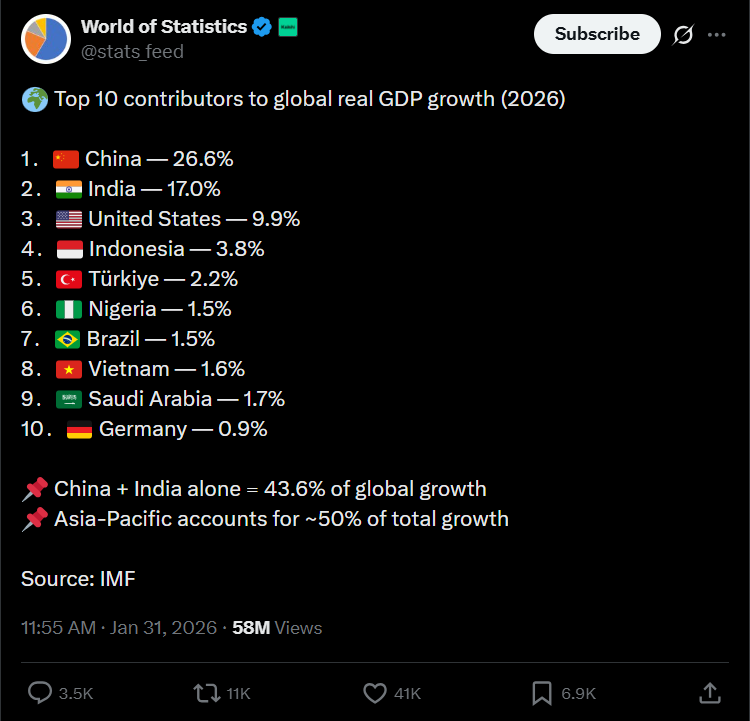

Elon Musk makes a bold claim: “Balance of power is changing”; could India soon surpass the US in GDP growth Elon Musk reposted a chart on X with the caption “The balance of power is changing.” There was no further explanation. The chart itself had already been circulating. It came from World of Statistics and used projections from the International Monetary Fund. What caught attention was not the format but the ordering. China and India sat at the top, well ahead of everyone else.China was shown contributing 26.6 per cent of global real GDP growth in 2026. India followed with 17.0 per cent. Together, they accounted for more than a third of all additional output expected this year. The gap between them and most advanced economies was wide enough to be obvious without commentary.

Elon Musk makes a bold claim: “Balance of power is changing”; could India soon surpass the US in GDP growth Elon Musk reposted a chart on X with the caption “The balance of power is changing.” There was no further explanation. The chart itself had already been circulating. It came from World of Statistics and used projections from the International Monetary Fund. What caught attention was not the format but the ordering. China and India sat at the top, well ahead of everyone else.China was shown contributing 26.6 per cent of global real GDP growth in 2026. India followed with 17.0 per cent. Together, they accounted for more than a third of all additional output expected this year. The gap between them and most advanced economies was wide enough to be obvious without commentary.

Elon Musk makes a bold claim: “Balance of power is changing” (Image Source – X/Elon Musk)

China and India dominate, while the United States rank third in the IMF report

The United States appeared next, in third place, with a projected contribution of 9.9 per cent. Further down were Indonesia, Türkiye and Nigeria, alongside other emerging markets. The list did not make a statement, but the pattern was clear enough.The IMF expects global growth to hold at 3.3 per cent in 2026 and ease slightly to 3.2 per cent in 2027. These numbers were revised marginally higher from the October 2025 outlook. There was no single reason given. Instead, a mix of factors was cited, along with continued technology investment. Policy support that has not fully unwound. Financial conditions remain relatively accommodating. A private sector that has adjusted faster than expected. Trade policy shifts are still in the background. They have not disappeared, but for now, they are not dominant in the forecast.

China and India dominate, while the United States rank third in the IMF report (Image Source – X/World of Statistics)

AI uncertainty and global tensions pose risks

A reassessment of expectations around artificial intelligence could cool investment and unsettle financial markets, particularly in technology-linked firms. Trade tensions could resurface. Political or geopolitical strains could interrupt supply chains or shake confidence. High public debt and widening deficits may push long-term interest rates higher, tightening conditions more broadly.There is also an upside-down scenario. Faster adoption of AI could still translate into real productivity gains. Trade tensions could ease rather than escalate. None of this is presented as certain.

Elon Musk On EU Radar; X’s AI Chatbot Grok Faces Biggest Probe Over Sexual Deepfakes | Details

The IMF’s policy advice is familiar. Rebuild fiscal buffers where possible. Keep prices and financial systems stable. Reduce uncertainty. Move ahead with structural reforms. It does not resolve the bigger question raised by the chart Musk reposted, but it sits alongside it, quietly.

Global inflation set to fall but the US lags behind

Inflation is expected to keep falling. The IMF projects global headline inflation at 3.8 per cent in 2026, down from an estimated 4.1 per cent in 2025, with a further decline to 3.4 per cent in 2027. These figures are largely unchanged from earlier projections. The United States stands out. Inflation there is expected to return to target more slowly than in other large economies.