By Leonard KehnscherperJulia Janicki Published: September 23, 2025 | Updated: September 24, 2025

Europe’s asset managers have long agreed they must consolidate to survive. A string of high-profile acquisitions suggests they’re finally willing to do something about it.

Deals from France to Switzerland and Italy have started to reshape the industry and create new trillion-dollar firms, driven by banks flush with cash from higher interest rates and keen to boost their fee income.

They’re pushing back against the large US firms that have taken market share since the financial crisis by flooding the region with cheap index-tracking funds. With fees under pressure, Europe’s fund managers have no choice but to merge and cut cost — and jobs — or venture into alternative assets and private markets, many of which are also dominated by the US competitors.

In France, BNP Paribas SA just formed the European Union’s second-largest asset manager by acquiring the investment arm of insurer Axa SA. In Switzerland, the government-brokered rescue of Credit Suisse afforded UBS Group AG the opportunity to expand its fund provider. Firms such as Amundi SA, DWS Group and Allianz Global Investors have been in on-again, off-again talks about various combinations.

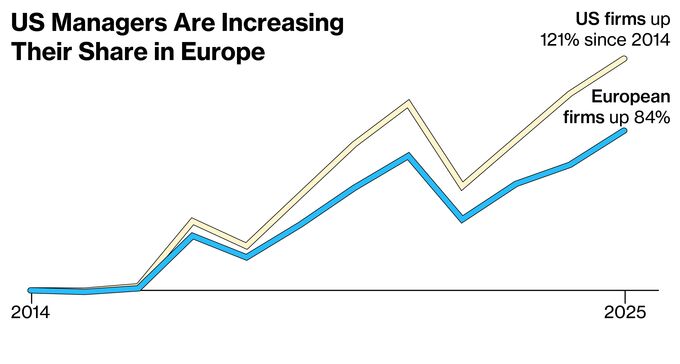

US Managers Are Increasing Their Share in Europe

Assets under management by

Source: ISS Market Intelligence

Note: Funds of funds and money market funds excluded. 2025 value until May.

Challenges abound. The market for passive funds is dominated by firms that moved early and have the scale to still make money from low-margin index trackers. While M&A between asset managers can cut costs it doesn’t fundamentally address the issue of fee compression among retail investors who are increasingly price sensitive.

And with valuations of traditional fund firms depressed, buying an alternative asset manager to add a higher margin business is expensive and doesn’t always work out, as some tie-ups in the US have shown, where Wall Street firms face mounting pressure to try more drastic measures.

Read More: Mutual Fund Titans Plowed Into Private Markets. It Isn’t Working

In Europe, it is even more complicated with national politics impeding at least one recent deal in asset management, and many more in banking. A plan by Assicurazioni Generali SpA and BPCE SA to create Europe’s second-biggest asset manager is looking increasingly fragile. Amundi-owner Credit Agricole, meanwhile, is exploring options what to do with its large stake in Banco BPM SpA, the Italian bank that recently acquired asset manager Anima Holding.

But the need to consolidate is a reality for asset managers globally, as investors shift money from actively managed funds to index-tracking vehicles with lower fees. Almost 39% of mutual fund and ETF assets worldwide were in such passive products last year, more than double the market share a decade earlier, according to Boston Consulting Group and ISS Market Intelligence.

“We’re not just hearing about conversations, we’re now also seeing action,” said Christian Edelmann, Oliver Wyman’s head of Europe.

Passive Funds Are Gaining Ground

Global share of

Sources: Boston Consulting Group, ISS Market Intelligence, MarketPulse

The implications of that shift are particularly relevant for Europe, where the industry remains highly fragmented along national lines. Roughly 4,600 asset managers operate in the region, according to industry body EFAMA, which estimates that total assets under management rose to almost €34 trillion ($40 trillion) last year. While some firms are household names in their national or regional markets, most have no meaningful size or position across Europe.

That fragmentation continues at the level of the investment products that these firms offer. Even when looking at the larger funds — those with $500 million or more in assets — only seven providers command a market share of more than 2%, according to an analysis of filings of open-ended funds and exchange-traded products tracked by Bloomberg.

