Dublin, Nov. 07, 2025 (GLOBE NEWSWIRE) — The “United Kingdom Forklift Market, By Region, Competition, Forecast and Opportunities, 2020-2030F” report has been added to ResearchAndMarkets.com’s offering.

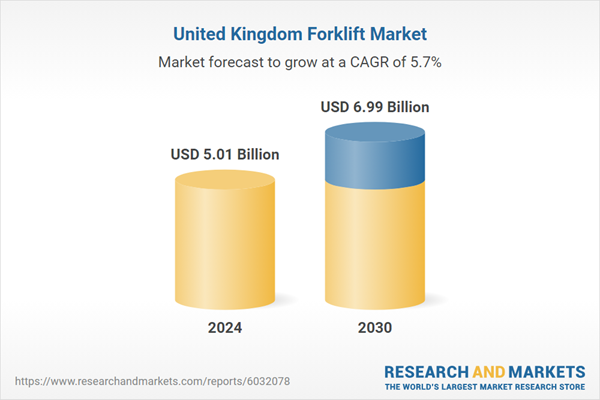

The United Kingdom Forklift Market was valued at USD 5.01 Billion in 2024, and is expected to reach USD 6.99 Billion by 2030, rising at a CAGR of 5.71%.

The United Kingdom forklift market is witnessing steady growth driven by the rising adoption of automation in material handling, expansion of the e-commerce sector, and increasing preference for electric and hybrid forklifts over traditional internal combustion models. As companies modernize their warehousing and logistics infrastructure, demand for advanced forklifts with telematics, IoT capabilities, and ergonomic designs is increasing. For instance, The UK warehousing sector has grown 61% since 2015, nearing 700 million sq ft.

Warehouses over 1 million sq ft rose 345%, and online retailer occupancy jumped 813%. Average unit size grew from 297,000 to 333,000 sq ft. 3PLs lead occupancy, with strong demand near urban centers. The East Midlands holds 130 million sq ft, while the East of England saw 104% growth, underscoring the urgent need for more development-ready land.

Manufacturers are focusing on offering energy-efficient, low-maintenance, and compact forklifts to cater to evolving industrial and commercial requirements. Trends such as the integration of lithium-ion batteries, deployment of autonomous forklifts, and real-time fleet management systems are reshaping product offerings and driving innovation.

Market Drivers

Rising Adoption of Electric Forklifts

The increasing demand for electric forklifts is significantly driving market growth due to their low emissions, quiet operation, and reduced maintenance costs. Industries are shifting away from internal combustion models as environmental regulations become stricter and carbon-neutral targets are adopted across sectors. Electric forklifts are now capable of matching the performance of traditional diesel or LPG-powered units, even in high-capacity applications.

Improvements in battery technology, particularly lithium-ion and fast-charging systems, are enabling longer operational hours and quicker turnaround between shifts. Companies operating in logistics, retail, and manufacturing are embracing electric forklifts not only for sustainability goals but also for cost savings in fuel and servicing over the equipment lifecycle. Operators benefit from reduced vibration, improved safety, and lower heat generation, enhancing working conditions. Government incentives and favorable leasing models are also contributing to faster adoption.

Key Market Challenges

High Initial Investment and Maintenance Complexity

Despite long-term benefits, the high upfront cost of modern forklifts and their associated technologies remains a significant barrier for many businesses. Electric and automated forklift models, while efficient, require substantial capital outlay for procurement, infrastructure, and operator training. Organizations with limited budgets may struggle to justify the transition from legacy equipment, especially in small and mid-sized enterprises where return on investment must be rapid.

The integration of advanced components such as lithium-ion batteries, telematics, and autonomous navigation systems also introduces maintenance complexity. Servicing these technologically advanced forklifts often requires specialized knowledge, tools, and diagnostics, which can be costly or hard to access. Downtime during repair or maintenance can interrupt warehouse flow and lead to productivity losses. Companies must also account for lifecycle costs, including battery replacements, software updates, and periodic inspections.

Key Market Trends

Growth of Lithium-Ion Battery Technology

The rising popularity of lithium-ion batteries is reshaping the forklift industry, offering significant advantages over traditional lead-acid batteries. Lithium-ion batteries deliver higher energy density, faster charging, and longer lifespans, making them ideal for high-intensity operations with minimal downtime. They also support opportunity charging, enabling operators to recharge during short breaks rather than long overnight sessions.

The absence of water maintenance, reduced risk of acid spills, and stable voltage output enhance operational safety and simplify maintenance routines. Forklifts powered by lithium-ion batteries exhibit consistent performance throughout a shift, improving productivity in environments where precision and timing are critical. As battery costs decrease due to economies of scale and wider adoption in other sectors like electric vehicles, lithium-ion solutions are becoming more accessible to forklift buyers.

Key Attributes:

Report AttributeDetailsNo. of Pages85Forecast Period2024 – 2030Estimated Market Value (USD) in 2024$5.01 BillionForecasted Market Value (USD) by 2030$6.99 BillionCompound Annual Growth Rate5.7%Regions CoveredUnited Kingdom

Report Scope:

Key Market Players

MLE B.V.JST Forklift TrucksHyster-Yale Group, Inc.Linde Material Handling GmbHLandoll CorporationJungheinrich AGCombilift LtdClark Material Handling CompanyToyota Material Handling Manufacturing Italy S.p.A.Impact Fork Truck Limited.

United Kingdom Forklift Market, By Tonnage Capacity:

Less than 5-ton5-15-ton16-25 tonabove 25 ton

United Kingdom Forklift Market, By Propulsion:

United Kingdom Forklift Market, By End Use:

Port FacilityLogisticsConstructionMunicipalityOthers

United Kingdom Forklift Market, By Region:

EnglandScotlandWalesNorthern Ireland

For more information about this report visit https://www.researchandmarkets.com/r/byxz6v

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

United Kingdom Forklift Market