billion, 17.5 billion, and 21.8 billion. The second breakpoint occurs in 2031, as the market moves towards full mainstream adoption, fueled by innovations in LiDAR technology, reduced costs, and growing demand for high-precision mapping in diverse industries.

Quick Stats for LiDAR in Mapping Market

LiDAR in Mapping Market Value (2025): USD 2.9 billion

LiDAR in Mapping Market Forecast Value (2035): USD 27.3 billion

LiDAR in Mapping Market Forecast CAGR: 25.0%

Leading Segment in LiDAR in Mapping Market in 2025: Airborne (39.5%)

Key Growth Regions in LiDAR in Mapping Market: North America, Asia-Pacific, Europe

Top Players in LiDAR in Mapping Market: FARO Technologies, Inc, Argo AI, Velodyne LiDAR, Inc, Cepton Technologies, Inc, Innoviz Technologies Ltd, Phantom Intelligence, Hesai Technology, LeddarTech, Inc, Luminar Technologies, Inc, Ouster, Inc, Phoenix LiDAR Systems, Fugro N.V, Quanergy Systems, Inc, Leica Geosystems AG (Hexagon), Tetravue, Inc, Trimble Inc, LeiShen Intelligent Systems Co., Ltd, Topcon Positioning Systems, Inc, Blickfeld GmbH

LiDAR in Mapping Market Key Takeaways

Metric

Value

LiDAR in Mapping Market Estimated Value in (2025 E)

USD 2.9 billion

LiDAR in Mapping Market Forecast Value in (2035 F)

USD 27.3 billion

Forecast CAGR (2025 to 2035)

25.0%

The geospatial industry market is a major contributor, accounting for around 30-35%, as LiDAR technology is essential for creating high-resolution, accurate maps and models used in land surveying, urban planning, and natural resource management. The aerospace and defense market plays a significant role, contributing approximately 20-25%, as LiDAR is used in military and defense applications for terrain mapping, surveillance, and mission planning, enhancing navigation and situational awareness. The construction and infrastructure market contributes about 15-20%, with LiDAR being widely used for mapping and monitoring construction sites and planning infrastructure projects like roads and bridges, improving accuracy and efficiency in design.

The automotive and transportation market also plays an important role, accounting for around 10-12%, as LiDAR is integral to autonomous vehicles, providing accurate 3D maps and real-time data for navigation and obstacle detection. Lastly, the environmental and agricultural market contributes approximately 8-10%, as LiDAR is used in environmental monitoring for flood mapping, forest management, and habitat analysis, as well as in agriculture for precision farming and crop assessment. These parent markets highlight the diverse and growing demand for LiDAR in mapping, driven by advancements in geospatial, defense, construction, transportation, and environmental technologies.

Why is the LiDAR in Mapping Market Growing?

The LiDAR in mapping market is witnessing sustained expansion, driven by the growing demand for high-resolution geospatial data and the increasing use of advanced mapping technologies in infrastructure development, environmental monitoring, and urban planning. Government agencies, construction firms, and utility providers are increasingly adopting LiDAR-based mapping systems to improve precision, reduce field time, and support large-scale project planning. Advancements in point cloud processing, sensor miniaturization, and real-time data acquisition are significantly enhancing the utility of LiDAR in diverse terrains and conditions.

The capability of LiDAR to generate three-dimensional models with sub-centimeter accuracy is offering considerable advantages over traditional surveying methods. Moreover, its integration with AI, GNSS, and photogrammetry is enabling more intelligent, automated workflows.

Regulatory initiatives supporting smart city development and digital twin technologies are further contributing to the increased deployment of LiDAR systems As infrastructure investment grows and data-driven decision-making becomes standard practice, the market for LiDAR in mapping is expected to expand steadily, supported by strong innovation, cost reduction of hardware, and cross-sector applicability across government, commercial, and research domains.