Three of them are from the US — BlackRock, Vanguard Group Inc. and JPMorgan — underscoring the threat to European asset managers from their larger overseas rivals. US-based firms in aggregate have seen assets in Europe grow by more than 120% since 2014, compared with about 84% at their European rivals, according to data from ISS Market Intelligence.

US firmsControlled by European insurersControlled by European banksIndependentBlackrock$12.5TVanguard$10.9Tassets under managementState Street$5.12TJPMorgan: $3.9TGoldman Sachs: $3.29TAmundi: $2.66TInvesco: $2TFidelity International: $1TMarket share in Europe-domiciled public market fundsSource: Bloomberg, company filingsGlobal assets under management024681012%024681012$14T

BlackRock Inc., the biggest ETF provider, is also the single-biggest player in Europe’s fund industry overall with almost double the market share of top European firm Amundi SA.

JPMorgan Chase & Co., which has expanded in European banking as local rivals pulled back, has been gaining in asset management as well and dominates the market for active ETFs in Europe.

Since going public in 2015, Amundi has grown aggressively through deals that pushed assets to €2.3 trillion and made it a major force in European ETFs. Ranked second after BlackRock, Amundi emulated the acquisition strategy of the world’s largest asset manager.

UBS Group AG’s asset management arm has a market share of around 5% among the large funds after combining with rival Credit Suisse. With almost $2 trillion under management globally, it’s well above the $1 trillion threshold that’s sometimes seen as minimum to successfully compete in the long term.

Apart from those firms, however, size is starting to become an issue. Allianz SE, the German insurer, on paper oversees more than $2 trillion for outside investors, but that’s split between two entirely separate firms. Its US subsidiary Pimco has a market share of about 1.4% among the larger European funds in the Bloomberg analysis, while the European fund unit Allianz Global Investors, or AGI, doesn’t make the top 20. Firms such as DWS Group hover just above the trillion-dollar mark in total assets but are still seen as potential takeover candidates — or perhaps acquirers.

“We are seeing consolidation increase because the market is becoming more competitive,’’ said Monika Calay, a research director at Morningstar Inc. “Private markets are also a driver — firms want to expand their offering in that space through acquisitions.’’

Two large deals have started to reshape the landscape and form new rivals for the dominant US firms. BNP Paribas SA’s purchase of Axa SA’s investment unit has created a $1.8 trillion player. Consolidated fund figures weren’t available at the cutoff date for this analysis, so the deal is not yet reflected in the chart.

BPCE SA, another French lender, signed a non-binding memorandum of understanding to combine its investment unit Natixis SA with that of Italian insurer Assicurazioni Generali SpA to form the European Union’s second-largest firm and underscore the dominance of French banks among the bloc’s fund providers. Since the announcement in January, however, doubts have emerged if the deal will actually go ahead.

↓

Scroll to see scenarios

BNP said the takeover of Axa Investment Managers will make it a European leader managing insurance and pension assets, with the ambition to become a top player in private assets and ETFs as well.

Top 20 European players by assets under management *Not counting merged

AmundiL&GBNP / AXAUBS AMNatixisDWSSchrodersAXA IMInsight InvestmentHSBC AMGenerali InvestmentsBNP ParibasAllianz Global InvestorsUnion InvestmentAberdeenM&GDekaBankEurizonJanus HendersonMEAGSwisscanto$1.76T$1.03T$719B Combined assets under management€1.5TFixed income€580BPrivate markets€267BEquities€179B

Two recent deals have started to reshape that landscape. BNP Paribas SA’s purchase of Axa SA’s investment unit, completed July 1, has created a $1.7 trillion player. The French bank said the takeover will make it a European leader managing insurance and pension assets, with the ambition to become a top player and private assets and ETFs as well. Consolidated fund figures for the combined entity weren’t available at the cutoff date for this analysis, so the deal is not yet reflected in the chart.

