By Frédérique Carrier, Rufaro Chiriseri, CFA and Thomas McGarrity, CFA

The UK faces a delicate economic balancing act, yet opportunities

remain in this undervalued equity market.

A softening labour market, decelerating wage growth and disinflation are likely to lead to more Bank of England policy easing and Gilts outperformance amid lingering volatility.

United Kingdom equities

The tax increases imposed on businesses and households in 2025 are

expected to further slow economic growth to just 1.2 percent in 2026,

according to the Bloomberg consensus forecast. Slowing growth will likely

allow inflation to ease further, which could give the Bank of England

(BoE) room to cut interest rates beyond the 3.25 percent level that

is currently priced in by markets for year-end 2026.

In our view, the risk is that an increasingly unpopular Labour government

abandons fiscal discipline. Elected with a landslide majority in July

2024, the government’s approval rating has since plunged to

17 percent, according to recent polls. It is hard for us to see it

recovering given the belt-tightening imposed on voters. If the government

loosens its fiscal stance to spur growth—and its approval rating—financial

markets would likely turn jittery, in our view, especially as the UK

relies heavily on foreign investors to finance its debt.

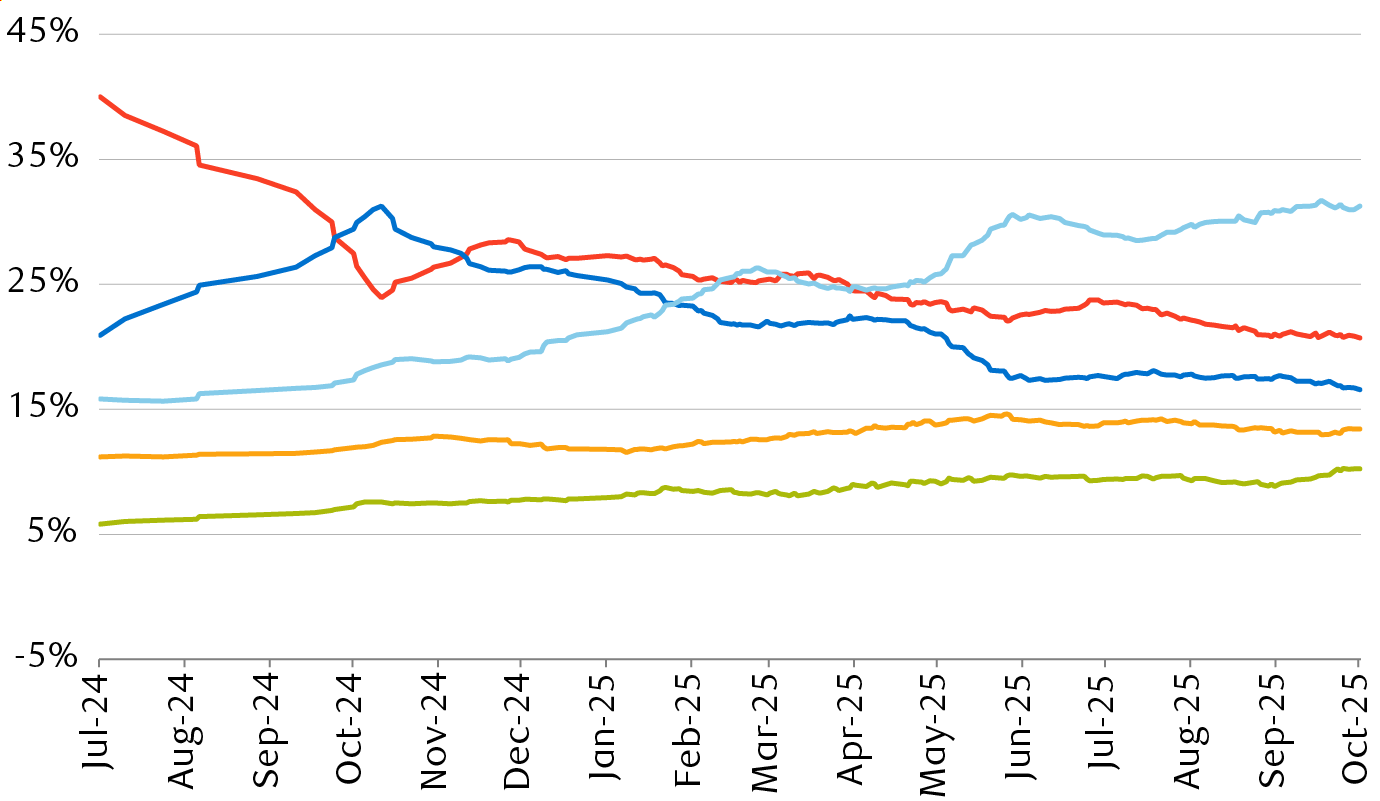

Labour’s popularity plunges, Reform’s soars

Polls of voting intentions

The chart, as of October 3, 2025, shows the voting intentions for the

five main political parties in the UK since the July 2024 general

election. Voting intentions for Labour have dropped to less than 25%

from 40%. Labour’s support recovered slightly in the three months

following the election but then steadily declined, so that it now

stands at less than 21%. By contrast, voting intentions for the

right-wing Reform party have increased steadily since the general

election, to 31% from 16%. The Conservatives, while enjoying an

increase in voting intentions from July to October 2024, have also

suffered a deep decline, with voting intentions for the party now

standing below 17%. The Greens and the Liberal Democrats have seen a

slow improvement in their voting intentions during this period, now

standing at 10% and 13%, respectively.

Labour

Conservative

Reform

Liberal Democrats

Green

Source – Election data vault

For a country that averaged an annual growth rate of two percent in the

decade before the pandemic, the UK’s sluggish economic performance is

disappointing. However, circumstances have changed, and a fairer

comparison, in our view, may be with other G7 economies—all of which face

their own challenges.

Perhaps because of that external environment and thanks to attractive

valuations, the FTSE All-Share Index has gained 15 percent year to

date in local currency terms, or 20 percent in U.S. dollar terms,

