The increasing complexity of blockchain technology, particularly within decentralised finance, presents new economic challenges, most notably the phenomenon of Maximum Extractable Value (MEV). Daniil Vostrikov from the Moscow Institute of Physics and Technology, Yash Madhwal from the Skolkovo Institute of Science and Technology, and Andrey Seoev from MEV-X, along with their colleagues, investigate MEV on the Polygon blockchain, focusing specifically on a strategy called Atomic Arbitrage. Their research establishes methods for identifying these transactions and analyses the behaviours of those seeking to profit from them, utilising a comprehensive dataset spanning nearly two years and over twenty-three million blocks. The team demonstrates that while certain MEV strategies occur more frequently, others prove significantly more profitable, offering crucial insights into how network design and transaction ordering influence the extraction of value within these decentralised systems and highlighting the need for improved mechanisms to manage this growing complexity.

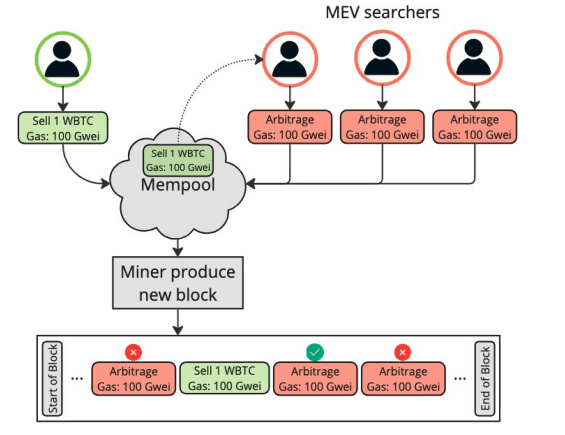

Researchers conducted a comprehensive analysis of MEV on the Polygon blockchain, focusing on Atomic Arbitrage (AA) transactions and revealing key insights into the evolving dynamics of decentralized finance. MEV represents a substantial amount of value extracted from DeFi protocols, impacting users, validators, and the overall health of the ecosystem. Initially focused on simple arbitrage opportunities, MEV has expanded to include more sophisticated strategies like front-running, back-running, sandwich attacks, and liquidations. The rise of Layer-2 (L2) networks introduces new dynamics to MEV, often more concentrated and easily exploited compared to Ethereum mainnet.

The transition to PoS alters validator incentives and introduces new MEV opportunities related to block proposal and attestation. Searchers are employing increasingly complex tools and strategies, including Flashbots, private transaction relays, and specialized MEV-boosting infrastructure. MEV extraction often leads to increased gas fees, slippage, and negative user experiences, creating instability in DeFi protocols. Various approaches aim to mitigate these negative effects, such as Flashbots creating a more transparent transaction ordering. Research focuses on transaction fee mechanisms discouraging MEV extraction and incentivizing validators to prioritize user transactions.

Order Flow Auctions (OFAs) allow users to auction transaction order, potentially capturing MEV value. Transaction encryption hides transaction details, reducing front-running opportunities. Proposer-Builder Separation (PBS) separates block proposal and building, allowing competition for the most profitable blocks. Distributing MEV evenly across validators reduces concentration and manipulation, while designing smart contracts resistant to MEV exploitation is also being explored. A vast body of research underpins these developments, including early MEV analysis and detailed taxonomies of strategies like front-running and liquidations.

Tools and techniques have been developed to detect and measure MEV on blockchains, and protocols like Flashbots and Fairflow aim to mitigate its negative effects. Numerous security audits and vulnerability assessments have identified potential MEV-related risks in DeFi protocols. Understanding and mitigating MEV is critical, as it has significant economic and social implications, requiring a multi-faceted approach involving protocol design, incentive alignment, and ongoing research.

Polygon MEV Reveals Auction Dominance

Findings demonstrate that while Spam-based backrunning strategies are more frequently observed, Auction-based strategies consistently generate greater profitability for those involved. The team established specific criteria for identifying AA transactions, allowing for detailed examination of searcher behavior, bidding dynamics, and token usage within the Polygon ecosystem. Through this analysis, researchers uncovered distinct operational characteristics and profitability trends associated with different MEV strategies, providing a nuanced understanding of how these strategies impact the network. The investigation focused on transactions across Uniswap V2, Uniswap V3, Algebra, and Balancer, allowing for a broad assessment of arbitrage opportunities and MEV extraction techniques.

Results demonstrate the importance of robust transaction ordering mechanisms and highlight the implications of emerging MEV strategies for blockchain networks. The study differentiates between Spam-based backrunning, relying on broadcasting multiple transactions, and Auction-based backrunning, a structured system utilizing private relays and bidding. While Spam-based strategies are more prevalent, the data confirms that Auction-based approaches consistently yield higher profits, suggesting a potential shift towards more efficient and less disruptive MEV extraction methods. This research provides valuable insights for optimizing blockchain protocols to enhance fairness, efficiency, and decentralization within the rapidly evolving landscape of decentralized finance.

Polygon MEV Reveals Validator Dominance

The study categorizes AA strategies into those utilising Spam-based and FastLane-based methods, revealing differences in their impact on network operation and profitability. While Spam transactions occur more frequently, FastLane transactions demonstrate greater efficiency in extracting MEV through competitive bidding. The findings demonstrate that MEV extraction represents a significant economic force within the Polygon ecosystem, accounting for approximately one percent of the Total Value Locked (TVL). Validators currently capture the majority of this value, receiving over 75% of extracted MEV.