MERGING your pension pots can boost your savings by thousands of pounds – but there are seven things you need to consider before you do it.

The Sun’s money team explain how you can find your lost pension cash and the best place to get advice when it comes to your retirement fund.

2

Combining your pension pots can boost your savingsCredit: PA

You’ll probably have an average of between six to 12 jobs in your lifetime, which could mean lots of different pension pots and with each one, you’re paying an admin fee.

By combining your pots, you could cut down these fees and boost your retirement fund by tens of thousands of pounds – giving you an opportunity to spend more on things like your family, home or travel.

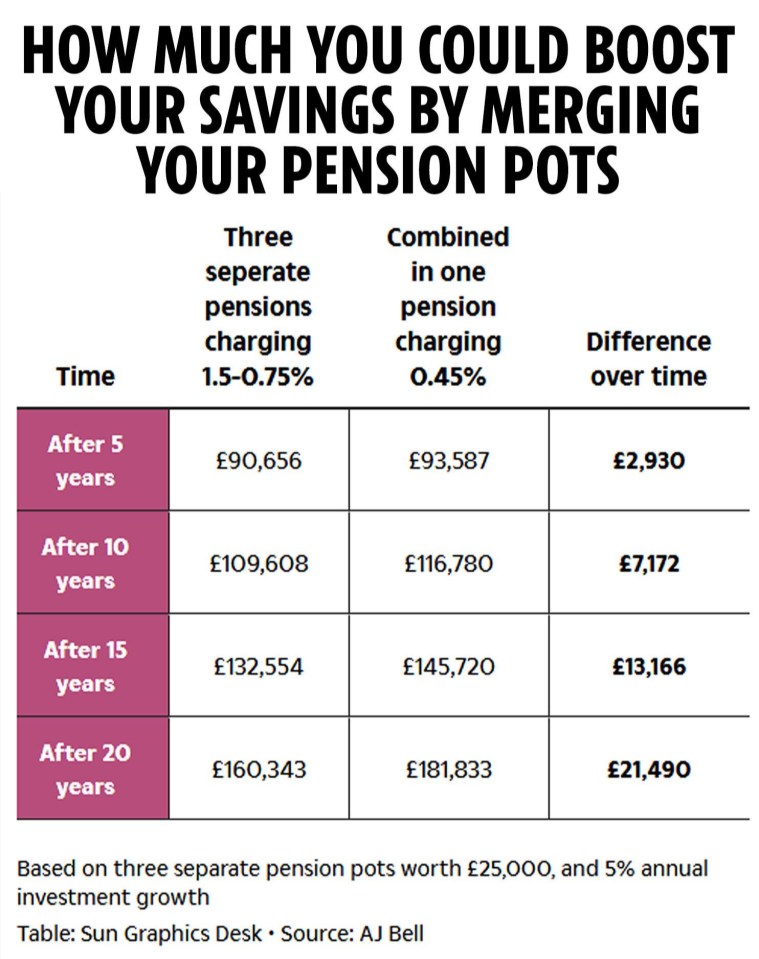

For example, a worker with three pension pots with £25,000 each from previous jobs who combined them and found a lower fee could add £20,000 to their retirement fund over 20 years.

The savings are not to be sniffed at! But it’s a complex process, which is why we’ve spoken to experts to help you track down lost posts and what you need to consider when you merge pensions.

2

Tracking down lost pots – are you missing out on cash?

Millions of people have “lost” pension pots from previous employers.

Recent estimates show 3.3million lost pots worth a combined £31billion – up from 2.8million worth £26 billion two years ago, says the Pensions Policy Institute.

Each lost pot is worth a whopping £9,393 on average.

You may have lost track of your pot if you’ve changed jobs because of auto-enrolment, which is when you are automatically placed into a workplace pension scheme.

By law, firms with a certain number of employees must open pension schemes for anyone over the age of 22 earning more than £10,000 a year.

The pension provider may also lose track of your contact details if you forget to update them.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, said: “There’s always a chance there that if you’ve forgotten about this pension, there could be a pot worth £10,000 or even more washing around in the system that you’ve got no idea about.”

How to protect your pension and Inheritance from the new Budget

In April, the government announced plans from 2030 to bring small pension pots together automatically, increasing pots for workers by an average of £1,000.

There are now 13 million small pots holding less than £1,000, and it costs £225million a year in unnecessary admin costs.

First, you should check any old paperwork from previous employers, such as your pension details, statements and payslips.

You will need details such as the name of the pension provider and the policy provider.

If you have lost your paperwork, you can still trace your pension pot by contacting your previous employers.

They should be able to tell you which pension scheme you are enrolled on.

Or, you can use the Government’s free Pension Tracing Service that can help you track down lost pension pots – https://www.gov.uk/find-pension-contact-details.

You will need to have the name of your employer or pension provider to use the service.

It won’t tell you whether you have a pension or what its value is, but it will give you contact details for the provider or your former employer.

Another free service for tracking your pensions is Gretel.

This works differently from the Government’s Pension Tracing Service, so it might be able to help you track employers you’ve forgotten about.

You’ll just need to create an account using your email address and a password, and then provide your name, date of birth, phone number and postcode.

Gretel will then run a soft search on your credit report (which won’t impact your score) to try to track down missing pensions.

If you do find a lost pension, you can get guidance for free on what to do next.

Over-50s can speak to Pension Wise, while everyone else can go to MoneyHelper.

I found £200,000 in lost pensions and it means I’m £2,500 a month richer

WHEN Carole Railton tried to track down a lost pension she found the adviser had shut up shop.

But three years ago the 73-year-old, who lives in Wapping, London, tracked down the lost cash and is now £2,500 a month richer.

In the late 1980s, Carole had been working for Xerox when a financial adviser persuaded her to switch from a company pension.

She, like thousands of others, had become a victim of pension mis-selling, where savers were lured into leaving gold-plated company pension schemes in favour of inferior self-funded personal pensions.

Carole, a body language expert, tried to track down her pension numerous times after leaving Xerox in the 1990s.

Eventually she got in touch with a financial adviser who managed to track down her lost pension.

Her lost fund was worth just over £200,000, which she used to buy an enhanced annuity which pays her £2,500 a month.

Seven things to check before you merge pots

For many people, merging their pension pots can have plenty of benefits.

But you should check you’re not going to lose out if you do so, because it’s not the best option for everyone.

Here’s everything you should check first…

How much are the fees?

Pension providers usually charge fees for investing and managing your pot if you have a defined-contribution pension.

This is where what you get in retirement depends on how much you have saved and how well your investments have performed.

Switching to a scheme that charges lower fees could save you thousands.

There are often lots of different charges you may have to pay, including monthly charges, platform charges, contribution charges and set-up charges.

These may be higher if you’re on an older plan, which is if you reached state pension age before 2016.

If you had £100,000 saved in your pot and paid 0.75% in charges while getting 5% investment growth, you could expect to have £233,000 saved after 20 years.

But if your fees were higher at 1.5%, you could have £201,000 after 20 years.

You should check the small print of your pension plan, as some fees might only appear there.

Where your pensions are invested

Consolidating could boost your investment return by giving you access to better-performing funds.

Lisa Picardo, chief business officer at PensionBee, says: “Bringing your pensions together into a single plan can allow you to make a much more informed investment choice to get a better long-term outcome, so it really enables your money to work harder for you.”

Although past investment returns can’t predict the future, it’s still worth doing your research into how well they’ve performed.

How much can you take out tax-free

The earliest you can take money out of your pot is age 55.

Then, you can take 25% out of your pot tax-free, and whatever is left over will be subject to your usual rate of income tax.

However, some plans let you take more, often older company pensions.

If you have one of these and want to withdraw a lump sum at retirement, then you might want to stick with your current provider.

Whether your workplace scheme is better than a private provider

Pension consolidation schemes can often work out to be cheaper and more convenient.

But it’s still worth checking what you get with your current workplace scheme.

For example, it might have negotiated lower fees.

Large exit penalties

Some pension funds have costly exit penalties if you want to leave, so it’s worth checking what the fee is first.

Most default work pension funds have cheap charges now.

But if you have an older pension, there might be more costly exit fees.

Exit fees are capped at 1% after you reach 55 so it’s worth bearing this in mind.

