Dublin, Feb. 03, 2026 (GLOBE NEWSWIRE) — The “United Kingdom Buy Now Pay Later Business and Investment Opportunities Databook – 90+ KPIs on BNPL Market Size, End-Use Sectors, Market Share, Product Analysis, Business Model, Demographics – Q1 2026 Update” report has been added to ResearchAndMarkets.com’s offering.

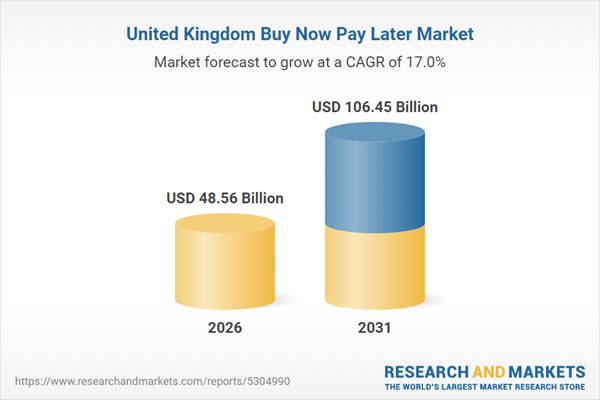

The BNPL payment market in United Kingdom is expected to grow by 20.7% on annual basis to reach US$48.56 billion in 2026. The buy now pay later market in the country has experienced robust growth during 2022-2025, achieving a CAGR of 24.9%. This upward trajectory is expected to continue, with the market forecast to grow at a CAGR of 17.0% from 2026-2031. By the end of 2031, the BNPL sector is projected to expand from its 2025 value of USD 40.22 billion to approximately USD 106.45 billion.

Over the next 2-4 years, competitive intensity is expected to shift towards regulated and capitalised players, such as banks, PayPal, and Klarna, which benefit from compliance infrastructure and diversified revenue streams. Retailers will likely consolidate BNPL partners through PSP-led integrations, reducing fragmentation. Regulation will create higher entry barriers, limiting the number of new standalone providers and supporting a more stable, but concentrated, BNPL landscape.

Current State of the Market

BNPL in the UK is shaped by competition between large fintech providers, global payment platforms, and banks that have expanded instalment capabilities. Klarna, Clearpay and PayPal remain widely integrated across major ecommerce retailers, while card-linked instalment products from banks such as Monzo, Barclays and NatWest have broadened consumer options.Competitive intensity has increased as FCA expectations on promotions and risk disclosures push both merchants and providers to differentiate through compliance readiness and checkout integration quality. Payment service providers (PSPs) such as Stripe, Adyen, and Checkout.com are playing a growing role in determining which BNPL providers merchants adopt, reducing reliance on single-provider integrations.

Key Players and New Entrants

Klarna remains a central player through extensive merchant coverage and app-led customer engagement. Clearpay continues to serve fashion and lifestyle retail, while PayPal Pay in 3 remains embedded across SME and marketplace checkouts. Banks have emerged as direct competitors: Monzo Flex and Revolut Pay Later expanded in 2024, and Barclays’ merchant instalment partnerships broadened availability across large retailers. New entrants are limited, with competitive shifts coming primarily from banks enhancing instalment features rather than standalone BNPL fintech launches.

Key Trends and Drivers

Regulatory scrutiny is formalising BNPL into mainstream consumer credit

The UK is moving towards a fully regulated BNPL environment. HM Treasury’s 2023-24 consultations and the FCA’s recent supervisory actions, such as requiring clearer disclosures on late fees and risk warnings, indicate that BNPL will be brought into the consumer-credit perimeter. Major providers like Klarna and Clearpay have already adjusted their disclosures, and retailers that integrate BNPL at checkout are increasingly required to meet compliance expectations set by the FCA.Growth in digital retail, rising cost-of-living pressures, and concerns around consumer over-commitment have brought BNPL under closer policy attention. The FCA’s 2024 review highlighted issues around promotions and affordability checks, while government feedback signals the need for proportionate regulation tailored to short-term instalments rather than full credit products.Regulation is expected to tighten onboarding, affordability checks, and promotions. Larger providers with established compliance infrastructure Klarna, PayPal, and Clearpay, are well-positioned, while smaller or non-regulated retailers offering pay-in-3-type products may face higher operational costs. BNPL may increasingly resemble a supervised consumer-credit category, raising barriers to entry and consolidating the competitive landscape.

Banks are expanding instalment offerings to respond to BNPL demand

UK banks are scaling card-linked instalment products, a notable shift from their earlier passive stance. Barclays launched partnerships enabling merchants to offer Barclays-powered instalments; NatWest and HSBC continue to embed instalment conversion features into mobile banking apps; and Revolut and Monzo expanded their pay-later functions in 2024.BNPL adoption has changed consumer expectations for checkout flexibility. Banks see an opportunity to retain card spending, align with affordability expectations under FCA oversight, and counter competition from fintech BNPL players. Higher interest rates have also strengthened bank economics for instalment lending, encouraging investment in these features.Banks’ participation will normalise instalments as a core credit product rather than a niche fintech offering. Merchant acceptance may improve where card-linked instalments reduce checkout friction. BNPL competition will shift from pure-play fintechs toward a dual model in which regulated banks and large fintechs dominate, reducing space for small entrants.

