SUMMARY

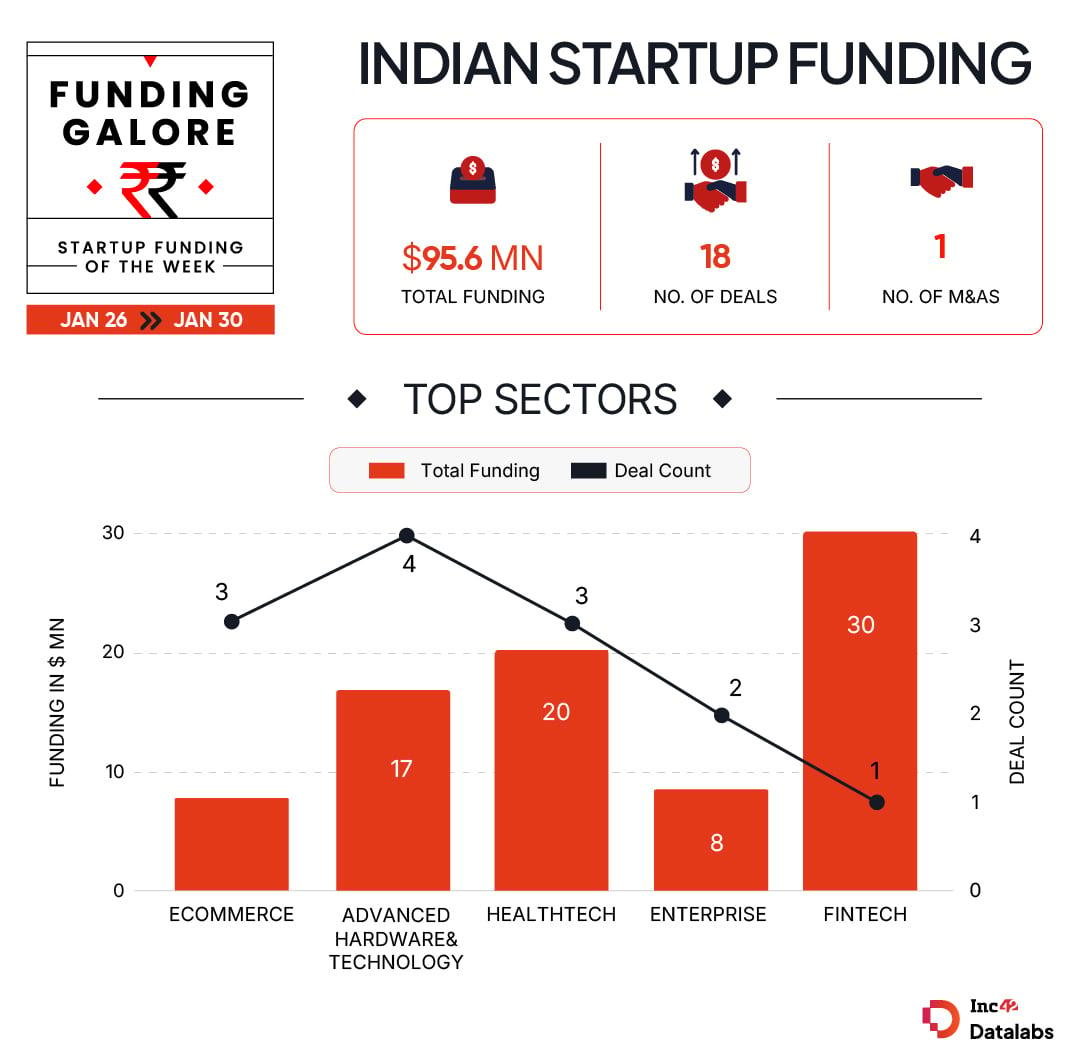

Between January 26- 30, Indian startups raised a total of $ 95.6 Mn, marking a decline of 68% from the $302.8 Mn cumulatively raised by Indian startups

Advanced Hardware & Technology segment saw the highest four deals materialise this week, with startups raising $17 Mn in cumulative funding.

Ace investor Ashish Kacholia emerged as the most active investor this week with two investments – 4baseCare and 1Buy.AI

As industries buckle up for Union Budget 2026, to be tabled by Finance Minister Nirmala Sitharaman tomorrow, the funding activity in the Indian startup ecosystem took a back seat this week.

Between January 26- 30, Indian startups raised a total of $ 95.6 Mn, marking a decline of 68% from the $302.8 Mn cumulatively raised by Indian startups. The deal count stood at 18 this week.

