Middle East Livestock Monitoring Market Summary

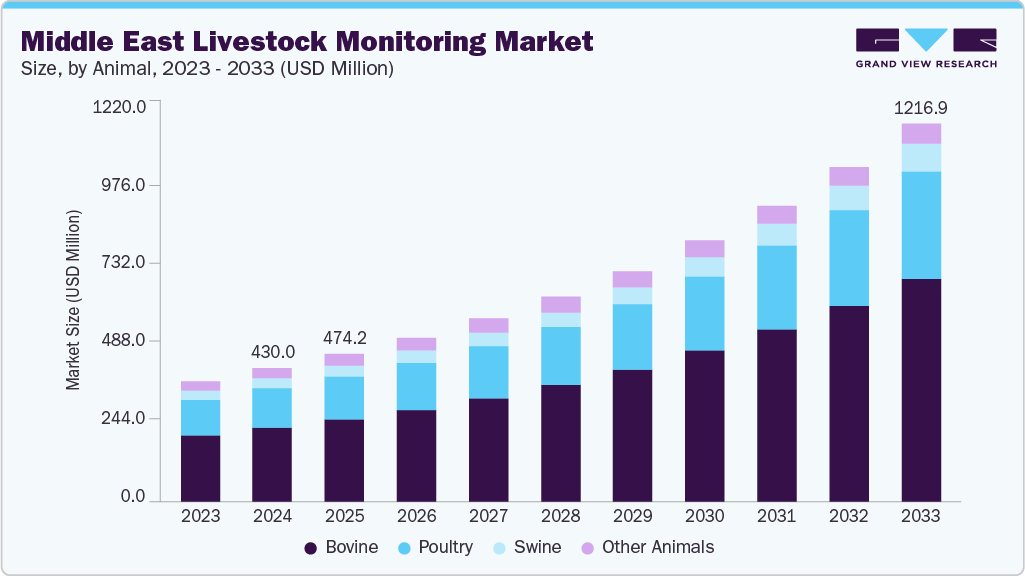

The Middle East livestock monitoring market size was estimated at USD 430.05 million in 2024 and is projected to reach USD 1,216.88 million by 2033, growing at a CAGR of 12.50% from 2025 to 2033. The key factors driving the Middle East market include growing emphasis on animal health and welfare, as producers face rising pressure to prevent disease, reduce losses, and ensure food safety.

Key Market Trends & Insights

South Africa livestock monitoring market held the largest share of 30.91% in 2024.

By animal, bovine segment held the largest share of over 55.42% of the market in 2024

By solution, software & services segment dominated the global market share in 2024.

Based on application, milking management segment held the highest market share in 2024.

Market Size & Forecast

2024 Market Size: USD 430.05 Million

2033 Projected Market Size: USD 1,216.88 Million

CAGR (2025-2033): 12.50%

South Africa: Largest market in 2024

UAE: Fastest growing market

New technologies like smart sensors and digital health tracking tools now allow farmers to monitor their animals more closely and on a larger scale. This makes it easier to spot issues early, manage herds more effectively, lower costs, and run farms more efficiently. At the same time, demand for animal protein in the region continues to climb, supported by population growth, urbanization, and changing dietary preferences, which increases the need for reliable and productive farming practices. Together, these factors create a strong case for adopting monitoring systems as essential tools for modern livestock management.

The livestock sector in Saudi Arabia remains vital to rural economies, with millions of animals reared in traditional holdings across the Kingdom. For instance, according to an article published by Food Business Middle East & Africa in July 2025, Saudi Arabia introduced the Saudi Smart Flock system as part of the Sustainable Rural Agricultural Development Programme (Saudi Reef) to modernize and enhance the livestock sector. The system leverages facial recognition technology to monitor the health and productivity of small ruminants. Initially piloted on six farms, the tool serves traditional and intensive farming operations by delivering more accurate and timely data to farmers.

This initiative is expected to accelerate market growth for livestock monitoring solutions in Saudi Arabia and beyond. Reducing animal losses, improving herd quality, and increasing farm efficiency highlight the value of adopting digital tools in livestock management. As small-scale and commercial farmers experience the benefits of improved productivity and cost savings, adoption rates are likely to rise, creating strong momentum for wider deployment of monitoring technologies and fueling long-term market growth.

