Key Takeaways:

● Uncertainty Around WB-D Deal, Impacts on Cycling TV Coverage

● Strava Report Shows Both Weakness and Opportunity for Cycling

● Reasons Behind Girmay’s Move to Rebranded NSN Team

● Sports Valuations Entering an Era of “Irrational Exuberance”

● Sports Investing Comes to Everyman

● Giro Route Announced – Geared to Attract Vingegaard and Evenepoel?

Sports media rights are the critical link holding the sports league and franchise economic system together – and recent developments in the pending sale of Warner Bros.-Discovery could completely redefine how consumers access sports broadcasts in the future. Last week, it appeared that Netflix had won the bidding war for Warner Bros. Discovery, making an offer valued at $83 billion. But the Netflix bid did not include the WBD cable channels that carry cycling – Eurosport and TNT. It’s not currently known what would happen to the cable side of the business should this deal close. And of course the process will be subject to complex regulatory scrutiny that could sink the deal at any point. Complicating things further, on December 8th, Paramount announced a hostile takeover bid for $108 billion that did include the WBD cable channels. The Paramount bid includes Donald Trump’s son-in-law Jared Kushner as well as money from Middle Eastern countries, including Saudi Arabia’s Public Investment Fund and the Qatar Investment Authority – and is rumored to be favored by Trump himself. At this point it’s unclear how the process will proceed, but it seems likely to be highly politicized, and the entire media world is paying attention as there seem to be new twists about every hour. But until a final deal is cut, which could take months or even years, cycling remains caught in the broader instability of the sports-rights economy – where the only constant seems to be that coverage keeps getting more expensive, more complex, and less predictable for fans.

