The XRP ecosystem delivered notable growth in the second quarter of 2025, according to a detailed report from Messari.

The analysis highlighted rising market caps, increasing adoption of Ripple’s stablecoin RLUSD, and key ecosystem infrastructure upgrades that strengthen XRP’s role in the global financial landscape.

Market cap and price performance

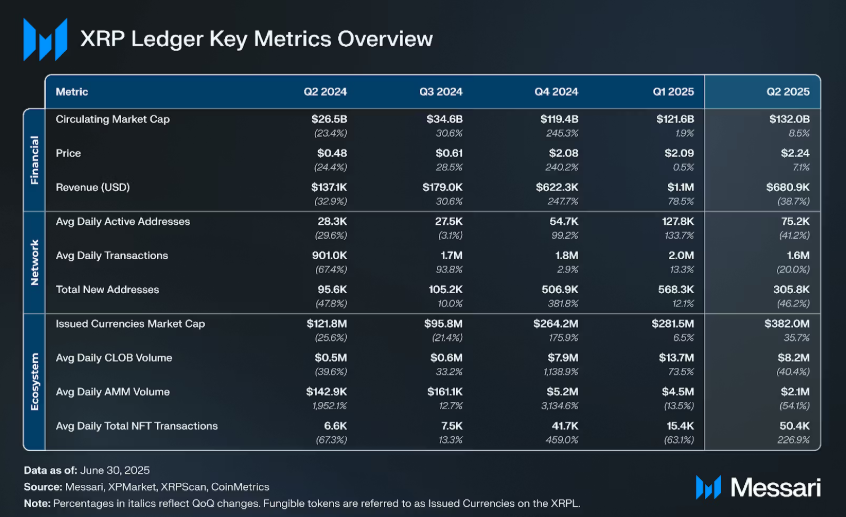

XRP’s circulating market cap reached $132 billion at the end of Q2, an 8.5% increase from the previous quarter. Prices followed the uptrend, with XRP closing at $2.24, up 7.1% quarter-over-quarter. The token peaked at $2.65 in May and later consolidated near $2.82 in July before retracing. Notably, the market cap has since rallied further to $167.8 billion, pushing XRP into the world’s top 100 assets by valuation.

Despite the strong performance, network revenue declined from $1.1 million to $680,900 in Q2 due to a slowdown in daily transactions from 2 million to 1.6 million. However, Messari stressed that XRPL is not designed to prioritize revenue from fees.

RLUSD and stablecoin growth

Ripple’s dollar-pegged stablecoin, RLUSD, continued to expand rapidly. On the XRP Ledger, its market cap climbed 49.4% to $65.9 million, while the Ethereum-based version nearly doubled, hitting $390 million by quarter’s end. The combined valuation of RLUSD closed Q2 at $455.2 million, and recent data shows it has since surged to $701.6 million.

Tokenization and institutional focus

The quarter also saw progress in real-world asset (RWA) tokenization. The RWA market cap on XRPL increased 13% to $131.6 million, led by the Montis Group Limited (MGL) project in collaboration with Archax. This aligns with Ripple’s long-term projection of an $18.9 trillion tokenization market by 2033, a sector analysts say could position XRP as a top institutional exposure asset.

Infrastructure upgrades and ecosystem expansion

Key technological milestones were also achieved. On June 30, the XRP Ledger launched its EVM sidechain, enabling Ethereum-style programmability and expanding access to over 35 blockchains via a Wormhole partnership. Additionally, the debut of XAO DAO introduced decentralized governance and a grant program to further ecosystem growth.

Outlook

With its market cap climbing, stablecoin adoption accelerating, and infrastructure expanding, XRP’s Q2 performance underscores its strengthening role in both retail and institutional markets. Analysts suggest that continued tokenization efforts and growing interoperability could cement XRP’s position as a key player in the next phase of blockchain finance.

Kosta has been working in the crypto industry for over 4 years. He strives to present different perspectives on a given topic and enjoys the sector for its transparency and dynamism. In his work, he focuses on balanced coverage of events and developments in the crypto space, providing information to his readers from a neutral perspective.