David James’s articles from Travers Smith LLP are most popular:

within Employment and HR topic(s)

in United Kingdom

with readers working within the Advertising & Public Relations industries

Travers Smith LLP are most popular:

within Environment topic(s)

The Financial Conduct Authority (FCA) and the Pensions Regulator

have issued a new joint consultation on their long-awaited value for

money (VFM) framework for workplace defined contribution (DC)

pension schemes.

The revised plans aim to take effect from 2028 and follow

industry criticism of the FCA’s original proposals issued in

2024. The Regulators have softened some measures, but the core

principles stand. The Regulators remain focused on improving

transparency, comparability and competition in the pensions

sector.

We set out below:

the background and scope of the new regime;

an overview of how the VFM framework will operate;

a commentary of how the proposed framework has changed since

the FCA’s earlier consultation; and

developments to watch out for in preparing for the new

regime.

1. Background

The FCA consulted on a VFM regime in relation to contract-based

schemes in 2024 (the “2024

Consultation”, see WHiP Issue 111 for more on this). The Pension

Schemes Bill introduces a power to make regulations to introduce

the VFM framework for trust-based occupational DC schemes (see WHiDC: Pension Schemes Bill special).

2. Which schemes will fall in scope?

The VFM regime will apply to default arrangements of workplace

DC pension schemes – i.e. the default strategy of qualifying

auto-enrolment (AE) schemes and legacy

“quasi-defaults” which predate AE.

Executive Pension Plans and Small Self-Administered Schemes will

be excluded from the framework. Exemptions will also be available

for contract-based arrangements closed to new employers that are

undertaking a transfer of all members to another arrangement and

trust-based schemes that have notified the Pensions Regulator that

they have commenced wind up.

3. How will the VFM framework operate?

Torsten Bell, the Pensions Minister, describes the framework as “being

straight with people and making sure people’s savings work as

hard as they did to earn them”.

The Regulators state four aims:

Consistent measurement and disclosure –

trustees and firms must measure and publicly disclose investment

performance, costs, and service quality using metrics designed to

assess VFM effectively.

Objective comparison – those responsible

for oversight (trustees for trust-based schemes, and independent

governance committees (IGCs) and governance

advisory arrangements for contract-based schemes) can assess

performance against the market on a consistent, objective

basis.

Transparency of outcomes – assessment

results must be publicly disclosed.

Action on poor value – trustees and

firms must take specified actions where an arrangement is assessed

as not delivering VFM.

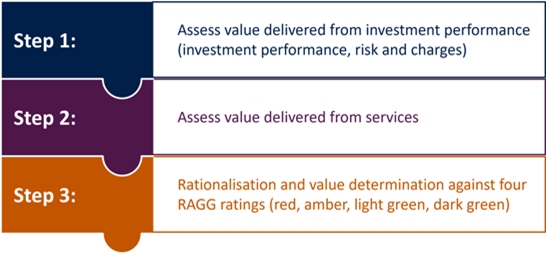

The assessment process will involve three steps:

Employers will have a central role in the regime. The Regulators

intend that schemes will provide them with the information to

select arrangements that deliver long-term value, leading to better

value pensions, without savers themselves having to take

action.

4. What’s changed in the latest consultation?

The fundamentals of the new framework remain unchanged from the

2024 Consultation. Schemes must publish key metrics every year,

covering investment performance, asset classes, costs, charges, and

service. Trustees and providers will need to assign a VFM rating to

their default arrangement(s). Underperforming schemes face

consequences – e.g. taking steps to improve, notifying

contributing employers of poor performance, closing to new business

and/or ultimately transferring members elsewhere.

The revised framework, though, proposes a more streamlined and

nuanced approach. In several respects, it is designed to be more

objective, and more accommodating of innovative investment

strategies:

1. Forecasting investment performance:

The most notable new requirement is the inclusion of

forward-looking metrics. Rather than focusing solely on past

performance, schemes will need to set out expected net returns and

risks over the next ten years. Schemes will be able to decide their

own bespoke methodology and assumptions when calculating these

metrics (tailored to the scheme’s chosen investment

strategy).

Guardrails will apply to limit the risk of unrealistic or

inflated metrics: (i) schemes will need to record, but not

disclose, their assumptions; and (ii) they must also obtain and

consider advice from an appropriate third-party on the

reasonableness of the assumptions.

Comment

The use of bespoke forward-looking metrics is intended to

support the Government’s agenda to drive pension scheme

investment in productive, long term asset classes, and alleviate

some of the potential obstacles to private market investment. For

instance, the Regulators have stated explicitly that they

“do not want to discourage trustees and firms from finding

ways to manage the potential ‘lag’ in returns from assets

with a projected J curve shaped return.”

