In the current market environment characterized by ample liquidity, the focus is again on technology centered around AI.

Zhitong Finance APP has learned that Dongwu Securities has released a research report stating that from June to August, the market’s main focus revolves around artificial intelligence. Currently, the market is primarily concentrated on upstream infrastructure hardware, with the most certain sectors of prosperity, such as overseas optical modules and PCBs, having started to gain traction in June. By mid-August, domestically produced computing power centered around Cambricon officially began to recover. Given the ample market volume and the absence of significant flaws in industrial logic, it is not believed that the computing power market is about to end. However, for those holding cash outside the market, the strong profit-making effect of upstream hardware is causing restlessness, and the objective continuous increase in profit margins will bring some profit-taking pressure. Subjectively, the accumulated gains inevitably heighten anxiety among low-risk appetite funds.

In the current AI market cycle, the core reason for the stagnation in downstream applications is insufficient short-term certainty—no blockbuster products with breakout effects or smooth business models have emerged, which corresponds to insufficient performance visibility at the listed company level, making them not the first choice for funding in this cycle. However, from the perspective of the evolution of technological waves, the ultimate realization of AI empowering all things will certainly be achieved through the application end, meaning that the outbreak of applications has medium-term certainty and a broader scope than upstream hardware. This has already been validated in the ‘Internet Plus’ wave ten years ago and the corresponding stock market trends, indicating that the launch of the AI application market is merely a matter of time.

In the current market environment with ample volume, the main focus is again centered on technology with AI at its core. If there is a loosening of chips on the upstream hardware side (for example, a 20% adjustment in core targets), then it only requires some marginal events that are sufficient to attract market attention (such as the H20 safety issue and the DS model’s FP8 leading to a shift in the domestic computing power market from obscurity to clarity). The lower-tier branches within AI will show strong elasticity, but joining on the right side at that point will result in losing a portion of the odds, facing the same dilemma as the current question of ‘whether to chase the rise in computing power.’ Therefore, it is recommended to actively position in the downstream application sectors of AI+ innovative drugs, AI+ military industry, AIGC, edge AI, humanoid robots, and smart driving based on the certainty of mid-term industrial logic, treating them as a form of ‘call option.’

In the current market environment with ample volume, the main focus is again centered on technology with AI at its core. If there is a loosening of chips on the upstream hardware side (for example, a 20% adjustment in core targets), then it only requires some marginal events that are sufficient to attract market attention (such as the H20 safety issue and the DS model’s FP8 leading to a shift in the domestic computing power market from obscurity to clarity). The lower-tier branches within AI will show strong elasticity, but joining on the right side at that point will result in losing a portion of the odds, facing the same dilemma as the current question of ‘whether to chase the rise in computing power.’ Therefore, it is recommended to actively position in the downstream application sectors of AI+ innovative drugs, AI+ military industry, AIGC, edge AI, humanoid robots, and smart driving based on the certainty of mid-term industrial logic, treating them as a form of ‘call option.’

The main points of Dongwu Securities are as follows:

The ultimate outcome of the technological wave must be the empowerment of all things, which was already confirmed during the ‘Internet Plus’ era. From the perspective of industrial trend evolution, the rise of AI applications is inevitable, and the latter half of the AI market will revolve around the application end.

Taking the ‘Internet Plus’ industrial wave from ten years ago as an example, with the technological advancements and penetration rates of upstream infrastructure construction and edge interactive entry-level hardware, the outbreak of downstream applications is an inevitable trend from the ultimate perspective. However, when and in what form this will occur requires retrospective observation. Additionally, from both spatial and temporal dimensions, the sustainability of the downstream application market is stronger than that of upstream hardware.

