The five-month surge is a sign of strong business investment, partly driven by the AI infrastructure buildout.

By Wolf Richter for WOLF STREET.

Orders for durable goods reported by manufacturing plants in the US fired on all cylinders in November, rising by 5.3% from October and by 12.3% year-over-year, including huge orders for civilian aircraft, a very volatile component, according to data from the Census Bureau today.

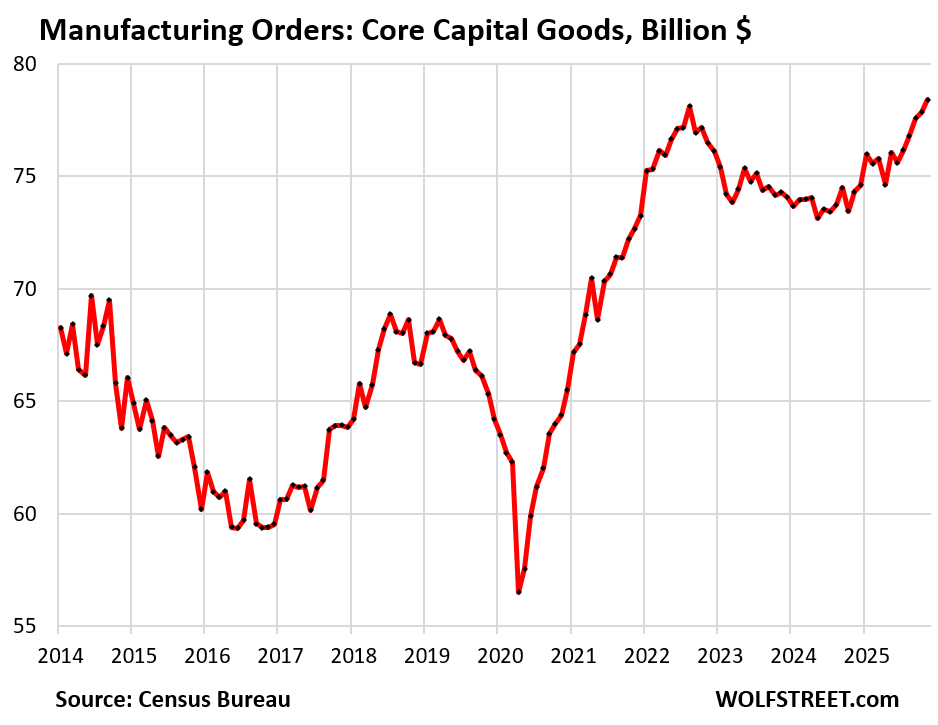

Orders for core capital goods (“nondefense capital goods excluding transportation”) are particularly interesting because they reflect future investment expenditures by businesses and more broadly, domestic business conditions in the manufacturing sector.

Orders for core capital goods rose by 0.7% in November from October, by 3.7% over the past five months, and by 5.5% year-over-year, to a record of $78.4 billion.

Manufacturers of core capital goods include manufacturers of fabricated metals, machinery, computer and electronic products including semiconductors, electrical equipment, and others.

They’d shot out of the lockdown, amid shortages, distortions, and inflation from mid-2020 through August 2022, then declined for two years. But in mid-2024, they started rising again, and over the five months, they have surged and in November hit a new record, surpassing the old record of August 2022:

The surge in orders over the past five months is another signal of strong business investment fairly broadly, but also related to the buildout of AI infrastructure that has been going on for some time.

Orders for fabricated metal products rose by 1.0% in November from October, by 3.9% over the past five months, by 5.5% since March, and by 5.3% year-over-year, to a record $42.4 billion.

Industries in the Fabricated Metal Product Manufacturing category (North American Industry Classification System NAICS code 332) use processes such as forging, stamping, bending, forming, machining, welding, and assembling metals into intermediate or end products, other than machinery, computers and electronics, and metal furniture.