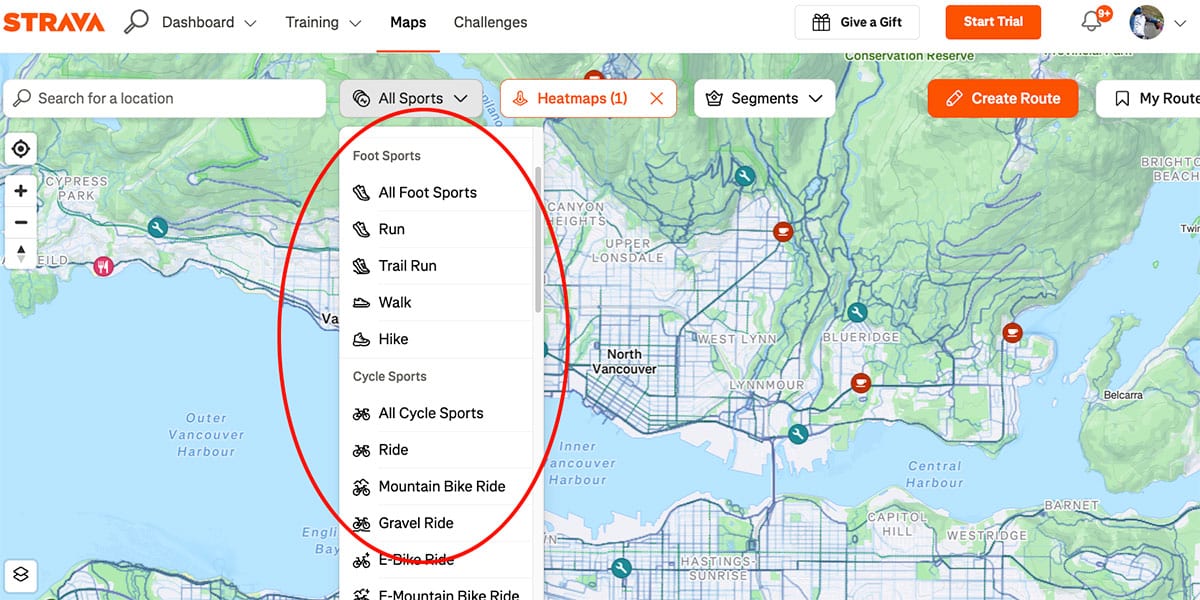

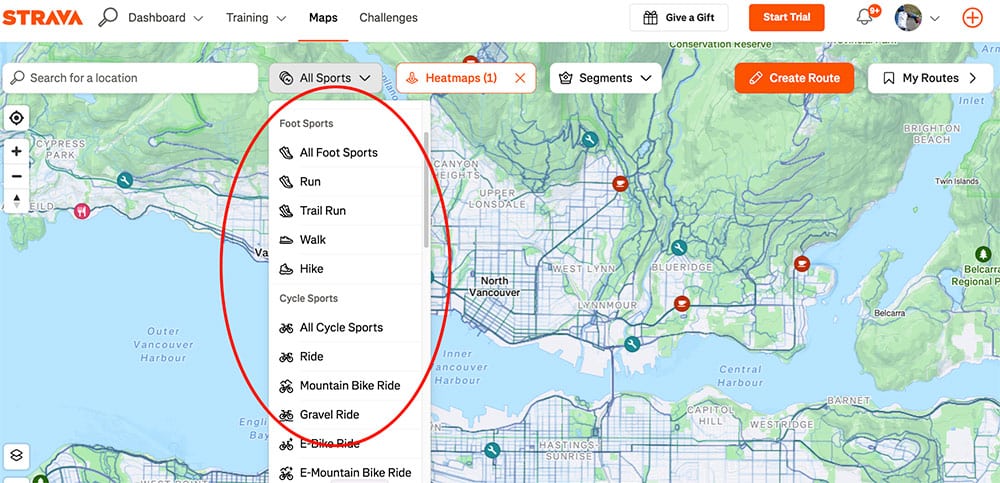

Strava’s recent “year in sport” compendium provided a remarkably transparent view into consumer interaction with the tech platform’s services, and the contents bolstered momentum towards its expected early 2026 IPO. However, cycling was scarcely mentioned in the presentation. Running, on the other hand, is on a participation surge that seems unlikely to crest, given its low cost of entry, and its popularity across various age and geographic demographics; it has become the greatest contributor to Strava’s membership growth and year-around usage. This falls in line with the company’s recent acquisition of online training platforms through which it can retain and upsell these athletes (especially Gen Z cohorts) into higher value subscription tiers for sustained revenue growth and new subscriber acquisition. Yet it’s that cycling data which should worry the cycling industry and the sport in general; Strava was built on cycling and while it hasn’t abandoned the activity, it is no longer the primary driver. Strava still has many longstanding cycling users, but growth has faded for a variety of factors – including the sport’s high cost of entry, seasonal participation, and competition from device manufacturers like Garmin that also host native interactive training and social media features.

As we wrote in an earlier newsletter, Strava usage has become a standard candle for the health of the sport, aggregating the activities and fostering important social interactions for its members. With bike sales languishing and race calendars contracting, Strava’s cycling base has bottlenecked. Given Strava’s position as the de facto global endurance athletics social media platform and as a data hub for related consumer activity, cycling’s downturn laterally indicates rough waters ahead for Zwift and Rouvy. Zwift has pivoted to the opportunity with its running treadmill features while Rouvy has opted to remain focused on cycling and triathlon. However, there are parallels emerging with Peloton, which entered the pandemic as a darling for home fitness and exited nearly bankrupt. The equipment requirements are virtually identical – Peloton’s ubiquitous, pricy, and unwieldy stationary bikes, and for Zwift and Rouvy, an even more expensive and extensive assortment of stationary trainers and app-compatible devices. Nevertheless, a successful Strava IPO could spur further investment and create opportunities for innovation, potentially attracting new cycling participants, spurring bike sales and overall economic growth in our sport.

Girmay going to NSN

Girmay going to NSN

The biggest transfer news over the past month has been Eritrean 2024 Tour de France Green Jersey winner Biniam Girmay signing with the newly rebranded NSN Cycling Team on a rumored three-year, €2 million per season deal. The deal was somewhat surprising, with Girmay joining a team which seems to face an uncertain future. The move further highlights the fragile proposed “merger” between his former Intermarché team and Lotto; the fact that Girmay was apparently free to leave Intermarché – despite being under contract – suggests that his contract wouldn’t carry over to the merged outfit. In turn, this implies that Lotto essentially swooped in to take the struggling Belgian team’s title sponsor and a few cheaper Intermarché staff members (while laying off some of their own higher-paid long-time staffers). Should any observers remain confused about why Girmay would take the risk of going to NSN, remember that if he stayed put he’d to have to compete for opportunities against Lotto’s homegrown sprinter Arnaud De Lie – a direct rival who is two years younger and who ran off seven straight head-to-head wins over Girmay to finish 2025. Additionally, the Lotto-Intermarché group was unlikely to match the superstar-level salary offered by NSN, which was apparently willing to pay top dollar for a marquee signing. The new and already embattled team desperately needed a “north star” going into 2026 to distract from its controversial I-PT rebrand and a protracted legal battle with former team leader Derek Gee.

