Every week, Zikoko seeks to understand how people move the Naira in and out of their lives. Some stories will be struggle-ish, others will be bougie. All the time, it’ll be revealing.

Everyone’s financial journey is different; Piggyvest gives you the tools to plan, save, and invest, so you can create your own money story. Start now with as low as ₦1,000!

What’s your earliest memory of money?

My secondary school didn’t allow students to bring food from home; we had to buy our meals in school. So, my parents gave me ₦100 daily. I was 10 years old, and the naira was stronger then. I remember I’d buy food and still have change left to do whatever.

What was the financial situation at home?

We were very comfortable. As a child, I thought other people had bigger and nicer things. But looking back now, I had it pretty good. My parents gave me everything I needed, and I lacked nothing.

In uni too, I had more than enough, and that might have contributed to my problem of not knowing what to do with money to this day.

How so?

I didn’t have a monthly allowance. My parents just said, “Here’s money. Use it. When it’s about to finish, let me know.” I had so much money, I didn’t know what to do with it. It just never ran out.

Also, I usually had a lot of cash from my parents’ visits. So, I’d just keep the cash in my drawers, and I later realised friends stole from me. I never identified the thief because my room was open to everyone. I had multiple friends coming in and out, and because of my money habits, I didn’t notice someone was stealing until it became obvious.

That’s wild. When was the first time you worked for money?

This was around 2015, and I was in 300 level. I heard people were making money online, and I decided to try it out of curiosity. I just wanted to see how I could do something for myself.

I tried a tech/AI platform that needed people from several countries to get data for social media evaluation. Essentially, they wanted to know what search results would look like when people in certain localities searched for specific things. I basically helped them fine-tune their search engines. The platform was similar to Appen, but I can’t remember its name.

Anyway, I did that for a few weeks, made ₦20k and never went back to it again.

Why?

I’m not sure. I knew the system worked, but I didn’t really care for it. Maybe the work wasn’t exciting enough, or maybe it was that the money wasn’t impressive enough. I just didn’t want to dedicate my free time to it.

The next time I did anything for money was during NYSC in 2017. Even then, it was just the ₦19800 allawee. My place of primary assignment was a government house, and they must’ve only given me ₦5k for the entire year I spent there.

How were you surviving on allawee?

I served in my state, so I still lived with my parents. I also didn’t have transportation expenses because we have a driver. Allawee was small, but it was just enough for my basic needs, like data.

After NYSC, I stayed home for about two years doing random internships and certificate courses before starting a master’s program. I wasn’t really particular about doing anything, really. I didn’t get an actual job until 2021 after completing my master’s degree.

Tell me about the job

It was an internship at an oil company, and the pay was ₦125k/month. It felt nice and refreshing earning my first salary and making my own money decisions. But that feeling didn’t last long. My newfound independence came with responsibilities I hadn’t bothered with before.

Suddenly, I was in a different state for work, going to the office daily and paying for my transportation. I mean, I used to pay for my transportation before, but it was usually when I went out with friends or went to get something. Having an actual job meant I had to do that consistently, and it was a major expense.

I could have relied on my family for support, but I was also at a point where I wanted to do things for myself. So, it was a bittersweet feeling. I liked that I was independent. The expenses part? Not so much.

Real. How long were you at this job?

One year. I left because the city I worked in was starting to affect my health. For context, the job was in Lagos, and I didn’t grow up in Lagos. So, I found the city overwhelming. I endured robbery, flooding and the daily struggle to get to work.

People might say I was just spoiled, but I felt leaving was the best decision for me at that point. It was a risk. I was leaving my job to go back home and recuperate, knowing how the job market was. But it was a decision I had to make.

Glad you prioritised your wellbeing. How long did this break last?

About eight months. During that time, I focused on getting back on my feet and researching and applying for opportunities.

Working in Lagos had shown me the work culture in most Nigerian organisations, and I didn’t like what I saw. I knew I didn’t want an office-based or hybrid job, so I focused my search on remote roles outside of Nigeria.

What kind of jobs were you searching for?

