Bond Market Update: US 10-year Yield up to 4.330%

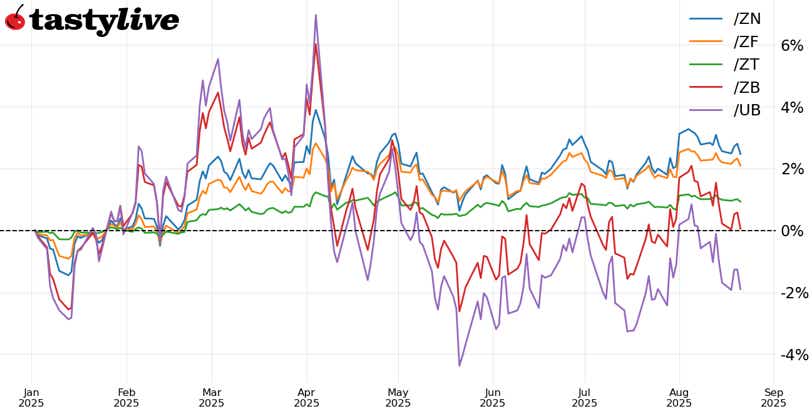

Fig. 1: Week-to-date price percent change chart for /ZT, /ZF, /ZN, /ZB, /UB

Bonds Key Takeaways:

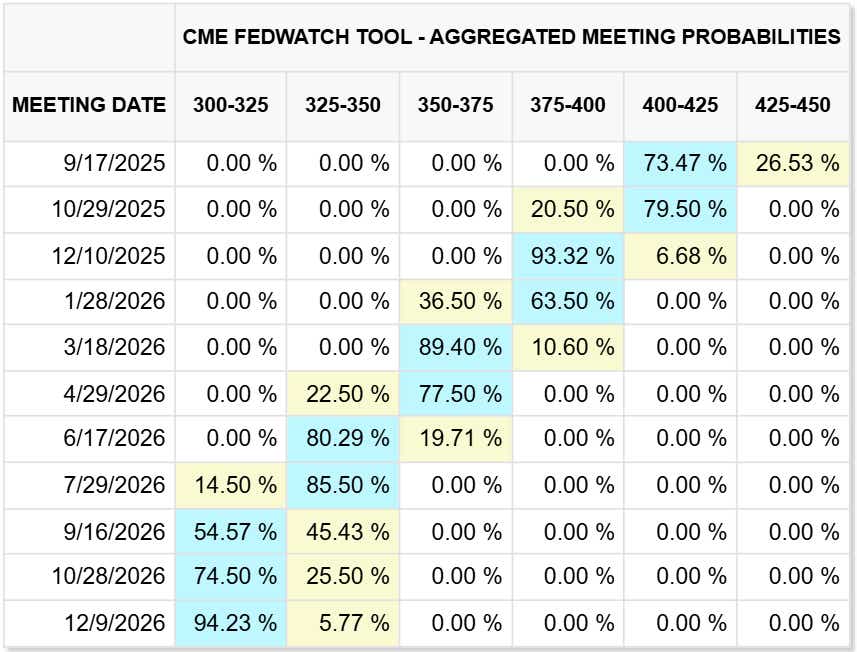

Fed Chair Jerome Powell’s speech at the Jackson Hole Economic Policy Symposium on Friday, August 22 is the most important macro event of the week – and perhaps from now until the next Fed meeting on September 17. In the run-up to the remarks, traders have taken a decidedly more level-headed view: the odds of a 25-bps rate cut in September has plummeted from 100% last Thursday to just 74% today:

Fig. 2: CME FedWatch Tool – Meeting Probabilities Through December 2026

Scant expectations of a 50-bps rate cut in September (5.7% chance at their peak last Thursday) have likewise been eliminated. What hasn’t changed is the fact that markets are still expecting Fed Chair Powell to communicate at least two 25-bps rate cuts in 2025. The degree to which Fed Chair Powell makes a promise for a September rate cut (from ‘not happening’ to ‘data dependent’ to ‘definitely happening’) matters, but not as much as it mattered a week ago.

With another inflation report and another jobs report due prior to the September meeting, it makes little sense that the FOMC would be too committal one way or the other, and it’s fair to surmise that traders are back in that headspace of Powell et al leaning towards a cut rather than guaranteeing one after the shift in rates pricing in recent days.

As for the trade? Nothing changes. Both 10s (/ZNU5) and 30s (/ZBU5) have been choppy in the post-Liberation Day world, largely tethered to the midpoint of the year-long trading ranges. Last year, when the Fed cut rates by 50-bps in September, the long-end of the curve blew out; a non-committal, dovish-leaning Fed is less of a risk.

/ZN US 10-year Note Price Technical Analysis: Daily Chart (2025 YTD)

Since the start of June, 10-year Treasury notes (/ZNU5) have traded within the confines of the 38.2% and 61.8% Fibonacci retracements of their 2025 trading range in all but three sessions. The midpoint of the range sits closer to 111’16, which is effectively where 10s were trading at the time this note was written; the 50-day EMA (exponential moving average) resides there as well. Momentum indicators (MACD, Slow Stochastics) are receding but remain in ‘bullish’ territory north of their median lines. Volatility is low (IVR: 7.2), but traders can still find opportunities around the year-long range.

Strategy: (64DTE, ATM)StrikesPOPMax ProfitMax LossShort Iron Condor

Long 108 p

Short 109 p

Short 114 c

Long 115 c

63% +203.13 -796.88 Short Strangle

Long 108 p

Short 109 p

Short 114 c

68% +484.38 x Short Put Vertical

Long 108 p

Short 109 p

90% +93.75 -906.25 /ZB US 30-year Bond Price Technical Analysis: Daily Chart (2025 YTD)

Similar to /ZNU5, the technical picture for 30-year Treasury bonds (/ZBU5) is choppy at best. The series of higher highs and higher lows since May has continued, but 30s are losing momentum below their EMA cloud (5-day EMA, 21-day EMA, and 50-day EMA). And like in the 10s, the 30s are meandering in the area around the midpoint of the yearly high-low trading range. As it were, directionally neutral strategies have worked best in the past few months, and from this analyst’s perspective, “if it ain’t broke, don’t fix it.”

Strategy: (64DTE, ATM)StrikesPOPMax ProfitMax LossIron Condor

Long 108 p

Short 109 p

Short 119 c

Long 120 c

64% +250 -750 Short Strangle

Short 109 p

Short 119 c

70% +1015.63 x Short Put Vertical

Long 108 p

Short 109 p

86% +140.63 -859.38

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx