41m agoThu 31 Jul 2025 at 12:54amMarket snapshotASX 200: -0.5% to 8,717 points (live values below)Australian dollar: +0.1% to 64.41 US centsS&P 500: -0.1% to 6,362 pointsNasdaq: +0.1% to 21,129 pointsFTSE: flat at 9,136 pointsEuroStoxx 600: flat at 550 pointsSpot gold: +0.3% to $US3,286/ounceBrent crude: +0.4% to $US73.51/barrelIron ore: +0.1% to $US99.25/tonneBitcoin: +1% to $US118,337

Prices current around 10:50am AEST

Live updates on the major ASX indices:

2m agoThu 31 Jul 2025 at 1:33amRetail sales rise more than expected

The Bureau of Statistics has released retail sales data, and it’s come in stronger-than-expected.

Australian retail turnover rose 1.2 per cent in June, according to seasonally adjusted figures, compared to expectations for an 0.4 per cent increase, according to economists polled by Reuters.

5m agoThu 31 Jul 2025 at 1:30am

Key takeaways from RBA deputy governor Andrew Hauser’s ‘fireside chat’ — analysis

So, I’ve got back to the office now after attending the RBA deputy governor’s fireside chat.

Having had a couple of hours to digest what Andrew Hauser had to say, here are my thoughts on the key takeaways:

Inflation in tracking in-line with RBA forecasts. RBA forecasts from May suggested inflation would be around the middle of the target with the cash rate at 3.2% by early next year. That suggests to me that the RBA can cut the cash rate at least twice and perhaps three times more.Unemployment isn’t high at 4.3%. The RBA is relaxed with where the jobs market is, so unless we see unemployment heading above 4.5% I don’t think it’s going to see the bank accelerate rate cuts.We will (at least officially) remain in the dark about how individual RBA Monetary Policy Board members voted on rates, even though they will be giving their own speeches at least once a year. However, we may get hints about who is more ‘dovish’ and ‘hawkish’. The RBA deputy, who came from the Bank of England which does publish how members voted, thinks that system creates more problems than benefits.There is still scope for major surprises in the global economy, depending where US tariffs end up and the response from other nations.

In summary, as I wrote in the headline of this article from May, interest rates could drop below 3%, but you probably don’t want them to.

I’m pretty sure Andrew Hauser, the RBA staff and probably most board members would still broadly agree with that analysis.

46m agoThu 31 Jul 2025 at 12:49am

Flight Centre downgrade disappoints

Analysts and investors have taken a negative view on Flight Centre’s latest update, which saw it lower its profit guidance.

“While current softness in the travel market is well known to investors, we believe another FY25 downgrade, one month after balance date, will negatively surprise the market,” RBC Capital Markets analyst Wei-Weng Chen noted.

And they were proven correct, with the stock off 7.9 per cent at the moment.

Mr Chen said the downgrade puts the middle of Flight Centre’s most recent guidance 25 per cent below its original guidance provided last November. And certainly a lot has changed in that time for global relations and the fallout for travel.

52m agoThu 31 Jul 2025 at 12:43am

Beach Energy falls on $674 million impairment hit

Beach Energy is the worst-performing stock on the benchmark index so far, down 9.9 per cent.

The company released its quarterly production report, with full-year production up 9 per cent and sales revenue up 13 per cent.

Underlying earnings and profit were also higher.

However, Beach flagged a non-cash impairment charge of $674 million that will be recorded in its results for the last financial year, “related predominantly to lower commodity price outlook”.

Its results will be released this coming Monday, August 4.

1h agoThu 31 Jul 2025 at 12:24amAustralian shares open lower as tariff deadline looms

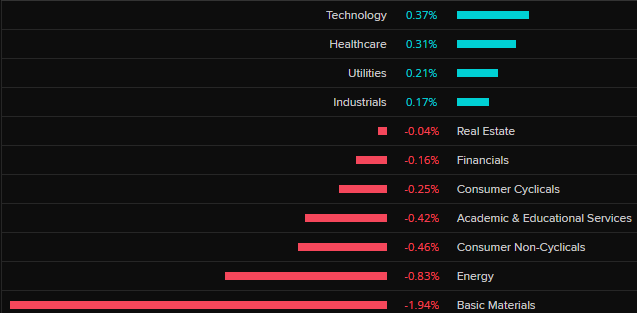

Most sectors on the local market remain in the red 20 minutes into the session, while the ASX 200 is currently down half a per cent overall.

ASX 200 sectors (LSEG Refinitiv)

ASX 200 sectors (LSEG Refinitiv)

Flight Centre shares are down 7.2 per cent after it lowered its profit guidance.

Miners are also a major drag, led by a 7.8 per cent fall for Mineral Resources. Beach Energy shares are off 10.9 per cent, weighing on the energy sector.