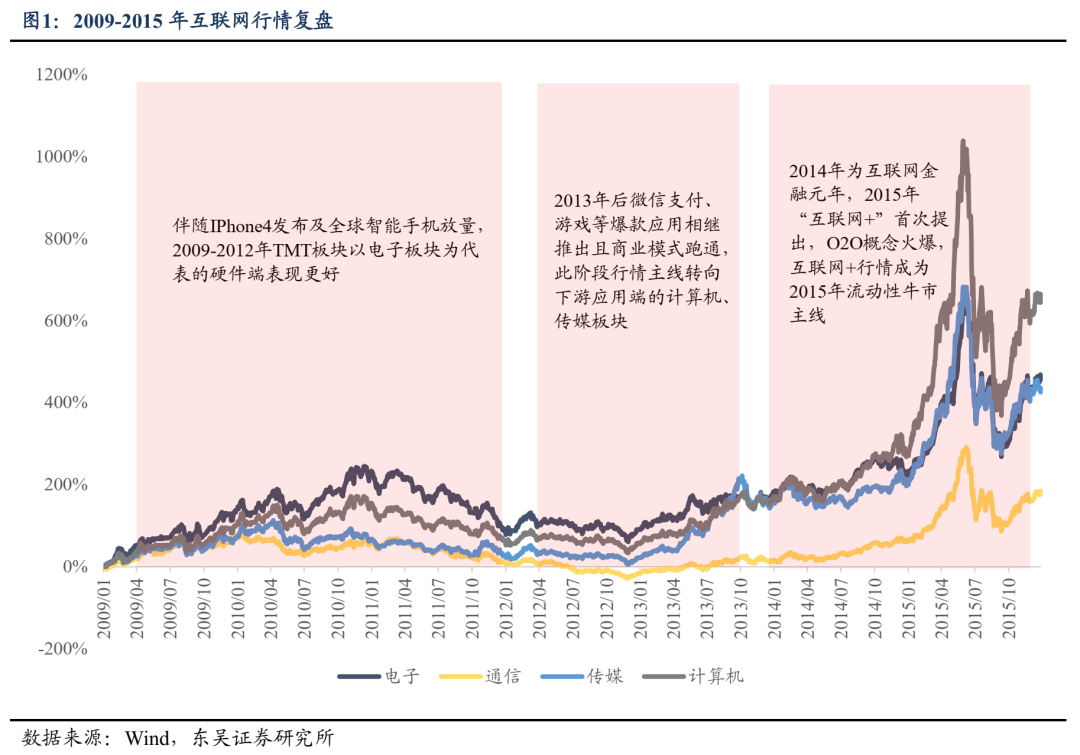

From the perspective of time, the main trend in upstream hardware from June 2009 to December 2010 was the consumer electronics market surrounding the fruit supply chain, lasting approximately 1.5 years. Subsequently, although the server sector saw upward movement from 2013 to 2015, it mainly consisted of sporadic trends. The downstream application market, which started in January 2013, did not peak until June 2015, lasting two and a half years. From a spatial perspective, the mobile internet market from January 5, 2009, to June 12, 2015, saw the TMT sector, particularly the computer and media segments, exhibit greater upward elasticity, with cumulative gains of 1039% and 710%, respectively, outpacing the hardware electronic and communication sectors, which recorded gains of 697% and 300%.

Specifically:

