Disposable income fell for 60 per cent of households across Britain in the year to July in what is being termed a ‘resurgence’ in the cost-of-living crisis.

It is the first time middle-income households have seen a yearly fall in their spare cash since September 2023, according to Asda’s Income Tracker.

The data comes as households are now bracing themselves for potential further tax hikes as Rachel Reeves gears up for the Autumn Budget.

Dwindling disposable income levels are also being blamed on higher inflation, which reached 3.8 per cent in July.

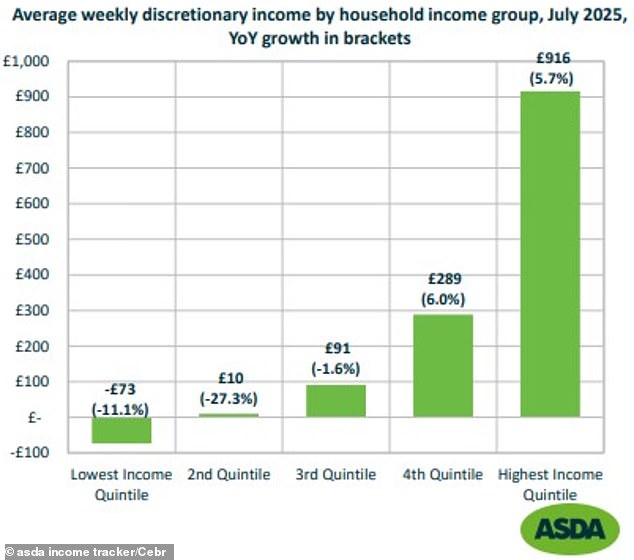

According to Asda’s data, middle-income households – those typically bringing in £41,000 in gross annual earnings – saw their disposable income slip by 1.6 per cent to £91 per week in July, representing the first fall in two years.

Falling: Households with lower incomes saw their disposable incomes drop in July

While Labour has vowed to protect the pockets of working people, the figures suggest lower-income households bore the brunt of higher costs and falling disposable income.

The lowest-income households experienced an 11.1 per cent drop in spending power, resulting in a shortfall of £73 per month between earnings and essential spending, the findings show.

Meanwhile, households in the next income bracket up, earning around £27,000 a year before tax, saw their disposable income fall by 27.3 per cent to just £10 in July, according to the data.

Households in higher income brackets remained ‘insulated’, but the gap between income growth and rising costs is ‘narrowing’ for this category, Asda said.

The cost of essentials, including food, drink and transport, rose by 5.1 per cent year-on-year, piling further pressure on household budgets.

As earnings growth begins to ease and tax contributions rise, all households are likely to ‘feel the squeeze in the months ahead’, Asda said.

Inflation is expected to stay above the Bank of England’s 2 per cent target well into 2026, it added.

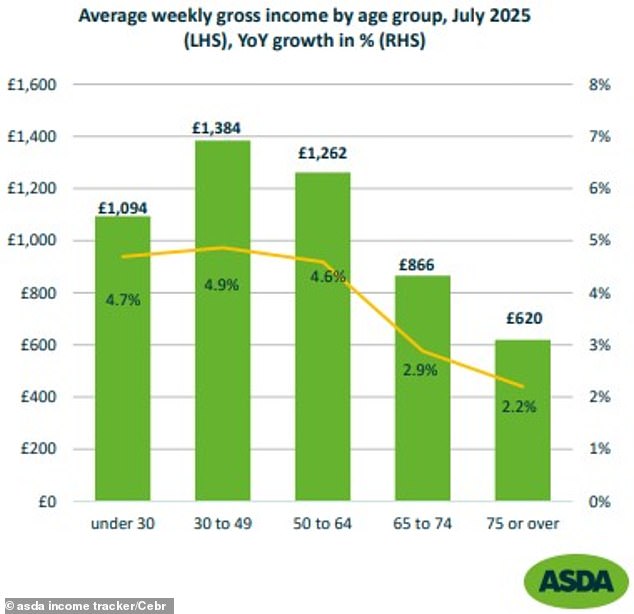

Gross incomes in July were higher across all age groups compared to a year ago, but the pace of growth has slowed across the board.

All age groups saw the second consecutive month of accelerating essential spending costs, ‘highlighting the resurgence of the cost-of-living crisis’, according to the report.

Asda said: ‘Gross income growth continues to exceed that of deductions, but the gap is narrowing, as both tax contributions and essential costs rise.’

Discretionary income is the income that is left over after you subtract all essential and fixed deductions and costs, while disposable income is the income left over after deducting personal taxes from your salary.

Variations: Average weekly gross income by age group, according to Asda’s Income Tracker

Tougher times for pensioners

Pension-age households saw the weakest gross income growth since October 2022, with those aged between 65 to 74 recording income rises of 2.9 per cent and those 75 and over rising 2.2 per cent.

Asda said: ‘Although the triple lock continues to uprate pensions, slower earnings growth relative to last year and persistently high inflation have constrained real income growth for these households.’

In July, pension-age households and those under 30 experienced a year-on-year contraction in discretionary income.

Tough times: Pension-age households saw the weakest gross income growth since October 2022 in July, Asda said

Households under 30 saw gross income growth of 4.7 per cent year-on-year in July, while those aged 50 to 64 recorded a 4.6 per cent increase.

In absolute terms, households aged between 30 to 49 had the highest gross income, amounting to £1,384 per week in July.

On the outlook for households spanning all age groups, Asda said: ‘Looking ahead, earnings growth is expected to outpace inflation, supporting further increases in spending power across households.

‘However, the benefits will vary, with working-age households likely to see stronger improvements than pension-age households.

‘Overall, spending power growth is expected to be muted across all groups in the near term.’

Sam Miley, head of forecasting and thought leadership at Cebr, said: ‘While wages are expected to rise over the remainder of the year, persistently high inflation will put continued pressure on purchasing power, weighing on further gains in the Tracker.’

Higher inflation piles pressure on households

Official data last week revealed inflation rose to 3.8 per cent in the year to July, up from 3.6 per cent in June. The upturn in inflation was largely driven by higher air fares and food prices.

At 3.8 per cent, inflation in Britain has reached its highest since January 2024 and remains above the Bank of England’s 2 per cent target.

Higher food prices have been driven by increases in the cost of beef, chocolate and confectionery, instant coffee, and fresh orange juice, according to the Office for National Statistics.

This week, data from the British Retail Consortium showed food inflation hit 4.2 per cent in the year to August, up from 4 per cent in July, adding that it looks set to rise to 6 per cent by Christmas.

The Bank of England expects broader inflation to peak at 4 per cent in September.

Amid higher inflation, the Bank is expected to ease the pace of further interest rate cuts.

On 7 August, the Bank voted for a fifth interest rate cut in a year. In one of its closest decisions since its independence more than a quarter of a century ago, the Bank’s monetary policy committee voted by 5 to 4 to trim its key base rate by a quarter percentage point to 4 per cent, spelling bad news for savers.

SAVE MONEY, MAKE MONEY

Sipp cashback

Sipp cashback

Up to £2,000 cashback until 31 August

![]()

4.42% cash Isa

![]()

4.42% cash Isa

Trading 212: 0.57% fixed 12-month bonus

£20 off motoring

£20 off motoring

This is Money Motoring Club voucher

Investing Isa offer

Investing Isa offer

1% back (max £200) when adding £5,000+

No fees on 30 funds

No fees on 30 funds

Potentially zero-fee investing in an Isa or Sipp

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence. Terms and conditions apply on all offers.