1h agoFri 1 Aug 2025 at 2:56amMarket snapshotASX 200: -0.8% to 8,672 points (live values below)Australian dollar: flat at 64.28 US centsNikkei 225: -0.4% to 40,914 pointsS&P 500: -0.4% to 6,339 pointsNasdaq: flat at 21,122 pointsFTSE: -0.1% to 9,132 pointsSpot gold: flat at $US3,290/ounceBrent crude: -0.1% to $US71.62/barrelIron ore: +0.9% to $US100.30/tonneBitcoin: -0.5% to $US115,995

Prices current around 12:50pm AEST

Live updates on the major ASX indices:

22m agoFri 1 Aug 2025 at 4:27amBusiness lobbies hit back at Productivity Commission tax proposal

The Productivity Commission has called for a 20 per cent tax rate on profits for companies with revenue of up to $1 billion.

That would represent a significant cut for all but the largest companies from the current rate, which is 25 per cent for companies with turnover under $50 million and 30 per cent for all others.

At the same time, the commission has called for a new 5 per cent tax on net cashflow rather than profits, which could see some large companies pay a higher rate but would provide immediate tax relief for smaller companies seeking to build their capital.

But 24 business lobby groups have banded together to release a joint statement saying that the Productivity Commission proposal to tax business cashflow “is an experimental change that hasn’t been tried anywhere else in the world”.

“This tax increase risks putting more pressure on all Australians still struggling under cost-of-living pressures,” it said.

“While some businesses may benefit under this proposal, it risks all Australian consumers and businesses paying more for the things they buy every day — groceries, fuel and other daily essentials.”

In separate statements, Australian Industry Group warned “the proposals themselves suffer serious flaws and may well further distort our tax system”.

“At face value the proposal has some attractions but as a whole the package fails the test of driving business investment across the economy,” its CEO Innes Willox, said.

ACCI chief executive officer Andrew McKellar noted the proposal would only apply to a minority of small businesses, because most are not companies.

He also says the proposal risks creating a more complex two-tiered approach to business taxation.

“This proposal creates winners and losers and any net impact on productivity and competitiveness will be diminished as a result,” he said.

“While the idea of a net cashflow tax is worth considering, it has yet to be applied in practice and would result in a more complicated multi-layered business tax system.”

Master Builders CEO Denita Wawn said they supported the proposed company tax cut, but that “further work will be required to assess the short, medium and long-term implications of pivoting to a combined company income and cashflow tax system for the building and construction industry”.

Read more about the Productivity Commission proposal here:

32m agoFri 1 Aug 2025 at 4:16am

Resmed shares touch record high

Shares in Resmed touched a record level earlier today, and while they’ve pulled back from those highs, they remain up by 1.7 per cent.

It follows the medical sleep device maker’s profit results, which came in ahead of analysts’ forecasts.

Analysts at Jarden described the result as impressive, while RBC Capital Markets analysts called it a “good result with revenue, gross profit, income from operations and net income exceeding consensus expectations”.

58m agoFri 1 Aug 2025 at 3:50amRerouting will ease tariff blow to Chinese exports: Capital Economics

Capital Economics China economist Leah Fahy says they “remain fairly sanguine” on the Trump tariff impact on China’s exports.

The Trump administration has announced that transshipped goods will be subject to a 40 per cent tariff instead of the regular reciprocal rates.

This, Ms Fahy notes, will stack on top of any other tariffs applicable to the true country of origin.

“In theory then, Chinese goods transshipped via Vietnam will be subject to an average tariff rate of ~70 per cent — the combination of a 40 per cent transshipment tariff, 20 per cent fentanyl tariffs and a 10 per cent baseline that predates Trump’s second term,” she said in a research note.

“That would be substantially higher than Vietnam’s 20 per cent reciprocal rate and the ~40 per cent average tariff on direct Chinese exports to the US.

“Our new estimates based on trade in thousands of individual products suggest that rerouting helped to offset around half of the fall in China’s exports to the US during the first Trump trade war. If the US continues to impose high tariffs on China, despite Wednesday’s court ruling, then rerouting is likely to be just as significant this time.

“While yesterday’s court order requires that all US reciprocal tariffs and the 20 per cent fentanyl tariffs on China are removed, we doubt the tariff threat to China has gone away.