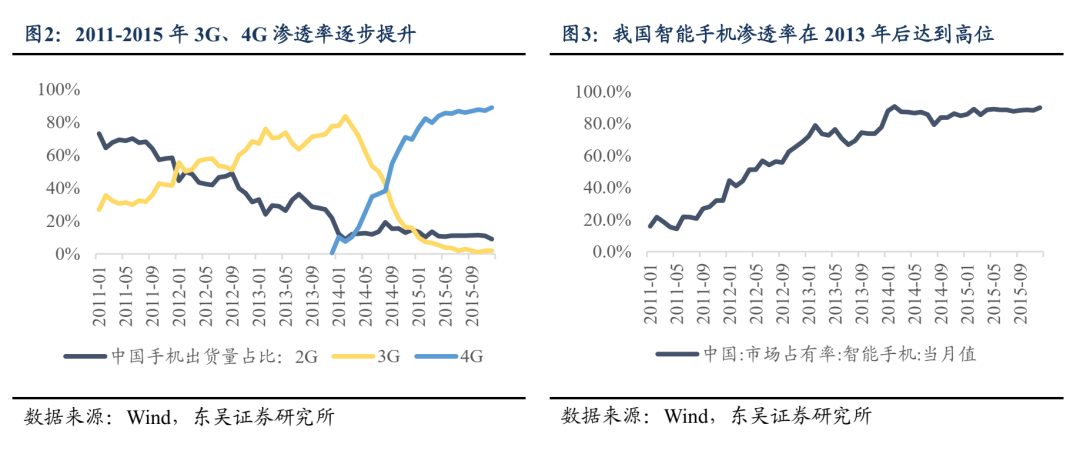

From 2009 to 2012, the mobile internet began to take shape, with 3G penetration rates steadily increasing. The release of the iPhone 4 stimulated the global smartphone market, leading the direction primarily represented by the hardware sector, with a trading logic based on growth. Additionally, the application side saw breakout products exemplified by Sina Weibo, but the commercialization model had not yet proven viable, and internet applications remained in a thematic investment phase.

Since 2013, with the accelerated reduction in costs for 4G and the high penetration rate of smartphones, the mobile internet market extended downstream. In 2013, WeChat launched its payment function, and the ‘free-to-play + in-app purchases’ model pioneered by ‘I am MT’ overcame monetization bottlenecks in mobile games. The user numbers for blockbuster applications like mobile payments and mobile games surged during this period, shifting the market focus from upstream hardware to downstream applications represented by media and computing. In March 2015, the government work report first mentioned the concept of ‘Internet Plus,’ and in July of the same year, the State Council issued the ‘Guiding Opinions on Actively Promoting the Internet Plus Action,’ with top-level design continually expanding downstream application scenarios. The ‘Internet Plus’ concept progressively penetrated the service industry and midstream manufacturing, significantly broadening market scope. Coupled with the liquidity bull market in 2015, ‘Internet Plus’ became the absolute main line of the market at that time. Additionally, the ‘pick-and-shovel’ server segment gradually outperformed smartphones, becoming the leading trend in the hardware sector during this phase.

When viewed independently, the software application market can be roughly divided into two phases: the ‘broad rally under the narrative of Internet Plus’ from 2013 to 2015, and the ‘winner-takes-all leading trend’ from 2016 to 2017. From 2013 to 2015, with the comprehensive penetration of ‘Internet Plus,’ new business models and applications emerged continuously, each with substantial imaginative potential. At this time, the vertical market was still in the land-grabbing phase, and structural issues had not yet manifested. Combined with the background of abundant liquidity, the market experienced a systemic valuation increase, resulting in a ‘rise whenever touched’ trend in software applications.