I was very open. I studied law, so I was looking for roles where I could apply my transferable skills. So like, project management, operations, admin and whatnot. I should also mention that I wasn’t exactly trying to move away from law. It was just that what I wanted didn’t necessarily fit what law practice looked like.

That said, I was pretty flexible in terms of what the role would be. The only constant in my search was that it should be a remote role with an organisation that wasn’t based in Nigeria.

In March 2023, I finally landed a job that fit my requirements — legal research at a US-based organisation. It was my confirmation that my search for opportunities like that wasn’t just a pipe dream; they actually existed.

Love to see it. What was the pay like?

It was a contract role, and I was paid based on the number of hours I worked, but my monthly income ranged between $1800 and $2500. I don’t remember the exact amount in naira, but it was around the ₦2.7m mark.

That’s a huge jump from ₦125k. How did that feel?

It was very satisfying. During my job search, several people in my life likely felt that I was unserious or just lazy for refusing to go to work and instead searching for opportunities online. So, it was a very gratifying feeling. Like, “Can you see that this works?”

At the same time, landing that job showed me a part of myself I didn’t realise. I always knew I was an ambitious go-getter, but I didn’t know how much until that first taste of money. I told myself, “There’s no going back. I just have to keep going.”

I worked there for about six months, and besides research, I did a bit of admin work here and there. That job brought the world to me in the sense that I began to see things with a clearer vision. The kinds of people I met and the types of organisations I suddenly became aware of through my job made it easy for me to secure my next job — this time in operations at an organisation in the advocacy space.

Was the pay better?