Moreover, according to an article published by ARAB NEWS, in September 2024, Saudi Arabia has allocated USD 533 million in loans and credit facilities to strengthen food sustainability and security, with a particular emphasis on red meat and poultry production. This investment will enable producers to scale operations, adopt modern farming methods, and implement technologies that enhance efficiency and output. Such initiatives are expected to fuel market growth, as farmers increasingly seek digital solutions to improve animal health, minimize losses, and optimize productivity. By combining financial support with the push for advanced farming systems, the Kingdom is paving the way for broader adoption of livestock monitoring technologies and long-term market growth.

Furthermore, the UAE’s push to modernize agriculture through advanced technologies strongly drives market growth by addressing local challenges and global trade demands. According to an article published by The Sustainable Times, in September 2025, with over 80% of food imported, ensuring food safety, disease traceability, and compliance with international standards has become critical. Government partnerships with technology providers and adopting tools such as RFID, GPS tags, AI analytics, and blockchain-based traceability enable real-time monitoring, stronger biosecurity, and greater transparency. These measures safeguard consumer trust, support sustainability goals under Vision 2030 and 2050, and create a strong incentive for producers and importers to invest in livestock monitoring systems, further contributing to market growth.

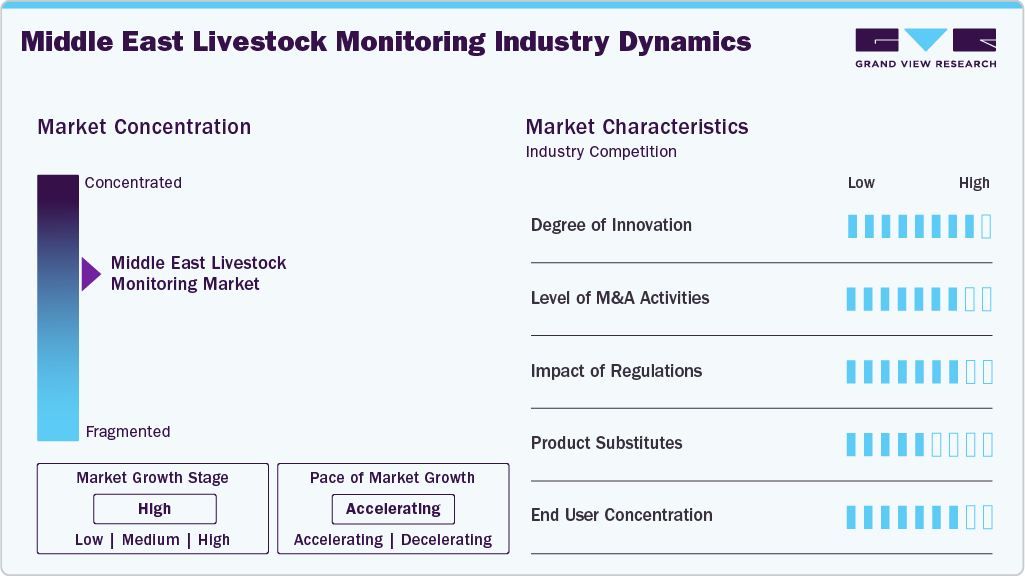

Market Concentration & Characteristics

The degree of innovation in the Middle East livestock monitoring industry is high, as the sector is rapidly shifting from traditional practices to advanced digital solutions. Advanced tools such as AI-driven health analytics, IoT-enabled sensors, blockchain-based traceability, and facial recognition systems like Saudi Arabia’s Smart Flock are being adopted to improve animal welfare, boost productivity, and enhance food safety. These innovations address regional challenges like food security and supply chain transparency and align with global standards, positioning the Middle East as an emerging hub for next-generation agri-tech adoption and driving strong market growth potential.

The market’s level of mergers and acquisitions is moderate, reflecting a growing consolidation trend as companies seek to expand their technological capabilities and market reach. Larger animal health companies are acquiring smaller innovators to integrate advanced tools. This steady flow of M&A activity is helping accelerate innovation, broaden product offerings, and strengthen the competitive landscape, ultimately supporting faster adoption of livestock monitoring solutions.

In the Middle East livestock monitoring industry, regulations directly impact the adoption and growth of monitoring solutions by enforcing standards for animal health, disease management, and traceability. Governments in countries such as Saudi Arabia, the UAE, and Qatar are increasingly implementing policies that require real-time tracking of livestock movements, health records, and feed management to prevent disease outbreaks and ensure food safety. These regulations drive demand for IoT-enabled sensors, wearable devices, and software platforms that enable compliance. At the same time, strict import and usage rules for technology, data privacy requirements, and country-specific certification standards influence which monitoring systems can be deployed, shaping the overall market dynamics and encouraging local adaptation of global technologies.