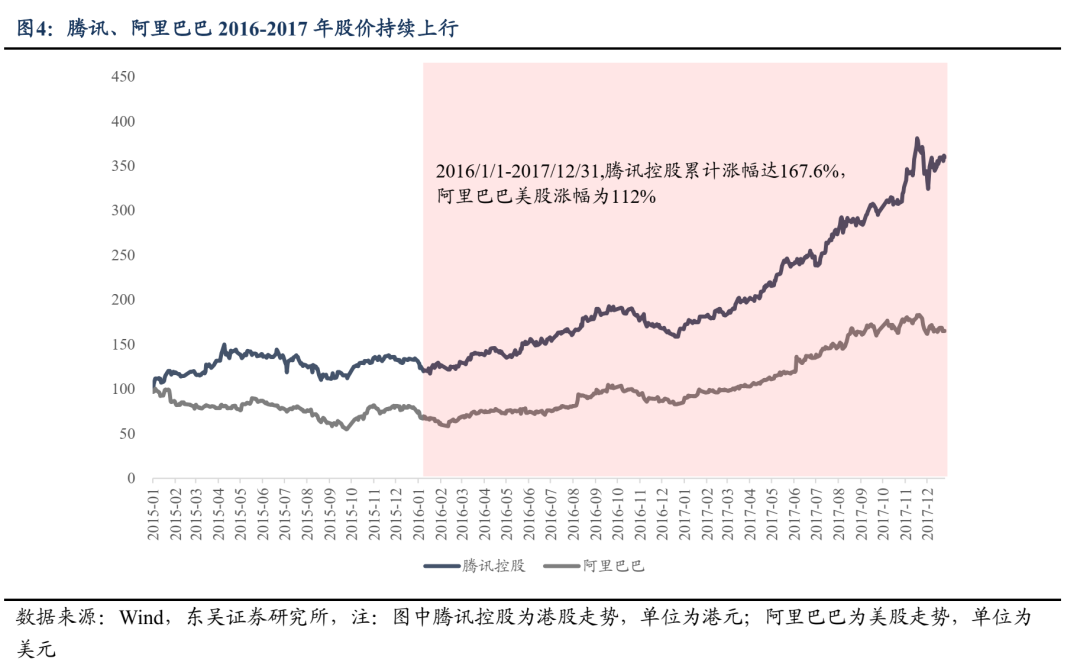

From 2016 to 2017, the market was characterized predominantly by structural trends. On one hand, the initial dividends from internet traffic began to show signs of fading. According to data from the China Internet Network Information Center, the internet penetration rates in China for 2016 and 2017 were 53.2% and 55.8%, respectively, indicating a slowdown in growth compared to the steep increase from 2010 to 2015. The mobile internet gradually shifted towards a stock market, where leading firms continued to expand their market share through advantages in capital, technology, and user resources, significantly compressing the survival space for small and medium enterprises. On the other hand, following the peak of the ‘water buffalo’ market in June 2015, there was a notable period of valuation regression, with market risk appetite clearly declining. This led to higher demands for companies’ performance delivery capabilities. In the highly pronounced Matthew effect in the internet sector, leading companies had greater visibility into their performance. In 2016 and 2017, Tencent and Alibaba achieved high revenue and profit growth, with their stock prices correspondingly trending upward, resulting in gains of 167% for Tencent on the Hong Kong Stock Exchange and 112% for Alibaba on the U.S. stock market from January 1, 2016, to December 31, 2017.

In contrast, what is expected next is a phase of widespread appreciation in the narrative of “AI + market trends.” On one hand, the growth slope of AI application fields has yet to slow down, with both Token usage and the number of AI software users accelerating. According to a press conference held by the National Bureau of Statistics on August 14, the daily average Token consumption in our country is projected to exceed 30 trillion by June 2025, having increased more than 300 times since the beginning of 2024. QuestMobile data also indicates that as of March 2025, the number of active users of AI-native apps has reached 270 million, a year-on-year increase of 536.8%. On the other hand, there have yet to emerge blockbuster AI applications or clear and efficient business monetization models domestically, leading to an insufficient understanding of AI applications in the market. Before the “leading companies emerge victorious,” it is expected that a “hundred flowers bloom” scenario will first appear on the application side.

The realization of a qualitative leap in the AI application sector in our country is backed by multiple factors, including policy and resource endowments.

The latest policy document issued by the central government, the “AI + Action Opinion,” can be compared at the policy level to the “Internet + Action Opinion” from 2015. The top-level design clarifies the development goals of “AI +,” with specific implementation measures expected to be issued by various functional departments, providing a clear “deadline” for the development and implementation of AI downstream applications.

