Intelligent Battery Sensor Market Overview

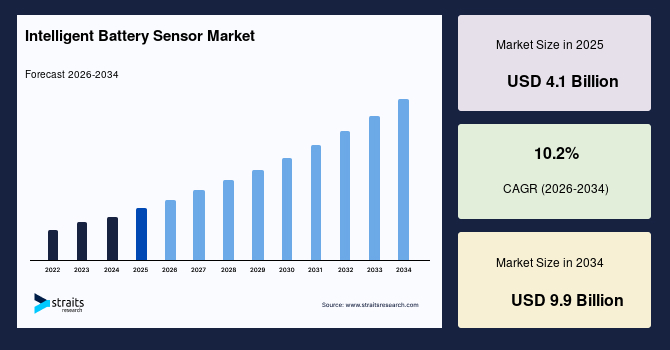

The global intelligent battery sensor market size is estimated at USD 4.1 billion in 2025 and is projected to reach USD 9.9 billion by 2034, growing at a CAGR of 10.2% during the forecast period. The growth of the intelligent battery sensor market is driven by the increasing use of electric and hybrid vehicles propelled by demand from end-users as well as government support, where these sensors allow accurate tracking of the health of batteries, optimize power consumption, and facilitate sophisticated vehicle features. Therefore, automakers are increasingly incorporating them into future-generation energy management systems.

Key Market Trends & Insights

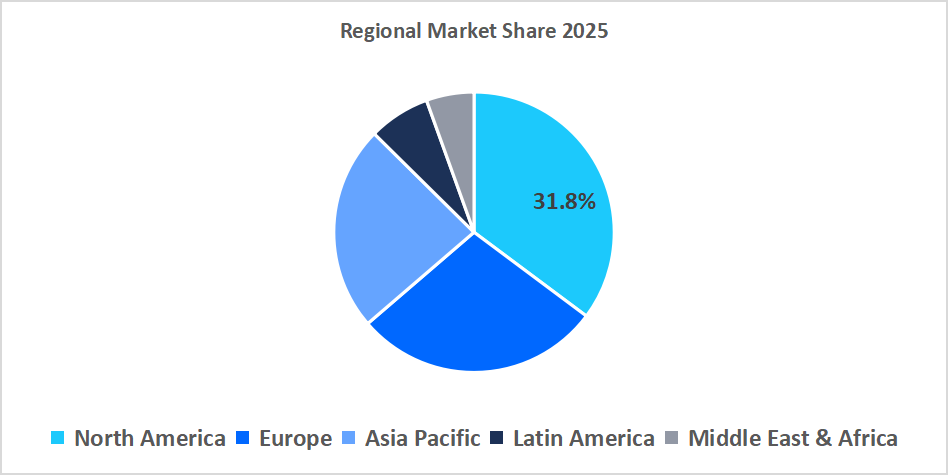

North America held a dominant share of the market, accounting for 31.8% share in 2025.

The Asia Pacific region grew at the fastest pace, with a CAGR of 11.3%.

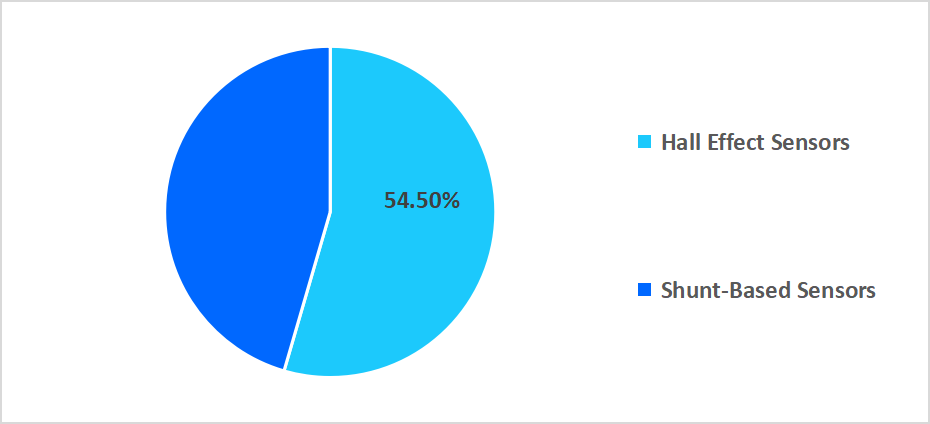

Based on sensor type, the Hall Effect Sensors segment held the highest market share of 54.50% in 2025.