Segmental Analysis

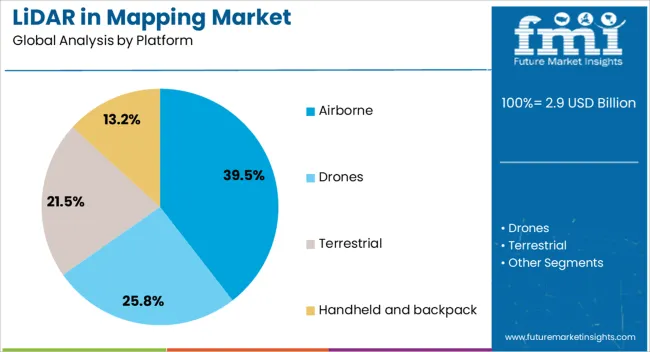

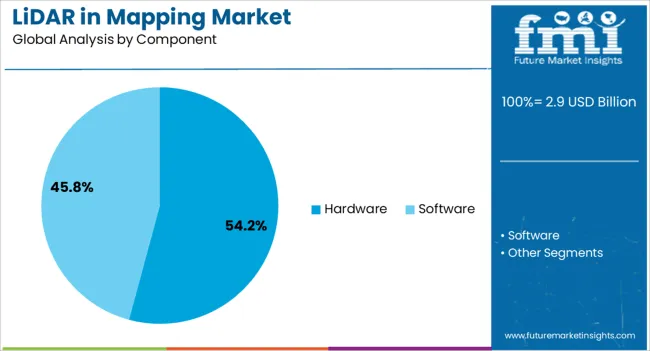

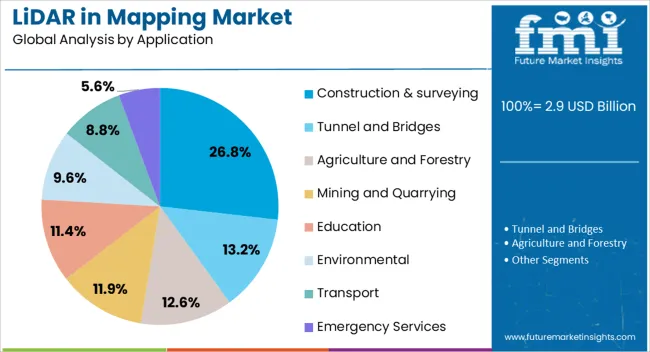

The LiDAR in mapping market is segmented by platform, component, application, and geographic regions. By platform, LiDAR in mapping market is divided into airborne, drones, terrestrial, and handheld and backpack. In terms of component, LiDAR in mapping market is classified into hardware and software. Based on application, LiDAR in mapping market is segmented into construction & surveying, tunnel and bridges, agriculture and forestry, mining and quarrying, education, environmental, transport, and emergency services. Regionally, the LiDAR in mapping industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Airborne Platform Segment

The airborne platform segment is projected to hold 39.5% of the LiDAR in mapping market revenue share in 2025, establishing itself as the leading platform. This dominance is being driven by the segment’s ability to capture large-area topographical data with high precision in a short time. Airborne LiDAR is proving advantageous for mapping inaccessible or hazardous regions, making it the preferred choice for national surveys, forest inventory, and coastal management.

The increasing deployment of LiDAR sensors on manned aircraft and unmanned aerial vehicles is allowing operators to conduct frequent and cost-effective surveys across expansive landscapes. Technological improvements in laser ranging, GPS integration, and inertial measurement units are further increasing the spatial accuracy and resolution of airborne systems.

The demand for updated and high-resolution elevation data for flood modeling, infrastructure planning, and environmental impact assessments is also supporting growth The ability to rapidly generate georeferenced 3D datasets from elevated platforms is enhancing project turnaround times and reducing labor-intensive ground surveys, thereby reinforcing the airborne segment’s leadership in the global market.

Insights into the Hardware Component Segment

The hardware segment is expected to account for 54.2% of the LiDAR in mapping market revenue share in 2025, making it the dominant component category. This leadership is being reinforced by the critical role hardware plays in enabling core LiDAR functionality, including light detection, data capture, and signal processing. The increasing sophistication of laser scanners, GPS units, and inertial navigation systems is enhancing data accuracy, enabling real-time terrain modeling, and supporting multi-environment usage.

The segment is also benefiting from advancements in miniaturization and energy efficiency, which are allowing hardware systems to be deployed on smaller drones and vehicles without compromising performance. Rising investments in autonomous systems and infrastructure projects are stimulating demand for robust, high-performance LiDAR hardware that can deliver precise data across variable terrains.

Manufacturers are prioritizing innovations that reduce cost and improve range and resolution, making LiDAR hardware more accessible to mid-size firms and new adopters As LiDAR technology continues to evolve, the hardware segment is expected to remain a foundational growth area, supported by its essential role in the broader mapping ecosystem.

Insights into the Construction and Surveying Application Segment

The construction and surveying segment is projected to capture 26.8% of the LiDAR in mapping market revenue share in 2025, positioning it as the leading application. This dominance is being attributed to the growing demand for high-precision site modeling, structural analysis, and volume measurement in infrastructure development and land surveying. LiDAR systems are enabling project managers and engineers to obtain detailed topographical data quickly, reducing the need for manual measurements and repeat site visits.