In August 2025, the State Council issued the “Opinions on Deepening the Implementation of the ‘AI +’ Action,” clearly stating that by 2027 and 2030, our country aims to achieve a penetration rate of new generation smart terminals and intelligent agents of 70% and 90%, respectively. By 2035, our country will fully enter a new stage of development characterized by an intelligent economy and intelligent society, emphasizing the extensive and deep integration of artificial intelligence with six key areas: science and technology, industrial development, quality improvement in consumption, public welfare, governance capacity, and global cooperation. Previously, the “AI +” initiative had been included twice in government work reports for 2024 and 2025, but setting specific development targets and implementation timelines is a first. Subsequent local measures to support AI are expected to follow and take effect, accelerating the development of downstream applications.

Our country possesses a natural soil for the vigorous development of AI applications, with the engineer dividend and a large user base forming the foundation for the quantitative to qualitative changes in downstream applications. From a hardware application perspective, the technology-intensive nature of AI terminal hardware is expected to further strengthen compared to previous two technological cycles. Additionally, our unique engineer dividend provides a stronger high-end manufacturing capability than that of emerging industrialized countries and a cost advantage lower than that of North America. For instance, in the largest-scale terminal application scenario of humanoid robots, Tesla’s Optimus mass production will still be best served by Chinese suppliers.

From a software perspective, the advantage of our user base is becoming apparent. According to the “2025 AI Application Market Semi-Annual Report” released by QuestMobile, as of June 30, 2025, the number of monthly active users for mobile AI applications has reached 680 million. The large user base in our country not only creates significant potential market demand, fostering more diverse application scenarios, but also provides a more varied and massive data set to support model training and enhance vertical application capabilities, empowering the development of the AIGC industry chain.

The insights gained from the current domestic chip market indicate that as long as the industrial logic is certain, the initiation of market trends is merely a matter of time.

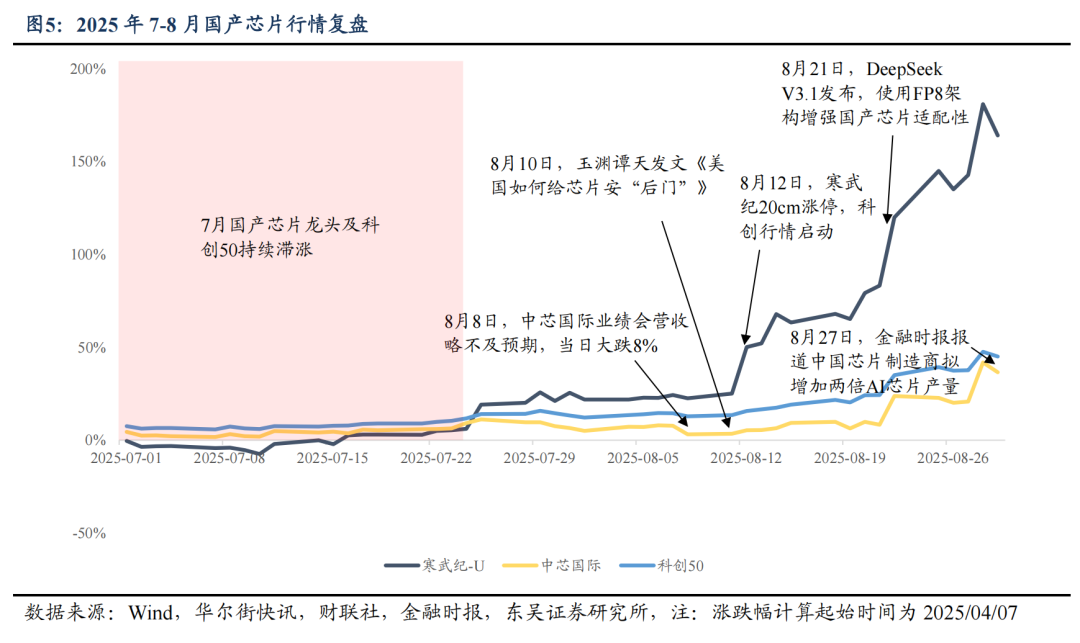

The visibility of fundamentals can affect the priority of sectors in investors’ minds; branches with slightly weaker current economic conditions may lag in performance order. As long as the overall market has ample trading volume and the AI market remains active, the initiation of trend-driven market movements with industrial logic is merely a matter of time. The current domestic computing power market is a typical example.

