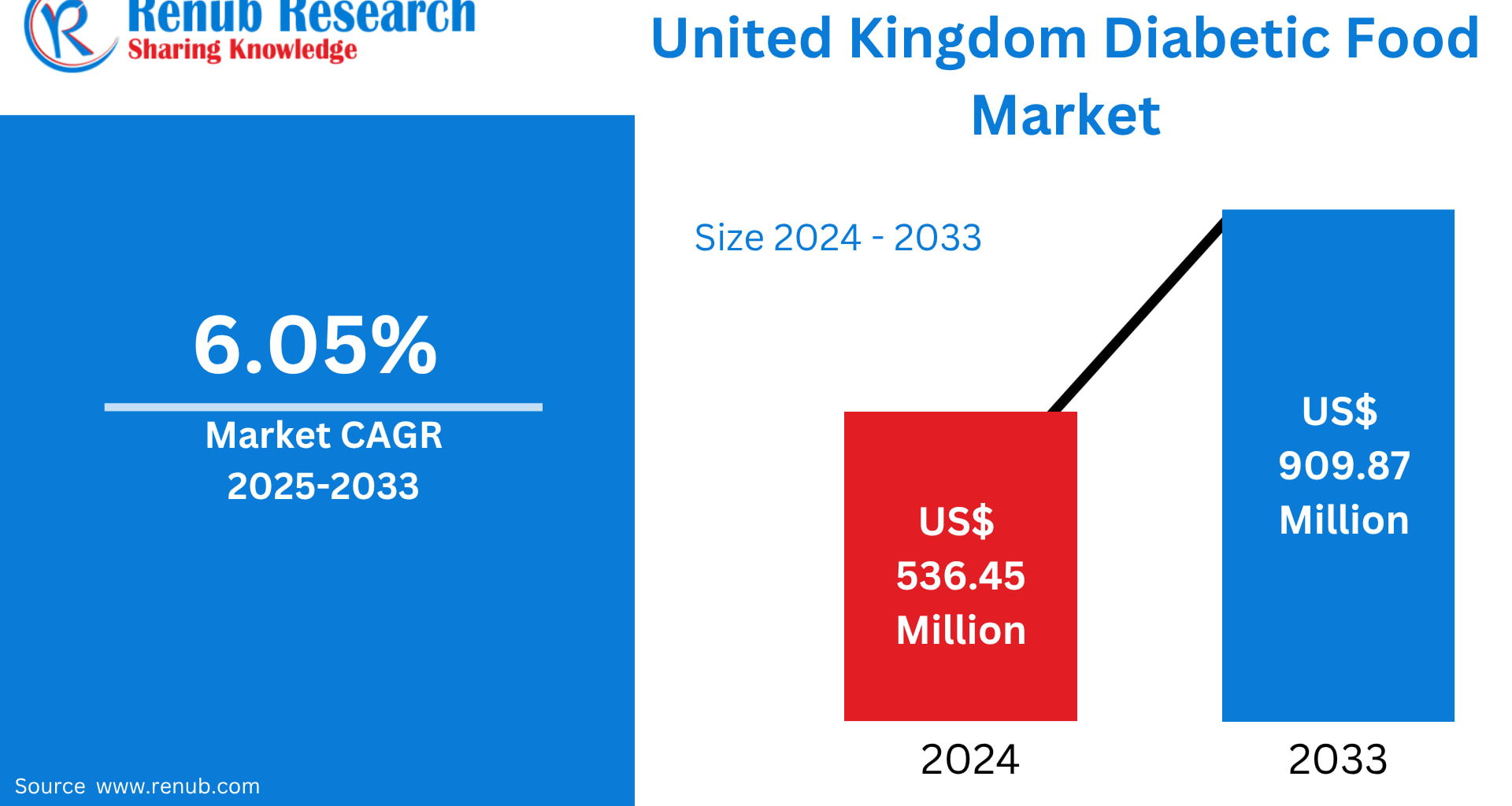

The United Kingdom Diabetic Food Market is witnessing a transformative shift, driven by rising health awareness, a growing diabetic population, and consumer demand for healthier food alternatives. According to Renub Research, the UK diabetic food market is projected to rise from US$ 536.45 million in 2024 to US$ 909.87 million by 2033, registering a CAGR of 6.05% during 2025–2033. This strong upward trajectory underscores the country’s evolving dietary landscape, where low-sugar, low-calorie, and functional products are becoming essential components of everyday nutrition.

