Des Grant has no pension pot after cashing out early on the small amount he had saved. He says his life circumstances stopped him saving more

In our Pension Diaries series, we will be speaking to people of all ages in the UK to find out how much or how little they have saved for retirement and the realities of putting money aside for your future.

Today, we speak to Des Grant, 62, a professional DJ and host who lives with his partner Lesley Knight in Preston, Lancashire.

The father of six sadly lost his 12-year-old daughter Melanie in 2001 after she was diagnosed with a brain tumour.

Des reveals he has no pension at all through a mixture of circumstances and believing that life is for living now rather than scrimping for a future that might never come.

What is your occupation now and what careers have you had?

I left school after doing my O levels and got a job as an apprentice at Leyland Motors at the age of 16. I am a fully trained fitter turner.

I had a bad accident while I was working there at the age of 24. I was working on the assembly clamp and was underneath the chassis when the lorry engine came off its moorings and embedded itself in my chest.

As a result, my shoulder is now pinned and wired. I get industrial injuries benefit and I could have claimed for being disabled – but I didn’t want to be a 24-year-old black lad who was disabled. Even though I am entitled to it, I have never claimed for disability.

New FeatureIn ShortQuick Stories. Same trusted journalism.

I could no longer do my job as an engineer, so I took a £4,000 a year drop in salary and went into sales for a company involved with selling nuts and bolts and personal protective equipment products.

I worked hard at it and quickly did exceptionally well and became their number-one salesman. I ended up leaving there to work for another company and trebled my wage and this then led to me starting my own business. Over the years, I have had various businesses including a singles club, which I am looking to set up again.

Des Grant fell into DJing by accident when he was convinced to play for a friend’s wedding

Des Grant fell into DJing by accident when he was convinced to play for a friend’s wedding

The DJing was something that I always did in the background while having other jobs, but over the last 25 years, my work has been very much music-focused.

I actually fell into DJing by accident at the age of around 21. One of my friends was getting married and the DJ didn’t turn up, but all the equipment was there. One of my friends said: “Des, you’ve got a good record collection. Go and get your records and do the gig.” So I did – and I got four bookings off the back of it.

What is your pension situation?

While working at Leyland Motors, I was paying into the company pension. A small amount of money came out of my wages and I didn’t even miss it. Bearing in mind my first wage was £27.50 a week and it went up to £35 the following year. I just paid the small amount into my pension and I didn’t really understand pensions at that age.

When I went into sales, someone came in to talk to us about pensions and I stupidly transferred my Leyland Motors pension to them. I didn’t realise the charges were so high, so it turned out to be the wrong thing to do.

When I was self-employed, I did not pay into a pension myself as there was too much going on and I was just trying to survive and run a household.

What is your attitude to pensions and why?

My daughter Melanie was diagnosed with a brain tumour at the age of eight after we noticed she was having difficulty gripping her fork. She had brain surgery and radiotherapy but recovered and was able to get on with life for the next four years.

But in October 2000, the brain tumour returned and was more threatening. She had emergency surgery and high doses of chemotherapy. Despite everything, it was all too much for her and she died in 2001 at the age of 12.