Also note the 8-month 5.5% surge since March:

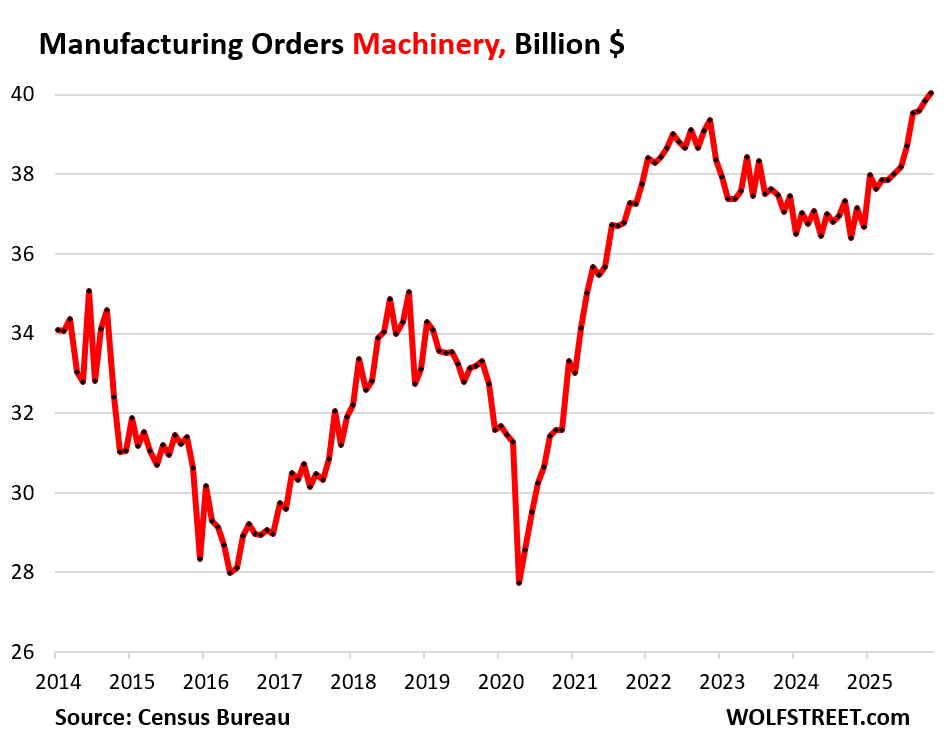

Orders for machinery rose by 0.5% for the month, by 4.8% for the past five months, by 5.8% since March, and by 7.7% year-over-year, to a record $40.0 billion in November.

Several of the subsectors below supply the AI infrastructure buildout.

Industries in Machinery Manufacturing (NAICS 333) consist of:

Agriculture, Construction, and Mining Machinery Manufacturing

Industrial Machinery Manufacturing

Commercial and Service Industry Machinery Manufacturing

Ventilation, Heating, Air-Conditioning, and Commercial Refrigeration Equipment Manufacturing

Metalworking Machinery Manufacturing

Engine, Turbine, and Power Transmission Equipment Manufacturing

Other General Purpose Machinery Manufacturing

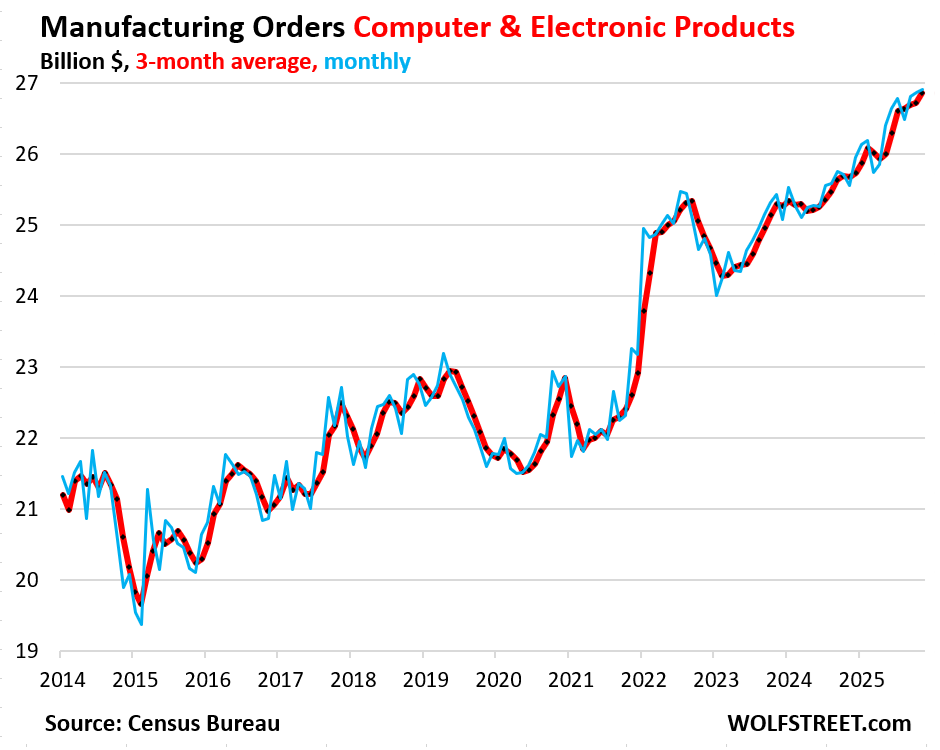

Orders for computer and electronic products rose by 0.2% for the month and by 5.3% year-over-year (blue in the chart below).