The use of LiDAR in pre-construction surveys is improving design accuracy, facilitating better risk management, and enabling compliance with regulatory requirements. Its ability to capture detailed elevation data supports grading and earthworks planning, while post-construction assessments are also benefiting from precise 3D documentation.

As construction projects become more complex and schedule-sensitive, the need for reliable geospatial data is reinforcing the value of LiDAR The segment is also benefiting from the integration of LiDAR with Building Information Modeling and other digital planning tools, enabling seamless workflows from survey to design to execution, thereby solidifying its role as a vital application area in the mapping market.

What are the Drivers, Restraints, and Key Trends of the LiDAR in Mapping Market?

LiDAR’s ability to create highly accurate 3D models and capture detailed topographic information is driving its adoption. Demand is particularly high for LiDAR systems used in geographic information systems (GIS) and remote sensing applications, where accurate elevation data and terrain modeling are critical. Challenges in the market include high equipment costs, limited access to skilled operators, and regulatory concerns related to data privacy. Opportunities are emerging in the integration of LiDAR with unmanned aerial vehicles (UAVs) and drones for aerial mapping applications. Trends point to the increasing use of LiDAR for autonomous vehicle navigation, infrastructure monitoring, and smart city development. Suppliers that offer cost-effective, high-performance, and integrated LiDAR solutions are well-positioned for growth.

Rising Demand for High-Precision Mapping and Surveying Solutions

The LiDAR in mapping market is being driven by the growing need for accurate, high-resolution mapping and surveying solutions across various sectors. LiDAR’s ability to generate precise 3D models and capture detailed data on topography, vegetation, and infrastructure makes it invaluable for applications such as land surveying, environmental monitoring, and flood modeling. As urbanization accelerates, there is an increasing demand for efficient mapping solutions for city planning, transportation infrastructure, and disaster management. LiDAR technology is also gaining traction in agriculture for precision farming, where it helps to map field conditions and optimize crop yield. The need for accurate, reliable, and real-time data across these applications is expected to continue driving the growth of the LiDAR in mapping market.

Costs, Supply, Regulatory, and Technical Constraints

The LiDAR in mapping market faces challenges related to the high initial costs of LiDAR equipment, which can be a barrier for smaller organizations or those in developing regions. The equipment, which requires advanced sensors, cameras, and processing systems, is typically expensive and may require significant investment. Additionally, operational challenges, such as the need for skilled operators who can process and interpret complex LiDAR data, further increase costs. Regulatory constraints, particularly regarding data privacy and airspace regulations for drone-based LiDAR systems, may limit the adoption of LiDAR technology in certain regions. Furthermore, the integration of LiDAR data with other mapping systems, like GIS, can require complex technical solutions and customized software, adding another layer of complexity for end users.

Opportunities in Drone Integration and Autonomous Vehicles

Opportunities in the LiDAR in mapping market are particularly strong in drone integration and autonomous vehicles. The use of LiDAR-equipped drones for aerial mapping applications is rapidly expanding, offering cost-effective and efficient solutions for surveying large areas, such as forests, agricultural fields, and construction sites. Drones provide a flexible, scalable option for LiDAR deployment, reducing operational costs and improving accessibility to remote or hazardous areas. In the autonomous vehicle sector, LiDAR is a critical technology for creating detailed, real-time 3D maps of roadways, obstacles, and traffic conditions, enabling safe navigation. As autonomous driving technology continues to evolve, the demand for LiDAR in mapping solutions for vehicle navigation is expected to rise. The integration of LiDAR with other technologies, such as AI and machine learning, is also creating new growth opportunities.

Trends in Miniaturization, Integration, and Smart City Applications

The LiDAR in mapping market is trending toward miniaturization and increased integration with other technologies. The development of smaller, more affordable LiDAR sensors is making the technology more accessible to a wider range of industries, including real-time monitoring of infrastructure and urban environments. LiDAR systems are also being integrated with other technologies such as GPS, camera systems, and communication networks, enabling more powerful and comprehensive mapping solutions. The rise of smart cities, where sensors are used to monitor everything from traffic flow to environmental quality, is also driving the adoption of LiDAR for urban planning and infrastructure monitoring. Trends indicate a growing preference for mobile LiDAR systems that can be mounted on vehicles for large-scale surveys and mapping projects, as well as the continued development of LiDAR systems for autonomous applications, which are expected to revolutionize navigation and mapping technologies.