One Italian takeover that did go through was Banco BPM SpA’s purchase of asset manager Anima Holding, creating a firm with more than €220 billion under management. While that doesn’t change the top ranks of European asset managers, the acquisition set off a series of sometimes competing takeover proposals across Italian finance. Banco BPM’s largest shareholder is French lender Credit Agricole SA, which also controls Amundi.

Other deals are being discussed. Amundi has made no secret of its ambition to continue its role as consolidator in European asset management. It was in talks last year about a potential combination with Allianz’s European fund unit AGI, though the discussions fell apart in a disagreement over control of the combined unit, Bloomberg reported at the time.

AGI also attracted the interest of Deutsche Bank AG’s asset management arm, which was spun out in 2018 with the aim of making acquisitions easier. A German deal might be less complicated to pull off culturally than a combination with Paris-based Amundi, but overlap in areas such as active equities would likely lead to significant layoffs that could be difficult to implement.

The 50-50 joint venture of Generali Investments Holding and Natixis Investment Managers would have about €1.9 trillion under management. But opposition in Italy has cast doubt over its prospects.

Top 20 European players by assets under management *Not counting merged

AmundiGenerali / NatixisL&GUBS AMNatixisDWSSchrodersAXA IMInsight InvestmentHSBC AMGenerali InvestmentsBNP ParibasAllianz Global InvestorsUnion InvestmentAberdeenM&GDekaBankEurizonJanus HendersonMEAGSwisscanto$2.23T$1.55T$758B Combined assets under management€1.9TFixed income€632BPrivate markets€266BEquities€399B

Groupe BPCE, another French lender, agreed to combine its investment unit Natixis with that of Italian insurer Assicurazioni Generali SpA. If completed, the deal would form Europe’s second-largest firm and underscore the dominance of French banks among the European fund providers. But opposition from an Italian billionaire investor and some government officials in that country has cast doubt over its prospects, particularly after Rome asserted its interests in other financial services deals recently.

Amundi has made no secret of its ambition to continue its role as consolidator in European asset management. It was in talks last year about a potential combination with Allianz’s European fund unit AGI, though the discussions fell apart in a disagreement over control of the combined unit, Bloomberg reported at the time. AGI would add €562 billion to Amundi’s €2.3 trillion under management. About €390 billion of AGI’s assets are from outside investors, the rest is insurance money overseen for Allianz.

AGI also attracted the interest of Deutsche Bank’s asset management arm DWS. Spun out in 2018 with the aim of making acquisitions easier, DWS has been searching unsuccessfully for a partner that would catapult it to the very top of the European rankings. A German deal might be easier to pull off culturally than a combination of AGI with Paris-based Amundi, but overlap in areas such as active equities would likely lead to significant layoffs that could be difficult to implement. AGI would, however, bring about €94 billion in private markets assets to DWS.

Allianz CEO Oliver Baete and Deutsche Bank’s Christian Sewing are still discussing the merits of a potential transaction, according to people with knowledge of the conversations (CHK — will need to run by companies closer to publication date). Spokespeople for both companies tktk comment.

Other, hypothetical deal scenarios could involve a cash-rich US buyer, according to interviews with more than a dozen asset management leaders, investment bankers and industry experts. Some suggested that a powerhouse like JPMorgan could decide to approach an arguably undervalued player like Schroders Plc.

Private equity buyers have been looking at various European asset managers including Aberdeen Group Plc in the past year, people with knowledge of the deliberations said. While there hasn’t been a firm approach recently, a consortium led by CVC Capital Partners last year acquired London-listed Hargreaves Lansdown, Britain’s biggest retail investment platform.

A takeover of Schroders would add about $1 trillion to JPMorgan’s $3.9 trillion under management and deepen its ties with European asset allocators. While the Schroder family controls around 44% of the voting shares, the UK’s largest standalone asset manager has seen its shares decline over the past decade.