Retailers are reassessing BNPL placement due to cost pressures and regulatory expectations

Large retailers in fashion, electronics, and home goods are re-evaluating how BNPL is presented and the number of providers displayed at checkout. Some retailers have reduced BNPL exposure, while others, such as ASOS and JD Sports, have consolidated providers or adjusted fee structures, citing cost management and FCA requirements for clarity in financial promotions.Higher funding and operational costs for BNPL providers have influenced merchant fees, prompting retailers to review commercial partners. Additionally, FCA guidance on how BNPL is promoted (including rules on fair, clear, and not misleading messaging) is pushing merchants to adopt more controlled placement of BNPL options. Retail profitability pressures have also increased scrutiny of payment-related costs.Retailers are likely to streamline BNPL partners and adopt models that reduce complexity and regulatory burden. PSPs such as Stripe, Adyen, and PayPal may strengthen their position as integrated BNPL routes, as retailers prefer consolidated technical and compliance workflows. BNPL visibility may become more curated rather than ubiquitous.

Consumer behaviour is shifting toward instalments for budgeting rather than discretionary spending

UK consumers increasingly use BNPL for budgeting routine purchases rather than just for discretionary retail purchases. Providers such as Klarna and Monzo have reported higher usage across everyday categories, including lower-ticket items and subscription-linked purchases. Consumers cite predictability of payments and cost-of-living pressures as reasons for uptake.Persistent inflation in essential categories and pressure on household finances are driving consumers to seek short-term liquidity tools. As credit-card limits tighten for some demographic groups, BNPL offers a structured repayment schedule without revolving interest. The broader shift toward subscription e-commerce and repeat purchasing has also created new use cases for instalments.BNPL may evolve from a fashion-centric tool to a more general budgeting mechanism. Providers integrating spending-management tools (e.g., Klarna’s in-app budgeting features) will gain relevance. Regulation may moderate excessive usage, but it will not remove demand among younger users. BNPL’s share of everyday spending categories is likely to rise, making instalments a standard budgeting approach in UK retail.

Key Attributes:

Report AttributeDetailsNo. of Pages101Forecast Period2026 – 2031Estimated Market Value (USD) in 2026$48.56 BillionForecasted Market Value (USD) by 2031$106.45 BillionCompound Annual Growth Rate17.0%Regions CoveredUnited Kingdom

Report Scope

United Kingdom Buy Now Pay Later Company Landscape

PayPalKlarnaAfterpayZilch

United Kingdom Retail Industry & Ecommerce Market Size and Forecast

Retail Industry – Spend Value Trend AnalysisBuy Now Pay Later Share of Retail IndustryEcommerce – Spend Value Trend AnalysisBuy Now Pay Later Share of Ecommerce

United Kingdom Buy Now Pay Later Market Size and Industry Attractiveness

Gross Merchandise Value Trend AnalysisAverage Value Per Transaction Trend AnalysisTransaction Volume Trend AnalysisMarket Share Analysis by Key Players

United Kingdom Buy Now Pay Later Revenue Analysis

Buy Now Pay Later RevenuesBuy Now Pay Later Share by Revenue SegmentsBuy Now Pay Later Revenue by Merchant CommissionBuy Now Pay Later Revenue by Missed Payment Fee RevenueBuy Now Pay Later Revenue by Pay Now & Other Income

United Kingdom Buy Now Pay Later Operational KPIs

Buy Now Pay Later Active Consumer BaseBuy Now Pay Later Bad Debt

United Kingdom Buy Now Pay Later Spend Analysis by Business Model

Two-Party Business ModelThird-Party Business Model

United Kingdom Buy Now Pay Later Spend Analysis by Purpose

United Kingdom Buy Now Pay Later Spend Analysis by Merchant Ecosystem

Open Loop SystemClosed Loop System

United Kingdom Buy Now Pay Later Spend Analysis by Distribution Model

StandaloneBanks & Payment Service ProvidersMarketplaces

United Kingdom Buy Now Pay Later Spend Analysis by Channel

Online ChannelPOS Channel

United Kingdom Buy Now Pay Later By End-Use Sector: Market Size and Forecast

Retail ShoppingHome ImprovementTravelMedia and EntertainmentServicesAutomotiveHealth Care and WellnessOthers

United Kingdom Buy Now Pay Later By Retail Product Category: Market Size and Forecast

Apparel, Footwear & AccessoriesConsumer ElectronicsToys, Kids, and BabiesJewelrySporting GoodsEntertainment & GamingOther

United Kingdom Buy Now Pay Later Analysis by Consumer Attitude and Behaviour

Spend Share by Age GroupSpend Share by Default Rate by Age GroupSpend Share by IncomeGross Merchandise Value Share by GenderAdoption RationaleSpend by Monthly Expense SegmentsAverage Number of Transactions per User AnnuallyBNPL Users as a Percentage of Total Adult Population

For more information about this report visit https://www.researchandmarkets.com/r/2r7qma

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

United Kingdom Buy Now Pay Later Market