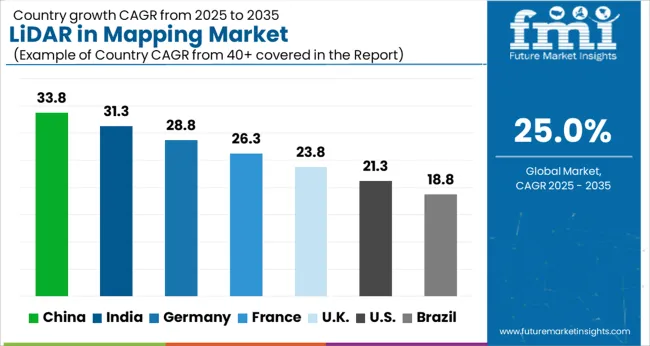

Analysis of LiDAR in Mapping Market By Key Countries

Country

CAGR

China

33.8%

India

31.3%

Germany

28.8%

France

26.3%

UK

23.8%

USA

21.3%

Brazil

18.8%

The global LiDAR in mapping market is projected to grow at an exceptional CAGR of 25% from 2025 to 2035. China leads the market with a CAGR of 33.8%, followed by India at 31.3% and Germany at 28.8%. The UK and USA show growth rates of 23.8% and 21.3%, respectively. LiDAR’s application in infrastructure development, autonomous vehicles, renewable energy projects, and agriculture is driving its adoption across these regions. As governments invest in smart cities, renewable energy, and autonomous technology, the demand for advanced mapping solutions continues to rise globally. The analysis spans over 40+ countries, with the leading markets shown below.

Demand Forecast for LiDAR in Mapping Market in China

The LiDAR in mapping market in China is projected to grow at a remarkable CAGR of 33.8% from 2025 to 2035. China’s rapid infrastructure development, especially in urban planning, transportation, and environmental monitoring, is fueling the demand for advanced LiDAR technologies. The use of LiDAR in mapping for applications such as topographic surveys, forest management, and autonomous vehicles is gaining momentum. China’s government-backed initiatives in smart city projects and large-scale infrastructure development, including high-speed rail, are significantly contributing to the adoption of LiDAR technology. Furthermore, with the rising integration of 3D mapping and geospatial data in government planning and construction, the demand for LiDAR solutions continues to rise. As the country leads the way in technology innovation and industrial development, the expansion of commercial and scientific applications for LiDAR is expected to contribute further to market growth.

Rapid growth in infrastructure and smart city development driving LiDAR adoption

Expansion of LiDAR applications in transportation, environmental monitoring, and urban planning

Rising government support and technological investments in LiDAR systems

Growth Outlook for LiDAR in Mapping Market in India

The LiDAR in mapping market in India is set to grow at a CAGR of 31.3% from 2025 to 2035. As India continues to modernize its infrastructure and urban planning, the demand for LiDAR technology in mapping applications is rising rapidly. The technology is increasingly being used in applications such as land surveying, transportation planning, and environmental monitoring, where precision is paramount. With a rising focus on smart city initiatives, urbanization, and road expansion, the need for accurate 3D mapping solutions is growing. India’s government is heavily investing in infrastructure development, including roads, bridges, and airports, which is creating substantial demand for LiDAR-based mapping solutions. The increased use of LiDAR in agriculture, especially in precision farming, is contributing to the market’s growth. As the adoption of autonomous vehicles in India increases, the demand for LiDAR systems for navigation and safety also rises.

Strong growth in infrastructure projects and urbanization driving LiDAR demand

Increased adoption of LiDAR for precision agriculture and transportation planning

Government investment in smart cities and transportation infrastructure supporting LiDAR usage

Trends Analysis of the LiDAR in Mapping Market in Germany

The LiDAR in mapping market in Germany is projected to expand at a CAGR of 28.8% from 2025 to 2035. Germany’s advanced manufacturing and engineering sectors are increasingly adopting LiDAR technology for a range of applications, including automotive, civil engineering, and environmental management. As a leader in the automotive sector, Germany is seeing significant demand for LiDAR in the development of autonomous driving systems, where accurate mapping is essential for navigation and safety. The country’s strong focus on renewable energy also drives the use of LiDAR in environmental monitoring and land surveys for wind and solar energy projects. Germany’s commitment to digital infrastructure and smart city initiatives is boosting the adoption of LiDAR-based mapping for urban planning, transportation networks, and construction projects.