Traditional methods, such as manual health checks, paper-based recordkeeping, or basic RFID tags, provide lower-cost alternatives to advanced digital monitoring systems, which can slow adoption, especially among smaller farms or cost-sensitive producers. This competitive pressure forces technology providers to innovate, differentiate their products with superior features, and offer scalable solutions to justify investment. Due to their scale and financial capacity, large commercial dairy and beef farms dominate adoption in the Middle East market, resulting in a moderate-to-high concentration of end users. However, there is a gradual shift as small and medium-sized farms increasingly adopt portable, battery-operated, cost-effective monitoring solutions. This diversification is slowly broadening the overall user base, yet the bulk of demand continues to come from large-scale operations with greater resources, underscoring their pivotal role in driving market growth.

Animal Insights

Bovine segment dominates the market with the largest revenue share of 55.42% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period, due to its significant economic importance in dairy and beef production. Large-scale cattle operations focus heavily on productivity, health management, and disease prevention, making them the primary adopters of advanced monitoring technologies. The market offers a wide range of technologically sophisticated products specifically for cattle, including IoT-enabled wearable sensors, automated feeding and milking systems, health-tracking software, and real-time location monitoring devices, all designed to optimize herd management and operational efficiency.

For instance, Afimilk, a high-tech company based in Israel, has developed a smart collar sensor capable of detecting and identifying approximately 50,000 cows in heat every 50 hours. Installed on the cows’ necks, these sensors also capture behavioral data such as walking, chewing, and other activities, providing valuable insights for veterinarians. The technology aids early illness detection and helps manage environmental conditions, such as cooling during hot summer days. Currently, Afimilk’s systems manage over 10 million cows across dairy farms in 52 countries, demonstrating the effectiveness and global reach of advanced cattle monitoring solutions. The availability of such comprehensive tools reinforces cattle’s dominance in the market and drives investments in precision livestock farming throughout the region.

The poultry segment is the second fastest growing segment in the Middle East market, driven by increasing per capita poultry consumption in countries such as Saudi Arabia and the UAE, along with government initiatives to improve food security and modernize poultry production. Adopting advanced hardware and software solutions ranging from behavioral monitoring and disease detection to production analytics has accelerated in poultry operations, significantly contributing to market growth and highlighting the segment’s critical role in the regional livestock monitoring industry.

Solution Insights

The software & services segment dominates the market with the largest revenue share of 56.04% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period, owing to the introduction of advanced software solutions and their pivotal role in streamlining, analyzing, and optimizing livestock operations. For instance, in December 2024, Tanmiah Food Company introduced its Central Monitoring System (CMS), marking a major step toward digital transformation in livestock and poultry management. Leveraging IoT and Big Data, the CMS captures real-time operational data across the entire value chain from farming to processing, allowing centralized monitoring and seamless oversight. This dependence on advanced software platforms for data integration, analytics, and visualization is boosting demand for sophisticated monitoring solutions, as operators aim to enhance productivity, efficiency, and operational control through technology-driven decision-making.

In addition, Tanmiah’s innovation roadmap, which plans to integrate Artificial Intelligence and Blockchain for predictive insights and product traceability, highlights the increasing importance of specialized software services. Services such as system installation, data management, analytics, and ongoing technical support are critical for maximizing the value of collected data, optimizing supply chain operations, and ensuring regulatory compliance. As more large-scale operators adopt these comprehensive digital solutions, the software and services segment is expected to grow further, reinforcing its dominant role in the regional market.

The hardware segment is the second fastest-growing segment in the Middle East, serving as the foundation of precision livestock management. Technologies such as wearable sensors, smart collars, ear tags, RFID devices, and automated feeding or milking systems provide real-time animal health, behavior, movement, and productivity data. By facilitating continuous monitoring and enabling early detection of health, reproductive, or behavioral issues, these solutions allow farmers to streamline operations, minimize losses, and enhance overall herd efficiency and performance.

Application Insights

The milking management segment dominated the market, with a revenue share of 24.6% in 2024. These systems enhance productivity by automating milking processes, monitoring udder health, and providing real-time milk yield and quality data. By integrating advanced technologies such as IoT and Big Data, milking management solutions enable dairy farms to optimize operations, reduce labor costs, and improve animal welfare.