As rates of diabetes—particularly Type 2—continue to rise across the nation, the demand for specialized, sugar-controlled foods is growing rapidly. This includes a wide range of categories such as snacks, dairy products, beverages, bakery items, and confectionery formulated to help individuals maintain healthy blood sugar levels. Moreover, this segment is no longer exclusive to diabetic consumers; it increasingly appeals to a broader health-conscious audience, reinforcing long-term growth prospects.

United Kingdom Diabetic Food Industry Overview

The UK diabetic food industry has expanded significantly as consumers turn toward healthier lifestyle choices and preventive nutrition. A combination of factors—including urbanization, sedentary work habits, and rising obesity rates—has intensified the need for dietary solutions that assist in blood sugar management.

Diabetic foods today are not merely “alternatives”; they have evolved into high-quality, innovative mainstream products that often outperform traditional items in nutritional value. From sugar-free chocolates and low-GI bakery goods to fortified dairy and functional beverages, diabetic-friendly products now occupy substantial shelf space across UK retail outlets.

However, despite the positive market dynamics, challenges remain. Diabetic-friendly products generally carry a premium price tag, which limits affordability among lower-income consumers. Awareness gaps persist, particularly in rural areas where misconceptions about diabetic foods or taste concerns hinder adoption. Nevertheless, the rising popularity of plant-based nutrition, natural sweeteners, and fortified functional foods is creating new opportunities, while e-commerce platforms continue to expand market reach.

Overall, the UK diabetic food market stands at the intersection of consumer innovation, healthcare influence, and nutritional science—positioning it for strong, sustained growth through 2033.

Key Drivers of Growth in the UK Diabetic Food Market

1. Rising Prevalence of Diabetes

One of the most significant drivers is the increasing number of individuals diagnosed with diabetes across the UK. Sedentary lifestyles, unhealthy dietary habits, and genetic predispositions have contributed to millions of people facing heightened risks of metabolic disorders.

As awareness campaigns gain momentum, more consumers—even those without diabetes—are seeking healthier, low-sugar alternatives. Products crafted for diabetic consumers offer:

Low glycemic index

Natural sweeteners

Reduced calorie content

Balanced nutrient composition

Government institutions and healthcare providers increasingly promote dietary intervention as a vital part of diabetes management. This growing, health-aware population ensures sustained demand across major categories like bakery items, dairy products, beverages, snacks, and confectionery.

2. Increasing Health & Wellness Awareness

The UK is experiencing a cultural shift toward wellness-oriented consumption. Younger and middle-aged consumers, in particular, are adopting proactive approaches to diet and fitness.

Diabetic food products fit seamlessly into this trend, offering:

Low sugar content

High fiber

Enhanced nutritional value

Functional health benefits

Public health campaigns and corporate wellness initiatives further shape consumer habits. Retailers and manufacturers have responded with new product launches, expanded ranges, and improved formulations that appeal to both diabetic and non-diabetic customers.

The convergence of wellness and dietary awareness has dramatically strengthened the UK market’s growth prospects.

3. Expansion of Retail & E-Commerce Channels

Retail and digital commerce are key accelerators for diabetic food market expansion. Major supermarkets, hypermarkets, and specialty stores have increased dedicated shelf space for low-sugar and functional foods.

E-commerce growth has contributed massively, offering:

Subscription-based delivery

Personalized recommendations

Greater product variety

Price comparisons and transparency

Online retailers have made diabetic foods accessible nationwide, including in regions where physical retail penetration remains limited. Digital platforms have also empowered emerging brands to reach consumers without hefty distribution costs, diversifying the competitive landscape.

Market Challenges in the UK Diabetic Food Sector

Premium Pricing

Diabetic-friendly products often cost more due to:

Specialized ingredients

Natural sweeteners like stevia and erythritol

Research and development investments

Stricter compliance and labeling requirements

This price premium creates affordability challenges for middle- and lower-income groups. To achieve broader adoption, the industry must address pricing barriers through economies of scale and increased competition.

