The race to become the most powerful person in finance is starting in two weeks.

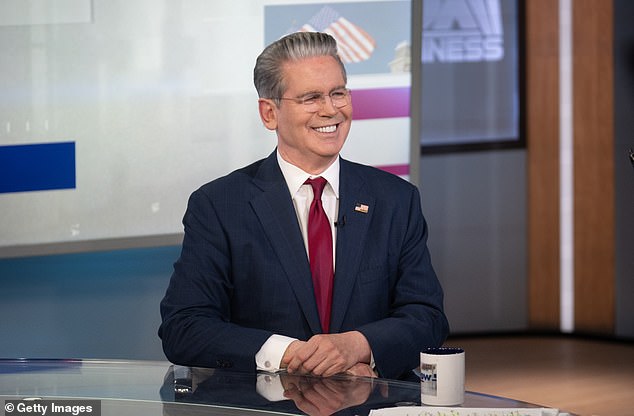

Treasury Secretary Scott Bessent told CNBC on Tuesday that he’ll begin interviewing 11 people vying to replace Federal Reserve chairman Jerome Powell right after Labor Day on September 1.

Powell’s term doesn’t end until May 2026, but the White House is pressing fast as it disagrees with his policies.They want interest rates cut.

The roster includes Fed insiders, economists, a White House advisor, and Wall Street heavyweights.

‘It’s an incredible group,’ Bessent said, noting he’ll begin meetings and eventually hand President Donald Trump a narrower slate.

The fast-tracked process comes amid White House calls for interest rate cuts —a move that could free up money for American consumers and businesses. That in turn boosts spending, stock prices, and 401(k) accounts.

Trump has consistently criticized Powell on Truth Social, nicknaming him ‘Too Late.’ He’s taken aim also at the Fed’s office over-budget renovations.

‘Jerome “Too Late” Powell must NOW lower the rate,’ the President said last Tuesday.

President Trump and Fed chairman Powell have been at odds over the country’s interest rate

‘I am, though, considering allowing a major lawsuit against Powell to proceed because of the horrible, and grossly incompetent, job he has done in managing the construction of the Fed Buildings.’

Appointed by Trump in 2017, Powell has drawn the President’s ire for keeping rates anchored above 4 percent.

The Fed establishes interest rates to balance two objectives: low inflation and a robost jobs market.

Typically, the Fed can lower rates to boost job growth or increase rates to cut back inflation.

Those goals are becoming trickier. July’s jobs report was bleak, while the month’s inflation rate continued to climb. Economists are mixed about the right way to proceed.

‘If both are moving in the wrong direction – like they are now – the Fed will be forced to address the bigger risk,’ Bret Kenwell, an investment analyst at eToro, told the Daily Mail.

‘With inflation on the rise, the committee is being put in a tough spot, but when push comes to shove, they will likely do what’s necessary to save the jobs market given how vital it is to the economy.’

Yesterday, Trump officials got another headline that could help push for a rate cut: homebuilders set a new low-mark for new housing sales since 2022.

Scott Bessent, the US Treasury Secretary, said he wants to see a rate cut to help the US housing market

Investors have been closely watching the White House’s decisions on the next Fed chair – many want a rate cut to lower borrowing costs

The Housing Market Index, or HMI, which combines survey results from contractors and real estate metrics from new home sales, fell to 32 out of 100.

It last dropped to 31 in December 2022 when interest rates initially started to rise.

Bessent reiterated the administration’s case for easier money, arguing that cheaper borrowing could revive that sluggish housing market.

‘If we keep constraining home building, then what kind of inflation does that create one or two years out?’ Bessent said on CNBC.

‘So a big cut here could facilitate a boom or a pickup in home building, which will keep prices down one two years down the road.’

Share or comment on this article:

Race to become most powerful person in finance begins – and how it affects your wealth