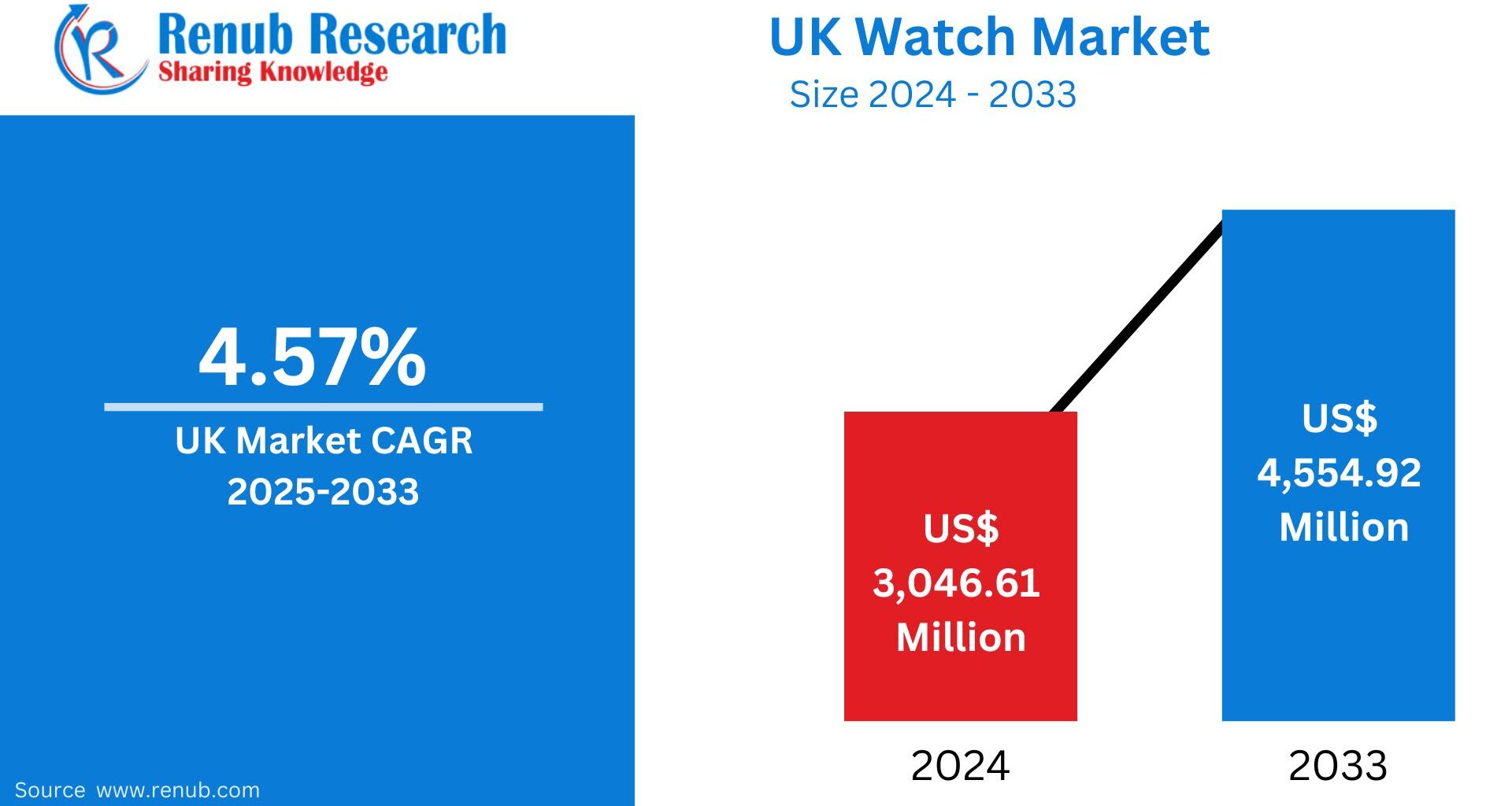

The United Kingdom watch market is marking a new era of transformation driven by luxury desirability, fashion appeal, and the rapid adoption of smart wearables. According to Renub Research, the industry is set to rise from USD 3,046.61 million in 2024 to USD 4,554.92 million by 2033, supported by a steady CAGR of 4.57% from 2024 to 2030. This growth reflects not only evolving consumer preferences but also strong technological innovation, the expansion of digital retail, and the enduring appeal of British watch culture.