“Even if the Trump administration fails to overturn the ruling on appeal, it will likely look to levy tariffs on China through other means.”

But she says the upshot for China is that, while its exports to the US will fall sharply if tariffs come back into place, rerouting is still likely to provide a significant offset.

1h agoFri 1 Aug 2025 at 3:42amBest and worst performing stocks on ASX

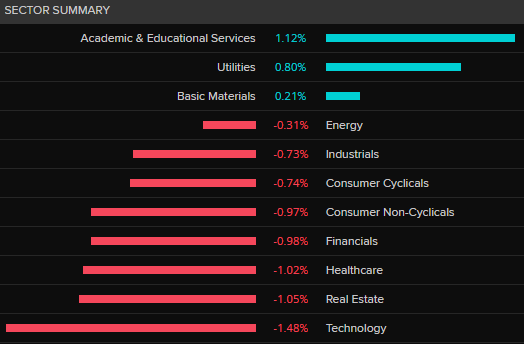

A quick check in on how the local share market is tracking at lunchtime — the ASX 200 is down 0.7 per cent, so off the early lows but still firmly in the red.

Here’s how the sectors are faring, with the mining stocks doing some heavy lifting in terms of capping the losses:

ASX 200 sectors (LSEG Refinitiv)

ASX 200 sectors (LSEG Refinitiv)

The best performing stocks so far:

Capstone Copper Corp +8.2%Sandfire Resources +4.1%Mineral Resources +3.2%Codan +3.1%Judo Capital +3%

And the worst:

Polynovo -4.1%West African Resources -3.8%Fisher & Paykel Healthcare -3.3%Bellevue Gold -3.1%Life360 -3%

Outside the biggest companies, shares in Star Entertainment Group have slumped 15 per cent as it revealed its deal to sell off its Brisbane casino development has collapsed and it owes millions to its Hong Kong-based joint venture partners as a result.

You can read more here:

1h agoFri 1 Aug 2025 at 3:22amHome prices climb despite interest rate pause in July

Australian property prices have scaled new record highs as demand for housing offsets buyer concerns about the Reserve Bank’s shock call to hold interest rates steady.

National dwelling values rose 0.6 per cent last month, marking the sixth consecutive monthly increase, according to figures from property research firm Cotality (formerly CoreLogic).

The median home value is now $844,000, an increase of 3.7 per cent in a year.

“That [growth] started with the cash rate being reduced in February,” said Eliza Owen, head of research at Cotality.

“Overall, it’s taken home values about 3 per cent higher through the year to date, or the equivalent of another $25,000 being added to the median dwelling value in Australia.

“And we’re seeing these gains right across the country now.”

Here’s how the capitals and regions fared in July:

Read more from reporter Rhiana Whitson:

1h agoFri 1 Aug 2025 at 3:02amCould RBA rate cuts see house prices lift more than 5% and reignite inflation?

UBS economist Stephen Wu says Reserve Bank rate cuts are boosting house prices and warns that could push house prices higher than 5 per cent over the coming year.

“Looking ahead, housing supply appears likely to remain weak relative to underlying housing demand,” he said.

National dwelling prices rose 0.6 per cent in July, marking the sixth consecutive monthly gain, and taking annual growth to 3.7 per cent, according to Cotality data cited by UBS.

“The key question for the RBA cash rate outlook is how much will rising home prices put upward pressure on actual CPI (new dwelling purchased by owner-occupiers, as well as rents) over the coming year?,” he asked.

“Looking ahead, UBS still expects the RBA to cut the cash rate further over coming months.

“Hence, for dwelling prices ahead, we still expect a pick-up to 5 per cent or more over the coming year.

“Indeed, if the RBA cuts rates by more than expected, as the market expects, it would likely push house prices up by an even larger amount.

“A tempering factor is that housing affordability is still extremely low, and this is likely to limit how quickly, and sustainably, prices can rise.”

2h agoFri 1 Aug 2025 at 2:47amWas Australia’s decision to dump biosecurity restrictions on US beef imports a way to avoid tariff turmoil?

Rabobank’s senior market strategist Benjamin Picton says Australia may have spared itself from harsher tariffs from the Trump administration because of an earlier decision to dump biosecurity restrictions on US beef imports.