largely outperforming the S&P 500’s 11 percent year-to-date

return. The outperformance is striking, especially given the UK’s limited

exposure to technology stocks, the main driver of U.S. and Asian stock

markets in 2025.

Absent major changes to the UK’s fiscal policies, we think UK equities

could continue to perform well. Valuations still look attractive to us

despite the rally, with the FTSE All-Share Index trading at 12.5x 2026

consensus earnings estimates, significantly below its long-term median

price-to-earnings ratio relative to global developed markets, even

accounting for sector differences.

We continue to favour attractively valued companies in the Financials

sector, given their propensity for a high level of shareholder returns via

dividends and share buybacks. Should the BoE loosen monetary policy more

than markets currently expect, interest-rate-sensitive industries, such as

housing, could outperform.

United Kingdom fixed income

Our base case calls for continued softening in the labour market, including wage pressures, leading to increased confidence that the Bank of England will cut interest rates by 50 basis points from December through to Q1 2026. Business surveys expect pay growth to average around 3.7 percent during the year, and we forecast headline inflation to reach 3.5 percent year over year by the second quarter. A wide range of fiscal tightening measures are being backloaded in the 2029-30 period of the budget, while spending is frontloaded. Therefore, the growth impact in 2026 will be minimal and our economists project a gross domestic product growth rate of 1.1 percent for the year. The risk to our base case view is the potential for household inflation expectations becoming anchored around the six-month average of four percent; this could put pressure on wage demands.

Tax hikes amounting to £26.1 billion, along with the increased “headroom”—the margin of safety between tax and spending plans—to £21.7 billion from £9.9 billion, has been positively received by markets. Against the backdrop of lowered fiscal risks and looser monetary policy, Gilts should remain stable and potentially outperform, in our view. Furthermore, Treasury’s bond issuance is likely past its peak and will continue being skewed away from long-dated Gilts where natural pension demand has fallen. That being said, Gilts could remain volatile, given the delayed fiscal consolidation, and the increased reliance on yield-sensitive investors needed to mop up supply.

UK corporate bonds have largely shrugged off fiscal concerns, with credit

spreads—the compensation for credit risk—remaining at tight levels. We

forecast a modest widening of spreads into 2026; therefore, we prefer an

Underweight position in corporate bonds. However, current yield

compensation for interest rate risk is still at compelling levels.

Furthermore, we think lower Gilt yields and lower borrowing costs will

support the credit sector.

