Liverpool owners Fenway Sports Group are sometimes characterised as relatively circumspect, but the reality is that they are among the biggest innovators in football.

It has taken FSG 15 years to get Liverpool into an imperial phase, but a Premier League title in the first year of a new post-Jurgen Klopp era and a historic transfer window suggest that it has now arrived.

Arne Slot has led his side to seven consecutive wins in all competitions ahead of tomorrow afternoon’s repeat of the Community Shield final against Crystal Palace.

The XI that takes the field will, even in the absence of Hugo Ekitike, be worth hundreds of millions of pounds. And every one of those pounds is backed up thousands of man-hours of data analysis.

Photo by Dan Istitene – Formula 1/Formula 1 via Getty Images

Photo by Dan Istitene – Formula 1/Formula 1 via Getty Images

It’s not enough simply to have a data department and sophisticated algorithms underpinning your recruitment, however. Owning a piano doesn’t make you a player.

What FSG have excelled at is getting the right technology and, crucially, hiring the right people to deploy it and pull the trigger when the system spots value in the transfer market.

And recruitment isn’t the only area that John Henry and his peers in the Fenway boardroom in Boston have developed an elan for enlisting the very best talent.

They have a sophisticated commercial insights partnership with Nielsen, for example, which helps them carve out lucrative opportunities in sponsorship, merchandise and events.

The commercial element is one of three core revenue streams at Liverpool, the other two being matchday income and media.

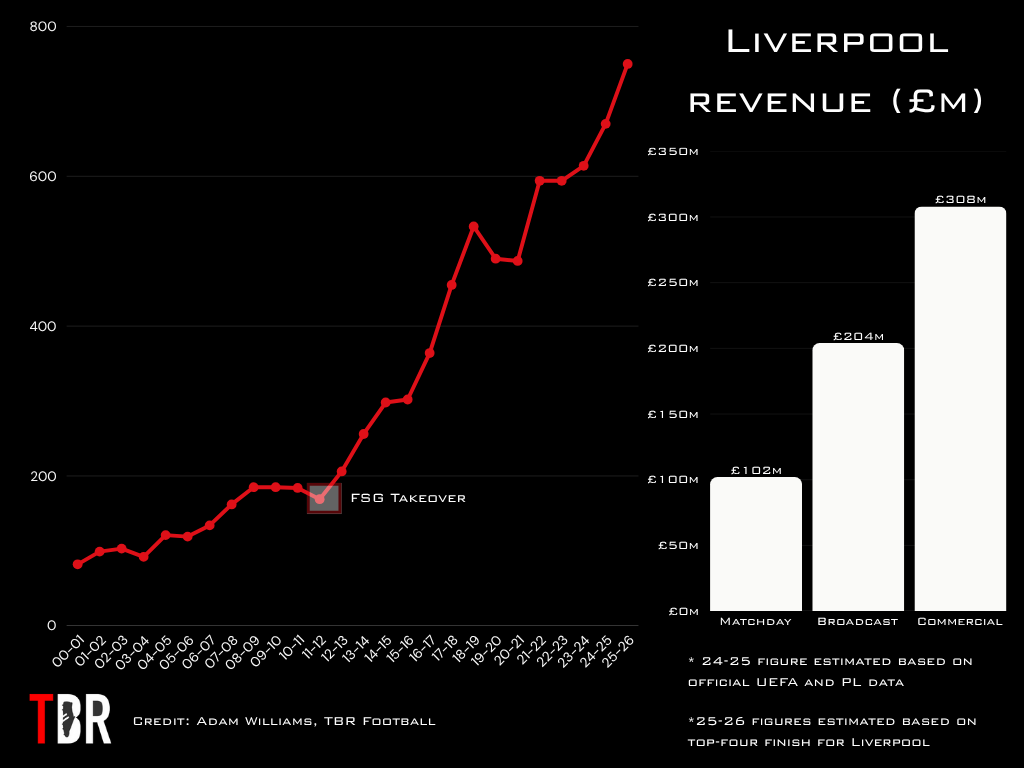

Liverpool revenue projections

Liverpool revenue projections

Credit: Adam Williams/TBR Football/GRV Media

At an expanded Anfield, matchday income is booming. They surpassed £100m in the last financial year and have designs to get to close to £150m with a good Champions League run this term.

And the latest developments within the media sector signpost that a potential explosion in TV money is in the post too.