The trade restriction on US beef had been a key grievance for the Trump administration, which placed a 10 per cent tariff on all Australian imports earlier this year.

Mr Picton notes that Australia like the UK runs a trade deficit with the USA.

“Australia and others who were not assigned a specific reciprocal tariff rate will continue to face the 10 per cent baseline figure,” he said.

“Perhaps Australia’s decision to dump biosecurity restrictions on US beef imports was a good move after all?”

He notes our neighbour, “New Zealand didn’t fare quite so well”.

“The reciprocal tariff rate for Kiwi exports has been bumped up from 10 per cent announced on April 2nd, to 15 per cent.

“New Zealand runs an tiny (but perhaps determinative) trade surplus with the USA and — according to the curious formula employed by the US Trade Representative — imposes trade restrictions equal to a 20 per cent tariff on US imports compared to just 10 per cent for Australia prior to the beef restrictions being dropped.”

2h agoFri 1 Aug 2025 at 2:30am

ATO chases $56 billion in tax debt

Now for some non-tariff news ….

As the Australian Taxation Office (ATO) chases $56 billion in tax debt owed by small businesses and individuals, victims of fraud and financial abuse have been caught in the firing line.

The tax office is ramping up use of its powers to recover tens of billions of dollars in debt, mostly owed by small businesses, and much of which is undisputed.

Is this heavy-handed debt recovery action? The ATO says it’s not, because it’s already given people time to repay debts.

But financial counsellors are worried the agency’s faster debt recovery could tip more people over the edge.

Watch my story on The Business here:

Loading…2h agoFri 1 Aug 2025 at 2:22amMost stock markets in Asia lower

Stock markets trading in our time zone are the first to react to the tariff developments out of the US this morning.

There’s a mix of responses, with the Australian share market not among the best or worst performing indices so far.

Here’s where we stand:

ASX 200 -0.8%Tokyo’s Nikkei 225 -0.4%Shanghai Composite flatShenzen Component +0.4%Seoul’s Kospi 200 -3%Hong Kong’s Hang Seng flat

2h agoFri 1 Aug 2025 at 2:15am

‘Reciprocal’ tariffs to apply from August 7

If you’re struggling to keep track of where we stand after the months of delays and backtracks, here’s an update from Brad Ryan in Washington DC.

US President Donald Trump has unveiled new tariffs for dozens of countries — but Australia has been spared, for now.

The “baseline” tariff on Australian exports remains unchanged, at 10 per cent, despite the president’s recent suggestion he would increase it.

But Mr Trump has ordered changes to the “reciprocal” tariffs on dozens of countries, which have been paused since April but were set to take effect on Friday.

They will now apply from August 7.

“The president has determined that it is necessary and appropriate to modify the reciprocal tariff rates for certain countries,” a White House statement said.

It said some countries had agreed to meaningful deals, but others had offered insufficient terms or not negotiated at all.

Under the new order, the hardest hit countries are Syria (41 per cent), Myanmar (40 per cent), Laos (40 per cent) and Switzerland (39 per cent).

2h agoFri 1 Aug 2025 at 2:02amAustralian copper miners ‘may suffer collateral damage’

Copper prices have taken a hit from US President Donald Trump’s shock decision overnight to exempt the most widely imported form of the metal from his planned 50 per cent tariff.

“As copper prices continue to dip after President Trump’s surprise policy turnaround (on) setting 50 per cent tariffs on copper products, we anticipate that Australian copper miners will be unaffected directly by the new tariffs but may suffer collateral damage from a weakening copper price,” according to Datt Capital CIO Emanuel Datt.

“Notably, the tariffs are enacted only on finished copper products, which are largely manufactured in China, and do not impact the raw material. It is evident that this measure has been enacted to encourage domestic industrial manufacturing to re-onshore back to the USA.”

CBA’s commodities analyst, Vivek Dhar, notes that COMEX copper futures plunged after the Trump administration announced that the 50 per cent copper import tariff that begins today would apply to a much smaller share of imports than expected.

He noted that semi-finished products — including copper pipes, wires, rods, sheets and tubes — and copper-intensive goods, including pipe fittings, cables, connectors and electrical components, would be subject to the import levy.