Whether worn as a statement of style, a symbol of prestige, or a multifunctional device, watches remain deeply embedded in British lifestyles. Professionals often gravitate toward mechanical and luxury timepieces, while fitness- and tech-oriented consumers increasingly adopt smartwatches for health tracking, navigation, and communication. Even collectors and fashion enthusiasts continue to fuel demand for analog craftsmanship and design-driven pieces.

Against this backdrop, the UK watch market is experiencing both opportunity and disruption—shaped by global brands, rising digital commerce, shifting demographics, and new forms of wearable competition.

Understanding the UK Watch Market

A watch today is much more than a timekeeping device. In the UK, watches serve multiple roles:

Professional identity: Business executives and high-income groups maintain steady demand for mechanical and luxury watches that signal status.

Health and lifestyle companion: Smartwatches from Apple, Garmin, Huawei, and Samsung have become indispensable for tracking fitness, monitoring health metrics, and staying connected.

Fashion accessory: From minimalist quartz pieces to trend-driven digital styles, fashion-conscious youth view watches as extensions of personal style.

Collector’s asset: The UK hosts a mature community of watch collectors who value craftsmanship, rarity, and heritage.

Despite the rise of smartphones, which can easily replace traditional timekeeping, watches remain irreplaceable in the UK market due to emotional value, convenience, and technology integration.

Key Drivers Shaping the United Kingdom Watch Industry

1. Rising Demand for Luxury Watches

Luxury timepieces continue to dominate consumer interest, with brands such as Rolex, Omega, Patek Philippe, Audemars Piguet, Cartier, and Hublot attracting British collectors and investors. In the UK, luxury watches serve as:

Status symbols

Long-term investment assets

Fashion statements

Collectibles with high resale value

The market is also seeing a surge in pre-owned luxury watch demand, a trend driven by sustainability, affordability, and increased access to rare models. London’s reputation as a luxury shopping hub—supported by stores like Watches of Switzerland, Harrods, and Bucherer—further strengthens this segment.

Industry example:

In January 2023, Fossil Group launched Katchin, a new UK marketplace featuring curated watch and jewelry selections, enhancing luxury accessibility through digital innovation.

2. Smartwatch Adoption and Technological Innovation

Smartwatches have become mainstream in the UK due to their:

Health monitoring features

GPS and navigation functions

Seamless smartphone connectivity

Mobile payments and AI-integrated capabilities

Brands like Apple, Samsung, Huawei, and Garmin dominate this rapidly expanding category.

Notable industry developments:

Huawei Watch D entered the European market in 2022, offering blood pressure tracking, ECG, heart rate, skin temperature, and SpO₂ analysis.

In September 2024, Apple unveiled the Apple Watch Series 10 and Apple Watch Ultra 2, commemorating a decade of smartwatch innovation in the UK.

These devices appeal to tech-savvy professionals, athletes, and health-conscious consumers—solidifying smartwatches as one of the strongest growth pillars in the UK watch industry.

3. Expansion of Online Watch Sales

E-commerce has fundamentally reshaped the UK watch market. Platforms such as Amazon, Chrono24, Watchfinder, eBay, and brand-owned websites offer vast assortments across multiple price ranges.

Consumers prefer buying online because of:

Competitive prices

Access to global inventory

Virtual try-on technology

Convenience of home delivery

Availability of pre-owned and vintage models

Brands increasingly leverage:

Influencer marketing

Live shopping sessions

Limited-edition online releases

Personalized consultations

These digital-first strategies have created a dynamic online watch economy that contributes significantly to market growth.

Challenges Facing the UK Watch Market

While the outlook is positive, several challenges persist.

