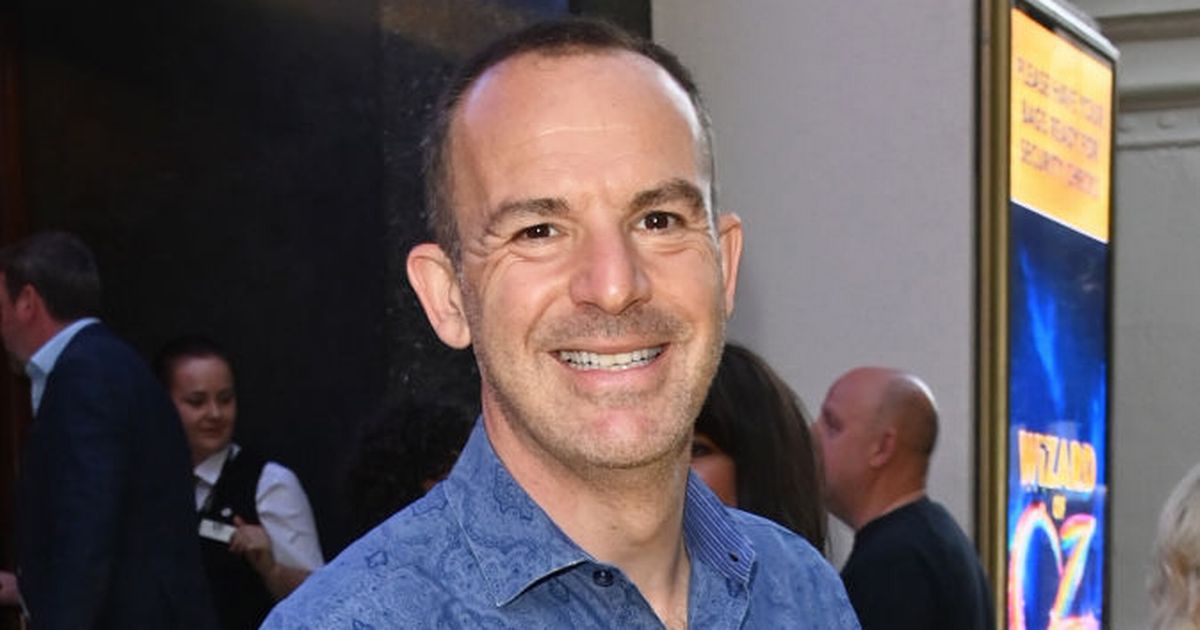

Martin Lewis questioned Rachel Reeves about the upcoming changes to the state pension and cash ISAs. Money expert Martin Lewis questioned Rachel Reeves on the changes to the state pension and cash ISAs.(Image: Dave Benett/Getty Images)

Money expert Martin Lewis questioned Rachel Reeves on the changes to the state pension and cash ISAs.(Image: Dave Benett/Getty Images)

Money expert Martin Lewis has questioned Chancellor Rachel Reeves about the big announcements in the Budget. Amongst talking about upcoming changes, he managed to secure a commitment from Reeves that should ease any stress for low income pensioners.

In the Budget, Reeves confirmed that the new full state pension will be rising by 4.8 per cent next April. While this will raise the pension to £12,548 a year, it has caused some people to worry as it is getting closer to the standard person allowance.

This allowance currently sits at £12,570. If you earn above this a year, you then need to start paying income tax. This has caused some concern as people are worried that if an older person on the new state pension has any other income, then this would take them over the threshold.

This would then mean they would have to start paying income tax, along with the extra hassle of filling in an annual tax return, reports the Mirror. However, all of these worries can disappear as the Chancellor confirmed on Martin’s ITV show that those whose only income is the state pension will not need to pay income tax.

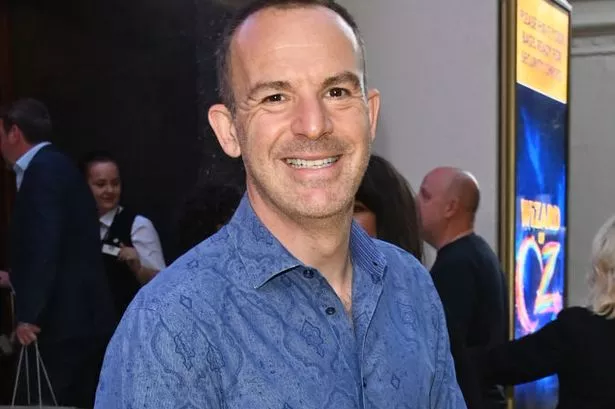

Chancellor Reeves gave a committment that those who only have state pension won’t need to pay income tax.(Image: Adrian Dennis/Getty Images)

Chancellor Reeves gave a committment that those who only have state pension won’t need to pay income tax.(Image: Adrian Dennis/Getty Images)

She said: “If you just have a state pension and you don’t have any other pension we are not going to make you fill in a tax return. I make that commitment for this parliament. They won’t have to pay the tax.” She added: “We are working on a solution so we are not going after tiny amounts of money.”

While the founder of Money Saving Expert was pleased with the clarity on the tax point, he was still critical of the government’s choice to cut the tax-free cash ISA limit from £20,000 to £12,000 from April 2027. It should be noted that this will not impact those aged 65 or over.

In order to help UK listed companies, Labour says this decision was made to encourage savers to put their money into stock and shares ISAs instead.

However, Martin commented: “I think this is the wrong way to do it. There are other ways to encourage people to invest instead.”

Reeves replied: “Ninety per cent of people with savings will still have no tax on their savings. At the same time we are changing the advice and guidance rules. I have worked with the Financial Conduct Authority to get these changes in.

“A number of the ISA providers have already said they will be promoting investment in UK equities which is a great boost for businesses starting up and scaling up and listing in Britain.”

Martin then added: “I agree with the Chancellor’s diagnosis of the problem but I just don’t agree with the solution she has come up with.”

Also in the Budget special of The Martin Lewis Money Show, the expert gave some advice on the change to energy prices as the Chancellor recently announced measures that she claimed would cut an average of £150 off bills.

Martin has welcomed the move, which will see the temporary cut coming from ditching two add-ons to bills, including a discredited home insulation scheme.

However, he did add: “I would have preferred it to have come off the standard charge then everyone gets the same reduction but it is better than nothing.

He advised that households on a standard tariff should consider switching to a fixed rate deal instead. He stressed: “I would absolutely not be waiting, I would be getting a good saving now.”

As there have been some growing concerns that the £150 saving would not benefit those on a fixed deal, Martin also spoke to Energy Secretary Ed Miliband.

He said: “We are determined that people feel the benefit, including those on fixed rates and we are going to be working with the companies and having discussions with them confidentially in advance. We are determined for those benefits are passed to those people on fixed rates.”