This is volatile data with big monthly up-and-down squiggles. So the chart below also shows the three-month average, which irons out the squiggles and shows the trend better (red).

The three-month average rose by 0.5% in November from October and by 4.6% year-over-year.

Industries in Computer and Electronic Product Manufacturing (NAICS 334) consist of:

Computer and Peripheral Equipment Manufacturing

Communications Equipment Manufacturing

Audio and Video Equipment Manufacturing

Semiconductor and Other Electronic Component Manufacturing

Navigational, Measuring, Electromedical, and Control Instruments Manufacturing

Manufacturing and Reproducing Magnetic and Optical Media

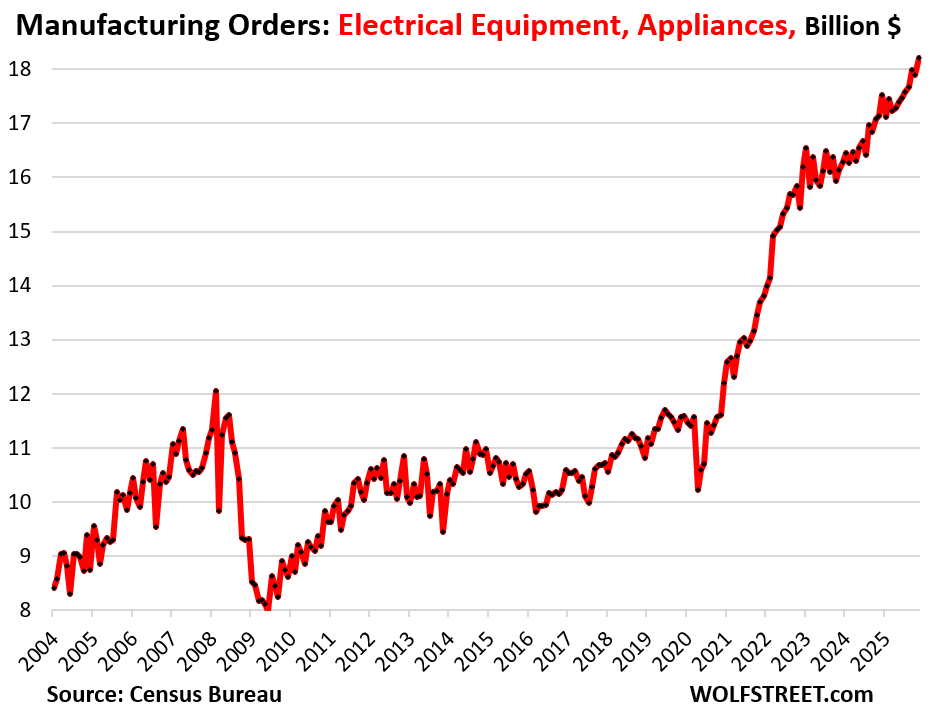

Orders for electrical equipment, appliances, and components jumped by 1.7% in November from October, by 4.2% over the past five months, and by 6.3% year-over-year to a record $18.2 billion.

From November 2020 through November 2025, orders have surged by 57%.

Industries in Electrical Equipment, Appliance, and Component Manufacturing (NAICS 335) consist of:

Electric Lighting Equipment Manufacturing

Household Appliance Manufacturing

Electrical Equipment Manufacturing

Other Electrical Equipment and Component Manufacturing

As we have seen in other data, part of this economic growth is fueled by strong business investment, in part driven by the AI infrastructure boom. It takes a while for the announced AI infrastructure projects to actually turn into orders for manufacturers, and that boom of announcements in 2025 – the portion of projects that will actually come to fruition – will turn into orders for US manufacturers over time.

It’s hard to imagine an economic slowdown until this business investment boom fizzles.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

WOLF STREET FEATURE: Daily Market Insights by Chris Vermeulen, Chief Investment Officer, TheTechnicalTraders.com.