The reason why overseas computing power hardware has become the leader in this round of market activity lies primarily in its solid current performance, high visibility in mid-term economic conditions, and an undeniable future growth trajectory. In contrast, domestic computing power, edge devices, and software applications fall short on these dimensions. A review shows that this round of overseas computing power chain market activity began at the end of May and has lasted a long time, driven by the validation and upward revision of the current and mid-term economic conditions of computing communications such as PCBs and optical modules by domestic companies like New East and capital expenditure guidance from major overseas cloud service providers. However, during the two-month period from June to early August, the domestic computing power sector remained relatively lackluster.

Investors familiar with the technology sector are well aware that whether NV computing cards are allowed to be exported to China, achieving chip self-sufficiency is a matter of survival in the AI era. The establishment of the National Integrated Circuit Industry Investment Fund Phase III and the Innovation Layer of the Sci-Tech Innovation Board all indicate a clear upper-level guidance to support “technological self-reliance and strength,” meaning that the mid-term logic for domestic chips and upstream manufacturing (wafer foundries, equipment, materials, etc.) is highly certain. However, there has yet to be a landmark event to attract more capital attention, thus lacking the opportunity to initiate market activity.

On August 8, SMIC’s Q3 earnings guidance slightly missed market expectations, leading to significant selling pressure. This indicates that just before the formal initiation of the domestic computing power and semiconductor market, the sector was already in a state lacking profitability. However, based on strong mid-term certainty and abundant market liquidity, the sector’s bottom is slowly rising. Taking SMIC as an example, after being mistakenly sold off on August 8, capital actively bottom-fished, and the market recovered quickly. It was not until August 10 that a media outlet under China Central Television published an article titled “How the U.S. ‘Backdoors’ Chips,” revealing that H20 “is neither environmentally friendly, advanced, nor safe,” and subsequently on August 12, Cambricon hit the daily limit, officially bringing the domestic computing power sector “from darkness into light.”

On August 21, DeepSeek V3.1 enhanced the compatibility of domestic chips using the FP8 parameter architecture. On August 27, the Financial Times reported that Chinese chip manufacturers plan to triple their AI processor output next year. The narrative from the bulls continues to accumulate, strengthening confidence in the sector, with the Sci-Tech Innovation 50 exhibiting significant upward elasticity: from August 1 to 27, the Sci-Tech Innovation 50 rose over 20%, significantly outperforming the CSI 300 and the ChiNext Index, while Cambricon, as a leader in domestic chips, saw an increase of over 90% during this period.

The transition of domestic chips and semiconductors from being “ignored” to becoming the market’s main line is fundamentally a process of building market consensus and accumulating bullish momentum. However, chasing after two consecutive bullish days is likely to incur losses in odds; if one enters the market later and lacks a profit cushion for protection, the holding mentality may also be affected. In the context of a mid-term industrial trend with certainty, it is difficult to accurately predict when significant catalysts will occur to reverse capital attitudes. However, when overall market liquidity is abundant, the downward space for the sector is also very limited. At this point, a preferable strategy is to use an odds-based mindset, positioning relatively low sectors with confirmed industrial logic as “bullish options” on the left side.

