Aida, the ‘AI digital adviser’, has outperformed human adviser averages across all six CII exams.

FT Adviser can reveal, Aida, founded by Helena Wardle at Money Means, passed the CII diploma in financial advice after outperforming adviser averages and ChatGPT.

According to Wardle, each exam took Aida around 40 minutes to complete on average.

She said: “We recreated the exam conditions as closely as possible, invigilated by the CII and with no prior access to questions to make sure it was a fair test.

“The RO6 paper was the outlier, since it required a written submission and went through the usual CII marking process, so we waited longest for those results.”

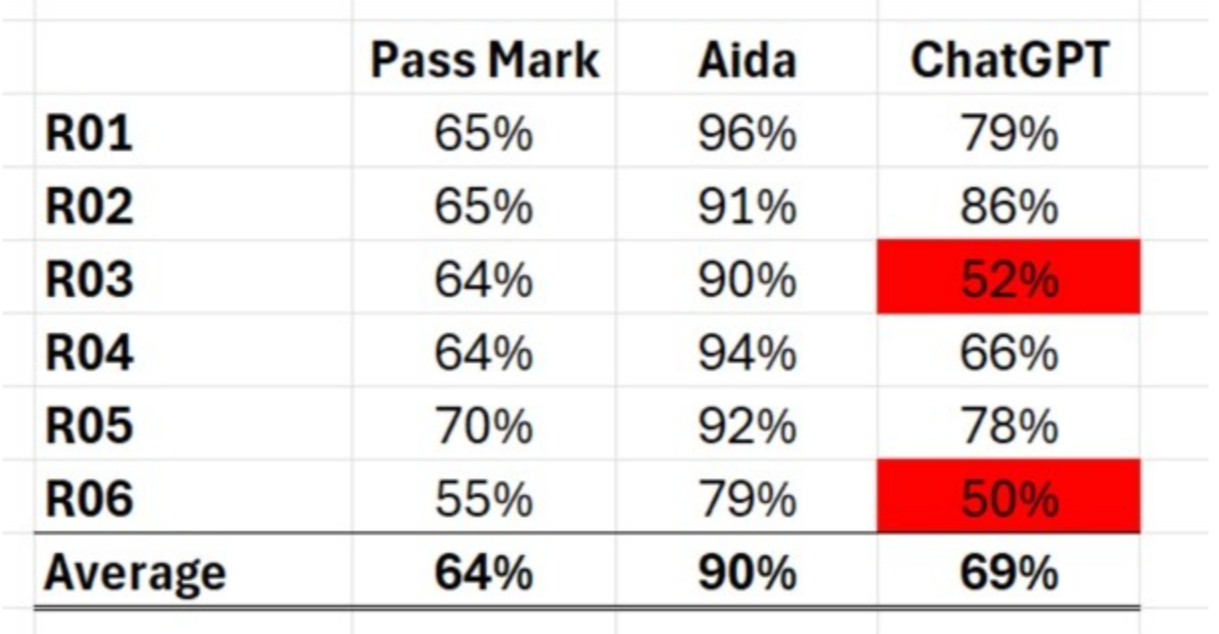

Aida scored the best in RO1, achieving a pass mark of 96 per cent compared to the human adviser average of 65 per cent.

ChatGPT fell short in RO3 and RO6 scoring 52 per cent and 50 per cent, respectively.

The below chart shows a breakdown of how Aida performed in each exam in comparison to ChatGPT and human advisers.

Pass marks across human advisers, Aida and ChatGPT for CII exams© Money Means

Sally Williams, chartered financial planner at Money Means, led the initiative in prepping Aida for the advisory exams.

She provided a robust knowledge base which Aida could draw from with additional input from Tom Richards, chief technology officer at Money Means.

Wardle said: “It was a painstaking process because we weren’t relying on generic data. We built Aida’s knowledge carefully, with all the intricacies of our field in mind.

“I can’t overstate the value of having that expertise in-house. If you’re serious about scaling financial help, you need that blend of technical depth and tech build.”

Learning curves

The big learning curve for Wardle and her team during this process was realising how differently AI consumes and processes information compared to humans.

Without standards and proper oversight, consumer-facing bots could do real harm. That’s why we need trained models, designed with expertise and consumer trust at the core

“Designing Aida wasn’t about stuffing her with facts, it was about teaching her the nuance and context needed to deliver genuinely good consumer outcomes. That was a huge effort.

“It also made me worry about how people might use general AI tools for financial help, when they have no way of judging the quality of the answer,” Wardle added.

She believed generative AI was brilliant at “sounding convincing, but not always at being right”.

“Without standards and proper oversight, consumer-facing bots could do real harm. That’s why we need trained models, designed with expertise and consumer trust at the core,” she said.

Roadmap for Aida

Now that Aida has passed the advisory diploma, Money Means plan to launch guidance first.

However, Wardle stressed the firm’s roadmap was very much geared towards delivering regulated advice through Aida.

“The exciting part is that we’re not just digitising the old process, we’re reimagining what relational advice looks like in a digital-first world.

Aida won’t work exactly like an adviser but this is the modern way of providing financial advice, it is progressive and bite sized

“Everything comes back to our north star, which is, we want good outcomes for consumers. We want to help millions, and we’re confident we will,” she said.

Wardle wanted to highlight that Aida was not ‘qualified’ in the way human advisers are because it is not a person and cannot hold such a title.

“Yes, Aida did outperform adviser averages and ChatGPT in the exams but exams alone don’t make a great adviser.

“So much of the job is relational, and no digital service has to date replaced that human connection. We are working very hard on that aspect and I can see that we are well on our way to crack this,” she said.

A different ‘type’ of advice

Wardle believed Aida could provide a different type of service, which she described as “fully digital, proactive, and scalable”.

“Aida won’t work exactly like an adviser but this is the modern way of providing financial advice, it is progressive and bite sized, to allow people to navigate the process themselves and adding value throughout.

“Imagine an adviser who never sleeps, can juggle thousands of tasks at once, and nudges clients in real time. That’s Aida’s space. All service industries will be disrupted in the same way,” the founder added.

Wardle felt too much of the industry’s focus with AI has been on internal efficiencies to make processes faster and lower costs.

While she believed these were all useful, Wardle she felt these use cases had not trickled down to benefit the consumer.

“We’ve taken the opposite approach by starting with the customer. Asking ourselves, ‘What do they value? What engages them? What truly helps?’ If we get that right, the industry shifts.

“In three to five years, I’d love to be talking not about our assets under management as a business, but about the real assets under management we’ve built for consumers who otherwise wouldn’t have had access to advice. That’s what will make the real difference,” Wardle said.

The CII did not wish to comment.

alina.khan@ft.com

Have your say in the comments section below or email us: ftadviser.newsdesk@ft.com