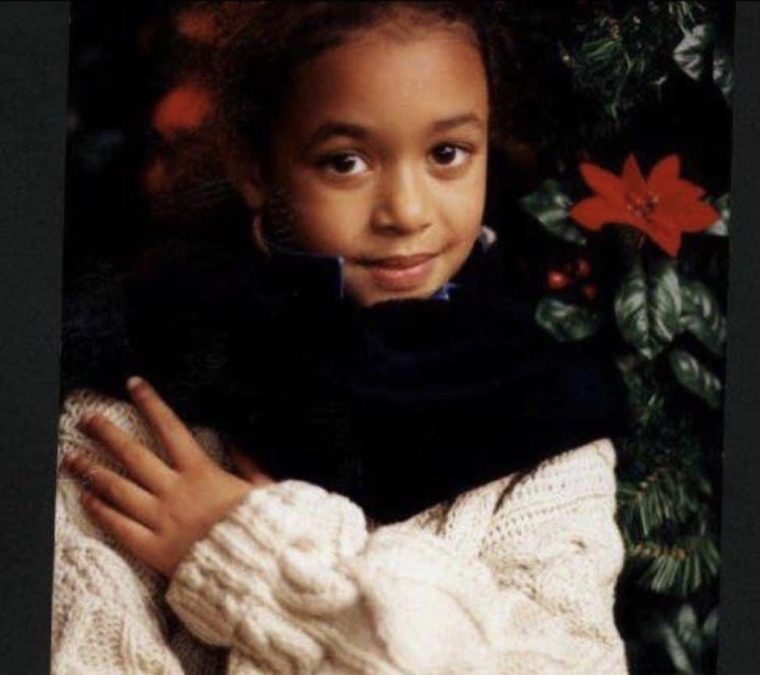

Des Grant’s daughter Melanie Grant who died at the age of 12 in 2001 after being diagnosed by a brain tumour

Des Grant’s daughter Melanie Grant who died at the age of 12 in 2001 after being diagnosed by a brain tumour

Something like that never leaves you and it affected the whole family greatly. I had three children when Melanie was going through everything with her brain tumour and was running my own business with eight staff who had mortgages. I was trying to support Melanie, my family and my staff. It was very challenging and pensions were the last thing on my mind.

Losing Melanie at such a young age changed my perspective and made me realise how fragile life is and the importance of living for today instead of tomorrow.

How many pension pots do you have and what is your estimated pension total?

As of right now, I have a total of zero pension pots and zero pounds in my pension. After transferring my pension from Leyland Motors, the money did not seem to be invested well and had been hit by high charges, so it did not grow anywhere as much as it would have done if I had left it where it was.

Eventually, it had about £18,000 in that pension pot and I decided to pull the money out last year as I needed the money and I felt life was too short as too many of my friends were dying. I have been to nine funerals of friends in the last year and eight of them have all been younger than me.

Although I don’t have a pension, I have a three-bedroom house which is an area of potential income once I have paid off the mortgage in three years time. It may well end up being my pension pot.

When would you like to retire?

The way I see it, these days, you go on working until you drop. I think your health dictates when you retire.

I love DJing and it is important for me to love what I am doing. I love making people happy and am passionate about that. My DJ work has gone through the roof and I am doing so many gigs across the country, as well as abroad including in Turkey, Greece and Malta.

Des hopes to one day retire and travel the world with his partner Lesley Knight

Des hopes to one day retire and travel the world with his partner Lesley Knight

If I felt my health was ever getting in the way of me delivering a good show for people and I could afford to retire, that is something I would look at. But right now, I can’t afford to retire as I have a mortgage to pay and children who I support financially if they need me if I possibly can.

My partner Lesley, who I have been with for two-and-a-half years, used to work in the NHS and is now retired. We would love to pool our resources and travel and see something of the world, so I would like to retire at some point. But it can’t be any time soon as I won’t be eligible for my state pension until I’m 67.

What is your biggest pension regret?

Circumstances have been the biggest barrier to me putting money into a pension. You have to be able to live while meeting your day-to-day obligations and if there is anything left you consider spare, you can invest that in the future.

Des Grant with singer Billy Ocean who he met at part of his work DJing and hosting events

Des Grant with singer Billy Ocean who he met at part of his work DJing and hosting events

Unfortunately for me, some of the decisions I made and the things that have happened made a massive hit to my finances.

I do wish that when I was younger, someone had taken me to one side and explained how pensions worked and told me: “If you put X amount of money in now, you will get X amount of money out in 30 or 40 years time.”

My biggest regret is taking my money out of the Leyland Motors pension as I know it would have been a much bigger pot if I had just left it there.

However, my decision-making around pensions and the future is one of living for today. With losing Melanie and so many friends recently, I really want to live for now.

Would you like to be featured in Pension Diaries? E-mail: Aasma.day@theipaper.com