On the basis of application, the State-of-Charge (SOC) tracking segment is expected to register the fastest CAGR growth of 11.2% during the forecast period.

Based on end-use industry, the automotive segment dominated the market in 2025.

Based on battery type, the lithium-ion batteries segment is expected to register the fastest CAGRduring the forecast period.

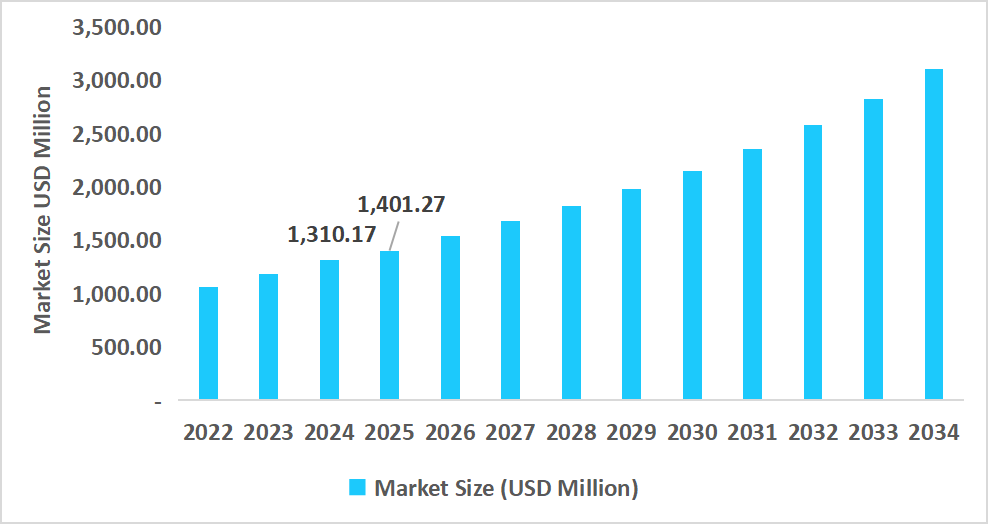

The U.S. dominates the intelligent battery sensor market, valued at USD 1.31 billion in 2024 and reaching USD 1.40 billion in 2025.

Table: U.S Intelligent Battery Sensor Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

2025 Market Size: USD 4.1 billion

2034 Projected Market Size: USD 9.9 billion

CAGR (2026-2034): 10.2%

Dominating Region: North America

Fastest-Growing Region: Asia-Pacific

The intelligent battery sensor market worldwide is growing with the increasing demand for sophisticated battery management systems in newer cars, boosting demand for accurate energy monitoring technologies. Increasing consciousness of optimizing battery health and fuel efficiency has extended the use of intelligent battery sensor to multiple segments in the automotive industry. In addition, the growth of electric and hybrid cars, along with strict emission controls, is driving the adoption of smart sensors to optimize the performance and lifespan of batteries. Encouraging government policies to encourage energy-efficient vehicles and increasing investment in automotive electrification are additionally driving market growth.

Latest Market Trends

Transition to Smart Energy Management from Traditional Battery Monitoring

The environment for battery management is shifting from conventional monitoring techniques towards end-to-end intelligent battery sensor solutions. Previously, business organizations and automobile makers relied on basic voltage and current monitoring, which, in turn, led to unexpected failures, energy wastage, and higher maintenance costs. Currently, smart battery sensors provide real-time notifications of battery status, state-of-charge (SOC), and state-of-health (SOH) to plan ahead-of-time maintenance and prolong battery life.

