THERE is often a suggestion shared among industry observers and some producers that there is a less competition for Queensland-based Angus genetics when compared to the results of sales held in southern states.

It is possible that this preconception has developed in response to the smaller number of Angus stud prefixes located in Queensland. It could also be that in the minds of many, cattle production north of the NSW border is driven almost entirely by tropically adapted breeds.

While these preconceptions or broader assumptions may have once been a factor, in 2025 it is very apparent that demand for Angus genetics, and particularly genetics sourced at sales held in Queensland (either local Queensland-based studs or southern bull breeders who choose to hold a sale fixture north of the border), is as strong as anywhere else within the country.

Although the bull-selling season has not yet reached its final few fixtures, it is possible to start drawing some key outcomes from the data available for the year to mid-October.

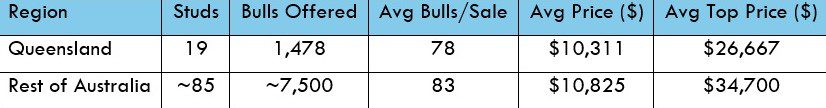

Across 2025, Queensland-based Angus studs (including southern studs holding fixtures in the north) offered close to 1500 bulls through 19 on-property or regional sales.

The average price achieved across those sales was $10,311 per head, compared with $10,825 for our sample of 85 Angus sales held across the rest of the country. The difference, which is less than five percent, is negligible, particularly given the much larger number of southern studs contributing to the national figure, and that southern sales often include a few ‘headline’ bull sold at high prices to other studs.

Catalogue sizes

Average catalogue sizes in both regions were also similar. On average, Queensland sales catalogues listed 78 bulls per sale in versus around 83 elsewhere. Clearance rates were consistently high, with many Queensland studs recording full clearances.

The only consistent gap lies in top prices, where Queensland’s mean top price of $26,667 sat about 23 percent below the southern average of $34,700. However, this difference reflects the handful of prestige sales in New South Wales and Victoria that regularly push national averages upward, rather than any structural weakness in the Queensland market.

It is realistic to now see the Queensland Angus sector characterised by a strong network of seedstock operations which reflect a maturing and importantly a regionally-adapted breeding base.

Apart from the handful of southern breeders sending bulls north, the genetics that are being offered are identifiable as being bred, raised and tested under Queensland conditions. For commercial producers, that means local access to sires with both the performance and environmental fit they need. The steady prices and clearances across these sales show that buyers recognise and trust these offerings.

An interesting evolution has also become evident in the traditional south-to-north flow of genetics. While many Queensland commercial producers still source elite sires from high-profile sales in southern states, the direction of movement is not predominantly one-way.

Meeting northern demand

Many southern programs now have partnerships or progeny represented in Queensland sales. Several Tasmanian, Victorian and NSW prefixes have established dedicated northern events to meet local demand directly. Examples include Raff, Landfall, Ardrossan, Lawson, Hazelean and JAD.

In parallel, Queensland studs are investing in top-tier genetics through embryo and semen imports, effectively bringing the best southern bloodlines north, rather than sending buyers south.

From a market structure perspective, Queensland Angus sales display the characteristics of a mature, commercially balanced environment, and a strong commercial buyer focus.

High clearance rates and moderate top prices suggest depth of demand across the catalogue rather than concentration at the top.

Southern sales continue to generate headlines through record lots and multi-state buying fields, but Queensland’s consistency across multiple studs demonstrates that commercial producers have confidence buying locally. These producers operate in some of the country’s most variable environments, and the bulls bred and sold within Queensland are proven under those same conditions.

The data also hint at a subtle shift in who is travelling and why. Where once Queensland producers headed south in search of better genetics, many of today’s movements are by seedstock breeders themselves, attending or partnering in southern sales to strengthen their own herds and branding.

This pattern suggests that the most active cross-border engagement now occurs within the stud sector, not necessarily among commercial buyers. The average commercial operation in Queensland can now access bulls of similar performance, pedigree depth and genomic backing within their own state.

Older assumptions

The data from 2025 does challenge the older assumptions that Queensland Angus sales are somehow less competitive. The numbers show a market that mirrors national averages in price and volume, supported by a broad base of well-managed studs and strong commercial participation.

The difference lies only in the extremes, with many of the southern record prices driven by a small number of prestige events, not in the fundamentals of demand or genetic quality.

For Queensland’s Angus seedstock industry, that represents a significant evolution. That is evolving from a region once seen predominantly as a destination for southern genetics to one capable of supplying much of its own, and contributing back into the broader national pool.

Next week: We wrap up our final genetics column for 2025 with a summary of the 2025 bull selling year – its highlights and low-lights, strengths and weaknesses.

Alastair Rayner

Alastair Rayner is Principal of RaynerAg and an Extension & Engagement Consultant with the Agricultural Business Research Institute (ABRI). He has over 28 years’ experience advising beef producers and graziers across Australia. Alastair can be contacted here or through his website: www.raynerag.com.au