United Kingdom Oil and Gas Market to 2032: Industry Growth, Market Share, Capacity & Production Data, Competitive Landscape, and L

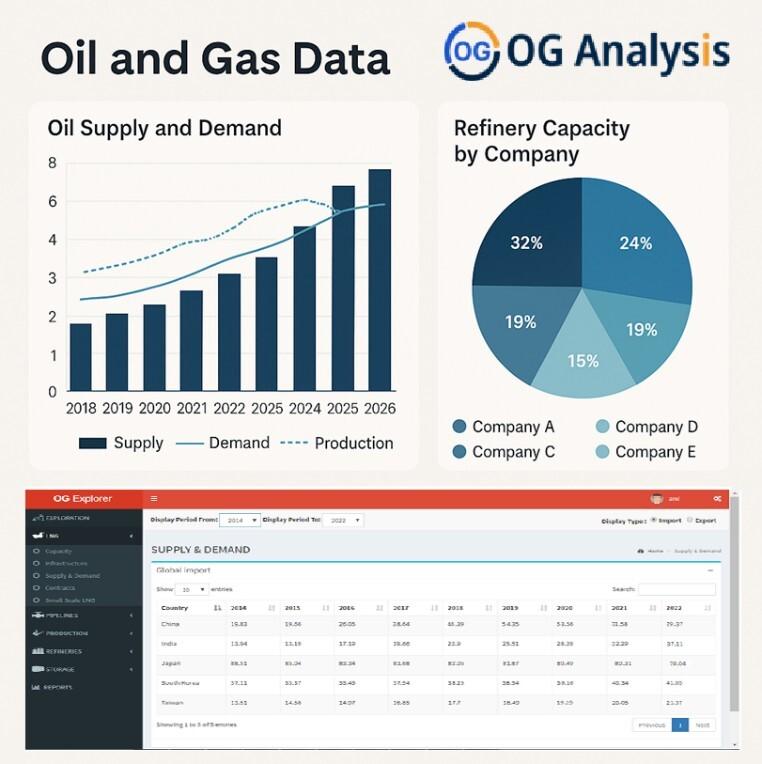

The newly published United Kingdom Oil and Gas Strategic Analysis and Outlook to 2032 delivers a complete and detailed assessment of one of Europe’s most structurally mature yet strategically evolving energy markets. The UK’s oil and gas sector continues to play a pivotal role in energy security, economic stability, and industrial support-even as the country accelerates toward net-zero targets. This comprehensive study analyzes the entire oil and gas value chain-from field-level offshore production and refinery configurations to LNG import terminals, pipeline networks, storage hubs, and vessel logistics-providing a granular view of national infrastructure and supply-demand dynamics spanning 2015 to 2032.

Request Free Sample:

https://www.oganalysis.com/industry-reports/united-kingdom-oil-and-gas-market

Despite declining domestic production, the UK remains a key offshore operator with significant assets across the UK Continental Shelf. Mature field redevelopment, tie-back projects, and new output from discoveries such as Penguins and Murlach continue to support national supply. The country’s midstream capabilities include legacy systems like Forties and Brent pipelines, critical terminals at Sullom Voe and St Fergus, and LNG infrastructure such as South Hook and Isle of Grain. Downstream, the report highlights refinery modernization strategies, CDU/FCC/coking unit transitions, and integration of hydrogen and CCS technologies. The study also maps the policy impact of the North Sea Transition Deal, Great British Energy’s public sector investment, and fiscal measures such as the Energy Profits Levy, all of which are reshaping the future trajectory of the UK energy value chain.

Customize This Report @:

https://www.oganalysis.com/industry-reports/united-kingdom-oil-and-gas-market

Report Key Takeaways –

Detailed asset-level profiles of the UK’s offshore oil and gas fields, LNG terminals, pipelines, refineries, storage systems, and shipping infrastructure.

Production forecasts and field-level analysis of key assets such as Penguins and Murlach, expected to offset part of the natural decline through 2025.

LNG import capacity trends, including utilization of South Hook, Isle of Grain, and new FSRU planning, amid fluctuating global gas trade patterns.

Impact assessment of the updated environmental review framework, particularly Scope 3 emissions requirements influencing project approvals like Rosebank.

Analysis of midstream logistics, including throughput capacity of Forties and Brent pipelines and integration with national grid via Sullom Voe and St Fergus.

Refinery operations coverage, including CDU, FCC, and coking unit analysis across UK plants, and downstream transition aligned with low-emission fuel policies.

Overview of the UK’s emerging hydrogen economy and carbon capture clusters such as Net Zero Teesside and Acorn, and their impact on legacy oil and gas assets.

Market impact of fiscal instruments such as the Energy Profits Levy, including Harbour Energy’s 2024 loss despite high revenues and constrained reinvestment.

Strategic role of long-term gas contracts with Norway (Equinor-Centrica) in stabilizing energy flows and reducing market exposure.

Opportunities in upstream licensing, LNG logistics, clean fuel distribution, and offshore infrastructure upgrades amid the UK’s evolving regulatory and energy landscape.

This report is an essential tool for energy investors, policymakers, service providers, and energy transition strategists aiming to understand and capture growth in the United Kingdom’s complex oil and gas ecosystem.

Related Reports:

https://www.oganalysis.com/industry-reports/norway-oil-and-gas-market

https://www.oganalysis.com/industry-reports/denmark-oil-and-gas-market

https://www.oganalysis.com/industry-reports/netherlands-oil-and-gas-market

https://www.oganalysis.com/industry-reports/saudi-arabia-oil-and-gas-market

Contact Us:

John Wilson

Phone: 88864 99099

Email: sales@oganalysis.com

Website: https://www.oganalysis.com

Follow Us on LinkedIn: linkedin.com/company/og-analysis/

OG Analysis

1500 Corporate Circle, Suite # 12, Southlake, TX-76358

About OG Analysis:

OG Analysis has been a trusted research partner for 14+ years delivering most reliable analysis, information and innovative solutions. OG Analysis is one of the leading players in market research industry serving 980+ companies across multiple industry verticals. Our core client centric approach comprehends client requirements and provides actionable insights that enable users to take informed decisions.

This release was published on openPR.