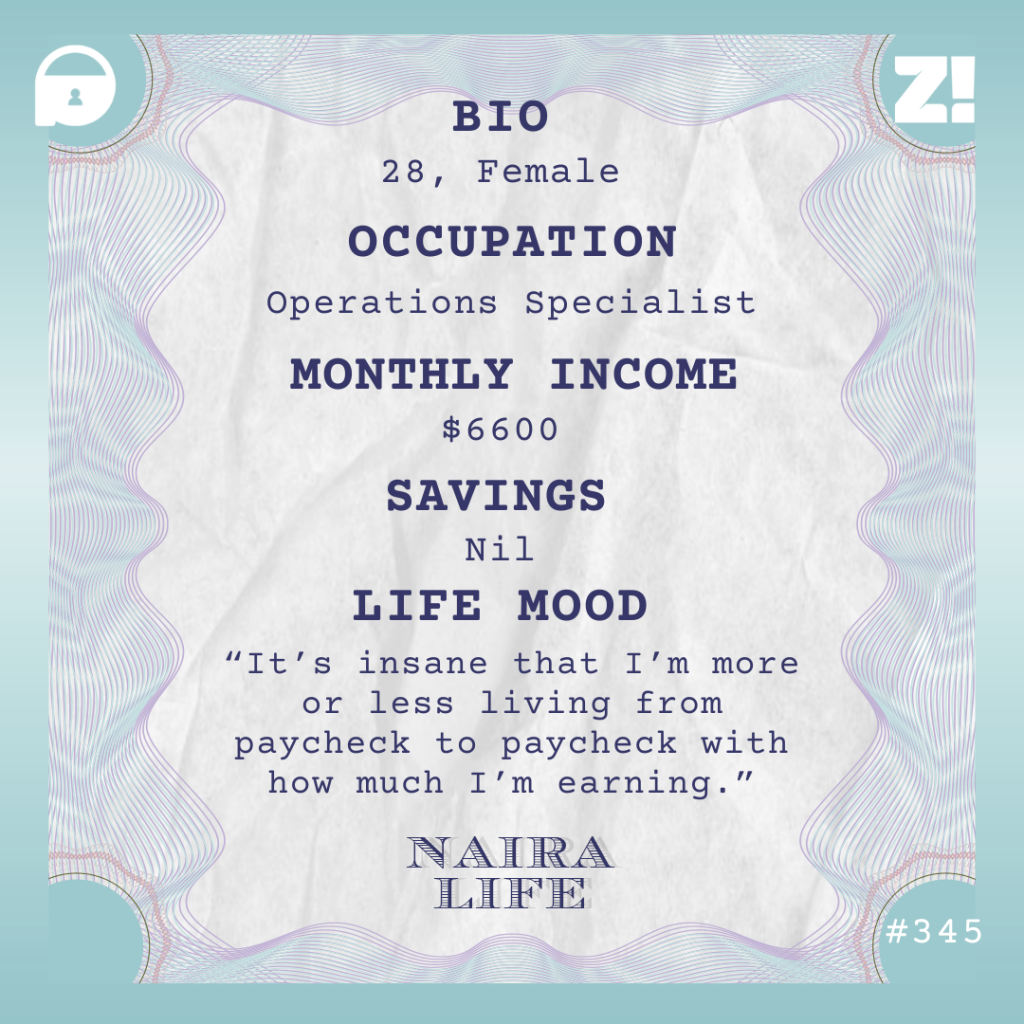

It was. $45k/year for an entry-level position, which came down to $3k/month after tax and all the deductibles. This was also in 2023, and I was at this job until two months ago, when I moved to another role in operations in the advocacy space. My new salary is $80k/year and around $6600/month. It’s over ₦9m/month in naira, and it’s the most I’ve ever made.

Mad figures. What’s it like doing your job?

It’s mixed feelings. On the one hand, it’s amazing getting to work with the people and the organisation. Sometimes I feel I’d still be good if I never surpassed this level. I mean, I want more, but I’m also super grateful for where I am.

On the other hand, it reminds me of what the average Nigerian is losing out on. It’s easy to get lost in the hustle and not realise how much the Nigerian factor is costing us. I didn’t realise how much there was to see until my income changed. And I don’t mean tourism or travelling to places, I mean the kinds of people and minds you can relate with and who can show you that what you think you have is little compared to the opportunities out there.

I used to think I wouldn’t need anything else once I earned ₦400k/month. Now I know there’s more out there, and I just need to figure my way into those places. It’s a bitter feeling when I think about how there are so many people with great potential, maybe even more than I have, who will never have the opportunity to live a more comfortable life and have a certain level of fulfilment, both financially and intellectually.

That’s a lot to think about. Someone reading this would probably ask: But HOW do we get these opportunities?

That’s a difficult question to answer, and it’s one I get all the time. Relationships with some family and friends have turned sour because they feel there’s a magic potion to get here. Sometimes it’s insulting when people think what I have is easy to obtain.

My last two jobs were global recruitments; I had to compete with people from all around the world. So, it can feel like an insult to my intellectual capacity when people think I can just give them jobs but refuse to do so. But I try to understand that it’s not always deliberate; some just don’t understand exactly what I do and how I navigated my way here.

To answer the question, it really depends on the person’s field. I always advise people looking for a field to pivot into to choose something that’s globally relevant, not just applicable to Nigeria. Big things can happen in Nigeria, but even bigger things — especially in terms of income — come from outside the country.

Also, utilise LinkedIn. Don’t just be on LinkedIn, follow the right people in the sector you want to pivot into, and you’d be surprised by the network and organisations that would pop up on your timeline and the vacancies you can apply to. That’s how I got my last two jobs.

Lastly, if you had to choose, follow the money first. Passion is great, but it’s easier to pursue it when you have a safety net. Once you’re financially comfortable, you can afford to let passion start paying you.

Interesting. How has your income growth impacted how you think about money?

The more I earn, the more isn’t enough for me. Maybe this makes me sound like an ungrateful person who isn’t easily satisfied, but that’s something I’ve learned about myself. I always want more, and I’m just trying to strike a balance.

When I earned ₦2m, I recall telling a friend that my goal was ₦5m, and they asked, “What do you want to use that kind of money for?” I said I didn’t know, I just wanted it. I now understand and accept that money is a spirit, and my needs and wants will increase as my money grows.

I just need to manage it; if not, I’ll never get to a point where I’ll want to retire, and that’s not healthy.

How about your money habits?