Ongoing employer contributions

If you’re currently employed, you’ll be getting free employer contributions into your work scheme.

Therefore, you won’t want to lose that cash coming into your pot by transferring out.

Protected pension ages

You should find out the age rules for your work and other personal pensions.

The minimum age you can start accessing your private pensions will rise from 55 to 57 overnight on April 6, 2028.

But some people will continue to be able to access their funds at the age of 55 if their pension scheme allows it.

If you transfer out then you could miss out on this benefit.

I found £60k in lost pension cash

HOSPITALITY worker James Wells couldn’t believe his luck when he stumbled upon a small fortune in forgotten pension pots.

The 47-year-old figured he must have retirement savings somewhere he had forgotten about.

But he could never have anticipated unearthing four different pots of cash each worth tens of thousands.

James, from near Swindon, had hopped between hospitality jobs for his whole career, meaning he often switched pensions and had lost track of some along the way.

After deciding to get his retirement savings in order, he stumbled across the app Penny.

James soon discovered four different pension pots dating back to 2003, including three with Aviva and one with a firm called Nest.

They all varied by amounts, ranging from £2,000 to a whopping £48,000.

James said the whole process was surprisingly straightforward.

“I put in my personal details, past addresses, and the companies I’d worked for and Penny did the groundwork,” he said.

Within weeks, the app had tracked down all his pensions from past jobs, and James couldn’t believe it.

How to merge pots

You’ve tracked down your pots and reviewed the terms and conditions, now it’s time to find a pension you can consolidate into.

A Self-Invested Personal Pension (SIPP) gives you more control over your investing choices, and they are offered by the likes of AJ Bell, Fidelity, Hargreaves Lansdown and Interactive Investor. Check fees and terms and conditions before you open one.

You could use a service like Pensions Bee, which helps track down and consolidate pensions and then invests them for you, for a small fee.

You need to check if your current scheme allows you to transfer it and whether the scheme you want to open will accept it.

Don’t forget to get free advice before you start, from Pension Wise (if you’re over 50 and have a UK-based defined contribution pot) or MoneyHelper if you want help.

Another option is to speak to a financial adviser, although these can be charged on a flat fee or an hourly basis. You can use unbiased.co.uk to find one.

The process usually takes a few weeks to complete.

What information you’ll need

IF you’ve decided to consolidate, here’s a checklist of all the information it’s worth gathering…

How many pensions you haveHow much is in each pot Which provider each pension is with (or the employer if you’re planning to trace lost pots first)Your policy or scheme number Any specific benefits or guarantees associated with each pension pot Potential exit fees Copies of any letters, statements or other documentation related to your pension Your personal details: name, address, date of birth and National Insurance Number Your bank details (for any refunds or future payments) Avoid these merging mistakes

If you have a defined benefit pension, it’s usually best to leave it alone.

Also known as “final salary” pensions, these schemes guarantee you an income for life in retirement that rises with inflation.

This makes them super generous and is now rarely offered by private companies to workers.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, says it “very rarely makes sense” to transfer out of a defined benefit pension scheme because they are “really, really valuable”.

Check whether you will lose any valuable benefits by merging.

For example, some plans offer guaranteed annuity rates, which set how much you’ll get per year, every year.

Your pension provider may offer a higher rate that beats the market, especially if your pension pot was set up back in the 1980s and 1990s.

Lisa says it’s “crucial” to check if you have this because it’s not worth giving up even if you want the convenience of consolidation.

Your pension provider should make you aware, as you approach retirement, if you have a guaranteed annuity rate.

But you can also check the terms and conditions of when you first joined the pension, or contact your provider directly.

Beware of scams

YOU should be aware that scammers often try to take advantage of people moving their pensions.

For example, some will try to get hold of your money by offering a fake pension transfer service.

Always do your research to make sure you’re dealing with a reputable, well-known company that is regulated by the Financial Conduct Authority or The Pensions Regulator.

Helen Morrissey says: “If you get out of the blue communication from someone offering pension consolidation or anything like that, that is an immediate red flag because you wouldn’t get that kind of out of the blue contact there.”

If you’re concerned you can contact Pension Wise online here or you can call them on 0800 138 3944.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories