This report is a partnership between WrapPRO and PitchBook, the go-to financial data and software platform that provides detailed information on private and public capital markets.

Welcome to The Funding File, an exciting new monthly column we are launching today in partnership with deals data provider PitchBook. This is just another premium we offer to our WrapPRO subscribers.

So what is The Funding File? Each month we will document the startups and young companies across entertainment, media, publishing, entertainment software and information services that are raising venture capital. This unique collection of data is critical because these startups are more often than not a bellwether of innovation and future trends for any industry. And where investors are placing their bets (financing, from seed to late stage) is essential to understanding fully where media and entertainment is heading.

We also intend to track investments that turn out to be duds. Again, crucial information for what’s not working.

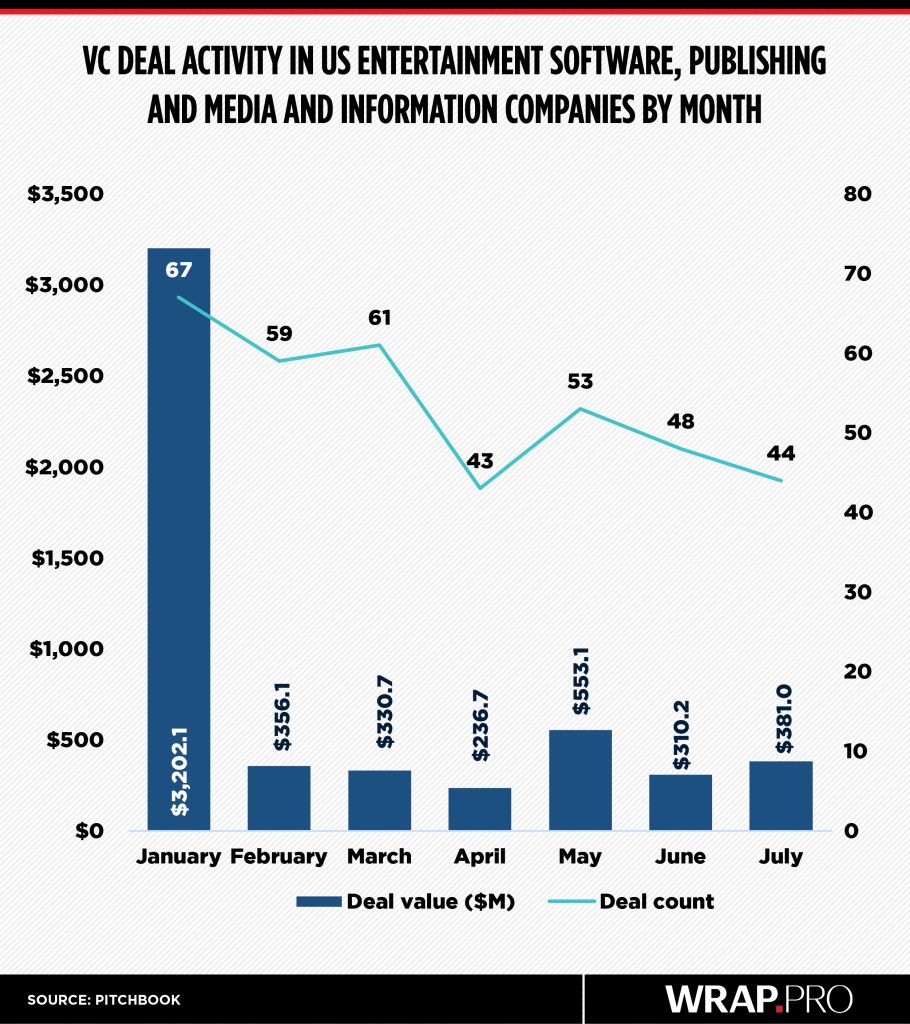

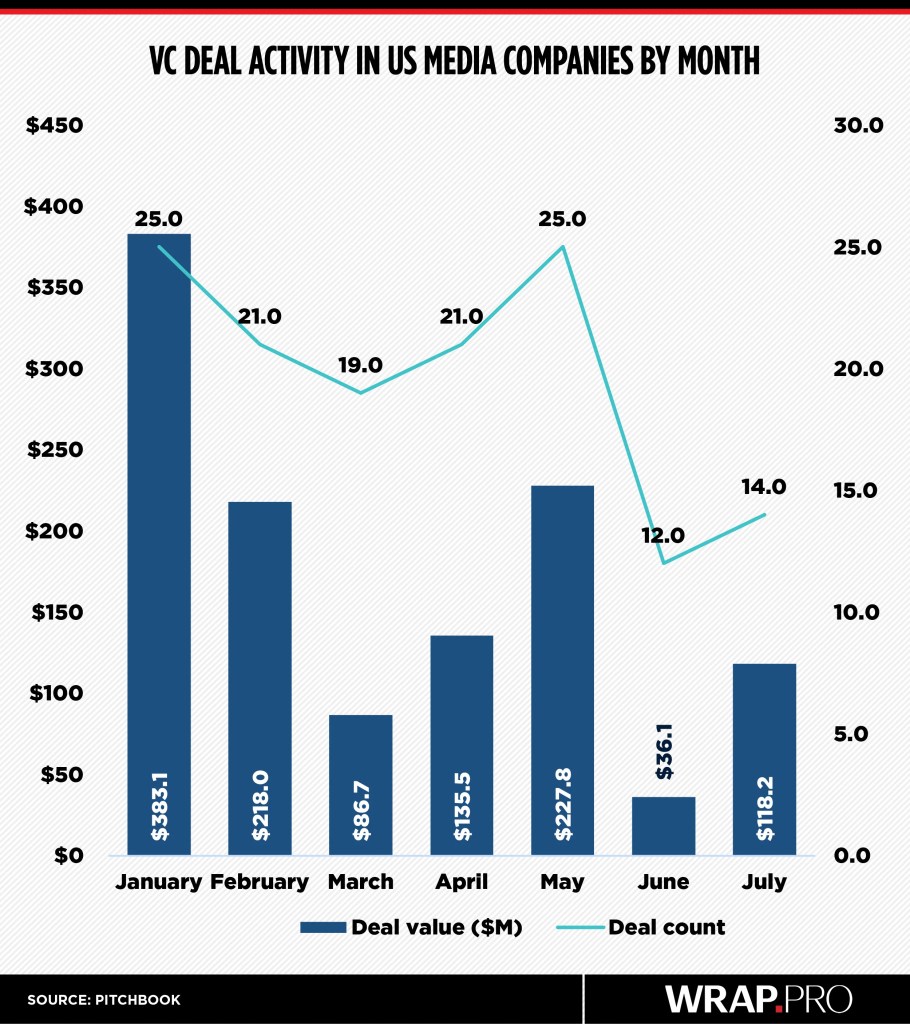

So far this year, media and entertainment companies have raised nearly $6.6 billion, almost half of that came from a $3 billion raise in early January by Infinite Reality from investors that it did not disclose, according to PitchBook data. Infinite Reality, which has bought the brand name of the former Napster file sharing company, said it uses immersive technologies to offer a suite of services to brands and creators to increase audience engagement.

Financings overall have not kept pace with 2024 activity, consistent with an overall slump in deal activity for M&A and IPOs since President Donald Trump took office, whose bombastic claims and inconsistent messaging has created market jitters and economic uncertainties.

Another big financing deal in 2025 was for MoviePass’ Mogul box office fantasy game that raised $100 million in May from Global Emerging Markets’ Token Fund.