Rampant Adoption in Electric and Hybrid Vehicles

Rising adoption in electric and hybrid vehicles. The early years witnessed battery sensors being limited to conventional lead-acid battery systems as well as specific industrial applications. Applications of intelligent battery sensors in the automotive industry have seen astronomical growth between 2015 and 2025.

This growth emphasizes the manner in which intelligent battery sensor solutions evolved from user-voluntary monitoring devices to core components in automotive energy management that enhance operational efficiency, reliability, and sustainability.

Intelligent Battery Sensor Market Drivers

Increasing Adoption of Intelligent Battery Sensors in Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs)

Increasing application of smart battery sensors on electric vehicles (EVs) and hybrid electric vehicles (HEVs) is gaining momentum globally. It is because of the high demand from consumers and government initiatives aimed at reducing greenhouse gas emissions. The International Energy Agency (IEA) stated that worldwide sales of electric vehicles in 2024 had crossed 17 million and accounted for more than one-fifth of the overall vehicle market. This boom is creating pressure for advanced battery management solutions, including smart sensors for batteries, essential for achieving maximum performance and lifespan of the batteries.

China led the market by selling approximately 11 million electric vehicles, contributing approximately 65% to worldwide sales. Europe was next in line, with approximately 3 million units sold, while the United States and Canada collectively sold approximately 1.8 million vehicles. This rapid expansion in the electric vehicle market is generating urgent need for advanced battery management systems. Advanced battery sensors are a part of such systems, providing optimal performance and prolonging EV battery life.

Integration of Smart Battery Sensors with Connected Vehicle Platforms

The growing trend of connected and intelligent vehicles is propelling the use of smart battery sensors, as these products offer real-time battery health and performance data to vehicle management platforms. Through the integration of sensors with telematics and fleet management software, automakers and fleet managers can optimize energy consumption, forecast maintenance requirements, and increase vehicle uptime.

Market Restraints

Limited Awareness and Adoption in Emerging Regions

A significant constraint in the intelligent battery sensor market is low awareness and adoption levels among industrial users and small and medium-sized fleet operators in emerging markets. Whereas mature automotive and industrial markets, most companies in these markets are still reliant on conventional battery monitoring techniques and are not entirely cognizant of the advantages of intelligent battery sensors, including longer battery life, less maintenance downtime, and operational efficiency.

Market Opportunities

Expansion in Industrial and Commercial Fleet Management

One of the most prominent opportunities in the intelligent battery sensor market is its expanded application across industrial, commercial, and marine fleet operations to enhance battery reliability and operational performance. Companies can maximize maintenance schedules, monitor battery health proactively, and reduce downtime within fleets and industrial machinery through adopting intelligent battery monitoring measures.

This mass use not only enhances operating reliability but also facilitates improved use of resources and energy efficiency.

Regional Analysis

North America drives the intelligent battery sensor market in 2025 with a 31.8% global revenue share. This is due to highly developed fleet management practices, standardized battery monitoring protocols, and robust regulatory structures that guarantee energy efficiency and operational dependability. In addition, North America has the advantages of bulk usage in commercial fleets, industrial power systems, and marine use, which together ensure uniform sensor deployment across industries.

The US market is witnessing high growth in the usage of smart battery sensors due to the increasing demand for electric vehicles and the requirement for effective battery management systems. The North American intelligent battery sensor market is estimated to grow at a substantial CAGR of 10.1% during 2025-2034,This expansion is largely a result of immense investments in electric vehicles, green energy infrastructure, and cutting-edge AI-based automotive technologies. The U.S. and Canada are witnessing an impressive spike in demand for connected vehicles and commercial fleet electrification, and this provides an optimum setting for the mass adoption of smart battery sensor solutions.

Asia-Pacific Market Insights

Asia-Pacific is becoming the region with the highest growth, and it is expected to grow at a 11.4% CAGR during 2026–2034, fueled by increasing industrial fleets, logistics growth, and rising maritime and aerospace activities. India, China, and Japan are leading countries that are expanding intelligent battery sensor adoption swiftly through fleet renewal schemes and industrial asset optimization programs. Domestic policies encouraging energy-efficient operations, safety regulations, and private investment in fleet management are also catalyzing sensor adoption in the Asia-Pacific.