Adoption of LiDAR for autonomous vehicle development and digital infrastructure projects

Increased use of LiDAR in environmental monitoring and land surveying for renewable energy

Growing demand for LiDAR in smart city projects and transportation network planning

Investment Opportunities in LiDAR in Mapping Market in the United Kingdom

The UK LiDAR in mapping market is expected to grow at a CAGR of 23.8% from 2025 to 2035. The demand for LiDAR technology in the UK is driven by applications in urban planning, civil engineering, environmental monitoring, and autonomous vehicles. With a push for infrastructure development and the expansion of smart cities, the need for accurate 3D mapping solutions is increasing. Additionally, the UK is investing heavily in renewable energy, where LiDAR is used for environmental monitoring and site assessments, particularly in wind and solar energy projects. The UK’s focus on enhancing transportation networks, improving road systems, and advancing autonomous vehicle technology is further contributing to the rise in LiDAR adoption. The use of LiDAR in agricultural and forestry management is increasing in the UK, supporting precision mapping and land-use analysis.

Growing investment in infrastructure development and smart cities driving LiDAR demand

Increased use of LiDAR in renewable energy projects, particularly wind and solar

Adoption of LiDAR in autonomous vehicles, agriculture, and land-use mapping

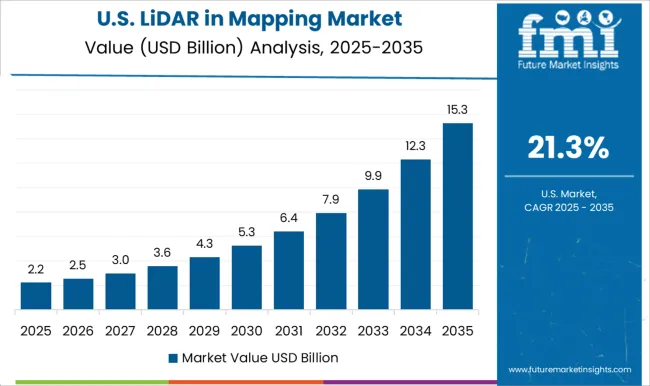

Trends Analysis of Heat Treating Market in the United States

The USA LiDAR in mapping market is projected to grow at a CAGR of 21.3% from 2025 to 2035. The USA has a robust demand for LiDAR technology across multiple sectors, including transportation, agriculture, and defense. LiDAR is increasingly being used in the development of autonomous vehicles, where accurate mapping is essential for vehicle navigation and safety. The growing adoption of LiDAR in urban planning, construction, and civil engineering projects is also fueling market demand. Moreover, the USA government’s focus on infrastructure modernization and environmental sustainability is driving the use of LiDAR for land surveying, environmental monitoring, and resource management. The use of LiDAR technology in agricultural and forestry management is expanding as it offers enhanced precision for land mapping and monitoring. The increasing integration of LiDAR with drone technology for aerial mapping is helping to expand its use in commercial and research applications.

Increased use of LiDAR in autonomous vehicle development and infrastructure planning

Growing adoption of LiDAR for environmental monitoring, land surveying, and resource management

Expansion of LiDAR technology in agriculture, forestry, and drone-based mapping applications

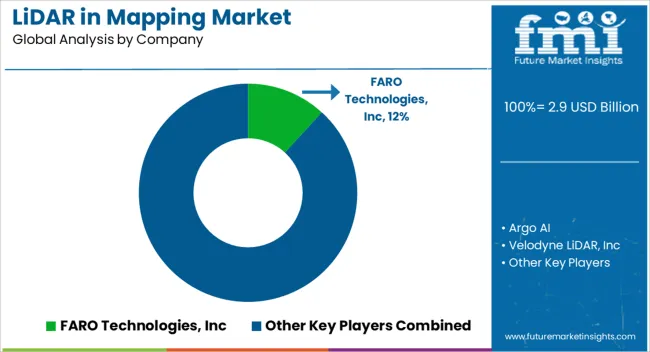

Competitive Landscape of LiDAR in Mapping Market

The LiDAR (Light Detection and Ranging) in mapping market is highly competitive, with numerous players offering advanced technologies that cater to applications across automotive, surveying, geospatial, and industrial sectors. FARO Technologies, Inc. is a significant market leader, offering high-precision LiDAR scanners designed for 3D imaging and mapping. Their solutions are widely used in construction, architecture, and industrial inspections, providing fast, accurate data collection for professionals. Argo AI competes in the autonomous vehicle space, leveraging LiDAR technology to enhance mapping for self-driving systems, with a focus on safety and real-time decision-making.