For instance, Afimilk, a leading dairy technology company, provides advanced tools that help farmers make milking more efficient and accurate. Their MPC Milk Meter tracks how much milk each cow produces, while the AfiLab milk analyzer checks important details like fat and protein levels during every milking session, giving farmers valuable insights into milk quality and herd performance. In addition, the AfiCollar neck collar monitors individual cow behavior, including heat detection, rumination, and eating patterns, providing valuable insights into cow health and performance. These integrated systems not only streamline milking procedures but also contribute to improved herd health and increased profitability, thereby fueling the expansion of the software and services segment in the regional market.

Behavioral monitoring is anticipated to grow at the fastest CAGR over the forecast period. Behavioral monitoring allows farmers to keep track of their animals’ daily activities, health, and overall well-being in real time. Farmers can spot early signs of illness, stress, heat cycles, or lameness by looking at patterns like eating, rumination, movement, resting, and social interactions. This makes it possible to step in quickly with the right care, protecting animal health, improving productivity, and reducing financial losses. With this proactive approach, farmers can use resources more efficiently, maintain healthier herds, and run their operations more effectively, making behavioral monitoring a vital part of modern livestock farming.

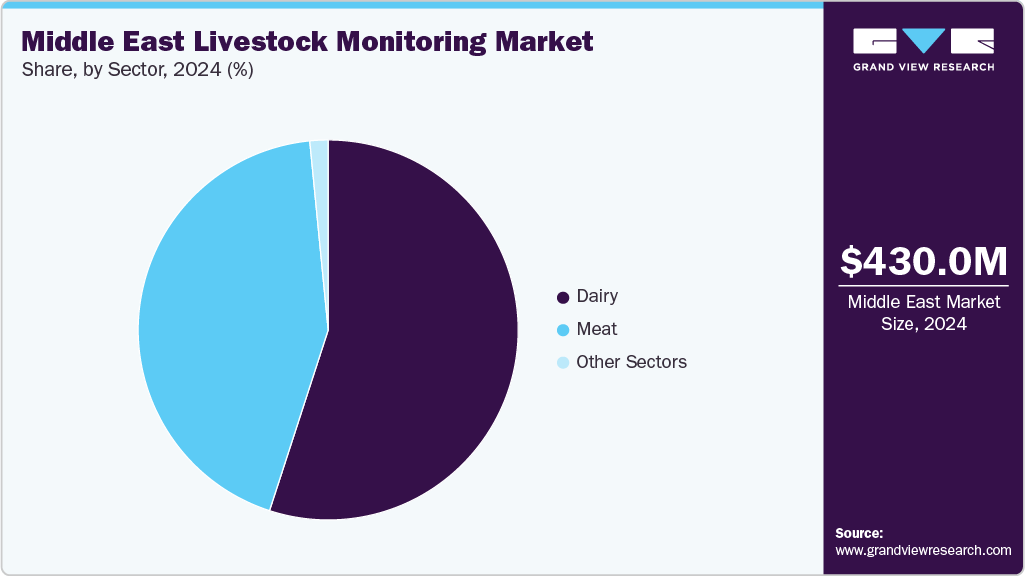

Sector Insights

The dairy segment dominated the Middle East market with the largest revenue share of 55.0% in 2024, due to the high economic significance of milk production and the critical need for maintaining herd health and consistent productivity. Dairy farms prioritize monitoring individual cows for milk yield, udder health, reproductive status, and overall welfare, making them the primary adopters of advanced monitoring technologies. Solutions such as automated milking systems, wearable sensors, and herd management software are widely implemented to enable real-time tracking, early detection of health issues, and optimization of feeding and milking routines.

The meat segment is anticipated to grow at the fastest CAGR over the forecast period. Rising meat consumption across the Middle East fuels demand for poultry products and the meat sector, driven by changing dietary habits, urbanization, and a growing population. For instance, according to an article published in May 2025 by The Saudi Food Show, Saudi Arabia is among the top consumers of poultry globally, ranking fifth in per capita consumption and holding the number one spot in the Middle East and Africa (MEA) region. This strong demand is fueled by the expansion of modern retail outlets, higher household incomes, and a growing shift toward protein-rich diets, all of which are steadily boosting the growth of the poultry segment.

Country Insights

South Africa Livestock Monitoring Market Trends

South Africa held the largest revenue share of 30.91% in 2024, due to its large and commercially advanced livestock industry, particularly in cattle and poultry farming. The country has increasingly adopted modern monitoring technologies, such as IoT-enabled wearable sensors, automated milking systems, RFID tracking, and environmental sensors, to enhance herd management, optimize productivity, and ensure animal welfare. These technologies help farmers detect health issues early, monitor behavior, and improve feed efficiency, reducing losses and increasing operational efficiency.