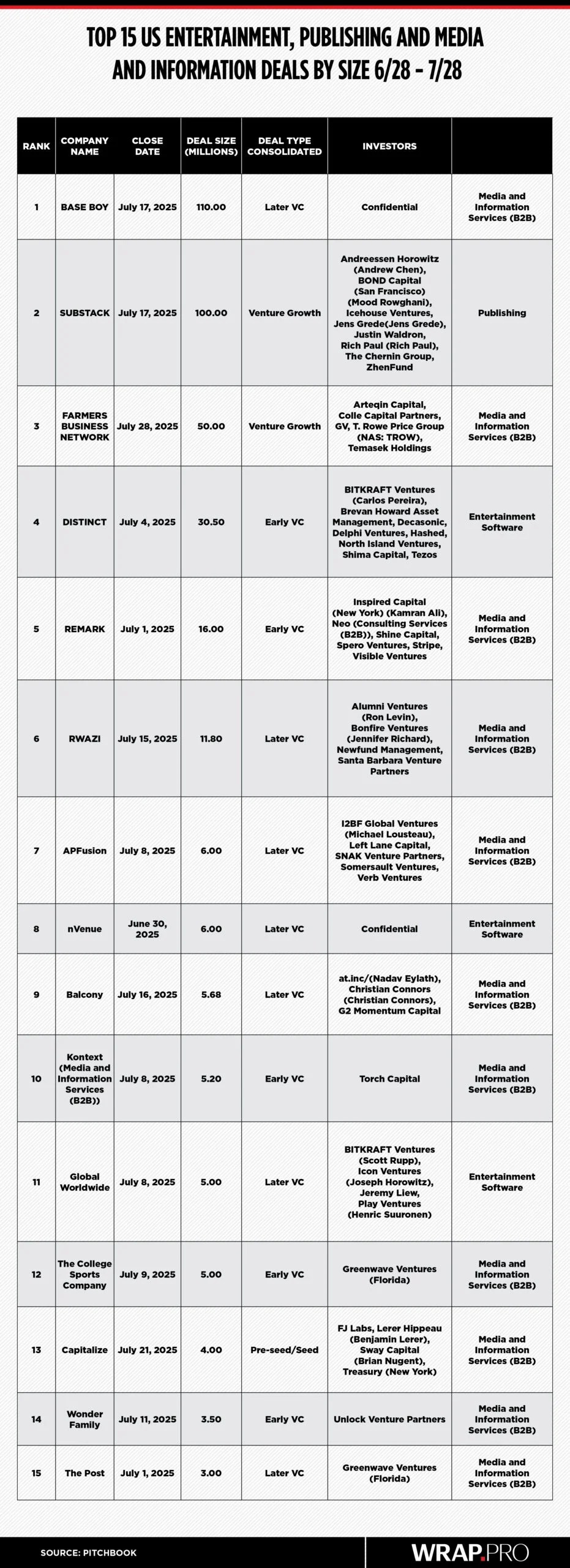

As for July, during which media and entertainment companies closed investments of nearly $500 million, here are a few highlighted companies — with a full chart of the top 15 financings below.

1. Base Boy Entertainment — $110 Million

Base Boy Entertainment Network, which offers services in talent development and management to support and guide artists, actors, models, filmmakers and music producers, raised $110 million from investors it did not disclose, according to PitchBook. This follows an earlier round of $7.5 million in 2024 led by the Black Unicorn Factory. The Santa Monica, California-based company was founded in 2017 by Juavona Gallien. The company did not respond to TheWrap’s request for comment on the latest raise.

2. Substack — $100 Million

Substack, the popular platform for creators and publishers, raised $100 million in July from a group of investors that included BOND and The Chernin Group (TCG), as well as Andreessen Horowitz. Founded in 2017, San Francisco-based Substack has surpassed five million paid subscribers on its platform. Media reports said the latest investment raises Substack’s valuation to $1.1 billion. Hamish McKenzie, co-founder of Substack, told TheWrap: “This raise propels Substack’s mission to create a new economic engine for culture. It allows us to double down on our commitment to writer and creator success by investing in better tools, expanding our reach and providing enhanced support.

“Our purpose is to empower creators to build sustainable businesses and communities at scale, with the freedom and ownership they deserve,” he added. “There has never been a better time to start a new media business. Substack provides the ideal ‘land’ to build on — modern publishing tools, a network that powers growth and a business model that works — while preserving ownership for the publishers.”

12. The College Sports Company — $5 Million

Boston-based The College Sports Company raised another $5 million in July from GreenWave Ventures, adding the more than $50 million the company raised so far. College Sports Company collaborates with big universities like Penn State, Oklahoma and Louisville to launch athlete-driven media networks that enhance both school and athlete visibility.

How the year is looking

To put July in perspective, it’s important to look at 2025’s previous months for dollar amounts raised and deal counts. Clearly there was been significant slowing from January, which was helped by the Infinite Reality funding.

If this kind of data is useful to you, go here to PitchBook for more information.