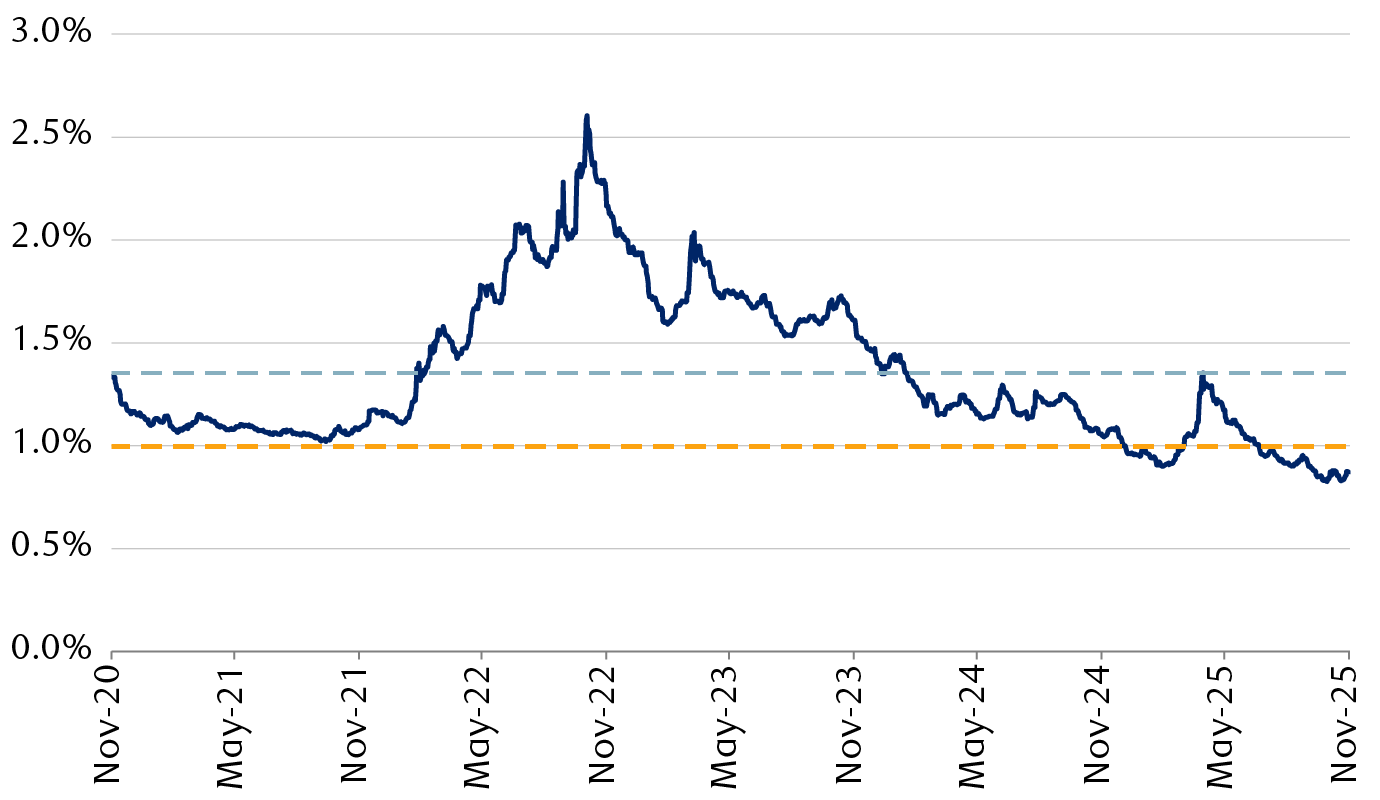

Corporate spreads are below historical averages

Spreads are the difference in yields between government and corporate

bonds

The chart shows the Bloomberg Sterling Corporate Index spreads over a

5-year horizon from November 11, 2020, through to November 10, 2025.

During this period, the index began at 1.34% and trended upward to a

high of 2.58% on October 12, 2022. After that time, the general trend

was a decline to a low of 0.90% on February 7, 2025. The latest

reading on November 11, 2025, shows 0.87%. The chart also shows the

1- and 5-year averages of the index of 1.00% and 1.35%, respectively,

during the same period.

Sterling Investment Grade Corporate Index

5-year average

1-year average

Source – Bloomberg, RBC Wealth Management; data as of 11/10/25

RBC Wealth Management is a business segment of Royal Bank of Canada. Please click the “Legal” link at the bottom of this page for further information on the entities that are member companies of RBC Wealth Management. The content in this publication is provided for general information only and is not intended to provide any advice or endorse/recommend the content contained in the publication.

® / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2025. All rights reserved.