Now, this is one negative I’ve noticed about myself in the last two to three years — I tend to do for others more than myself. I don’t think I’ve done anything for myself in these last few years that I can be proud of, or at least show how my finances have changed. But everyone around me can testify that their quality of life has improved in one way or another. I’ve been prudent to myself — even stingy — but very careless when it comes to other people.

The other day, my mum was telling me to invest ₦500k in a quality bag so I wouldn’t have to replace bags all the time. I screamed and was like, “Why would I spend ₦500k on a bag?” Tell me why, just last year, I had bought her a bag of over ₦500k without batting an eye.

I can see an apartment with a rent price tag of ₦4m and be like, “Where am I going to? I’m in my parents’ house”, but I’ll comfortably bring out that money to help someone else. It’s a problem, and I’m working on it.

What are some of the things you’re doing to change this?

I want to be more intentional about savings. I’ve been a bit relaxed about that because I didn’t have specific responsibilities to plan for. But I’ll get married someday and have kids, so I feel I should prepare for that.

I know the societal expectation is that the man covers most of the expenses, but I don’t 100% subscribe to that. Why will I manage a tiny apartment because that’s all he can afford when I can contribute to getting something better? Of course, there are limits to it, especially if you’re dealing with someone who’ll drop his responsibilities once you start bringing money. So, I don’t judge people with different views because they know their partners better.

That said, I have to be responsible for any little human I bring into this world, so things need to change. I don’t have a specific savings schedule yet because I’m working on relocating, but I hope to have a working savings plan I can implement by the end of the year.

I want to explore investments too, but I’m a bit lost. I know people do crypto, stocks and whatnot, but I’m not sure where to start. My parents are pretty old school, so they may not be able to give me the guidance I need. They’re from the generation of “buy land and keep it for 10 years.”

I know there are newer ways to make money and earn passive income, and I want to explore them because I truly don’t have an entrepreneurial mindset. I just don’t know where to start.

Do you have a safety net right now?

Yes and no. No, because I don’t have access to the money right now. I lent about $15k to a family member, and I’m expecting it in a few weeks. Everything is going according to schedule, and it’s guaranteed, so I guess you can say I have money somewhere. Oh, wait, I also got some land last year. I spent $8k on that, so that’s an investment I have to my name.

It’s insane that I’m more or less living from paycheck to paycheck with how much I’m earning, and I know people will say it’s very careless financial management, but this is like a wake-up call to do better.

Also, to be fair, my expenses have still stayed at $3k since I got the pay increase two months ago. So, there’s that extra money in my account.