UEFA revamp Champions League rights process, Liverpool watching closely

Liverpool, as one of the game’s commercial juggernauts, have long explored the possibility of a so-called OTT (over the top) streaming service that cuts out traditional broadcast partners.

Sometimes, this idea is referred to as Premflix, i.e., the Netflix of the Premier League, where subscribers would pay a monthly fee to access coverage via the internet rather than through television.

And now, it looks as though UEFA are opening up the possibility of something similar at Champions League level.

As reported by Bloomberg, UEFA is revamping the tender process for its Champions League rights to open the door to Netflix, Amazon and other potential OTT partners to bid for global rights.

In 2024-25, the Champions League prize pot was an astonishing £2.2bn, the vast majority of which came from TV rights.

Despite a relatively early round-of-16 exit at the hands of Paris Saint-Germain in 2024-25, Liverpool earned around £86m in last season’s competition.

Photo by Visionhaus/Getty Images

Photo by Visionhaus/Getty Images

It was the first season under the new 36-team ‘Swiss model’, which increased the total minimum number of games per team to eight.

Revenue from UEFA is expected to grow as a result, but many believe that a new approach to streaming could supersize six-time European champions Liverpool’s TV income further still.

Could streaming revolution unlock billions for FSG?

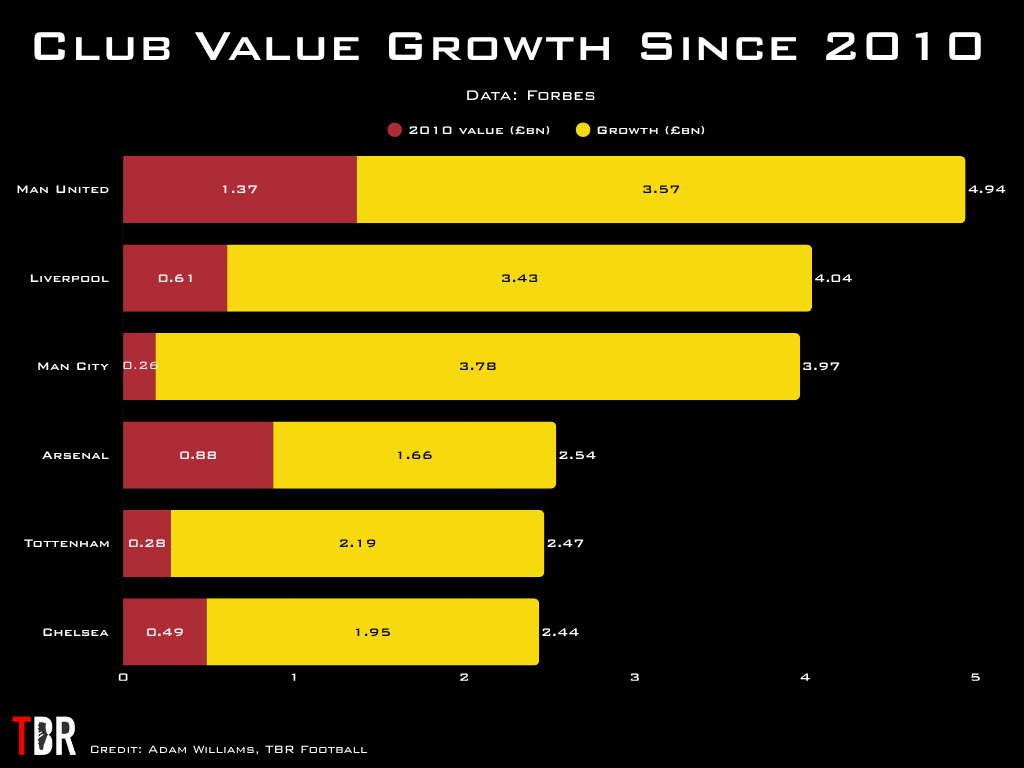

At present, most analyses value Liverpool between £4bn and £5bn.

But FSG are yet to make any money from the club. In fact, with their initial purchase price and further funding for infrastructure, they are around £500m down.

So where is that multi-billion pound valuation coming from?

Premier League club value growth graphic

Premier League club value growth graphic

Credit: Adam Williams/TBR Football/GRV Media

Well, many football finance experts evangelise about technology as a beachhead to create new fans, nurture existing ones, and seismically increase commercial and media income.

Could a streaming revolution in the Champions League and perhaps the Premier League be the next big revenue panacea?