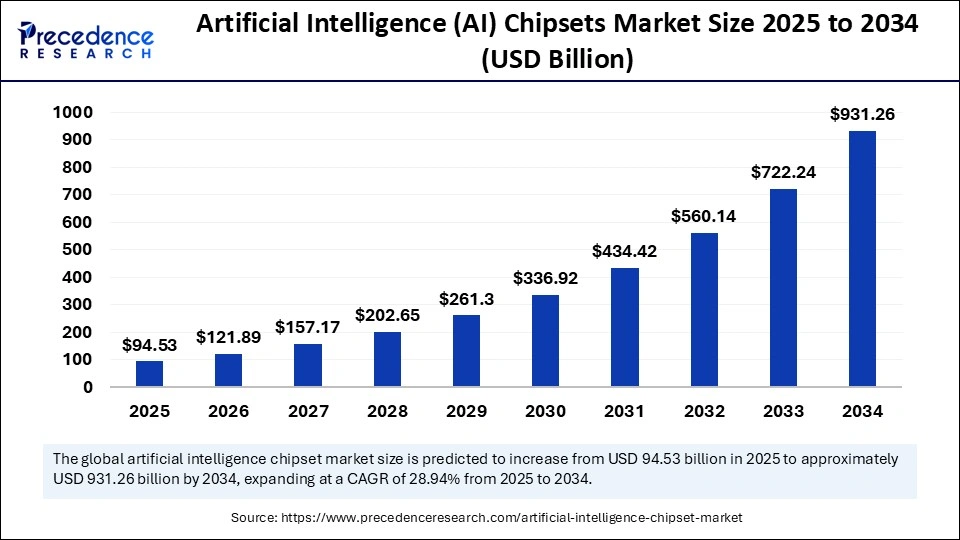

The global artificial intelligence (AI) chipsets market is on the cusp of explosive expansion, projected to surge from $94.53 billion in 2025 to $931.26 billion by 2034, marking a monumental CAGR of 28.94%. This dramatic rise is powered by rapid advances in generative AI, sophisticated autonomous systems, and the unrelenting demand for efficient, high-performance processors across cloud, edge, and embedded platforms.

Industry giants such as NVIDIA, Intel, and Google are fortifying North America’s leadership, while major initiatives across Asia Pacific are fostering a new wave of breakthroughs in chip design and manufacturing. As AI workloads become central to operations in automotive, healthcare, finance, and more, the push for cutting-edge, energy-efficient AI hardware has never been stronger.

Where Are the Largest Opportunities and Emerging Trends in AI Chipsets?

Can Edge AI and Ultra-Fine Chip Nodes Change the Game?

The answer is a resounding yes. Edge AI is rapidly gaining traction, driving demand for low-power, ultra-efficient chipsets capable of local, real-time inference and data processing. Simultaneously, the industry is shifting towards ultra-fine process technologies (e.g., 5nm and 3nm nodes), with leaders like TSMC, NVIDIA, and Apple driving the adoption of sub-7nm chipsets for enhanced speed, compute density, and power optimization.

The rise of Industry 4.0, autonomous vehicles, and smart city infrastructure continually highlights the relevance of on-device AI computation. Cloud leaders (AWS, Microsoft Azure, Google Cloud) are scaling GPU-accelerated infrastructure for generative AI models, while enterprises in healthcare and automotive deploy custom ASICs for mission-critical applications.

Expert Take: Insight from Precedence Research

“AI chipsets are at the forefront of the next technology revolution. As industries embrace generative AI, autonomous systems, and decentralized analytics, the demand for specialized, high-performance semiconductors will accelerate. Companies investing in edge AI, cloud-based inferencing, and advanced technology nodes are best positioned to lead, and to benefit from, the current wave of innovation and disruption.”

— Dr. Sanjana Rao, Principal Consultant, Precedence Research

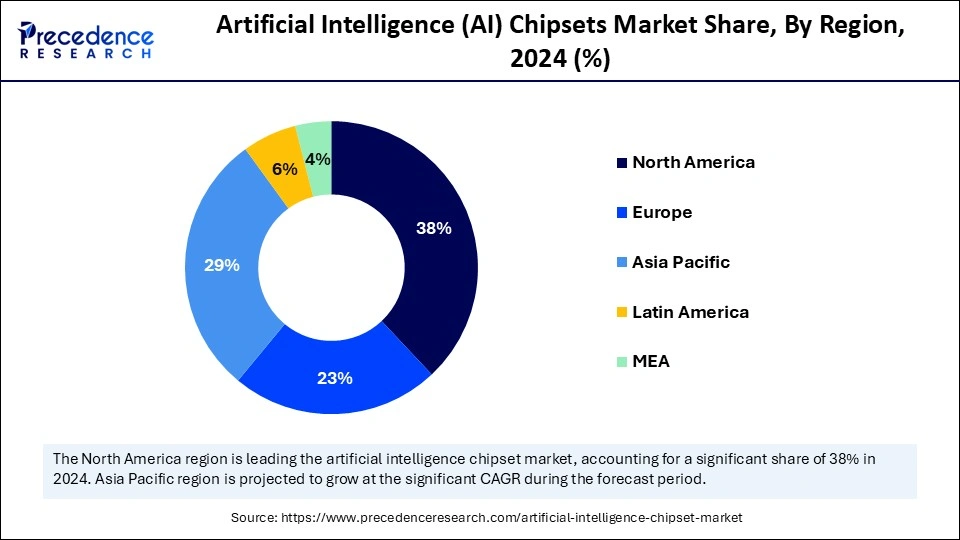

Regional Analysis: Dominance and Growth Hotspots

North America: The Powerhouse

North America claimed the biggest market share in 2024, fueled by deep-rooted AI research, major venture capital inflows, and the supremacy of semiconductor and cloud giants. The U.S. market alone is set to climb from $19.50billion (2024) to $252.77billion in 2034. Legislation such as the CHIPS and Science Act continues to boost domestic semiconductor production, supporting leaders like NVIDIA, AMD, Intel, Google, Tesla, Meta Platforms, and OpenAI.

