Under a government decree on electronic road toll payment, from Oct. 1 cars not switched to traffic accounts will be barred from using electronic toll collection (ETC) lanes.

The system links payments to bank accounts or e-wallets, allowing drivers to pay for multiple transport services instead of topping up a toll account directly.

However, many drivers report that VETC and ePass pose difficulties, including limited bank payment options, strict requirements for matching bank details and additional charges for some international transactions.

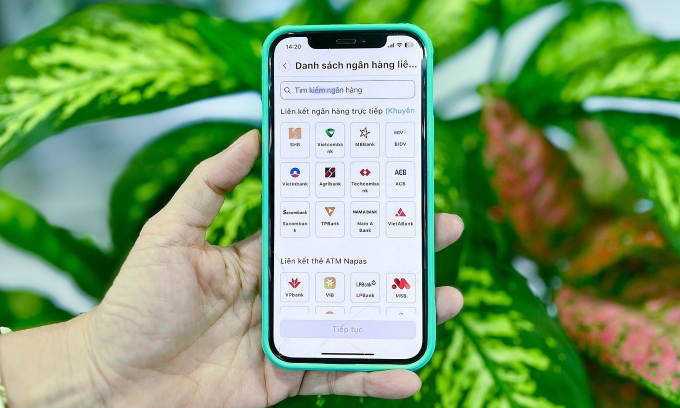

Not all banks connect directly with the apps. VETC allows in-app linking with only 12 banks though linking through ATM cards expands the list to 30. ePass relies on Viettel Money, a digital wallet platform, to process payments, which links it with 41 banks.

Electronic toll collection app VETC list of banks connected through the app. Photo by VnExpress/Minh Hy

Drivers whose banks are not in these lists must open new bank accounts to use the traffic account system.

Under the previous toll account system, vehicle owners had greater flexibility as they could transfer money from any bank directly to the service provider’s account.

Another inconvenience now is that the bank account holder’s name must exactly match the traffic account holder’s name. Both apps require identical full names, ID documents and phone numbers as those registered with the bank.

Thus, if a woman’s name is in the traffic account, only her bank account can be linked and her husband cannot top it up through his bank account.

This requirement creates particular challenges for transport business owners, who, in the past, could let their hired drivers top up the toll account directly.

Now owners must use their own bank accounts for their entire fleet of vehicles. Besides, a fleet of 10 container trucks making one expressway trip a day at VND600,000–700,000 (US$23–27) each would require VND6–7 million daily, meaning owners must maintain a large bank balance.

While ePass allows linking credit cards, eliminating the need to top up, this incurs two extra charges: a VND2,200 transaction fee and an international payment fee of 2–2.5% depending on the bank.

These factors make the transition challenging for many.

Experts say that to meet the transition deadline, service providers should broaden bank and e-wallet connections, offer more flexible linking options, lower transaction costs, and enable direct fee deductions from bank accounts to make the system more convenient.