Dublin, Oct. 21, 2025 (GLOBE NEWSWIRE) — The “United Kingdom Travel Insurance Market, By Region, Competition, Forecast and Opportunities, 2020-2030F” has been added to ResearchAndMarkets.com’s offering.

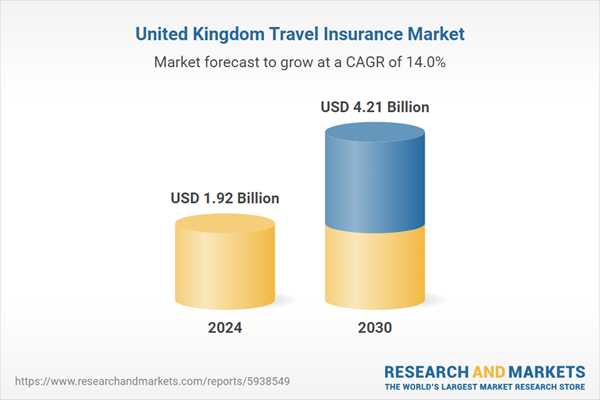

The United Kingdom Travel Insurance Market was valued at USD 1.92 Billion in 2024, and is expected to reach USD 4.21 Billion by 2030, rising at a CAGR of 14.04%.

The United Kingdom Travel Insurance Market is a robust and dynamic sector that provides travelers with financial protection and peace of mind when they embark on domestic or international journeys. Travel insurance offers coverage for a variety of unexpected events that can disrupt travel plans, including trip cancellations, medical emergencies, lost luggage, and other unforeseen incidents. The United Kingdom Travel Insurance Market is a well-established and competitive space. It offers a wide range of insurance products designed to meet the diverse needs of travelers, whether they are going on a short weekend getaway, a business trip, or an extended vacation abroad. These insurance policies aim to provide financial protection and assistance in case of unexpected events during travel. Inbound and outbound tourism to and from the UK increased in 2023 compared to 2022 but remained below pre-pandemic levels.

VisitBritain estimated 41.2 million inbound visits in 2024, slightly above pre-pandemic levels by 1%, and forecasts 43.4 million visits in 2025, reflecting 5% growth. While domestic tourism slightly declined in 2023, domestic spending still surpassed inbound spending. According to the Office for National Statistics, tourism directly contributed £58 billion (approx. $73 billion USD) to the UK economy and supported 1.2 million jobs in 2023, highlighting the sector’s ongoing importance despite recovery challenges.

Key Market Drivers: Increasing Awareness and Demand for Comprehensive Coverage

One of the primary drivers of the United Kingdom Travel Insurance Market is the increasing awareness among travelers of the importance of having comprehensive coverage. As people become more aware of the potential risks associated with travel, they are actively seeking travel insurance policies that can provide financial protection and assistance in times of need. The UK has a significant number of residents who travel internationally for business and leisure.

Whether it’s a beach vacation in the Mediterranean, a business trip to Asia, or a backpacking adventure in South America, international travel exposes individuals to various risks. This has led to a growing awareness of the need for travel insurance that covers unexpected events, such as trip cancellations, medical emergencies, and lost luggage. Modern travelers often plan complex itineraries that may involve multiple destinations, connecting flights, and various accommodation options. According to ABI (Association of British Insurers), over 24 million travel insurance policies were sold in the UK in 2023, up from approximately 21 million in 2022, indicating growing awareness of the importance of travel protection.

Key Market Challenges: Digital Transformation and Cybersecurity Risks

While digitalization is transforming the UK travel insurance market through streamlined operations, online sales, and improved customer engagement, it also presents challenges, particularly regarding data privacy and cybersecurity. The increasing use of digital platforms and mobile apps exposes both insurers and customers to risks of data breaches, identity theft, and cyberattacks.

Travel insurance providers collect sensitive personal and financial data, making them prime targets for cybercriminals. A major breach could severely damage a brand’s reputation, lead to financial losses, and trigger regulatory penalties under laws like the UK GDPR. Furthermore, legacy IT systems used by traditional insurers often struggle to integrate with newer technologies, resulting in system vulnerabilities and inefficient workflows. Adopting advanced digital solutions such as AI-powered underwriting or blockchain for smart contracts also requires substantial investment and technical expertise, which may not be feasible for smaller providers.

Key Market Trends: Rise in Demand for Tailored and Flexible Travel Insurance Plans

Modern UK travelers increasingly seek travel insurance that is personalized to their specific needs rather than generic, one-size-fits-all policies. This shift is driven by more diverse travel preferences, such as adventure tourism, luxury cruises, digital nomadism, and long-term international stays. Consumers are now looking for coverage that reflects the type, duration, and destination of their travel. For instance, a backpacker traveling across Southeast Asia may require different coverage than a retiree on a Mediterranean cruise.

Insurers are responding by offering modular or customizable plans that allow policyholders to add or remove features like gadget protection, COVID-19 coverage, or cancellation due to political unrest. This trend reflects a broader push toward customer-centric insurance products that enhance value and satisfaction. Technology also plays a critical role, enabling online platforms to guide users through tailored policy options based on real-time inputs. As personalization becomes the norm, insurers that offer flexible, user-friendly, and clearly defined policies are likely to gain a competitive edge in the UK travel insurance market.

Key Market Players:

Aviva plcAXA UK & IrelandAllianz Partners (Allianz Assistance)Staysure GroupSaga plcDirect Line GroupAdmiral GroupAIG Europe (Travel Guard)Coverwise Ltd.Bupa Global Travel

Key Attributes:

Report AttributeDetailsNo. of Pages87Forecast Period2024 – 2030Estimated Market Value (USD) in 2024$1.92 BillionForecasted Market Value (USD) by 2030$4.21 BillionCompound Annual Growth Rate14.0%Regions CoveredUnited Kingdom

Report Scope:

In this report, the United Kingdom travel insurance market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

United Kingdom Travel Insurance Market, By Type:

United Kingdom Travel Insurance Market, By Source:

BankNon-Banking Financial Company (NBFC)

United Kingdom Travel Insurance Market, By Insurance Cover:

Single TripAnnual Multi-TripLong Stay

United Kingdom Travel Insurance Market, By End User:

Senior citizensEducation TravelersBackpackersBusiness TravelersFamily TravelersFully independent Travelers

United Kingdom Travel Insurance Market, By Location:

IntracityIntercityInternational

United Kingdom Travel Insurance Market, By Region:

EnglandScotlandWalesNorthern Ireland

For more information about this report visit https://www.researchandmarkets.com/r/f06gq5

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

United Kingdom Travel Insurance Market