Girmay’s move contributes another data point on how drastically the sport’s financial landscape is shifting, with the NSN team – which has seemingly far more financial firepower than the long-running Lotto-Intermarché team – picking off a top rider. In other words, deep pockets continue to become more important even when it’s not clear who the deep pockets actually belong to. Meanwhile, rumors are swirling about the imminent signings of Derek Gee, Sam Welsford, and 2025 Tour de France breakout star Oscar Onley at INEOS. If the latter moves go through, it would mark yet another case of Picnic–PostNL selling high on a mid-contract star rider, but, unlike in the past, it isn’t clear if Picnic-PostNL could bounce back from this departure. Iwan Spekenbrink’s team has been one of the worst-performing teams over the last few seasons, only narrowly avoiding WorldTour relegation in the last cycle, and now it appears to be on the verge of losing the rider who contributed the most UCI points to the team. Meanwhile, after years in the wilderness, the well-funded INEOS team is looking to be a bit more back on track, potentially adding Gee and Onley, along with the previous signing of Kévin Vauquelin (from Arkéa–B&B Hotels). All of these moves continue the trend of top riders joining big-budget operations, while smaller teams are forced to adopt development-oriented, transfer-for-profit structures for funding continuity. Yet – somehow – the idea of a budget cap which was recently presented was roundly booed.

Investment interest in professional sports continues to explode, with new deep-pocket owners and richer deals seemingly announced every other day. As Front Office Sports recently reported, a quarter of all the NBA franchises have changed hands in the last five years. “This year alone, three franchises announced sales – the Celtics, Lakers, and Trail Blazers – at a collective valuation of more than $20 billion.” The 100 most valuable sports teams in the world were recently valued at more than $550 billion. Mark Cuban, former owner of the Dallas Mavericks, suggests that a lot of “original” owners are reaching retirement age and interpreting these valuations as a sign that it’s the right time to sell – despite recent gambling scandals and ownership disputes here and there, and the controversial influx of private equity stakes in team or league ownership. Although this trend is apparent across all the major sports, it has been more significant in pro basketball due to “a higher cap on private capital, limited labor strife, and a big-money, long-term media-rights deal.”

Unfortunately, this trend has yet to reach into the far dark corners where niche sports like cycling find themselves, but we have to wonder whether we have reached (in the words of former Fed Chairman Alan Greenspan) a time of “irrational exuberance.” However, Cuban’s point about “original owners” finding now is the right time to sell actually fits ASO’s current state of affairs, as the Amaury family ages and its sporting enterprise revenues are squeezed by shrinking broadcast space for professional cycling. Thus, with apologies to those who reportedly worked on One Cycling (and readers tired of hearing about its failure), the relatively low total valuation of pro cycling’s entire portfolio of teams, monuments, and grand tours leaves the possibility open that a super-patron could pull the right governance, diplomatic, and financial acquisition levers in the future.

Given this explosion of investment interest in various sports properties, it was only a matter of time until new financial instruments became available to smaller investors. CAIS, an investment platform for independent financial advisors, announced the formation of a Sports, Media and Entertainment Fund that will be accessible to accredited individual investors, offering the opportunity to invest in all five of the major North American professional sports leagues, sports-related film and television companies, live event properties, and other entertainment assets to the broader public. In short, a highly attractive investment area that was previously really only open to the billionaire class or sovereign wealth funds will now be available to anyone with as little as $25,000 to invest. Arctos and Eldridge, two investment firms with significant sports exposure were selected to jointly manage the new fund. “We believe the Fund will be well positioned to provide accredited investors the opportunity to participate in industries that have historically been difficult to access, yet influence culture in significant ways.”

Further evidence of the challenges facing the bicycle industry were underscored last week, when the iconic Campagnolo brand announced that it was laying off up to 40 per cent of its staff. The company indicated that it has suffered three straight years of operating losses, which amount to more than $25 million. The company is by no means alone, as almost all bicycle, components and accessory manufacturers have faced serious financial challenges ever since the COVID era turned the industry upside down. Manufacturers blame declining demand, excessive inventories and the Trump administration’s chaotic tariff policies for most of the problems. As we noted recently, Campy’s primary competitor, Shimano, has also suffered from declining revenue and profits over the past few years, with the company recently indicating that its profits had slumped despite steady sales. Campagnolo had said there is “no alternative” to this round of redundancies “without dramatic consequences” for the company.

The 2026 Giro d’Italia route was revealed last week, with a toned-down level of difficulty compared to last year – presumably in order to court more of the sport’s biggest GC names. Both Jonas Vingegaard and Remco Evenepoel are reportedly considering complicating their Tour de France buildups to contest the Spring grand tour. With a long mid-race time trial and multiple summit finishes in the third week, but not an overly punishing course, this is a route seemingly specifically built to attract Vingegaard and Evenepoel. While it seems risky for Vingegaard to line up at the race, it would signal an extremely pragmatic approach from his Visma team, who must now recognize that their chances of defeating Tadej Pogačar straight up at the Tour de France are limited, and that it could be worth it for Vingegaard to hedge that risk with an early-season Giro victory. Additionally, a win there would mean that Vingegaard had captured victories at all three grand tours, something even Pogačar hasn’t accomplished and which only a handful of riders in history have accomplished – the last being Chris Froome with his 2018 Giro victory.

And speaking of the Giro – check out Pez’s eyewitness account from roadside at the 2025 Giro d’Italia stage 9 finale into Siena…