Households saving more due to Budget uncertainty

We turn now to one of our economic experts who has sifted through the data, including not just these revised GDP figures but also the accounts which show household saving and spending.

That shows households are saving slightly more and are likely cautious about personal finance situations, given uncertainty on the domestic front and a slew of negative economy-related announcements.

“The big question now is whether speculation about the budget will undermine confidence further,” said Thomas Pugh, chief economist at tax firm RSM UK.

“Headline growth remained at 0.3% in Q2. But the saving rate increased from an already high 10.5% to 10.7%. This was driven by an increase in non-pension saving suggesting that consumer caution after April’s tax and tariff increases prompted households to save more.

“Looking ahead, the second half of the year will be tougher going than the first six months. The combination of inflation reaching 4% and a weakening labour market, means real pay growth is set to slow to almost zero. What’s more, the chances of further interest rate cuts this year look slim.

“The wildcard is how much speculation about tax rises in the upcoming budget will dent consumer and business confidence. The risk is that we get a repeat of last year and growth effectively flatlines in the second half of the year. Overall, we expect growth of around 1.3% this year.”

Karl Matchett30 September 2025 08:40

UK production fell 0.8% in worrying decline for Reeves

Back to the economic data and we’ve got figures from the ONS which show areas of industry that contributed to the overall 0.3% growth.

Information and communication services grew 2.5 per cent, while human health and social work activities was the second-biggest contributor in services, up 1.2 per cent.

In production, pharmaceuticals was easily the lead contributor, growing 6.9 per cent, but production overall fell by 0.8 per cent.

This will be the major area of concern for Reeeves and co, who cannot afford for production and manufacturing to be on the decline.

Nine of the 13 subsections in production fell though, including metals, manufacturing and repair, and foods, beverages and tobacco.

Karl Matchett30 September 2025 08:20

Retail prices show 1.4% inflation last month – but food prices may have peaked

Outside of UK economic data for the moment (though certainly related), figures from the British Retail Consortium (BRC) and NielsenIQ released today show shop prices continue to increase.

Annual shop price inflation rose to 1.4 per cent in September.

That’s an increase from the 0.9 per cent in August, but food price inflation finally remained the same at 4.2 per cent after rising for most of this year.

Other non-food items had been lower in price of late compared to a year ago, but last month were almost back to level, at 0.1 per cent lower.

Helen Dickinson, the BRC chief executive, said:“Households are finding shopping increasingly expensive. The impact on retailers and their supply chain of both global factors and higher national insurance and wage costs is playing out in prices for consumers.”

Karl Matchett30 September 2025 08:00

Economy grew faster than expected at the end of last year

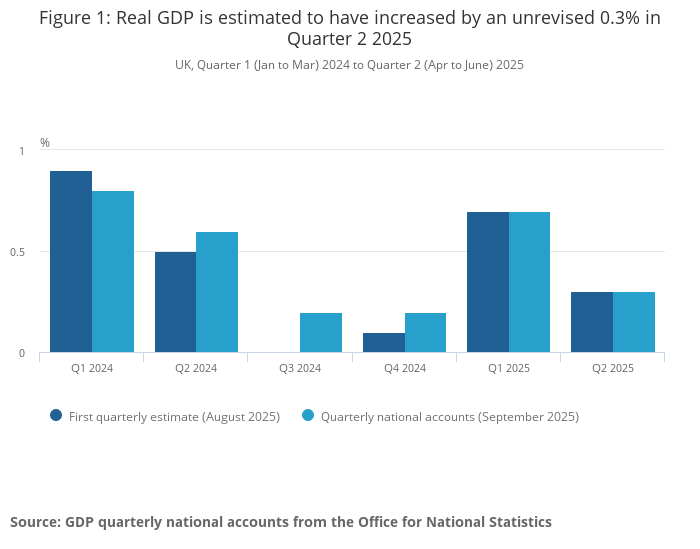

As mentioned, there is no revision to the estimates for 2025, but a couple of alterations for last year.

Essentially, the economy grew by less than the ONS expected at the start of 2024, but by more than expected towards the end of it.

“Across 2024 as a whole, annual growth is estimated at an unrevised 1.1% increase,” the ONS said.

This graph should help showcase that visually.

(ONS)

(ONS)

Karl Matchett30 September 2025 07:45

Why the slowdown in UK economy from Q1 to Q2?

Rachel Reeves and the rest of the government are desperate for economic growth to fire into gear but, as the chancellor noted yesterday, there have been some pretty big external factors to contend with this year.

However, there have also been several of their own making.

The ONS point to stamp duty as one big reason for the drop in GDP growth between the first and second quarters of the year, as people rushed through certain deals including house purchases to beat the raise.

Their statement today noted the step drop was in part due to “some activity was brought forward to February and March 2025 ahead of changes to Stamp Duty in April and, to some extent, ahead of announced US tariff changes.”

Karl Matchett30 September 2025 07:30

Revised figures show stronger UK performance at end of 2024

Just to be clear – these figures being released today are not “new” as such – they are the revised figures from ONS after greater checks and slight changes to the data within each set.

Quite often they will revise the overall percentages up or down by an amount to give a more true reading based on data which can be tricky to handle in the tight turnaround for initial readings, which are usually given around mid-month.

It includes no changes so far for 2025, but there are slight alterations for last year, which we’ll detail in a moment.

Explaining the alterations, ONS director of economic statistics Liz McKeown said:

“Today’s figures include improvements to our measurement of the economy, including better information on research and development and the activities of complex multinational companies, alongside the usual inclusion of updated and improved data sources.

“Growth for 2024 as a whole is unrevised, though these new figures show the economy grew a little less strongly at the start of last year than our initial estimates suggested but performed better in later quarters.

“Quarterly growth rates for 2025 are unrevised.

“In the latest quarter we saw an increase in the household saving ratio, very little growth in consumer spending and a slight fall in output for consumer facing services, despite growth in services overall.”

Karl Matchett30 September 2025 07:19

UK economy grew by 0.3% across April to June 2025

The ONS have released their major accounting figures for the UK across Q2 – the second three months of the year, April to June.

Chief among the headline figures is confirmation that the economy grew 0.3 per cent during that period, a marked slowdown on the 0.7 per cent from the first quarter of 2025.

Perhaps also notably, the second quarter of last year was also higher, at 0.6 per cent.

Karl Matchett30 September 2025 07:14

Business and Money – 30 September

Morning all, lots going on once more, from the usual companies focus and stock market updates to more economic data pouring in to tell us how the UK is faring in the lead up to the Budget.

Karl Matchett30 September 2025 06:57