1. Competition from Smartphones and Wearable Alternatives

The rise of smartphones, smart rings, and fitness bands has reduced reliance on traditional watches among casual users. This trend most significantly impacts mid-range quartz and digital segments, where innovation and brand loyalty are less pronounced.

2. Counterfeit and Grey Market Activity

Counterfeit luxury watches are widespread online, misleading buyers and harming reputable brands. Similarly, the grey market—selling authentic watches without authorized dealer support—affects:

Price control mechanisms

Brand reputation

Consumer confidence

Official retailer profitability

Strong regulatory oversight and consumer education are essential to protect both brands and buyers in the UK market.

United Kingdom Watch Market by Key Segments

1. Quartz Watch Market

Quartz watches continue to appeal due to:

High accuracy

Low maintenance

Competitive pricing

Brands like Seiko, Citizen, and Tissot lead this category, offering styles suitable for both everyday wear and formal occasions. The UK is also witnessing growth in eco-friendly quartz watches made from recycled materials, aligning with rising sustainability trends.

2. Electronic Watch Market

Digital and hybrid electronic watches cater to consumers seeking durability and functionality. Brands such as Timex and Casio are popular among:

Students

Outdoor enthusiasts

Athletes

Budget-conscious shoppers

Features including LED displays, alarms, water resistance, and world time functions make them reliable alternatives to smartwatches and analog models.

3. UK Men’s Watch Market

Men’s watches dominate the UK market, driven by demand for:

Mechanical watches

Sports timepieces

Luxury brands

Retro and minimalist styles

Brands such as TAG Heuer, Breitling, Longines, Omega, and Rolex remain aspirational choices among British men who view watches as extensions of personality and status.

4. United Kingdom Luxury Watch Market

Luxury watches represent a major revenue source, supported by:

High-net-worth individuals

Collectors

International tourists

Investors

Premium retailers like Watches of Switzerland, Harrods, and Selfridges play a critical role in distributing high-end timepieces. The pre-owned luxury segment—fueled by authentication services and rising resale platforms—adds further momentum.

5. Convenience Stores Watch Market

Convenience stores in the UK provide low-cost watches primarily for:

Tourists

Students

Last-minute shoppers

Although small in contribution, this segment sustains steady demand for basic quartz and digital watches from brands like Casio and Swatch. Affordability and accessibility are key strengths here.

6. Online Watch Market

Online retail remains one of the strongest growth engines. Platforms such as eBay, Chrono24, Amazon, Watchfinder, and direct brand websites cater to all customer categories—from casual buyers to luxury collectors.

Digital platforms often offer:

Rare and vintage models

Exclusive online-only drops

Live expert consultations

Seamless returns and authentication services

The rise of digital communities and creator-led watch content also drives online engagement and sales conversion.

United Kingdom Watch Market Segmentation

Type

Quartz Watches

Electronic Watches

Mechanical Watches

Gender

Men

Women

Unisex

Price Range

Luxury

Non-Luxury

Distribution Channel

Hypermarkets/Supermarkets

Convenience Stores

Online

Key Companies in the UK Watch Market

Each player is evaluated across four viewpoints—overview, key executives, recent developments, and revenue.

Fossil Group Inc.

Titan Company Limited

LVMH Group

Apple Inc.

Compagnie Financière Richemont S.A.

The Swatch Group Ltd.

Citizen Watch Co. Ltd.

Seiko Group Corporation

Final Thoughts

The United Kingdom watch market is entering a dynamic phase where tradition meets innovation. As consumers embrace luxury collectibles, digital smartwatches, and online retail convenience, the industry’s growth trajectory looks promising. The blend of craftsmanship, technology, and e-commerce expansion positions the UK as one of Europe’s most influential watch markets through 2033.

While challenges such as counterfeits, smartphone substitution, and wearable competition persist, brands that invest in digital engagement, authenticity assurance, sustainability, and experiential retail will capture the strongest long-term gains.

Whether it’s a mechanical masterpiece, a high-end luxury statement, or a feature-packed smartwatch, the UK’s enduring love for timepieces ensures that the watch industry will continue to evolve—and thrive.