Top 20 European players by assets under management *Not counting merged

JPMorgan / SchrodersAmundiL&GUBS AMNatixisDWSSchrodersAXA IMInsight InvestmentHSBC AMGenerali InvestmentsBNP ParibasAllianz Global InvestorsUnion InvestmentAberdeenM&GDekaBankEurizonJanus HendersonMEAGSwisscanto$4.96T$1.06T Combined assets under management$4.96TFixed income$1.11TPrivate markets$671BEquities$1.25T Other, hypothetical deal scenarios could involve a US buyer launching a bid for a European firm that trades at a depressed valuation, according to interviews with more than a dozen asset management leaders, investment bankers and industry experts. Some suggested that a powerhouse like JPMorgan could decide to approach an arguably undervalued player like Schroders. Such a deal would add about $1 trillion to JPMorgan’s $4.3 trillion under management and deepen its ties with European asset allocators.

A similar, transatlantic deal helped Goldman Sachs climb the ranks in European asset management a few years ago, when it bought the asset-management arm of Dutch insurer NN Group NV. Goldman at the time reportedly beat out rivals including DWS and Allianz.

Another likely scenario includes a takeover of an undervalued mid-sized firm by a private equity buyer. Buyout firms have been looking at various players including Aberdeen Group Plc in the past year, people with knowledge of the deliberations said, but there hasn’t been a firm approach recently. A consortium led by CVC Capital Partners last year acquired London-listed Hargreaves Lansdown, Britain’s biggest retail investment platform.

Aberdeen’s Interactive Investor platform — a rival to Hargreaves Lansdown — already contributes the biggest share of the group’s profit. Private equity owners could be looking to squeeze the successful business for dividends while it looks for a strategic buyer to take over the struggling asset-management operations.

Whatever shape the deals take, they would come with an abundance of challenges. For one, asset management takeovers are notoriously difficult to pull off because the primary assets involved are people, investment performance and client trust, especially where active managers are involved. Then there’s the issue that simply combining two active managers with similar offerings can lead to client attrition. Even deals by traditional fund managers to expand into private markets and other alternative assets don’t always pay off.

“It would be nice to think we can create a European superpower in asset management,” Schroders Chief Executive Officer Richard Oldfield said at London’s Funds Congress earlier this year. But “slamming together two businesses that have fundamentally different cultures and investment processes is very difficult to manage.”

In 2017, Aberdeen Asset Management and Standard Life Plc merged, only to see assets under management eroded by years of outflows. Janus Henderson Group Plc, formed the same year through the transatlantic merger of two active managers, saw more than $100 billion of client money out the door over 21 consecutive quarters.

Other hurdles have to do with Europe’s political and regulatory landscape. National governments have imposed high hurdles on a number of proposed deals between banks, and may also seek to retain some degree of influence over the firms that allocate their country’s savings.

Prospective buyers are also unlikely to benefit from a preferable accounting treatment known as Danish Compromise, after the European Central Bank’s supervisory arm opposed its use in several deals, including BNP Paribas’s acquisition of AXA IM.

Still, says Dean Frankle, a partner at Boston Consulting Group, scale is not just key for firms to compete on price, but also in winning large mandates from institutional investors, where manager selection is closely scrutinized.

“No one gets fired for hiring a top-three manager,’’ he said. “You might for taking a chance on a boutique with a short track record.”

By Leonard KehnscherperJulia Janicki Edited by Christian BaumgaertelMichael Ovaska With assistance from Tom FevrierJan-Henrik FörsterClaudia CohenArno SchützeNoele IllienLevin StammFabio Moretta

Data

Market share landscape: Bloomberg News’ sample of asset managers is based on market share in open-ended and exchange-traded funds with assets of more than $500 million as of Aug. 11. The funds are domiciled in 30 European countries, including the UK and Switzerland. The sample includes assets under custody. Assets under management are based on latest available filings, with a cutoff date of June 30. All data converted to US dollar on Sept. 15, 2025.

Scenarios: The 20 largest Europe-based asset managers and the various deal scenarios are from the firms’ latest disclosures. Assets under management data converted to USD on Sept. 15, 2025. Merged businesses included for illustration purposes only.

(Updates to add details of deals in fourth paragraph.)