Funding Galore: Indian Startup Funding Of The Week [Jan 26 – 30]

Date

Name

Sector

Subsector

Business Model

Funding Round Size

Funding Round Type

Investors

Lead Investor

28 Jan 2026

Easy Home Finance

Fintech

Lending Tech

B2C

$30 Mn

Series C

Investcorp,Claypond Capital, Ranjan Pai Family Office, Asia Rising Fund

Investcorp

27 Jan 2026

4baseCare

Healthtech

Lifescience

B2B

$9.8 Mn

Series B

Ashish Kacholia (Lucky Investment Managers), Lashit Sanghvi (Sixth Sense Ventures), Yali Capital

Ashish Kacholia, Lashit Sanghvi

28 Jan 2026

Agrani Labs

Advanced Hardware & Technology

Semiconductors

B2B

$8 Mn

Seed

Peak XV Partners

Peak XV Partners

27 Jan 2026

SpotDraft

Enterprise Tech

Horizontal SaaS

B2B

$8 Mn*

Series B

Qualcomm Ventures

Qualcomm Ventures

27 Jan 2026

Nivaan Care

Healthtech

In-Clinic Healthcare

B2C

$7 Mn

Series A

Sorin Investments, W Health Ventures, Endiya Partners, Rebright Partners

Sorin Investments

27 Jan 2026

Entellus Industries

Enterprise Services

Manufacturing Solutions

B2B

$5.5 Mn

–

ZeroW

ZeroW

28 Jan 2026

Vimag Labs

Advanced Hardware & Technology

Internet Of Things (IoT) & Hardware

B2B

$5 Mn

Series A

Accel, Chakra Growth Fund, Thinkuvate

Accel

29 Jan 2026

CAVA Athleisure

Ecommerce

D2C

B2C

$4.4 Mn

Series A

Sharrp Ventures, V3 Ventures, Spring Marketing Capital

Sharrp Ventures

29 Jan 2026

1Buy.AI

Ecommerce

Horizontal Marketplace

B2B

$3.5 Mn

Seed

100Unicorns, Gruhas, FJ Labs, Ashish Kacholia (Lucky Investment Managers)

100Unicorns

27 Jan 2026

Mysa

AI

Application Layer

B2B

$3.4 Mn

Pre-Series A

Blume Ventures, Piper Serica, Ikemori Ventures, Dhan parent Raise Financial Services, QED Innovation Labs, Antler, IIMA Ventures, Neon Fund

Blume Ventures, Piper Serica

28 Jan 2026

D-Propulse

Advanced Hardware & Technology

Aerial Vehicles

B2B

$2.7 Mn

–

IAN Alpha Fund

IAN Alpha Fund

29 Jan 2026

Biopeak

Healthtech

Lifescience

B2C

$2.7 Mn

–

NKSquared

NKSquared

28 Jan 2026

ScrapUncle

Consumer Services

Hyperlocal Serices

B2C

$2.4 Mn

Pre-Series A

Orios Venture Partners, Acumen Fund, Upaya Social Ventures, Venture Catalysts, We Founder Circle, Soonicorn Ventures, Bharat Jaisinghani (PolyCab)

Orios Venture Partners, Acumen Fund

28 Jan 2026

AquaAirX

Advanced Hardware & Technology

Aerial Vehicles, Maritime Tech

B2B

$1.4 Mn

Seed

Rainmatter, Prime Venture Partners, Wyser, India Accelerator

Rainmatter

29 Jan 2026

EarthSync

Cleantech

Climate tech

B2B

$1 Mn

Pre-Seed

Theia Ventures, Eximius Ventures

Theia Ventures

28 Jan 2026

The Stack

Ecommerce

D2C

B2C

$660K

Pre-Seed

OTP Ventures, Huddle Ventures

OTP Ventures, Huddle Ventures

29 Jan 2026

OneARVO

Enterprise Tech

Horizontal SaaS

B2B

$134K

Pre-Seed

Inflection Point Ventures

Inflection Point Ventures

28 Jan 2026

Kore.ai

AI

Application Layer

B2B

–

–

AllianceBernstein Private Credit Investors, Vistara Growth, Beedie Capital, Sweetwater Private Equity

AllianceBernstein Private Credit Investors

Source: Inc42

*Part of larger round

Key Startup Funding Highlights Of The Week

Easy Home Finance raised $30 Mn in its Series C funding round led by Investcorp this week. On the back of this round, fintech became the most funded startup sector this week.

In terms of deal count, the Advanced Hardware & Technology segment saw the highest four deals materialise this week, with startups raising $17 Mn in cumulative funding.

Seed stage funding slumped 40% week-on-week, with three startups at this stage raising $12.9 Mn.

Ace investor Ashish Kacholia emerged as the most active investor this week with two investments – 4baseCare and 1Buy.AI.

Startup IPO Updates This Week

Other Developments Of The Week

Navam Capital, which counts Ather Energy in its portfolio, marked the final close of its maiden alternative investment fund (AIF), at INR 315 Cr to back Indian deeptech startups building for global markets. The fund, which had a target corpus of INR 250 Cr, was oversubscribed and closed at INR 315 Cr following the exercise of green shoe option.

]]>