Indian venture capital firms and startups are increasingly tapping into the Middle East for investments and business opportunities, as the region looks to expand beyond traditional oil business amid the technology shift the world is witnessing, multiple people told ET.

Stellaris Venture Partners and Blume Ventures have raised funds from the Middle East, while VC firms like Ideaspring Capital and Java Capital are exploring the region for potential investment opportunities.

An Indian early-stage venture fund, 100Unicorns, made its first international expansion to Abu Dhabi in December 2024 after a $200 million fund raise. Cricketer Shikhar Dawan’s VC arm Yashaa Global Capital is set up in Abu Dhabi and is looking to raise $75 million.

Startups are also exploring the Middle East as a region for expansion and funding. Companies that have moved to the region include Nykaa, which has subsidiaries in the UAE, and fintech startup InCred that acquired Dubai-based Arrow Capital, according to reports.

As per data from Venture Intelligence, Indian startups received $200 million in funding from middle-eastern investors in 2024.

Blume Ventures partner Ashish Fafadia said apart from becoming investors in funds, UAE investors are looking to make direct investments in VC firm’s portfolio companies as well.

ETtech

ETtech

Middle East advantage

More family offices, wealthy individuals and sovereign funds from the region are looking to expand beyond traditional businesses like oil and natural resources, offering opportunities for Indian fund houses and startups, said Sanjay Nath, co-founder and managing partner at Blume Ventures.

“This is being driven by increasing awareness and interest in startups, as they seek to take part in the technology shift the industry is witnessing,” he said.

There is a trend of family offices in the UK and Switzerland wanting to move to Dubai, which might help ease capital raising from the region, said Naganand Doraswamy, managing partner, Ideaspring Capital.

Vinod Shankar, cofounder and partner at Java Capital, said: “We are seeing growing interest from the region and are currently in conversations with several HNIs and family offices in Dubai and Abu Dhabi for potential investment opportunities.”

Gaming and digital entertainment company JetSynthesys is witnessing a huge opportunity in engaging with the youth in the Middle East, especially Saudi Arabia, which is a large consumption market in the areas of eSports and video gaming, CEO Rajan Navani said. The Middle East is a fast-growing high revenue market and a base for global operations as more overseas businesses set up in Dubai and Abu Dhabi, where Indian companies can work with them together, he said.

In October last year, Jetapult, a gaming investment startup backed by JetSynthesys and VC firms Accel and Fireside Ventures, invested $4.5 million in Saudi Arabia-based game developer UMX Studio. “Since the pandemic, the world has started to converge in the UAE and because of the trade free zones, which are governed by global laws, lots of international companies have moved there. We are also setting up a base in Abu Dhabi,” Navani said.

Attracting startups

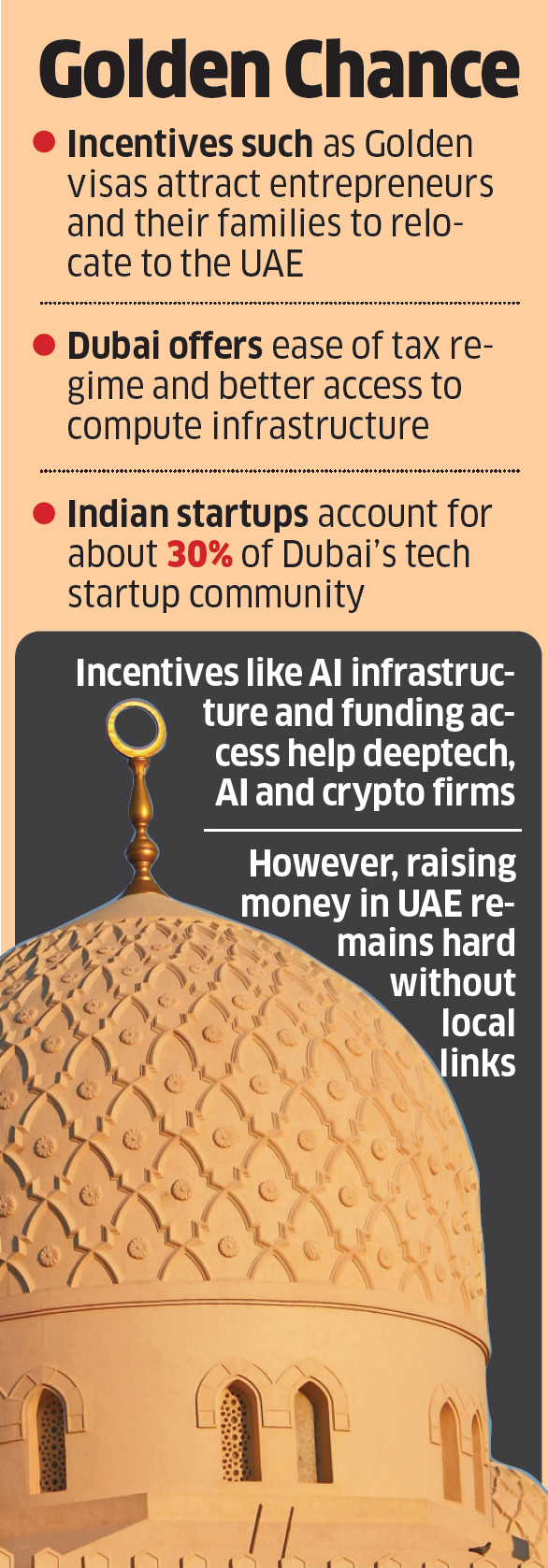

By creating institutions such as the Dubai International Finance Centre and incentives such as golden visa, an easy tax regime and massive AI infrastructure, the region is attracting Indian startups working in deeptech, financial services and AI/crypto. According to an earlier ET report, Indian startups account for about 30% of Dubai’s tech startup community.

“Despite being a smaller market they have more access to compute than India on a per capita basis, because essentially it is a function of money,” said a Gurugram-based AI investor. “If I can commit to you that I am going to have these many GPUs, and you are a compute-heavy company, you are more likely to be based in Dubai than in any part of India or even other regions for that matter,” he added.

Dubai is trying to attract entrepreneurs by offering golden visas, which allows the entrepreneur and his or her family to move into the UAE, said Ashitha Bhagwan, managing partner at Inventus Law Technology Partners.

Her law firm has worked with several startups that wanted to move to Dubai.

But these are not without challenges.

Ideaspring’s Naganand said unless you know someone, raising money from the UAE is still hard.

It is not easy running a business in the UAE if it does not contribute to the local economy.

Bhagwan said one of the founders who moved to Dubai returned to India and emigrated to the US, as he was working on a global product. “It only works if you are building for the Middle East market and it is much more challenging if the focus is a global product with customers outside the region,” Bhagwan said.