By Mike Riddell, portfolio manager of the Fidelity Strategic Bond fund

“What would you do if you were stuck in one place, and every day was exactly the same, and nothing that you did mattered?” was a question posed by Phil (played by Bill Murray) in the cult classic 1993 film Groundhog Day. Some investors out there might feel similar emotions right now.

This year we’ve faced daily challenges from sovereign bond wobbles, geopolitics, tariff uncertainty, and ongoing war.

And yet most markets are more or less back to where they were at the beginning of 2025, which is roughly where they were in October last year. On a trade weighted basis, even the US dollar is only 1% weaker than at end September 2024, after Chair Powell had surprised markets with a 50bps rate cut (remember that?).

What will it take to shift markets out of the recurring daily time loop? With markets seemingly ‘priced for perfection’ again, then the first answer might be ‘anything’, as I touched on last month. In order to jolt markets into believing something new is about to happen, we’ll probably need the advent of some ‘unknown unknowns’, otherwise known as ‘shocks’. Such an event should cause global investors to reappraise their current benign outlook. By definition, it’s very hard to identify any of these, let alone the risk of them happening.

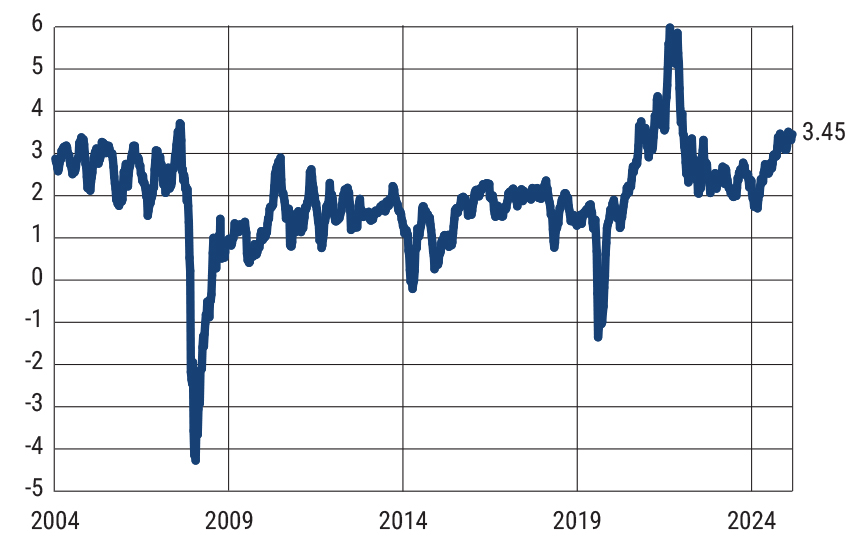

Out of the ‘known unknowns’, the one that bothers us the most, since most markets don’t consider it much of a risk, is US inflation. I say ‘most markets’ because inflation markets themselves are a bit concerned (see chart below). The US inflation rate derived from the inflation swap market, which has had a better track record at forecasting inflation than most, now indicates that US CPI will accelerate to almost 3.5% over the next year.

For context, market implied 1-year ahead US inflation hasn’t been higher than that since the inflation hysteria of August 2022, and that was at a time when realised US inflation was running at over 8%. And US inflation is expected to be sticky at 2.7% between summer 2026 and summer 2027 too, which equates to around 2.4% on core PCE inflation, the measure that the Fed targets.

Despite the likely prospect that US inflation remains well above the Fed’s target in the medium term, the rates market is at the same time pricing in almost another 1.5% of US interest rate cuts. A Fed funds rates at 3% is around what most Fed committee members consider to be ‘neutral’ monetary policy. But we know more aggressive tax cuts will be supporting the US economy from next year, and we can be confident the US budget deficit is going to be around 6% of GDP too.

If US inflation is well above target, then it seems unlikely the Fed is going to want to slash interest rates. The only real way it feels that we’ll get to a 3% or lower Fed funds rate is if the US labour market and economy begin to crumble – but it’s unlikely this would be a great environment to own risky assets. Something doesn’t add up.

It seems that risky assets are priced as richly as they are, precisely because markets think that President Trump will get his way, and the Fed will slash interest rates regardless. Which leaves a lot of room for disappointment if the still independent Fed worries about inflationary pressure and doesn’t deliver on these cuts.

US inflation markets indicate that US CPI will be higher in the next year than in any period outside of peak Covid

Source: Fidelity International, Bloomberg, August 2025

Source: Fidelity International, Bloomberg, August 2025

What we worry about most is a less dovish than expected Fed, which could become outright hawkish if inflation surprises to the upside. We’re defensively positioned within risk assets such as corporate bonds given incredibly rich valuations. Against this, we do own a number of positions across emerging markets, both EM currencies as well as local currency government bonds, as discussed in a previous column.

Being long EM has worked very well so far this year, a rare case of something that has actually moved. For example, the Brazilian real has rallied more than 20% against the US dollar. But a hawkish pivot from the Fed would likely push both the US dollar and US Treasury yields higher, which is what tends to hurt emerging markets too.

As long-term value investors, we still really like EM assets, as they remain exceptionally cheap on an historical basis. But cognisant that a US inflation upside surprise would hurt us, we have added to long US inflation positions a few months ago to hedge some of this risk. Market implied inflation has moved higher, but we think it’s still worth having some protection.

In August, we slashed our US Treasury positions too. We previously thought not enough Fed cuts were priced in given the deteriorating economic outlook, but growing inflation risks mean we now think the market may have moved to price in too many cuts. US government bonds are now one of our biggest underweights.