“Based on US trade data from last year, that only amounts to under 15 per cent of US copper import volumes,” he said.

“The big surprise was the exclusion of refined copper, which is by far the biggest component of US copper imports by volume.”

2h agoFri 1 Aug 2025 at 1:55am

Australia’s Resmed shrugs off Trump’s tariffs

Australia has escaped the worst of Trump’s tariff wrath with the baseline 10 per cent tax formalised, but one of our biggest companies, Resmed, says it’s exempt almost entirely, posting a better-than-expected full-year profit.

I’ve just spoken with CEO of the sleep device maker, Mick Farrell, who says the company is protected under an international protocol that guarantees tariff relief for products that help people with disabilities.

“The way we look at it, is the sort of ups and downs that are happening in geopolitics and trade right now is noise for the rest of the market,” Mr Farrell told me this morning

“But Resmed is a compelling investment because we’re free of that.”

The company manufactures sleep devices and masks in Australia and Singapore and is expanding its footprint in the US, which Mick Farrell says was not influenced by the Trump administration’s policies so far.

“But look, this administration has been very clear that they want to be very supportive of US manufacturing, of US investments in R&D, and so that fact that our investments are in line with the current administration is a good thing.

“There will be some investments or some subsidies or incentives that they want to have for people increasing their manufacturing and we’ll work with the government to ensure we take advantage of those.”

Resmed made $US1.4b ($A2.18b) in the 12 months to June, up 37 per cent on the previous year. Revenue jumped 10 per cent to $US5.1b.

One of the big concerns about the growth outlook for the company in recent years has been the widespread take-up of weight-loss drugs impacting demand for its devices.

But Mr Farrell says that’s now a tailwind rather than a headwind, as GLP-1 medications work in conjunction with Resmed’s products.

Resmed shares are 3.3 per cent higher after the first few hours of trade.

I’ll have the full interview on Close of Business at 9:30pm AEST on the ABC News Channel tonight or anytime on iView over the weekend.

3h agoFri 1 Aug 2025 at 1:48am

Government to lobby US for removal of baseline tariffs

Trade Minister Don Farrell says the baseline tariff rate for Australian exports to the US will remain at 10 per cent.

Farrell says he spoke with US Secretary of Commerce Howard Lutnick who confirmed there would be no change to Australia’s baseline tariff rate.

The trade minister says there was pressure in the US administration to increase baseline tariffs on Australia to 15 per cent, but that President Donald Trump decided to maintain the current rate.

Mr Farrell confirms the Australian government will continue to lobby the US to remove all tariffs on Australian goods, regardless of today’s decision.

If you want more on the Australian political reaction to the tariff update, and the other news of the day out of Canberra, open our live politics blog in a new tab:

3h agoFri 1 Aug 2025 at 1:39am

South Korea clinches last-minute deal

Automotive and electronics powerhouse South Korea will breathe a sigh of relief, after a last-minute deal with the US saw tariffs drop from 25 to 15 per cent.

Pressure was mounting on the new Lee Jae Kyung administration after Japan struck a similar deal a week ago.

To clinch the lower tariff rate, South Korea has agreed to invest $US350 billion in the US, including ship building, and it will purchase $US100b of liquified natural gas and other energy over four years.

South Korea’s investment package is significantly lower than what the US wanted ($US400b) and the Japanese deal ($US550b), which will be chalked up as a win.

Donald Trump has been particularly harsh in his language against the two Asian allies, once declaring South Korea an “enemy” when it came to trade.

It should be noted — many industries are still not happy with the 15 per cent tariffs, something I wrote about recently.

So a 15 per cent tariff isn’t “good” news, but rather “better”.

3h agoFri 1 Aug 2025 at 1:20am

ASX falls sharply on tariff announcement — analysis

The initial share market reaction to the latest round of reciprocal tariffs was muted.

However, two relatively large economies have been slugged with materially higher tariffs: Canda (35 per cent) and India (25 per cent).

That appears to be fraying nerves just a little now.

At 11am AEST the S&P/ASX 200 had fallen roughly 1 per cent.

“The Australian share market is down on Trump’s tariff announcements,” AMP’s head of investment strategy Shane Oliver said.