Key Middle East Livestock Monitoring Company Insights

Leading companies such as Evonik, Boehringer Ingelheim, Zoetis, and Afimilk Ltd. hold a notable market share, supported by their extensive product portfolios and well-established geographic reach. Their ability to offer diverse, innovative solutions across multiple regions strengthens their competitive positioning and enables them to meet the varied needs of livestock producers across the region.

Key Middle East Livestock Monitoring Companies:

Evonik

Farm Ranger (ETSE Electronics (Pty) Ltd)

Affimilk Ltd.

iSiTech

Merck & Co., Inc. (Allflex)

Zoetis

Boehringer Ingelheim

Cattle Eye Ltd

Dev Technosys

GEA Group Aktiengesellschaft

Recent Developments

In June 2025, a Dubai-based start-up, Greener Herd, introduced the region’s first Arabic-language digital livestock management application, designed to provide farmers with advanced tools for monitoring and improving herd performance. The platform integrates features such as nutrition planning, health and vaccination tracking, digital record-keeping, and access to a comprehensive feed product database, making it highly relevant for small and medium-sized producers across the Middle East. By addressing the language barrier and tailoring the technology to regional needs, Greener Herd enables wider adoption of digital livestock management solutions, enhancing operational efficiency, animal welfare, and overall productivity.

In December 2024, Tanmiah Food Company launched its Central Monitoring System (CMS), representing a significant advancement in the digital transformation of livestock and poultry management. Utilizing IoT and Big Data technologies, the CMS collects real-time operational data throughout the entire value chain—from farming to processing—enabling centralized control, enhanced visibility, and streamlined oversight.

In June 2025, Globalstar strengthened its partnership with CERES TAG, supporting satellite-enabled livestock monitoring amid New World Screwworm threats, ensuring uninterrupted connectivity, real-time traceability, and biosecurity intelligence to safeguard herds across remote ranching regions.

Middle East Livestock Monitoring Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 474.24 million

Revenue forecast in 2033

USD 1,216.88 million

Growth rate

CAGR of 12.50% from 2025 to 2033

Actual data

2024

Historical data

2021 – 2023

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, solution, application, sector

Country scope

South Africa; Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

Evonik; Farm Ranger (ETSE Electronics (Pty) Ltd); Affimilk Ltd.; iSiTech; Merck & Co., Inc. (Allflex); Zoetis; Boehringer Ingelheim; Cattle Eye Ltd; Dev Technosys; GEA Group Aktiengesellschaft

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Livestock Monitoring Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East livestock monitoring market report based on animal, solution, application, sector, and country:

Animal Outlook (Revenue, USD Million, 2021 – 2033)

Bovine

Poultry

Swine

Other Animals

Solution Outlook (Revenue, USD Million, 2021 – 2033)

Hardware

Sensors

GPS/RFID

Collars

Tags

Other Hardware

Software & Services

Application Outlook (Revenue, USD Million, 2021 – 2033)

Milking Management

Breeding Management

Feeding Management

Health Monitoring

Behavioral Monitoring

Other Applications

Sector Outlook (Revenue, USD Million, 2021 – 2033)

Country Outlook (Revenue, USD Million, 2021 – 2033)

South Africa

Saudi Arabia

UAE

Kuwait

Qatar

Oman

Rest of MEA

Frequently Asked Questions About This Report

b. The Middle East livestock monitoring market size was estimated at USD 430.05 million in 2024 and is expected to reach USD 474.24 million in 2025.

b. The Middle East livestock monitoring market is expected to grow at a compound annual growth rate of 12.50% from 2025 to 2033 to reach USD 1,216.88 million by 2033

b. South Africa dominated the Middle East livestock monitoring market with a share of 30.91% in 2024. This is attributable to increasingly adopting modern monitoring technologies, such as IoT-enabled wearable sensors, automated milking systems, RFID tracking, and environmental sensors, to enhance herd management, optimize productivity, and ensure animal welfare

b. Some key players operating in the Middle East livestock monitoring market include Evonik, Farm Ranger (ETSE Electronics (Pty) Ltd), Affimilk Ltd., iSiTech, Merck & Co., Inc. (Allflex), Zoetis, Boehringer Ingelheim, Cattle Eye Ltd, Dev Technosys, GEA Group Aktiengesellschaft

b. Key factors that are driving the market growth include growing emphasis on animal health and welfare, as producers face rising pressure to prevent disease, reduce losses, and ensure food safety.