India’s intelligent battery sensor market is growing strongly with the help of government-backed fleet modernization programs and expanding commercial fleet networks. For example, major logistics operators fitted more than 150,000 vehicles with intelligent battery sensors in 2025, enhancing operational uptime and minimizing maintenance cycles. Furthermore, major industrial operators implemented centralized battery monitoring tactics, reflecting India’s rise as a major hub in the international Intelligent Battery Sensor marketplace.

Europe Market Insights

According to industry projections, Europe was a top contender for the intelligent battery sensor market in 2025 with a global revenue share of 28.7% of revenues. It attributes this dominance to solid automotive manufacturing bases, industrial electrification programs, and strict regulatory regimes promoting sustainable energy culture. Large-scale use in passenger vehicles, fleets for business, and industrial equipment has made Europe a strong market for smart battery sensors. Furthermore, cross-border collaboration and EU-sponsored energy efficiency directives are driving harmonized adoption in member states.

The U.K. is emerging as a leader in Europe due to its strong focus on emission reduction and fleet electrification. More than 320,000 vehicles in the U.K. had been fitted with intelligent battery sensors during 2025, backed by government electrification plans and private fleet operators that continue to modernize their fleets. The momentum positions the U.K. as a leading European center for the installation of intelligent battery sensors.

Middle East & Africa Market Insights

Middle East & Africa market for smart battery sensors is forecasted to expand steadily at a projected CAGR of 8.9% from 2026-2034. The expansion is fueled by increased demand in industrial power systems, marine applications, and commercial fleet. An increase in the adoption of smart battery management practices is also being fueled by efforts in the region towards achieving grid stability and integrating renewable energy. Maritime transport and oil field activities will benefit the most from increased surveillance and reduced downtime offered by smart battery sensors.

The UAE leads the MEA market with the support of its mass-scale logistics, aviation, and maritime sectors. More than 60,000 commercial vehicles and port-handling equipment were equipped with intelligent battery sensors as part of efficiency and sustainability efforts in 2025, making the UAE a regional strategic adopter.

Latin America Market Insights

Latin America’s intelligent battery sensor market is gathering pace, accounting for 6.6% of global market revenue in 2025. It is driven by the expansion of logistics fleets, mining operations, and urban transport programs. Despite how slow adoption is compared to other markets, increased investments in green transport and industrial upgrading are creating firm opportunities for deployment.

Brazil is the leading country in Latin America, underpinned by its vast commercial fleet market and agricultural transport logistics. In 2025, more than 85,000 trucks and buses in Brazil had smart battery sensors installed to maximize uptime and reduce fuel and maintenance expenses. Brazil’s government-backed initiatives to upgrade fleet operations further cement its leadership in the region.

Regional Market share (%) in 2025

Source: Straits Research

Sensor Type Insights

The Hall Effect Sensors segment dominated the market with a revenue share of 54.5% in 2025. This growth is driven by their extensive application in commercial and fleet automotive usage, where steady current tracking and minimal maintenance requirements are critical. Hall Effect Sensors are preferred in fleet operations as they ensure stable battery performance under heavy load conditions, supporting uninterrupted operations.

Shunt-Based Sensor segment is anticipated to witness the fastest growth, registering a projected CAGR of 11.3% during the forecast period. High growth is driven by increasing adoption in electric and hybrid vehicles, commercial fleets, and advanced automotive systems, supported by continuous improvements in sensor accuracy, durability, and integration with battery management systems.

By Sensor Type Market Share (%), 2025

Source: Straits Research

Functional Capability Insights

The Integrated Multi-Parameter Devices (SOC/SOH) segment is projected to register the fastest CAGR growth of 11.3% during the forecast period. This growth is attributed to their ability to provide end-to-end battery health and charge status monitoring. Industrial customers and fleet operators are increasingly adopting these devices to prevent unexpected battery failures, enhance operational efficiency, and optimize maintenance scheduling, thereby supporting rapid segment growth.