“The good news is that the general tariff on Australia remains at 10 per cent, but the bad news is that other countries appear to be facing higher tariffs than many had come to expect, which will push the average US tariff up to around 20 per cent, which is way up from 2-3 per cent at the start of the year.

“This risks weaker US and global growth which could mean less demand for our exports threatening Australian growth,” Dr Oliver said.

A key question is, does the imposition of relatively tough tariffs on Canada and India suggest Donald Trump is bold enough to impose larger-than-expected tariffs on China — Australia’s largest trading partner?

Marcus Today senior portfolio manager Henry Jennings says it’s fraying some nerves on domestic markets.

“Banks and industrials are coming under pressure.”

Jamieson Coote bond trader James Wilson is still licking his wounds after a big week of economic data more broadly.

“This week has been a colossal week for data, corporate earnings, and policy updates.”

“In the end not much has moved in markets except the $USD, which has rallied on better data and status quo policies.”

Both James Wilson and Henry Jennings say the open of US financial markets tonight (Australian time) and the release of crucial US unemployment data have the potential to move markets substantially.

3h agoFri 1 Aug 2025 at 1:10am

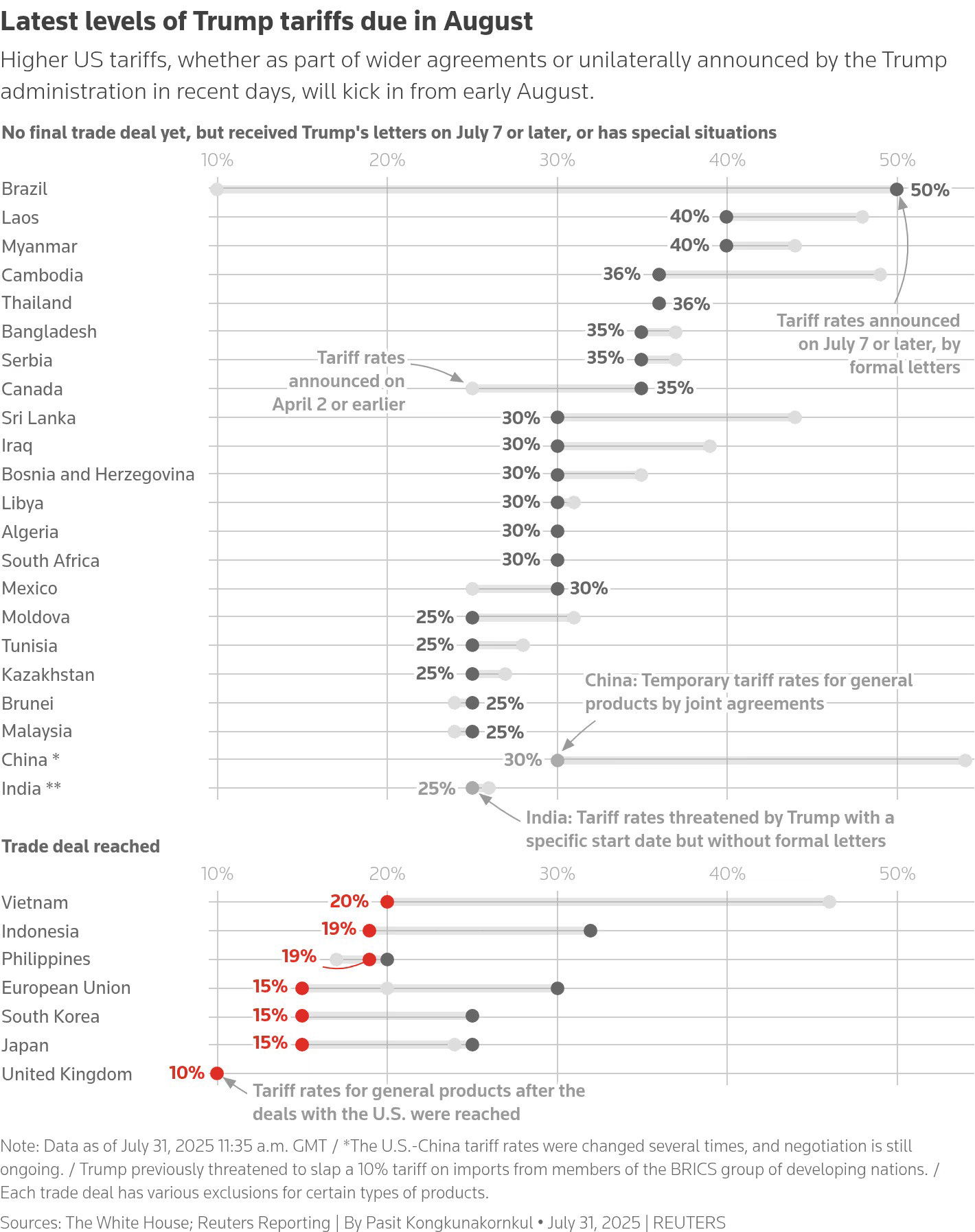

Bit confused about all the tariffs?

You’re not alone.

Reuters has this table which shows the swerves on some key trading partners with the US.

(Reuters)

(Reuters)

3h agoFri 1 Aug 2025 at 1:05am

Why a 10% tariff on Australia isn’t our only concern

While the continued tariff of 10% on Australian goods going into the US will be an expected relief for exporters, it is not the only economic impact from this global trade upheavel.

Economists and commentators have for some time now been noting a more indirect concern for Australia.

Here’s a fresh note from analyst Kyle Rodda.

“The fact Australia has managed to maintain the 10% tariff rate is a positive. While we don’t do much business with the US, the relatively lower rate is a relief for the industries that are exposed to the tariffs.

“However, there’s more to the news last night that could impact the Australian economy. Arguably from the start, the biggest effect from Trump’s tariffs on Australia weren’t the direct imposts but the level of tariffs on other major economies and the subsequent drag on global economic activity.

