New Zealand Dollar is under broad pressure today, partly as risk sentiment turned mildly sour in Asian trade and extended into the European morning. The move reflected a combination of modest risk aversion and steady cross-selling against Australian Dollar, which found relative support following the RBA’s policy decision earlier in the day.

Even though Aussie was weighed down by the softer risk tone, it held firm against Kiwi after the RBA left the cash rate unchanged and signaled no further rate cuts this year, and likely only one more in 2026. In contrast, the OIS market continues to fully price a 25-basis-point cut by the RBNZ at its next meeting on November 26, with around a 50% chance of one final cut by mid-2026.

This policy divergence makes Wednesday’s New Zealand labor market report a potential flashpoint for further moves. Consensus forecasts point to only 0.1% employment growth in Q3 and an unemployment rate rising to 5.3%. Any downside surprise could tip the economy into two consecutive cycle of job losses, reinforcing, which would solidify the case for additional RBNZ rate cuts next year.

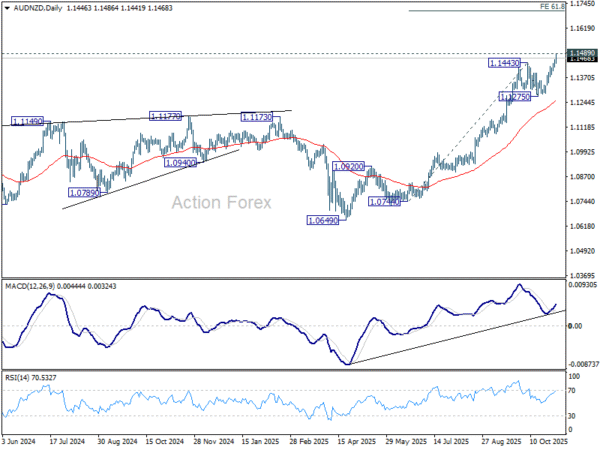

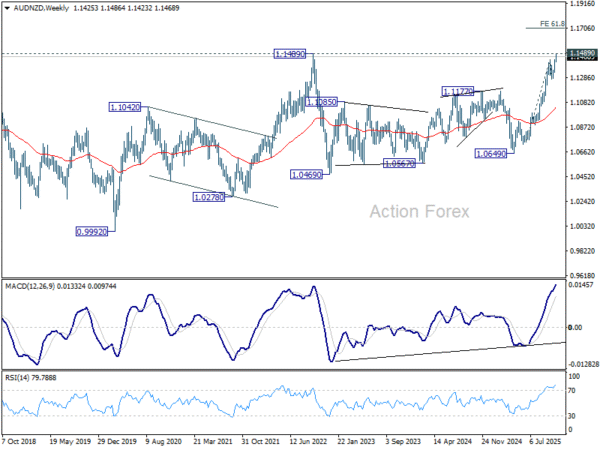

Technically, AUD/NZD is testing the 1.1489 resistance, its highest level since 2022. A decisive break above this zone would confirm bullish continuation and open the way toward the 61.8% projection of 1.0744 to 1.1443 from 1.1275 at 1.1707.