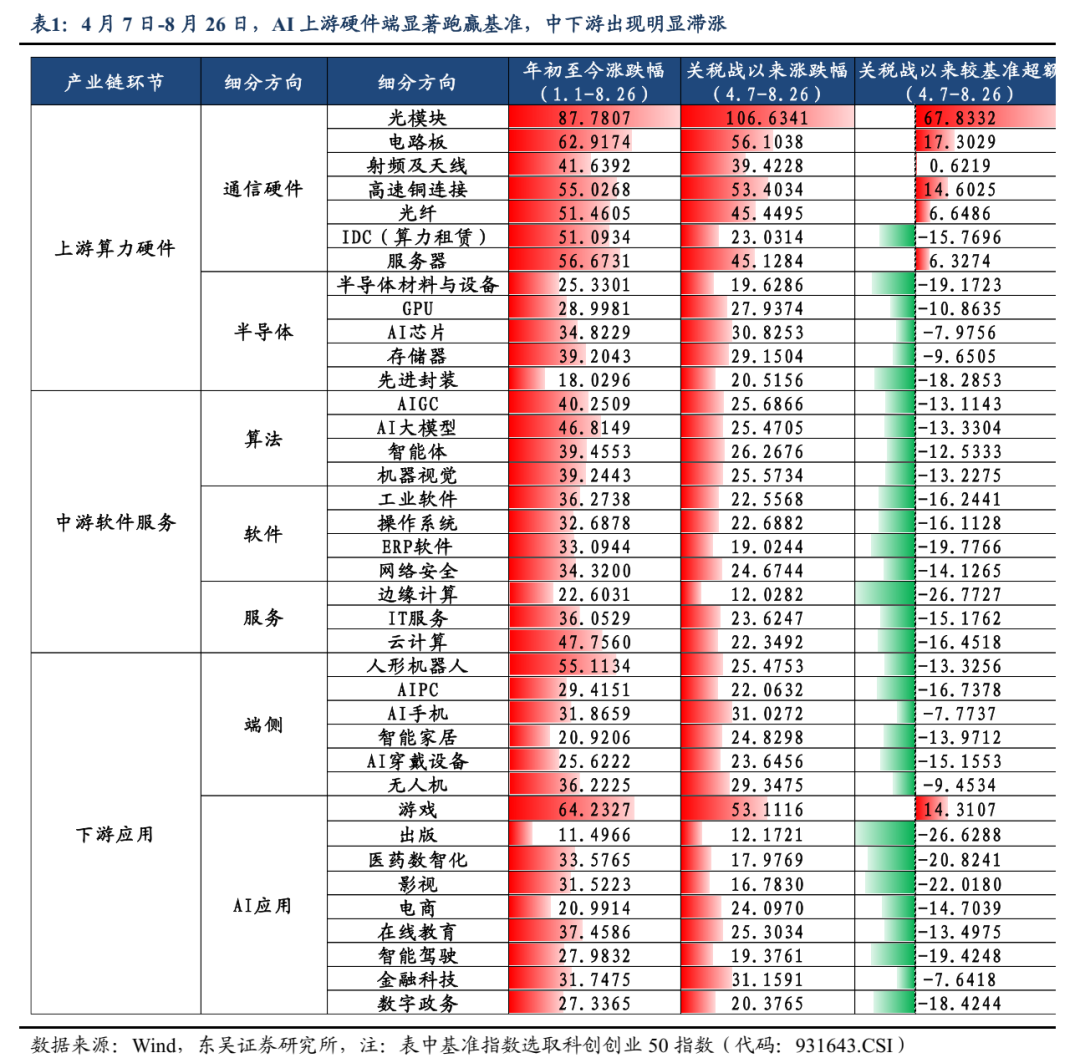

Currently, in the AI market, downstream application sectors are significantly lagging behind upstream hardware, making them a potential configuration direction with odds advantages. The initiation is merely a matter of time since the formation of a “golden pit” in the market following the tariff storm on April 7. If the Sci-Tech Innovation 50 is used as a benchmark, only the upstream hardware sector has outperformed, followed by the consumer electronics and robotics sectors, while the software application sector has shown the least increase. From April 7 to August 26, the performance of the upstream hardware sectors such as optical modules/PCBs/high-speed copper connections/servers outperformed the benchmark by 67.8/17.3/14.6/6.3 percentage points, while only the gaming sector in the mid and downstream software and application sectors outperformed the benchmark by 14.3 percentage points. The remaining sectors such as AIGC/intelligent agents/cloud computing/humanoid robots/AI wearable devices/intelligent driving/e-commerce underperformed the benchmark by 13.1/12.5/16.5/13.3/15.1/19.4/14.7 percentage points respectively.