Velodyne LiDAR, Inc., a well-known pioneer in the field, continues to lead with its diverse range of LiDAR sensors, including the VLP-16 and HDL-64, designed for applications in autonomous vehicles, robotics, and mapping. Their focus is on providing scalable, high-performance solutions that deliver clear, detailed 3D maps. Cepton Technologies, Inc. differentiates itself with its compact, cost-effective LiDAR sensors, tailored for both automotive and industrial applications, emphasizing performance without sacrificing affordability. Innoviz Technologies Ltd provides cutting-edge solid-state LiDAR solutions aimed at autonomous vehicles, offering high-definition mapping and enabling precise environmental understanding for self-driving cars.

Other key players include Hesai Technology, LeddarTech, Inc., and Luminar Technologies, Inc., which focus on developing high-performance LiDAR systems for a variety of mapping needs. Hesai’s products are particularly noted for their advanced point cloud generation and long-range scanning, while LeddarTech provides scalable LiDAR solutions with strong integration capabilities. Luminar, known for its LiDAR sensors for autonomous vehicles, also extends its technology to high-precision mapping for commercial and industrial applications. Companies like Ouster, Phoenix LiDAR Systems, Fugro N.V., and Leica Geosystems AG (Hexagon) provide advanced solutions for surveying, geospatial mapping, and construction.

Leica’s LiDAR solutions are widely used in engineering, while Fugro focuses on integrating LiDAR data into geospatial mapping for environmental and infrastructure applications. Trimble Inc. and Tetravue, Inc. target the geospatial market, offering LiDAR systems for detailed mapping and data collection in remote and rugged terrains. Other notable companies, including Quanergy Systems, Inc., LeiShen Intelligent Systems Co., Ltd., Topcon Positioning Systems, Inc., and Blickfeld GmbH, are also advancing LiDAR technology for a range of applications, from surveying to infrastructure and transportation. Product brochures from these companies emphasize LiDAR’s ability to provide high-definition 3D data, precision, and efficiency, positioning their offerings as essential tools for modern mapping and autonomous systems. Competitive strategies focus on technological advancements, affordability, and meeting the growing demand for precise, real-time mapping in a variety of industries.

Key Players in the LiDAR in Mapping Market

FARO Technologies, Inc

Argo AI

Velodyne LiDAR, Inc

Cepton Technologies, Inc

Innoviz Technologies Ltd

Phantom Intelligence

Hesai Technology

LeddarTech, Inc

Luminar Technologies, Inc

Ouster, Inc

Phoenix LiDAR Systems

Fugro N.V

Quanergy Systems, Inc

Leica Geosystems AG (Hexagon)

Tetravue, Inc

Trimble Inc

LeiShen Intelligent Systems Co., Ltd

Topcon Positioning Systems, Inc

Blickfeld GmbH

Scope of the Report

Items

Values

Quantitative Units

USD 2.9 billion

Platform

Airborne, Drones, Terrestrial, and Handheld and backpack

Component

Hardware and Software

Application

Construction & surveying, Tunnel and Bridges, Agriculture and Forestry, Mining and Quarrying, Education, Environmental, Transport, and Emergency Services

Regions Covered

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Country Covered

United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa

Key Companies Profiled

FARO Technologies, Inc, Argo AI, Velodyne LiDAR, Inc, Cepton Technologies, Inc, Innoviz Technologies Ltd, Phantom Intelligence, Hesai Technology, LeddarTech, Inc, Luminar Technologies, Inc, Ouster, Inc, Phoenix LiDAR Systems, Fugro N.V, Quanergy Systems, Inc, Leica Geosystems AG (Hexagon), Tetravue, Inc, Trimble Inc, LeiShen Intelligent Systems Co., Ltd, Topcon Positioning Systems, Inc, and Blickfeld GmbH

Additional Attributes

Dollar sales by LiDAR sensor type (2D, 3D, hybrid), application (autonomous vehicles, construction, agriculture, environmental monitoring, geospatial surveying), and technology (solid-state, mechanical). Demand dynamics are driven by the increasing adoption of autonomous systems, advancements in geospatial mapping, and the growing need for accurate, real-time data in construction and urban planning. Regional trends highlight significant growth in North America, Europe, and Asia-Pacific, with investments in smart city development, autonomous vehicles, and infrastructure projects driving demand for LiDAR technology.