Sir Steve Webb, the former Liberal Democrats Pensions Minister, has spoken out over growing pressure to change the Triple Lock. State pension rule change will leave 25 million with ‘inadequate income’

State pension rule change will leave 25 million with ‘inadequate income’

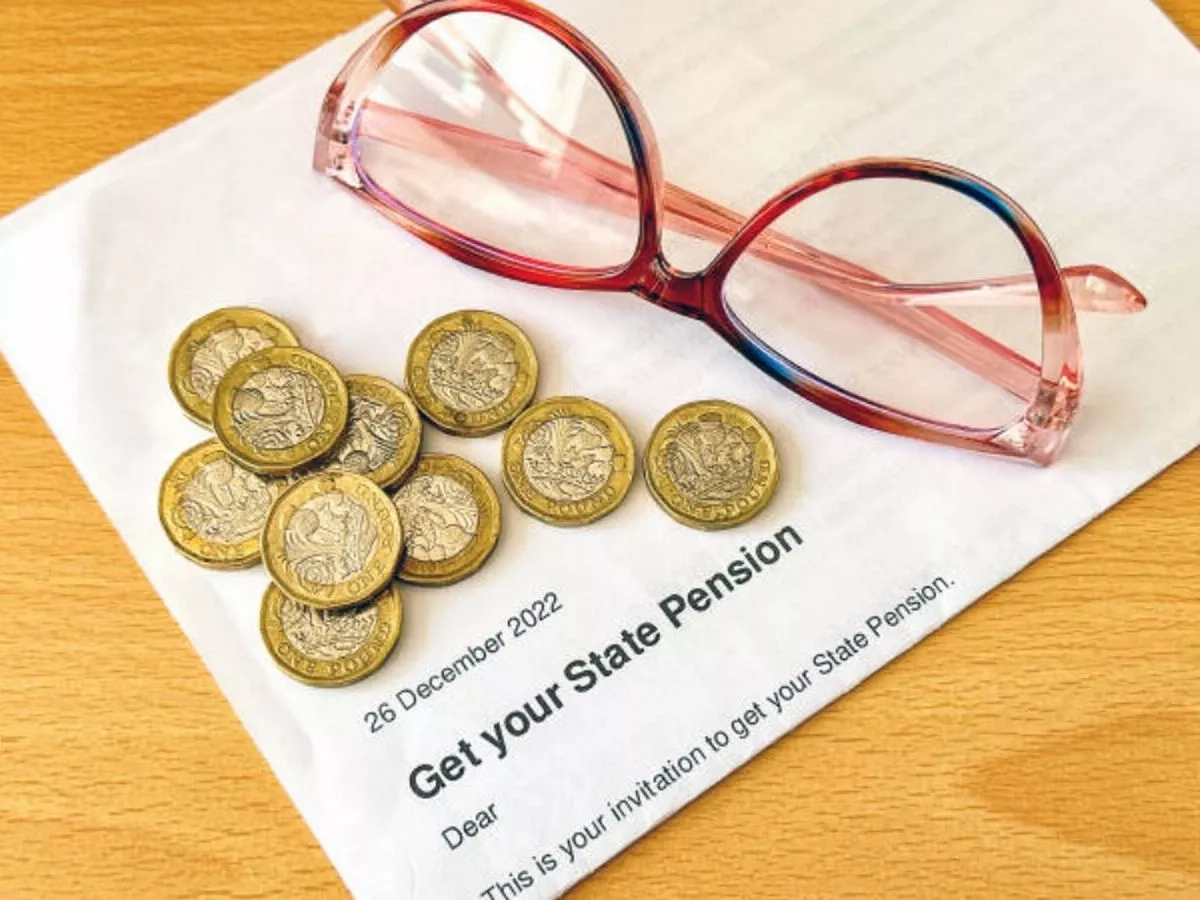

A state pension rule change could put 25 million state pensioners at risk of inadequate income, a former Pensions Minister has warned. Sir Steve Webb, the former Liberal Democrats Pensions Minister, has spoken out over growing pressure to change the Triple Lock.

Due to the ballooning benefits and welfare bill, the Labour Party government is being told to tweak the Triple Lock. If the triple lock is replaced with annual increases only in line with inflation (CPI), the number of people who will have an inadequate retirement income leaps to over 25m.

Sir Steve described the situation as “living in a fools paradise”. Stuart Earle, Partner, Eversheds Sutherland, who chaired the event, said: “Hearing about the past, present and future of both state and occupational pensions and how they interact proved genuinely illuminating.

READ MORE Premium Bonds holders urged to consider withdrawing cash from NS&I

“We are moving ever closer to the original State Pension Age of the early 1900’s (70) and as Sir Steve highlighted the ticking time bomb of inadequate pension saving is probably worse than the government and others think.”

Rebecca Howard, Senior Practice Development Lawyer, Pinsent Masons LLP gave an overview of Pre and Post 1988 GMP (Guaranteed Minimum Pension), bridging pensions and state pension offsets/deductions.

Phil Warner from Dalriada Trustees gave a fascinating run-through of the history of pensions starting with the early forerunners to the State Pension.

Around 200 pension professionals attended the SPP event. Warner detailed the Chatham Chest of the 1500s and Poor Laws to the Old Age Pensions Act of 1908 which was non-contributory.

Warner explained this was only payable to those “of good character” and payable from age 70. Warner explained then came the creation of the State Pension in the 1940’s, payable at age 60 from women and 65 for men.

The 1959 National Insurance Act saw the State Pension and Occupational pensions interact before being separated by the 2014 Pensions Act.

Warner told attendees: “…its’ simpler for state and occupational schemes to remain separate, no matter how much they influence each other”.