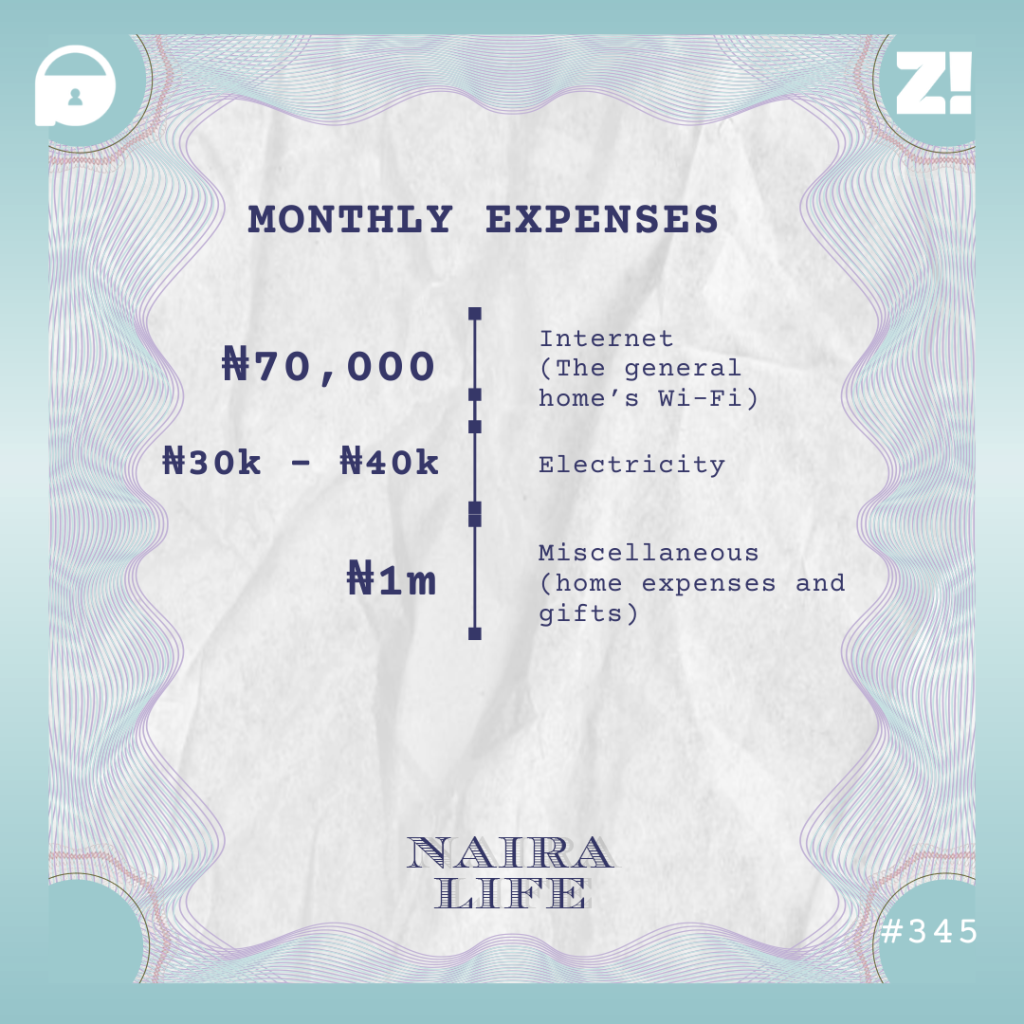

Let’s break down those expenses in a typical month

Honestly, there’s always one massive unplanned expense that depletes my money. My siblings are in uni, and they often need money for something. Sometimes I find that almost my entire salary goes back to them in one way or another.

What kind of lifestyle does your income afford you?

I live very modestly, way below what someone else who earns the same probably lives. If I didn’t have to bring out money for multiple requests, I’d probably live a very luxurious life. Unfortunately, I don’t.

Hmm. Is there an ideal amount you think you should be earning?

I think my current income is pretty good pay. But if I had to answer, I’d say $10k. It’d be nice to earn that monthly. Knowing myself, once I hit $10k, I’ll start saying, “$15k isn’t bad too.”

Is there anything you want right now but can’t afford?

I don’t think so. I can afford most of the things I want right now, in terms of lifestyle and travel, I just feel a need to go for them yet.

What was the last thing you bought that made you happy?

This is funny, but it was the shortbread I got a few days ago. It was ₦2500, so I splurged and bought two and was very happy with myself.

I’m really very simple. My family keeps asking me to act and look like what I earn, but I’m not crazy about materialistic things and appearance. I’m actually trying to take the appearance bit seriously, though. Dressing like you want to be addressed is very valid.

I’m curious. Does your family know how much you earn?

Yes. I come from a very close-knit family. I also feel comfortable sharing because I don’t come from a family that gives you responsibilities once they hear you have money.

However, I’m also trying to be cautious. Not because they’ve given me a reason to be, but because I want to be able to say I don’t have money to attend to a need without feeling like they’re silently questioning why I’m saying no.

How would you rate your financial happiness on a scale of 1-10?

In terms of my earnings, I’d rate it an 8. I’m happy I earn this much, and I know there’s room to grow. However, in terms of how secure I am in my finances, I’d rate it a 3. I don’t have systems in place to feel financially secure.

What would make you feel secure?

Knowing I’ve made good investments and that I’m using my salary to create channels for passive income that’s giving me more money that I don’t have to work a 9-5 for.

What stage would you say you are in your money journey now?

The learning stage. I’m still learning that there’s a lot of money out there. Also learning what to do with money and the various ways to make it without having to “work” for it. Legally, of course.

If you’re interested in talking about your Naira Life story, this is a good place to start.

Find all the past Naira Life stories here.