The basic single-parameter sensor segment held the largest market share of 28.6% in 2025, driven by widespread adoption in commercial vehicles and automotive applications. Its preference is further supported by cost-effectiveness, ease of integration, and reliable performance, ensuring consistent monitoring and prolonged battery life across fleets and industrial operations.

Operating voltage range Insights

The 12 V systems segment dominated the market in 2025 with a revenue share of 46.5%, as these systems are extensively used in standard cars and small industrial applications. Their widespread adoption is supported by compatibility with standard vehicle systems, ensuring robust battery monitoring without major system adjustments, thereby enhancing fleet availability and user confidence.

The 24 V systems segment is projected to witness the fastest growth during the forecast period. This growth is fueled by increasing deployment in commercial vehicles, heavy-duty industrial equipment, and specialized fleet applications, supported by advancements in high-voltage sensor integration and enhanced monitoring capabilities, driving rapid segmental expansion.

Technology Type Insights

CAN (Controller Area Network)-based sensors are anticipated to register the highest CAGR of 10.9% due to their widespread use in medium and large commercial fleets. CAN-based technologies enable smooth integration with incumbent fleet management systems, offering real and centralized battery information to minimize operational downtime and enhance energy consumption.

Battery Type Insights

Lithium-ion batteries led the market in 2025 due to their dominance in commercial vehicles, marine applications, and industrial power systems. The strong adoption is driven by the demand for energy-dense, dependable, and maintenance-effective battery systems that complement well with smart battery sensors to improve overall system reliability.

Applications Insights

Battery Management System (BMS) Integration is anticipated to experience the strongest growth,as businesses pay more attention to maximizing battery lifespan and minimizing operational downtime. BMS integration helps manage optimal charge-discharge cycles, avoids deep discharge problems, and offers actionable data for fleet and industrial asset operators, fuelling adoption worldwide.

End-Use Industry Insights

Automotive dominated the market in 2025, fueled by rising adoption of smart battery sensors in commercial and passenger cars. The emphasis on reliability, fleet effectiveness, and minimized maintenance expenses is encouraging mass popularity, making automotive the leading end-use segment globally.

Competitive Landscape

The worldwide intelligent battery sensor market is reasonably fragmented with both well-established automotive and industrial component makers and specialized sensor suppliers. Some large players hold the majority of the market share through large product lines, international distribution networks, and bundled service packages. At the same time, numerous regional and niche players serve in regional markets, fulfilling particular industrial, automotive, and marine applications.

The key market players are Robert Bosch GmbH, NXP Semiconductors N.V., Continental AG, DENSO Corporation, TE Connectivity Ltd., and so on. These market players compete with each other to establish a robust market position by means of strategic collaborations, mergers & acquisitions, and the expansion of their sensor portfolios to address the increasing need for quality battery monitoring solutions across the world.

Midtronics: An emerging market player

Midtronics, a top U.S.-based battery diagnostic leader, is growing its presence in the intelligent battery sensor market. The firm is focused on sophisticated battery testing and monitoring solutions designed for automotive, industrial, and energy storage usage.

In August 2025, Midtronics introduced the xLVS-9000 EV 12V Battery Diagnostic System, which is meant to evaluate the condition of auxiliary 12V batteries in electric vehicles. The system covers the importance of 12V batteries in EVs, providing assurance for the dependability of critical vehicle systems.

Midtronics’ dedication to innovation and attention to the changing needs of the electric vehicle industry make it a key contender in the smart battery sensor market

List of key players in Intelligent Battery Sensor Market

Robert Bosch GmbH

NXP Semiconductors N.V.

Continental AG

DENSO Corporation

TE Connectivity Ltd.

HELLA GmbH & Co. KGaA

Midtronics, Inc.

Texas Instruments Inc.

Infineon Technologies AG

Murata Manufacturing Co., Ltd.

Valence Technology, Inc.

Delphi Technologies

Analog Devices, Inc.

Eberspaecher Vecture Inc.

Current Ways Inc.

Sensata Technologies, Inc.