A focus on future performance could also reduce the risk of

herding towards benchmarks focused on short-term returns. A risk

remains that the use of non-standardised forward-looking metrics

could make it harder for employers and savers to compare schemes

and could potentially increase the risk of challenge where actual

performance falls short of projections.

2. Streamlined reporting:

(a) Past performance and charges: Past

performance will still need to be assessed and reported on three

levels:

Gross investment performance (net only of transaction

costs).

Gross investment performance net of investment charges.

Gross investment performance net of all costs and charges.

Notably, one hard edge has been softened. The previous proposals

required schemes to report 15-year historic data on investment

performance and charges. That has gone. Instead, backwards looking

investment performance data must be disclosed for periods of 1

year, 3 years and 5 years where available, and 10 years where

reasonably practicable to obtain. As for how performance data is

calculated, the original proposal was to calculate based on the

annual performance of multiple cohorts of members as they each pass

through a given point in the retirement journey, aggregating those

performances into a geometric average. In response to feedback, it

is now proposed this be changed to consider the average experience

of multiple cohorts of members as they pass through a specific year

to retirement points (i.e. arithmetic averaging).

The Regulators have also dropped the proposal to require schemes

to distinguish between service costs and investment changes. Both

updates will be a welcome reduction in the reporting burden for

schemes.

(b) Service quality: The 2024 Consultation

proposed five service metrics, being (i) secure, prompt, and

accurate transactions, (ii) member satisfaction (iii) retirement

decision-making support for members (iv) ability to easily amend

pensions and (v) supporting members to engage with their pensions.

The Regulators are proposing minor changes to the first two ratings

for record-keeping and assessing member satisfaction. The initial

proposal to adopt a standardised member survey will now not be

included at launch, with work continuing across industry to develop

one over the medium term. The remaining three metrics will also not

now be required when the VFM framework is launched and will instead

be developed following further consultation with industry. However,

a new metric will be introduced to require information about member

nomination of beneficiaries.

Comment

Despite being scaled back, the revised proposals will still

impose a material compliance burden. Slimming down historic metrics

means less paperwork, but more subjective, forward-looking metrics

add another layer of work and judgement for schemes. Smaller,

own-trust schemes may have the most to do with the fewest

resources. This could drive further consolidation, with smaller

schemes transferring to bigger providers better equipped to

shoulder the reporting burden.

3. Comparison against commercial market comparator

group:

Instead of letting schemes cherry-pick three comparison groups,

schemes will need to use a single commercial market comparator

group, drawing from a central data repository. The commercial

comparator group will consist of contract and trust-based

arrangements that are open to new employers which are either firm

or scheme-designed multi-employer arrangements (i.e. no bespoke

arrangements or single employer trusts).

Comment

This approach could reduce the scope for gamesmanship and lead

to a more complete, objective and consistent approach to measuring

value (provided the central data set is efficiently kept up to

date, is robust and includes sufficiently granular detail on the

scheme specific context for that data).

4. Four-point ratings system:

The Regulators are also proposing a new, four-tier

“RAGG” rating (rather than the three tier “RAG”

rating proposed originally). Adding “light green” and

“dark green” above “amber” and “red”

offers welcome nuance, giving employers and savers a more granular

view. Schemes rated amber or red will be barred from taking on new

business, and red cases must transfer members elsewhere if that is

in their best interests. Amber rated schemes will be required to

prepare and submit an improvement plan setting out how they will

achieve a green rating with specified timescales for prescribed

actions or set out other arrangements such as a transfer of members

to a better value arrangement. Few arrangements are expected to

attain a dark green rating.

Comment

More nuanced ratings may mitigate the risk of cliff-edges and

herding toward uniform investment strategies, where schemes can

avoid “standing out from the crowd”.

5. What happens next

Feedback to the consultation: The joint

consultation closes on 8 March 2026. It includes draft rules and

guidance for contract-based schemes. The VFM framework will apply

to trust-based schemes through regulations made under the Pension

Schemes Bill currently before Parliament. Responses to the

consultation will inform both the development of these regulations

and the draft rules and guidance for contract-based schemes.

Further engagement: The FCA plans to offer

roundtables and stakeholder events to discuss practical aspects as

they develop the framework. The Government intends to consult on

draft regulations to implement the VFM framework for trust-based

schemes and the Pensions Regulator will consult on any changes to

its Code of Practice or guidance. The FCA is also likely to

undertake a further consultation.

Implementation: Final rules will be confirmed

once the Pension Schemes Bill receives Royal Assent. The Regulators

are currently expecting that the first VFM assessments will be

required in 2028. In the meantime, workplace DC providers and

trustees and employers with DC or hybrid schemes should monitor

developments in the regime, consider responding to the consultation

and start reviewing data.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.