Asia Pacific: The New Frontier

Asia Pacific is poised for the fastest growth, as China, South Korea, and Japan double down on chip design, advanced packaging, and national semiconductor strategies. The region’s transformative investments in manufacturing automation and smart city initiatives are rapidly turning it into a global hub for AI chipset innovation.

Europe, Latin America, Middle East & Africa

Other regions are also increasing their footprints, particularly with sovereign AI projects in Europe and growing AI innovation ecosystems in Latin America and the Middle East. Demand for secure, on-premise chipsets is rising in areas with stringent compliance and data localization requirements.

Artificial Intelligence (AI) Chipsets Market Highlights

By Chipset Type: The AI chipsets market encompasses a diverse array of specialized hardware. Graphics Processing Units (GPU) lead the segment, known for accelerating deep learning and generative AI tasks. Application Specific Integrated Circuits (ASIC) provide highly optimized performance for dedicated AI workloads, particularly at the edge. Field Programmable Gate Arrays (FPGA) offer flexible, reconfigurable hardware for industry-specific use cases. Central Processing Units (CPU) remain fundamental for general-purpose computing in AI applications, while System on Chip (SoC) integrates multiple components for portable AI solutions. Neural Processing Units (NPU) and Tensor Processing Units (TPU) are engineered for rapid inference and complex neural network computations. The segment also covers other innovative chips, including analog chips tailored for ultra-efficient edge AI operations.

By Technology Node: Technology node refers to the semiconductor manufacturing process’s fineness, directly impacting speed, power consumption, and integration density. State-of-the-art chipsets operating at nodes smaller than 7nm are setting new standards in performance and energy efficiency. The 7–10nm category captures significant market share, balancing technological maturity and scalability. Nodes between 11–28nm remain relevant for cost-sensitive or legacy applications, while those greater than 28nm are typically used for simpler, robust edge devices

By Processing Type: AI chipsets are classified based on processing locale and model sophistication. Edge AI Processing enables on-device analytics for instant response and privacy, essential for IoT and autonomous machines. Cloud AI Processing is deployed for heavy computational tasks, including large model training and scalable inference, ensuring flexibility and massive data throughput. Hybrid AI Processing combines both approaches, optimizing cost and latency for enterprise and industrial ecosystems.

By Functionality: Chipsets specialize in either model training or inference. Training chipsets excel in handling massive parallel workloads, critical for deep neural network development and large-scale generative models. Inference chipsets are optimized for energy-efficient real-time predictions, making them indispensable in consumer electronics, healthcare devices, and connected vehicles.

By Deployment Mode: On-Premise deployment mode is favored where security, compliance, and data sovereignty are paramount, including healthcare, finance, and defense organizations. Cloud-Based deployment dominates high-growth sectors requiring scalable compute for model training, analytics, and AI service delivery, led by hyperscale players and enterprise platforms.

By End-Use Industry: AI chipsets power innovation across industries. In consumer electronics, they drive smart devices like smartphones, speakers, TVs, and wearables, enabling voice assistants and intelligent features. The automotive segment is transforming with chipsets supporting Advanced Driver-Assistance Systems (ADAS) and autonomous vehicles. Healthcare applications rely on AI chips for imaging diagnostics, surgical robotics, and virtual nursing assistants. The BFSI sector harnesses chipsets for fraud detection, automated trading, and enhancing customer experiences. Industrial end-use sees applications in predictive maintenance and quality control. In retail, AI chipsets enable inventory management and recommendation engines. Telecommunications leverage them for network optimization, while markets in defense and aerospace utilize chipsets for smart surveillance and mission-critical systems. Data centers depend on leading-edge AI hardware for processing, storing, and securing vast volumes of information, with other verticals, such as education, agriculture, and logistics, adopting AI chipsets for domain-specific innovation and automation.

Challenges and Cost Pressures

Supply Chain Risks: Geopolitical tensions, trade restrictions, and export controls (especially between the U.S. and China) are major hurdles, impacting access to fabrication hardware and key raw materials.

Development Costs: High R&D and fabrication expenses limit entry for smaller players and increase risk for scaling manufacturers.

Regulatory Complexity: Increasing demand for compliance, especially for on-premises deployments, heightens risk and costs for AI hardware enterprises.

Artificial intelligence (AI) chipsets market Key Players

Tenstorrent Inc

SiFive, Inc.

Samsung Electronics Co., Ltd.

Qualcomm Technologies, Inc.

NVIDIA Corporation

Mythic AI

Microsoft Corporation (Project Athena)

Meta Platforms Inc. (MTIA)

MediaTek Inc.

Intel Corporation

IBM Corporation

Huawei Technologies Co., Ltd. (Ascend)

Graphcore Ltd.

Google LLC (Alphabet – TPU)

Cisco Systems, Inc.

Cerebras Systems

Arm Ltd.

Apple Inc.

Alibaba Group (T-Head)

Advanced Micro Devices, Inc. (AMD)