“Some of the tariffs announced overnight on some of the US’s other larger trading partners will be a headwind to global growth. And that could have quite a negative effect on Australia’s relatively small, export driven, global growth sensitive economy.”

For more, on this idea, check out recent comments made by the RBA’s deputy. He reiterated these only yesterday.

3h agoFri 1 Aug 2025 at 12:50am

‘I wouldn’t take it to the bank:’ former Biden advisor

Ernie Tedeschi is a former economic advisor to Joe Biden.

He told ABC News Mornings Australia’s baseline 10 percent tariff may not be set in stone.

“I wouldn’t take that to the bank so to speak,” he said.

“This administration has shown they are prone to surprise tariff announcements…”

But he did say escaping higher tariffs today is positive sign.

“It probably speaks well so far of the position Australia has.”

4h agoFri 1 Aug 2025 at 12:39am

Some other Trump tariff news you might have missed

There’s been a lot of tariff info swirling around this week.

One thing you might have missed is that US President Donald Trump has suspended the so-called “de minimis” exemption that allowed packages worth less than $US800 to get into the United States without tariffs.

The exemption has already been axed on shipments going into the US from China, impacting massive online retailers like Shein and Temu.

Now the rest of the world’s shipments won’t get the free pass from July 1 either. They will now get one of two types of tariffs, depending on their origin.

ABC News has reached out to several Australian brands that ship into the US.

The owner of one swimwear company, Bond Eye, told us it “knew this was coming” and the company has already moved its online shipping logistics to inside the US.

If you’re still confused by this tax exemption that’s now ended for all brands going into the US, I can recommend this piece by our colleague Kate Ainsworth from earlier this year.

ASX 200: -0.8% to 8,672 points (live values below)Australian dollar: flat at 64.28 US centsNikkei 225: -0.4% to 40,914 pointsS&P 500: -0.4% to 6,339 pointsNasdaq: flat at 21,122 pointsFTSE: -0.1% to 9,132 pointsSpot gold: flat at $US3,290/ounceBrent crude: -0.1% to $US71.62/barrelIron ore: +0.9% to $US100.30/tonneBitcoin: -0.5% to $US115,995

ASX 200: -0.8% to 8,672 points (live values below)Australian dollar: flat at 64.28 US centsNikkei 225: -0.4% to 40,914 pointsS&P 500: -0.4% to 6,339 pointsNasdaq: flat at 21,122 pointsFTSE: -0.1% to 9,132 pointsSpot gold: flat at $US3,290/ounceBrent crude: -0.1% to $US71.62/barrelIron ore: +0.9% to $US100.30/tonneBitcoin: -0.5% to $US115,995