Renesas Electronics Corporation

Vishay Intertechnology, Inc.

Panasonic Corporation

STMicroelectronics

Strategic Initiatives

12th March 2025: Johnson Controls formed a strategic partnership with Siemens Energy to integrate intelligent battery sensors into large-scale industrial and commercial EV charging infrastructure, aiming to optimize battery performance and predictive maintenance capabilities.

5th June 2025: Tesla collaborated with LG Energy Solution to expand the deployment of smart battery sensors across its electric vehicle lineup, enhancing real-time monitoring, state-of-charge accuracy, and fleet energy efficiency.

18th August 2025: Schneider Electric launched a regional expansion initiative to deploy intelligent battery sensor solutions in emerging markets, targeting commercial fleets and renewable energy storage systems to improve operational efficiency and reduce maintenance downtime.

29th September 2025: Panasonic entered a joint development agreement with ABB to develop next-generation intelligent battery sensor technologies for hybrid and electric vehicles, focusing on high-precision state-of-health measurement and predictive analytics integration.

Report Scope

Report Metric

Details

Market Size in 2025

USD 4.1 Billion

Market Size in 2026

USD 4.52 Billion

Market Size in 2034

USD 9.9 Billion

CAGR

10.2% (2026-2034)

Base Year for Estimation 2025

Historical Data2022-2024

Forecast Period2026-2034

Report Coverage

Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends

Segments Covered

By Sensor Type,

By Functional Capability,

By Operating Voltage Range,

By Technology Type,

By Battery Type,

By Applications,

By End-Use Industry,

By Region.

Geographies Covered

North America,

Europe,

APAC,

Middle East and Africa,

LATAM,

Countries Covered

U.S.,

Canada,

U.K.,

Germany,

France,

Spain,

Italy,

Russia,

Nordic,

Benelux,

China,

Korea,

Japan,

India,

Australia,

Taiwan,

South East Asia,

UAE,

Turkey,

Saudi Arabia,

South Africa,

Egypt,

Nigeria,

Brazil,

Mexico,

Argentina,

Chile,

Colombia,

Explore more data points, trends and opportunities Download Free Sample Report

Intelligent Battery Sensor Market Segmentations

By Sensor Type (2022-2034)

Hall Effect Sensors

Shunt-Based Sensors

By Functional Capability (2022-2034)

Current-Sensing Modules

Voltage-Detection Sensors

Thermal Monitoring Units

Integrated Multi-Parameter Devices (SOC/SOH)

By Operating Voltage Range (2022-2034)

12 V Systems

24 V Systems

36 V & Above

By Technology Type (2022-2034)

LIN (Local Interconnect Network)

CAN (Controller Area Network)

Other Interfaces

By Battery Type (2022-2034)

Lithium-Ion Batteries

Lead-Acid Batteries

Nickel-Metal Hydride (NiMH) Batteries

Other Battery Types

By Applications (2022-2034)

State-of-Charge (SOC) Tracking

State-of-Health (SOH) Monitoring

Battery Management System (BMS) Integration

Regenerative Energy & Power Optimization

Start-Stop & Idle-Reduction Functions

Miscellaneous Applications

By End-Use Industry (2022-2034)

Automotive

Marine

Aerospace

Industrial Power

Others

By Region (2022-2034)

North America

Europe

APAC

Middle East and Africa

LATAM

Frequently Asked Questions (FAQs)

The global intelligent battery sensor market size is estimated at USD USD 4.52 billion in 2026.

Transition to smart energy management from traditional battery monitoring and Rampant adoption in electric and hybrid vehicles are key factors driving market growth.

North America drives the intelligent battery sensor market in 2025 with a 31.8% global revenue share.

Leading market participants include Robert Bosch GmbH, NXP Semiconductors N.V., Continental AG, DENSO Corporation, TE Connectivity Ltd., HELLA GmbH & Co. KGaA, Midtronics, Inc., Texas Instruments Inc., Infineon Technologies AG and Murata Manufacturing Co., Ltd.

The 12 V systems segment dominated the market in 2025 with a revenue share of 46.5%