Consumer Awareness and Perception Barriers

Despite rising health awareness, many consumers continue to hold outdated misconceptions about diabetic foods, such as:

Poor taste

Limited variety

Low nutritional value

These perceptions—especially prevalent in rural regions—hamper demand. Stronger education campaigns, clearer labeling, and partnerships with healthcare providers are crucial to overcoming these barriers.

United Kingdom Diabetic Food Market Overview by Regions

The UK’s diabetic food market presents varied dynamics across its four regions: England, Scotland, Wales, and Northern Ireland.

England

England accounts for the largest share of the diabetic food market due to:

Higher population density

Greater prevalence of diabetes

Strong healthcare infrastructure

Wide retail and e-commerce availability

Urban centers such as London, Manchester, and Birmingham lead consumer adoption. Continuous product innovation in England—especially in bakery, beverages, and dairy—fuels ongoing growth. Awareness campaigns and healthcare partnerships further strengthen market penetration.

Scotland

Scotland’s diabetic food market is expanding steadily, supported by:

Public health nutrition campaigns

Growing health consciousness

Increased retail availability in Glasgow and Edinburgh

However, premium pricing remains a barrier in rural communities. Still, functional foods and e-commerce expansion are creating opportunities. With rising awareness and improved distribution, Scotland is expected to maintain a positive growth trajectory.

Wales

Wales is gradually emerging as a key player in the UK diabetic food market due to:

Government initiatives promoting healthy lifestyle choices

Expanding retail and online availability

High interest in healthier bakery, snacks, and dairy options

Challenges persist in affordability and awareness in rural areas, though urban demand continues to rise. Integration of diabetic products into mainstream supermarkets is helping drive growth.

Northern Ireland

Northern Ireland represents a smaller but growing segment. Demand is fuelled by:

Increasing diabetes rates

Rising health awareness

Expanding e-commerce access

Cities like Belfast show strong interest in sugar-free, low-calorie, and functional foods. Product cost and low rural awareness remain challenges, but ongoing health education campaigns and improved retail access are supporting steady growth.

Market Segmentation

By Product Type

Confectionery

Snacks

Bakery Products

Dairy Products

Others

By Distribution Channel

Supermarkets & Hypermarkets

Specialty Stores

Online Stores

Others

By Region

England

Scotland

Wales

Northern Ireland

Key Players Covered

The UK diabetic food market features several major global and regional companies, including:

Nestlé

Unilever

The Kellogg Company

Conagra Brands, Inc.

Tyson Foods

The Hershey Company

Hain Celestial Group

Each key player contributes to market growth through continuous product innovation, portfolio expansion, cleaner ingredient formulations, and strategic partnerships with healthcare and retail sectors.

SWOT Analysis of the UK Diabetic Food Market

Strengths

Rising health-conscious population

Strong retail and online distribution

Increased government and healthcare support

Weaknesses

High product costs

Limited awareness in rural areas

Misconceptions about diabetic food quality

Opportunities

Growing demand for functional and plant-based foods

Expansion of natural sweeteners

Rising interest in fortified and clean-label products

Threats

Competition from low-cost alternatives

Regulatory challenges in labeling and formulation

Economic pressures affecting premium food spending

Revenue Analysis & Future Outlook

With a robust 6.05% CAGR projected through 2033, the UK diabetic food market is set for sustained expansion. Continuous innovation in sweeteners, improved taste profiles, and cleaner labels will help accelerate mass adoption. Digital retail and personalized nutrition services will further reshape the market’s growth trajectory.

Final Thoughts

The United Kingdom’s diabetic food market is entering a new era of health-driven growth. With rising diabetes rates and a national shift toward preventive wellness, demand for low-sugar, functional foods is surging. While challenges persist in pricing and awareness, ongoing innovation, e-commerce expansion, and government health initiatives will ensure steady, long-term market development.

As the lines blur between “diabetic food” and “everyday healthy eating,” the industry is poised to transform how British consumers approach nutrition—making healthier choices more accessible, more enjoyable, and more essential than ever.