1h agoThu 31 Jul 2025 at 12:06amASX opening in the red

It’s very early days as stocks are just coming online, but we currently have the ASX 200 down 0.6 per cent.

1h agoThu 31 Jul 2025 at 12:03am

The balancing act of individual RBA board members speaking

Andrew Hauser’s answer to my question about RBA board members giving speeches — something that was a recommendation of the RBA review — is quite revealing of the tensions involved.

There’s no point in the board members speaking individually if they, as Andrew Hauser put it, simply “parrot” the views of the board as a whole, as already expressed by RBA staff like himself and the governor, Michele Bullock.

Equally, he said board members won’t be able to say how they or other board members voted on contested monetary policy decisions.

A tricky balance.

1h agoWed 30 Jul 2025 at 11:59pm

RBA still working out how board member engagement will look

Our business editor, Michael Janda, is up with a question and asks whether RBA board members will be able to speak freely on their views or whether their comments will be vetted by the central bank, when an upcoming review recommendation to hear from board members is more broadly implemented.

“We’re still working that out, I’ll be totally honest with you,” Andrew Hauser says.

He says the public engagement strategy won’t just be about speeches, mentioning other mediums like podcasts.

“It’s also about listening,” he notes, saying board members will go to events and hear from the businesses and other community members.

1h agoWed 30 Jul 2025 at 11:56pm

What would RBA like to see from productivity roundtable?

Wavestone Capital portfolio manager Catherine Allfrey asks what the RBA would like to see from the upcoming productivity roundtable.

Andrew Hauser says it’s not for the RBA to weigh in on.

“We take the economy as it is and deliver our mandate,” Mr Hauser says.

“They are political choices … any central bank that plays in that space risks their credibility.”

1h agoWed 30 Jul 2025 at 11:50pm

How does the RBA define full employment?

Even though unemployment recently jumped from 4.1 to 4.3%, RBA deputy governor Andrew Hauser says the Australian economy remains near “full employment”.

Orthodox economists define “full employment” as the level of unemployment compatible with inflation remaining within the central bank’s target range, in Australia, 2-3%.

Many economists have suggested that, for whatever reason, the unemployment rate compatible with “full employment” — the NAIRU, or non-accelerating inflation rate of unemployment — has fallen, perhaps to 4 per cent or less.

It seems Hauser is sticking with the RBA’s previous estimates that full employment is somewhere around 4.25-4.5%.

1h agoWed 30 Jul 2025 at 11:47pm

Consumer confidence weak but hasn’t got worse: Hauser

Barrenjoey chief economist Jo Masters turns the conversation to the consumer.

Andrew Hauser notes that consumer confidence remains weak, but hasn’t got worse (or better, for that matter).

“There are reasons for optimism,” he notes, including real income growth and a pick-up in consumption growth overseas.

“This is one of the areas of debate on the board, to be honest, how much momentum there is in the economy,” Mr Hauser says.

“On balance, we’re going to continue to hope and pray and forecast that consumption growth will pick up.”

1h agoWed 30 Jul 2025 at 11:45pm

Pay attention to RBA forecasts: Hauser

RBA deputy Andrew Hauser, despite earlier saying that it was relatively rare for economic forecasts to be completely right, says investors (and those interested in where interest rates are heading) should pay more attention to the bank’s forecasts.

Inflation figures out yesterday were broadly in line (maybe just a touch higher) than what the bank expected when it last updated those forecasts in May.

Based on what the RBA governor has previously said, it seems that it should give a green light to lower interest rates on August 12.

But, after July’s surprise hold, no-one is prepared to express too much certainty!

1h agoWed 30 Jul 2025 at 11:42pm

We don’t name names, says RBA deputy governor

Reserve Bank deputy governor Andrew Hauser says, in order to keep the focus on the policy arguments, the RBA won’t name names of who votes what way at its monetary policy board meetings.

He says it allows for a more open debate.

1h agoWed 30 Jul 2025 at 11:38pm

Labour market close to full employment: RBA’s Hauser

Mr Hauser has reiterated what the RBA governor, Michele Bullock, said in the wake of a rise in unemployment shown in figures released since the last central bank meeting.

While the rise in the unemployment rate had surprised the market and economists, Mr Hauser (echoing Ms Bullock) said it was in line with the RBA’s forecasts and consistent with the “broad coming into balance” of the economy.

He says there are different views on the RBA board about exactly how tight the labour market is, but that the “labour market is close to whatever full employment means”.

You can read more on the governor’s earlier speech on inflation and employment here:

2h agoWed 30 Jul 2025 at 11:35pmRBA deputy Andrew Hauser says bank not getting carried away with forecast accuracy

I am sitting in a room full of investment bankers, analysts and economists, including former RBA governor Phil Lowe, who is sitting one person over from me.

We’re all listening to RBA deputy governor Andrew Hauser chatting with Barrenjoey’s chief economist Jo Masters.

