As the United Kingdom’s FTSE 100 index faces challenges amid weak trade data from China, investors are exploring diverse opportunities within the market. Penny stocks, often representing smaller or newer companies, continue to capture attention due to their potential for significant growth and affordability. In this article, we explore three penny stocks that stand out for their financial resilience and potential value in today’s shifting economic landscape.

Name

Share Price

Market Cap

Financial Health Rating

DSW Capital (AIM:DSW)

£0.60

£15.08M

★★★★★★

Brickability Group (AIM:BRCK)

£0.526

£169.55M

★★★★★☆

Foresight Group Holdings (LSE:FSG)

£4.145

£473.64M

★★★★★★

Ingenta (AIM:ING)

£1.05

£15.85M

★★★★★★

System1 Group (AIM:SYS1)

£2.23

£28.3M

★★★★★★

Integrated Diagnostics Holdings (LSE:IDHC)

$0.6425

$373.5M

★★★★★☆

Michelmersh Brick Holdings (AIM:MBH)

£0.855

£77.51M

★★★★★★

Alumasc Group (AIM:ALU)

£2.75

£98.89M

★★★★★★

Begbies Traynor Group (AIM:BEG)

£1.215

£195.53M

★★★★★☆

ME Group International (LSE:MEGP)

£1.388

£541.66M

★★★★★★

Click here to see the full list of 284 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Begbies Traynor Group plc is a UK-based company offering business recovery, financial advisory, and property services consultancy, with a market cap of £195.53 million.

Operations: The company generates revenue from two primary segments: Property Advisory, contributing £48 million, and Business Recovery and Advisory, which brings in £111.4 million.

Market Cap: £195.53M

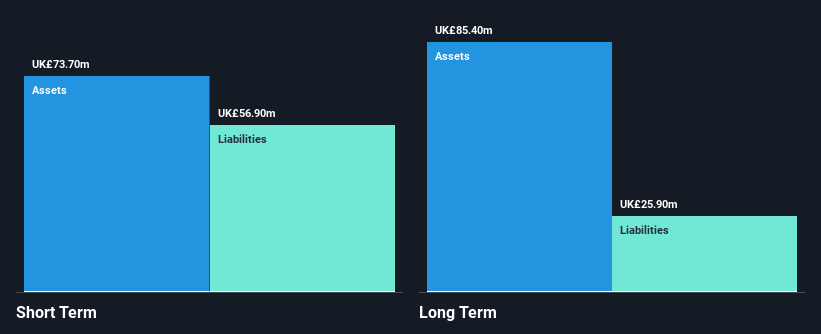

Begbies Traynor Group plc, recently renamed BTG Consulting plc, has shown substantial earnings growth, with a 296% increase over the past year compared to its 5-year average of 60.6%. The company’s financial health is bolstered by well-covered debt and interest payments. Despite a large one-off loss impacting recent results, it maintains strong short-term asset coverage over liabilities and continues to offer a reliable dividend yield of 3.62%, recently increased by 7%. Trading at significant value below fair estimates, it presents potential for investors seeking exposure in this sector without substantial dilution concerns.

AIM:BEG Financial Position Analysis as at Feb 2026

AIM:BEG Financial Position Analysis as at Feb 2026

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Naked Wines plc operates a direct-to-consumer wine retailing business in Australia, the United Kingdom, and the United States, with a market cap of £53.09 million.

Story Continues

Operations: The company generates revenue from its direct-to-consumer wine retail operations in the United Kingdom (£105.44 million), the United States (£97.26 million), and Australia (£28.25 million).

Market Cap: £53.09M

Naked Wines plc, with a market cap of £53.09 million, operates across the UK, US, and Australia, generating substantial revenue from its direct-to-consumer model. Despite being unprofitable with losses increasing at 14.4% annually over five years, it maintains a strong cash position exceeding debt levels and has not significantly diluted shareholders recently. The company’s recent share buyback program could signal confidence in its valuation as it trades below estimated fair value. However, challenges persist with declining earnings and an inexperienced board averaging 1.6 years tenure amidst ongoing executive changes aimed at strategic realignment.

AIM:WINE Financial Position Analysis as at Feb 2026

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Braemar Plc operates as a shipbroking service provider across the United Kingdom, Singapore, Australia, Switzerland, the United States, Germany, and other international markets with a market cap of £71.58 million.

Operations: The company’s revenue is derived from three segments: Chartering (£77.11 million), Risk Advisory (£23.42 million), and Investment Advisory (£29.24 million).

Market Cap: £71.58M

Braemar Plc, with a market cap of £71.58 million, operates across multiple international markets and derives revenue from Chartering (£77.11M), Risk Advisory (£23.42M), and Investment Advisory (£29.24M). The company faces challenges with negative earnings growth (-19.9%) over the past year and declining profits at 11.5% annually over five years, yet it trades significantly below estimated fair value, suggesting potential undervaluation. Despite a low return on equity (5%), Braemar maintains satisfactory debt levels with net debt to equity at 18.5%, well-covered interest payments by EBIT (5.8x), and short-term assets exceeding liabilities, indicating strong liquidity management amidst financial volatility.

LSE:BMS Debt to Equity History and Analysis as at Feb 2026

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:BEG AIM:WINE and LSE:BMS.

This article was originally published by Simply Wall St.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com