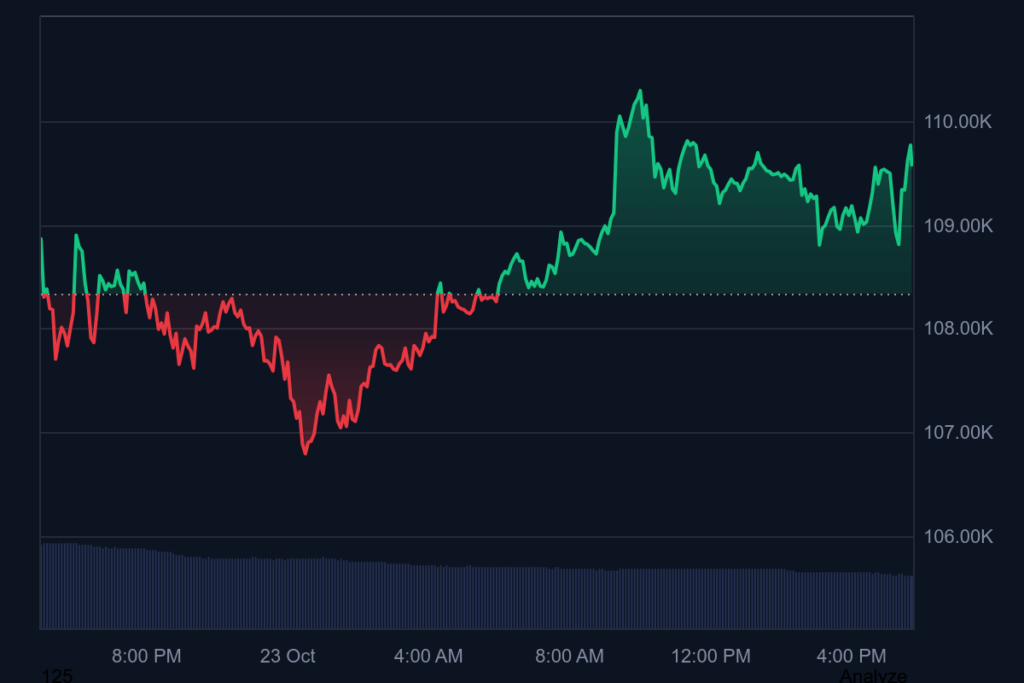

Bitcoin hovered around $109,000 on Oct. 23, with traders watching a narrowing price corridor and growing market tension.

Analysts from BRN and QCP Capital say the asset is now moving within a fragile range, where even small shifts could spark sharp reactions.

According to market data, BTC has shed more than 3% over the past month, with intraday moves largely capped between $107,200 and $109,500. Persistent rejections near the $113,000 mark have encouraged profit-taking, leaving the $108,000 support level as a key line in the sand. If that breaks, analysts warn of potential slides toward $104,500 – or even below $100,000, as Standard Chartered recently predicted.

Options traders have also entered a more volatile phase. Open interest in BTC contracts has hit fresh highs, but the build-up in put exposure means dealers are sitting on significant short gamma positions. This setup, analysts say, can quickly amplify volatility when the price shifts, triggering sudden surges or steep drops around critical strike prices.

Institutional sentiment remains mixed. Spot Bitcoin ETFs saw outflows of roughly $101 million on Tuesday, with Ethereum products losing another $19 million. The data hint at a pause in institutional appetite after several weeks of uneven inflows.

Macroeconomic uncertainty is adding to the pressure. With most U.S. government data releases delayed by the ongoing shutdown, investors are now laser-focused on Friday’s CPI print. A softer-than-expected number could revive bullish sentiment, while a higher reading might accelerate risk-off moves across the board.

For now, Bitcoin appears trapped in what analysts describe as a “proof-of-conviction phase,” where long-term holders are trimming positions while institutions continue cautious accumulation through ETFs and treasury vehicles. The result, they say, is a rangebound market—one that could stay choppy until a clear macro or liquidity catalyst emerges.

Alexander has been working in the crypto industry for three years, during which time he has established himself through his active participation in monitoring market dynamics and technological innovations. His interest in cryptocurrencies and new technologies is not just a professional commitment, but a deep personal passion. He follows the news in the sector daily, analyzes trends, and is excited about every new step in the development of blockchain solutions. His enthusiasm drives him to continuously learn and share knowledge, as he sees the future in digital finance and its role in global transformation.