In terms of domestic software applications, the insufficient capability of models has led to limitations in vertical application capabilities, and the market has yet to see potential performance realization or the imaginative space brought by blockbuster applications in the software application sector. From the perspective of ‘overseas mapping’, the current performance of AI software applications in the US stock market is only reflected in a few companies such as Palantir and AppLovin, without a widespread market trend; the core issue remains that the ‘singularity’ of industrial development still needs to be awaited. This is also one of the concerns for many investors, which makes the stagnation in the AI software application sector particularly evident.

According to the previous analysis, the implementation of applications is an inevitable result of the technological wave. Before leading companies emerge victorious, there will first be a comprehensive market trend based on industrial logic narratives. The trigger points could be a leap in the capabilities of a domestic foundational model and a sharp increase in token usage, a steep rise in the monthly active users/ranking of a certain application, or specific R&D or implementation subsidies from a certain ‘AI+’ policy.

In fact, under a favorable ‘slow bull’ pattern, it is difficult for excess returns within the sector to widen indefinitely. Some holders, fearing high valuations, tend to ‘set up another table’ at lower levels, while some other holders’ profit-taking mentality amplifies with accumulated profits. If there is a loosening of positions in the upstream hardware sector at high levels (oscillation/correction), liquidity spillover will also help enhance the upward elasticity of lower-level branches. For funds missing out in the upstream hardware sector, there is motivation to position at lower levels, where short-term performance visibility is low, but the medium to long-term outcome is certain and the current position has cost-effectiveness in downstream application directions. Based on the odds mindset, it is recommended to actively layout investment opportunities in downstream application directions such as AI+ innovative drugs, AI+ military industry, AIGC, media gaming, AI edge computing, humanoid robots, and intelligent driving sectors.

Based on this, we core recommend the following AI application directions (including hardware and software applications):

AI+ Innovative Drugs: The application of AI in the pharmaceutical field is expected to significantly reduce the cost and time cycle of drug discovery, accelerate target development and verification processes, and also lower the risk of initial trial failures through simulation of clinical trials.

AI+ Military Industry: Artificial intelligence empowers the informatization of military construction by effectively integrating satellite, radar, drone, and other multi-source intelligence data in real-time to construct a comprehensive and precise battlefield situation map, revolutionizing command systems. Unmanned equipment such as robotic wolves and robotic dogs, as well as autonomous combat systems, are another key area of AI+ military industry.

AIGC: The end narrative is complete, but in the short term, due to the pending launch of blockbuster applications, performance visibility is relatively low. Future attention should focus on upgrades of domestic large models, progress in the AI Agent industry, and other catalysts.

Humanoid Robots: The largest-scale application scenario for AI, domestic robot manufacturers are gradually entering the order verification stage, with a focus on the new design updates for Tesla Optimus V3.

Consumer Electronics: A series of new products will be launched intensively after September, with particular attention on the Apple consumer electronics launch event on September 10 and feedback on Meta AI glasses.

Intelligent Driving, Vehicle-Cloud Integration: The VLA technology paradigm is reshaping the landscape of automotive companies, with cloud-vehicle collaborative competition entering an intense phase. This is also an important branch of edge AI, but short-term elasticity is relatively limited due to the competitive landscape among automakers.

AI + Others: AI + Finance, AI + Agriculture, AI + Logistics, AI + Law, AI + Public Administration, AI + E-commerce, AI + Programming, etc.

Risk Factors

The pace of domestic economic recovery is slower than expected; the Federal Reserve’s interest rate cuts are less than anticipated; the strength of macroeconomic policies is below expectations; technological innovation is not meeting expectations; geopolitical risks.