We’ll get to some questions towards the end, including hopefully one from me…

For the time being, the discussion started with yesterday’s inflation data, which came in almost bang in line with the Reserve Bank’s most recent May forecasts.

But Hauser says the bank’s economists are not getting carried away with that because it’s quite rare, and usually a bit lucky, for actual data to land so close to the forecast.

I’ll have more analysis of Hauser’s speech and Q&A.

Jo Masters and Andrew Hauser (RBA)

Jo Masters and Andrew Hauser (RBA)

2h agoWed 30 Jul 2025 at 11:30pm

RBA’s Hauser says tariff impact better than feared so far

Barrenjoey’s Jo Masters asks the RBA’s Andrew Hauser about tariffs — he says, so far, the impact of Donald Trump’s tariffs has been “substantially better than feared in the worst case”.

He says the worst of threatened tariffs hasn’t eventuated, particularly in terms of retaliatory measures.

“Maybe the system globally and in Australia too is more resilient” than expected, he notes, while saying that stockpiling has also cushioned the impact.

Mr Hauser says another reason the fallout so far hasn’t been so bad could be a negative one — “it’s coming, but it just hasn’t come yet”, likening it to Brexit.

“Good news that it hasn’t been as severe yet as feared … but we’re paid to worry”, he notes, and says the concern that it’s just a drawn-out impact is on the RBA’s mind.

2h agoWed 30 Jul 2025 at 11:24pmInflation easing welcome: RBA deputy governor

Reserve Bank deputy governor Andrew Hauser has framed yesterday’s inflation number as “very welcome” during a “fireside chat” with Barrenjoey’s chief economist Jo Masters in Sydney.

Inflation eased further in the June quarter, with consumer prices rising at an annual pace of 2.1 per cent, down from 2.4 per cent in the March quarter.

The “trimmed mean” measure of inflation, which is the Reserve Bank’s preferred measure of underlying inflation, also declined.

It fell from 2.9 to 2.7 per cent between March and June, which broadly matches the Reserve Bank’s forecasts from May.

You can catch up with this piece from Gareth Hutchens:

2h agoWed 30 Jul 2025 at 11:19pmSouth Korean president responds to US trade agreement

South Korean President Lee Jae Myung has commented on the country’s tariff deal with the US, which was announced a short time ago by US President Donald Trump, saying it would put South Korea on an equal or better footing compared with other countries.

President Lee said the countries had agreed to set up a $US350 billion investment fund, out of which $US150 billion was aimed at a shipbuilding partnership.

In his social media post announcing the deal, Mr Trump had said the fund would be “owned and controlled” by the US and he would select the investments as president.

However, the South Korea presidential office has said there are enough safeguards in place when asked about Mr Trump’s claims.

The 15 per cent tariff on South Korean imports will also see the auto tariff lowered from 25 per cent, the office said, noting the South Korean president had pushed for a 12.5 per cent auto tariff but Mr Trump has insisted on 15 per cent.

Reporting with Reuters

2h agoWed 30 Jul 2025 at 11:04pm

Flight Centre lowers earnings guidance

Travel group Flight Centre has released some preliminary results ahead of its official results for the last financial year on August 27.

It expects underlying profit before tax to come in between $285-295 million, below its previous guidance range, citing “short-term cyclical challenges encountered late in year”.

Those factors include underperformance and additional costs in its Asia business, the escalating tensions in the Middle East in recent months, and an ongoing, global downturn in bookings to the US.

“This volatility temporarily disrupted traditional travel and booking patterns during FLT’s peak trading period as some customers either booked closer-to-home overseas holdings (In Australia, examples include China, Japan, Fiji and New Zealand), or delayed finalising travel plans,” it said in a statement to the ASX.

Flight Centre expects to deliver a record total transaction value of $24.5 billion.

ASX 200: -0.5% to 8,717 points (live values below)Australian dollar: +0.1% to 64.41 US centsS&P 500: -0.1% to 6,362 pointsNasdaq: +0.1% to 21,129 pointsFTSE: flat at 9,136 pointsEuroStoxx 600: flat at 550 pointsSpot gold: +0.3% to $US3,286/ounceBrent crude: +0.4% to $US73.51/barrelIron ore: +0.1% to $US99.25/tonneBitcoin: +1% to $US118,337

ASX 200: -0.5% to 8,717 points (live values below)Australian dollar: +0.1% to 64.41 US centsS&P 500: -0.1% to 6,362 pointsNasdaq: +0.1% to 21,129 pointsFTSE: flat at 9,136 pointsEuroStoxx 600: flat at 550 pointsSpot gold: +0.3% to $US3,286/ounceBrent crude: +0.4% to $US73.51/barrelIron ore: +0.1% to $US99.25/tonneBitcoin: +1% to $US118,337